Updated 10.01.2021

A big part of Financial Freedom is mastering your spending habits!

I’ll most likely change “savings rate” to “expenses” in the near future, as I don’t have any salary income anymore.

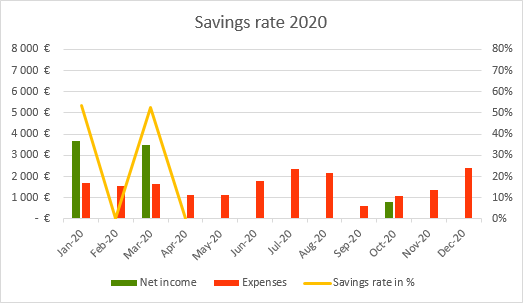

2020

| Month | Net income | Expenses | Saved | Savings rate in % |

| Jan-20 | 3 696€ | 1 714€ | 1 982€ | 53.63% |

| Feb-20 | 1 551€ | – 1 551€ | ||

| Mar-20 | 3 507€ | 1 662€ | 1 846€ | 52.62% |

| Apr-20 | 1 146€ | – 1 146€ | ||

| May-20 | 1 126€ | – 1 126€ | ||

| Jun-20 | 1 802€ | – 1 802€ | ||

| Jul-20 | 2 348€ | – 2 348€ | ||

| Aug-20 | 2 183€ | – 2 183€ | ||

| Sep-20 | 600€ | – 600€ | ||

| Oct-20 | 793€ | 1 098€ | – 305€ | |

| Nov-20 | 1 365€ | – 1 365€ | ||

| Dec-20 | 2 382€ | -2 382€ | ||

| Total 2020 | 7 996€ | 18 976€ | – 10 979€ | – 137.31% |

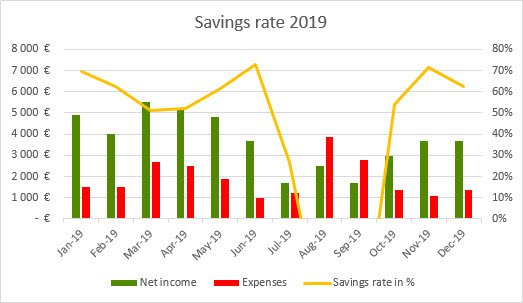

2019

| Month | Net income | Expenses | Saved | Savings rate in % |

| Jan-19 | 4 889€ | 1 496€ | 3 393€ | 69.40% |

| Feb-19 | 3 993€ | 1 503€ | 2 490€ | 62.37% |

| Mar-19 | 5 520€ | 2 685€ | 2 835€ | 51.36% |

| Apr-19 | 5 215€ | 2 494€ | 2 722€ | 52.19% |

| May-19 | 4 829€ | 1 859€ | 2 970€ | 61.50% |

| Jun-19 | 3 655€ | 987€ | 2 668€ | 73.00% |

| Jul-19 | 1 679€ | 1 230€ | 449€ | 26.74% |

| Aug-19 | 2 500€ | 3 856€ | -1 356€ | -54.25% |

| Sep-19 | 1 671€ | 2 786€ | -1 115€ | -66.76% |

| Oct-19 | 2 954€ | 1 360€ | 1 594€ | 53.95% |

| Nov-19 | 3 700€ | 1 060€ | 2 640€ | 71.35% |

| Dec-19 | 3 688€ | 1 378€ | 2 310€ | 62.64% |

| Total 2019 | 44 294€ | 22 695€ | 21 599€ | 48.76% |

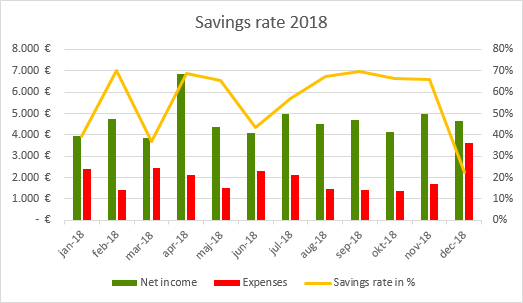

2018

| Month | Net income | Expenses | Saved | Savings rate in % |

| Jan-18 | 3 940€ | 2 397€ | 1 543€ | 39.17% |

| Feb-18 | 4 763€ | 1 423€ | 3 340€ | 70.12% |

| Mar-18 | 3 843€ | 2 431€ | 1 412€ | 36.75% |

| Apr-18 | 6 842€ | 2 127€ | 4 715€ | 68.91% |

| May-18 | 4 358€ | 1 511€ | 2 847€ | 65.33% |

| Jun-18 | 4 064€ | 2 308€ | 1 756€ | 43.20% |

