Dear fellow investors, friends, family and future self.

September was a busy and eventful month for me and my family.

Unexpectedly, I’m no longer involved in the restaurant business. Long story short, the founder and I didn’t agree on the execution plan.

So we decided to move to a new city, where most of my family lives. At the moment we live in 2 rooms at my dads house, which is not optimal, but it’s nice to have the option while we search for something else. If we find a good house or apartment here, we’ll stay in this area. If not, we’ll move back to Portugal. The kids already started in the new school and they’re enjoying it so far.

The P2P industry is going through tough times. A few platforms like Swaper*, Robocash* and PeerBerry* are doing exceptionally well, with no delayed payments and no withdrawal issues.

Here’s my account statement from September:

Monthly Income Statement: September 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -491.93€ | -0.55% | 9 902€ | 9 832€ |

| Bulkestate* | 0€ | 6.98% | 10 000€ | 10 989€ |

| Crowdestate* | 2.57€ | 5.31% | 5 305€ | 6 389€ |

| Crowdestor* | 472.17€ | 12.37% | 82 912€ | 94 814€ |

| FastInvest* | 0.12€ | 3.27% | 864€ | 1 130€ |

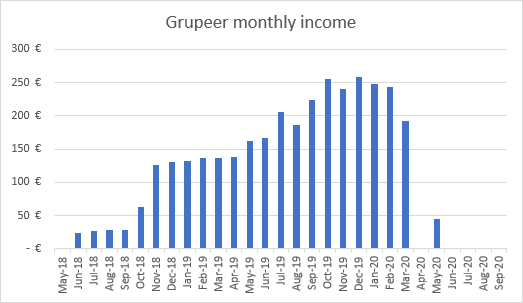

| Grupeer | 0.00€ | 10.12% | 20 474€ | 24 047€ |

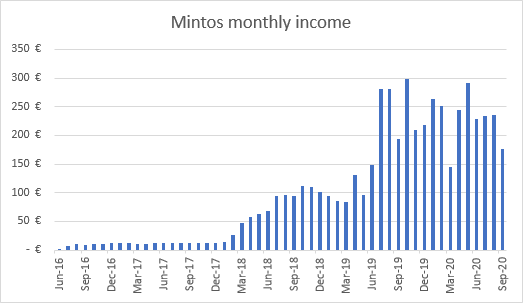

| Mintos* | 175.66€ | 17.31% | 20 000€ | 27 032€ |

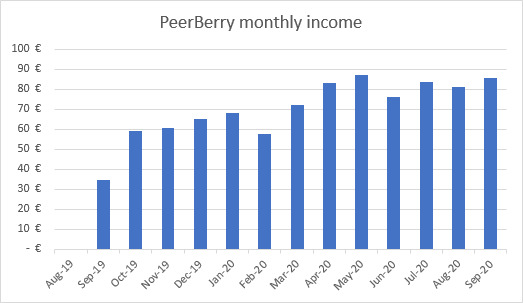

| PeerBerry* | 85.81€ | 14.98% | 6 000€ | 6 846€ |

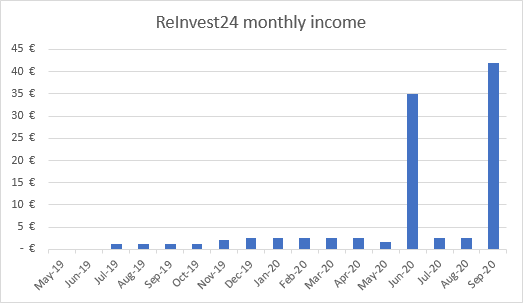

| ReInvest24* | 42.03€ | 5.55% | 1 000€ | 1 037€ |

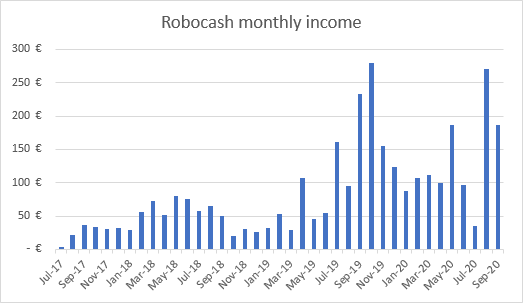

| Robocash* | 186.34€ | 13.05% | 10 000€ | 13 135€ |

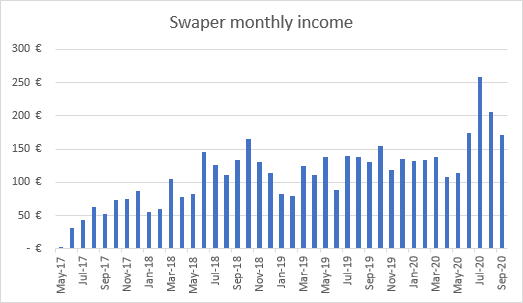

| Swaper* | 171.52€ | 14.43% | 10 000€ | 14 437€ |

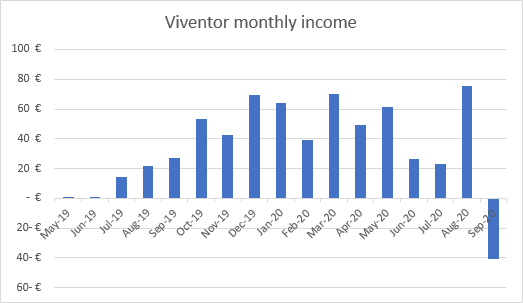

| Viventor* | -40.74€ | 14.78% | 5 000€ | 5 888€ |

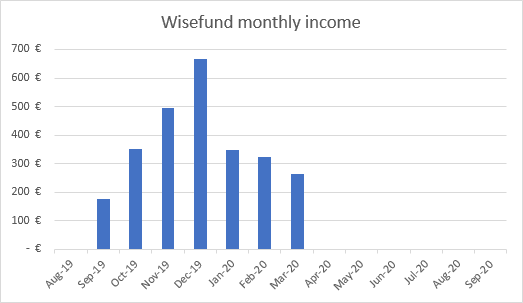

| Wisefund | 0.00€ | 12.73% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 603.55€ | -1.96% | 244 012€ | 236 796€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 380€ | 38.97% | 18 080€ | 43 471€ |

| Property #2 | 1 167€ | 3.89% | 61 200€ | 64 223€ |

| 1 547€ | 79 280€ | 107 694€ | ||

| Total | 2 150.55€ | 3.05% | 323 292€ | 344 491€ |

Note: I marked Grupeer as orange for now because I’m questioning future repayments.

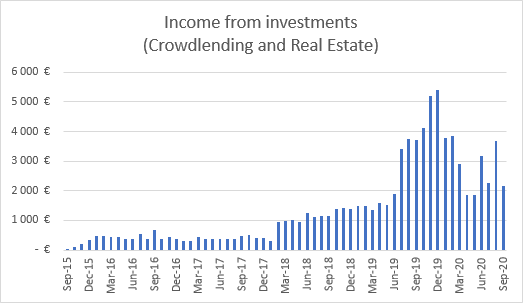

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 2 150.55€

(1 544.17€ less than last month).

That means I’m 71.69% Financially Free (-51.47 percentage points down from last month).

Stocks / trading

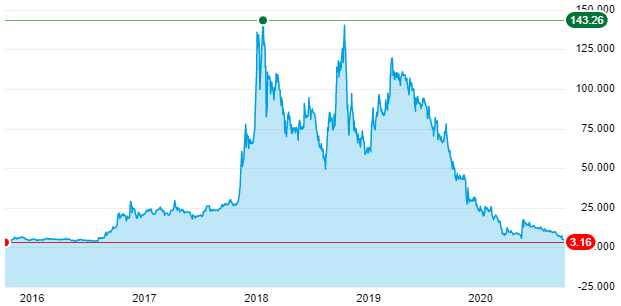

I added 1 new stock to my portfolio since last update:

- Aurora Cannabis (ACB)

Cannabis stocks surged in 2018 due to expectation of legalization of marihuana in US and Canada. That never happened and ACB is now trading at the same level as in 2016.