| Jul-18 | 4 973€ | 2 140€ | 2 832€ | 56.95% |

| Aug-18 | 4 529€ | 1 477€ | 3 052€ | 67.39% |

| Sep-18 | 4 704€ | 1 420€ | 3 284€ | 69.82% |

| Oct-18 | 4 113€ | 1 387€ | 2 726€ | 66.27% |

| Nov-18 | 4 961€ | 1 691€ | 3 270€ | 65.91% |

| Dec-18 | 4 628€ | 3 598€ | 1 030€ | 22.26% |

| Total 2018 | 55 717€ | 23 910€ | 31 807€ | 57.09% |

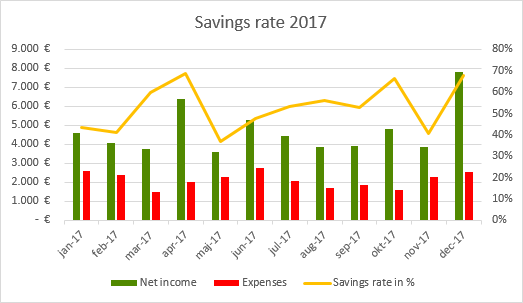

2017

| Month | Net income | Expenses | Saved | Savings rate in % |

| Jan-17 | 4 591€ | 2 588€ | 2 003€ | 43.63% |

| Feb-17 | 4 062€ | 2 384€ | 1 678€ | 41.32% |

| Mar-17 | 3 743€ | 1 504€ | 2 240€ | 59.83% |

| Apr-17 | 6 401€ | 1 996€ | 4 405€ | 68.81% |

| May-17 | 3 611€ | 2 285€ | 1 326€ | 36.71% |

| Jun-17 | 5 281€ | 2 771€ | 2 510€ | 47.53% |

| Jul-17 | 4 456€ | 2 079€ | 2 377€ | 53.35% |

| Aug-17 | 3 879€ | 1 711€ | 2 168€ | 55.90% |

| Sep-17 | 3 896€ | 1 831€ | 2 065€ | 53.01% |

| Oct-17 | 4 818€ | 1 611€ | 3 207€ | 66.56% |

| Nov-17 | 3 857€ | 2 298€ | 1 559€ | 40.42% |

| Dec-17 | 7 818€ | 2 517€ | 5 301€ | 67.8% |

| Total 2017 | 56 413€ | 25 575€ | 30 838€ | 54.66% |

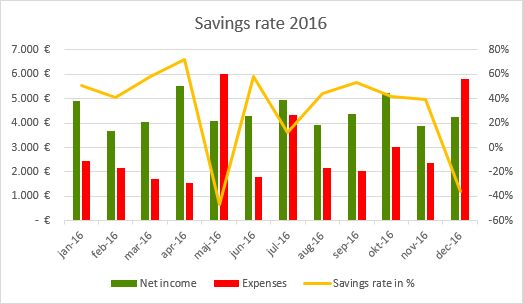

2016

The drops in savings rate in May and Dec shows the impact of owning an expensive Audi. Good thing I god rid of that!

| Month | Net income | Expenses | Saved | Savings rate in % |

| Jan-16 | 4 908€ | 2 431€ | 2 477€ | 50.47% |

| Feb-16 | 3 681€ | 2 167€ | 1 514€ | 41.13% |

| Mar-16 | 4 046€ | 1 702€ | 2 344€ | 57.92% |

| Apr-16 | 5 522€ | 1 550€ | 3 972€ | 71.93% |

| May-16 | 4 082€ | 5 995€ | -1 913€ | -46.86% |

| Jun-16 | 4 283€ | 1 773€ | 2 511€ | 58.62% |

| Jul-16 | 4 946€ | 4 351€ | 596€ | 12.04% |

| Aug-16 | 3 940€ | 2 181€ | 1 759€ | 44.64% |

| Sep-16 | 4 362€ | 2 032€ | 2 329€ | 53.41% |

| Oct-16 | 5 223€ | 3 035€ | 2 188€ | 41.90% |

| Nov-16 | 3 876€ | 2 355€ | 1 521€ | 39.23% |

| Dec-16 | 4 251€ | 5 795€ | -1 545€ | -36.34% |

| Total 2016 | 53 121€ | 35 368€ | 17 753€ | 33.42% |