This is a high risk stock pick which can easily lose 30% of it’s value in 6 months. On the other hand, it’s also a stock that could surge to back to 25$ on the right news. So to me, it has a fair risk/reward ratio.

This is my current equity portfolio:

[table id=1 /]I buy my stocks and trade on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction). I don’t receive any commission besides the fee deduction.

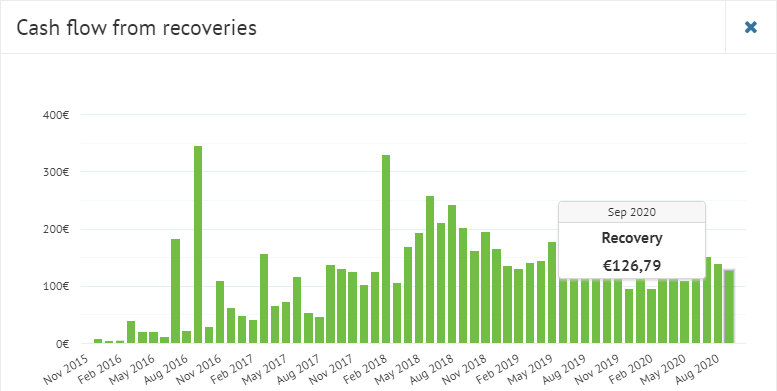

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

126.79€ was recovered in September but I still have 24 480€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

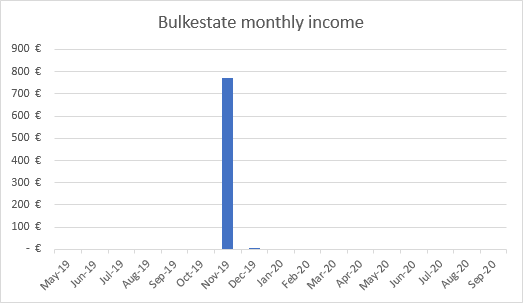

Bulkestate

Bulkestate* has not had any failed projects since it was founded in December 2016. New projects are funded quickly and everything seems to be business as usual.

I’m invested in 2 projects and the next payout is scheduled for 21.12.2020.

All new investors will receive a 5 EUR cash-back bonus upon their first investment if you use this link*.

See more info and screenshot from my Bulkestate account

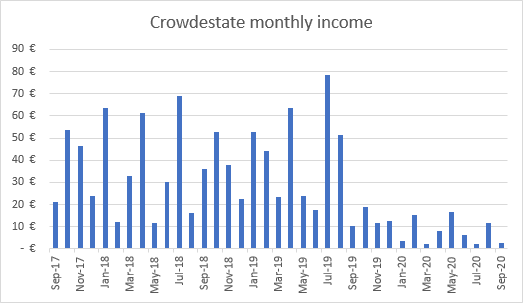

Crowdestate

I’m still withdrawing from Crowdestate*. While there’s no doubt in my mind that the platform is legit, I have not been convinced about their ability to pick the right borrowers. In my opinion, too many projects have experienced payback issues.

See more info and screenshot from my Crowdestate account

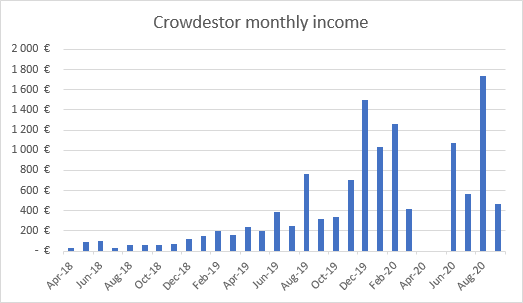

Crowdestor

Crowdestor* updated their website to show better statistics and give a better overview. There’s still plenty of room for improvement but it’s nice to see they follow suit and listen to investors.

Covid-19 has been rough for small companies and many projects are delayed. Up until February 2020 I didn’t have a delayed project on Crowdestor for nearly 2 years! Now 14 of my 47 investments are delayed, which is not great but also not terrible.

It’s nice to see that Crowdestor looks for opportunities in stressed marked situations, where we might be able to buy troubled companies or properties for 20-25% of market value. Such projects might look like extremely high risk at the moment but, on the other hand, the virus is not going to impact travel and tourism forever. Eventually, the world will go on. Always has, always will.

See more info and screenshot from my Crowdestor account

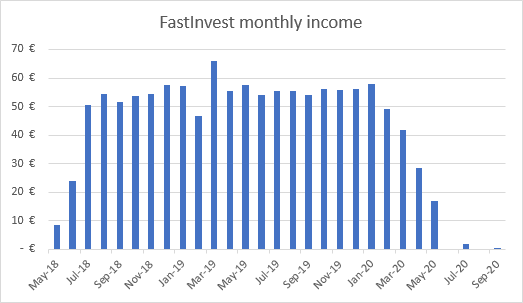

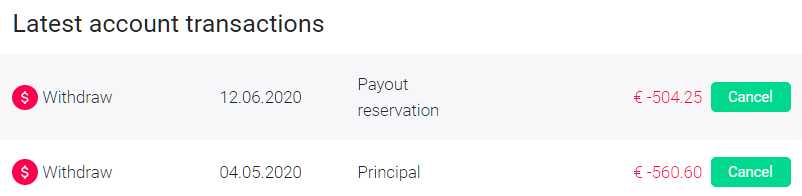

FastInvest

My latest successful withdrawal from FastInvest* was requested in late April and processed on 12.05.2020. I still have 2 pending withdrawals from May and June.

I received several messages from readers in September that they finally got their money, which they requested in late April and early May. I’m pleased to hear that they’re paying as promised, even though it’s delayed.

See more info and screenshot from my FastInvest account

Grupeer

Grupeer continues to communicate to investors through their blog. Not much else has happened since last update though.

See more info and screenshot from my Grupeer account

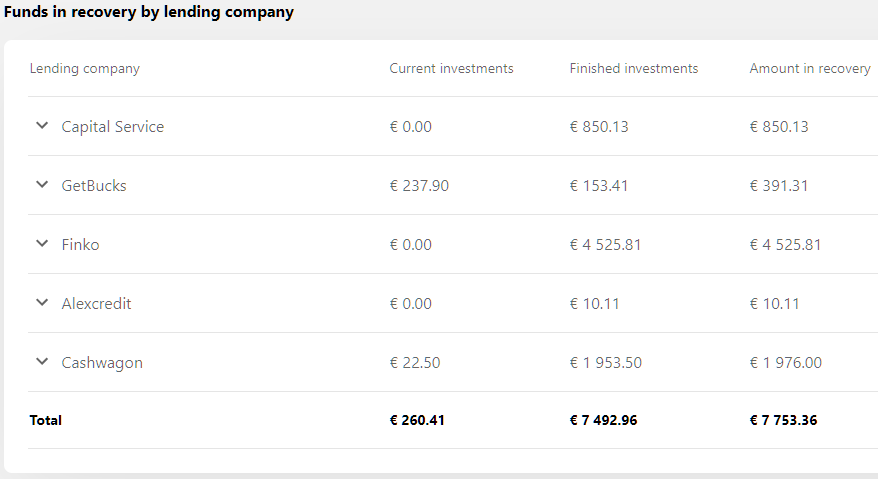

Mintos

While my monthly Mintos* earnings looks quite stable, the amount of funds in recovery now adds up to more than I’ve earned. Hopefully they’ll recover some of the funds.

Mintos does a good job giving updates on their blog.

See more info and screenshot from my Mintos account

PeerBerry

I use PeerBerry* as my children’s savings account. Everything is running smooth here. Even interest rates jumped from 10 to 12%.

See more info and screenshot from my PeerBerry account

Reinvest24

I only have a small position at ReInvest24* but I’m starting to like it more and more. The income has been small but reliable.

ReInvest24 successfully sold the property “Duplex apartment development in Tallinn’s tech hub – unit 2.” and I received my investment back plus capital gains.

I reinvested everything into the project “Modern office in the business center of Tallinn” which has monthly repayments.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

Robocash

Another solid month on Robocash*.

Robocash published their audited financial statements for FY2017-2019. You can find the audited report here. The management report is available here.

See more info and screenshot from my Robocash account

Swaper

Swaper* is one of my favorite P2P lenders.

To me, Swaper has been a stable a predictable platform without any issues (other than the occasional lack of loans available for investment, but that’s currently not an issue).

See more info and screenshot from my Swaper account

Viventor

If you remember from last month’s update, I pointed out that half of my earnings on Viventor* came from late fees. It turned out being too good to be true – Viventor had mistakenly charged a higher fee due to a calculation bug.

For this reason, my account was deducted 55.25€ in September, which was money I should not have earned in the first place. The deduction ended up being more than interest received, which caused my monthly income to be negative for the first (and probably last) time.

See more info and screenshot from my Viventor account

Wisefund

Wisefund… I don’t even know where to start with this company. I had so much faith in Ingus ![]() and saw huge potential when I researched them last year.

and saw huge potential when I researched them last year.

Lately however, the lack of communication to investors is just ridiculous. No wonder new projects are not getting funded. It seems like the website is only up to delay legal action from investors. No words can describe my disappointment.

See more info and screenshot from my Wisefund account

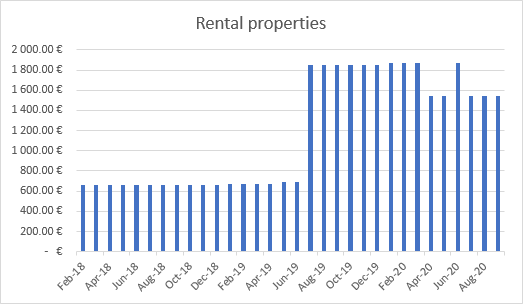

Real Estate

I received rent from 4 tenants in September. One apartment is currently vacant while it’s being renovated. The renovation is taking longer than expected do to a high level of moist.

See more info about my First property and Second property

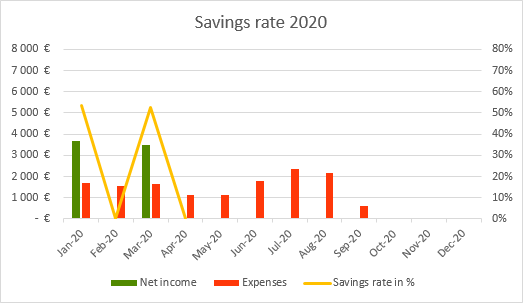

Savings rate / expenses overview

My total expenses for the month were 600€. Living with friends and family reduces the cost of living significantly but it’s only for a very limited time.

See more info about my Savings rate

Blog statistics

Visitors: 5 504 (-16.02% compared to last month)

Page views: 14 645 (-16.63% compared to last month)

3 174 Subscribers (+23 compared to last month)

1 603 Facebook followers (+13 compared to last month)

Quote of the month

Start your own blog

Have you been thinking about starting your own WordPress blog?

FinanciallyFree.eu is hosted on SiteGround* – probably the best WordPress host in Europe!

Free EUR bank account with no fees

I use N26* to transfer to and from my investments. It even comes with a free debit MasterCard!

If you live in Denmark, Poland or Sweden, having an N26 bank account will save you from currency exchange fees when dealing with euros.

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.