To all my readers and followers. Happy New Year everyone!

It’s time to wrap up the year and see how my portfolio performed in the last month of 2019.

But before we continue I’d like everyone to take a chill-pill. I get way too many emails and messages from people who are worried by the slightest hickup.

Crowdlending platforms are high-risk investments! If you’re not prepared for some rollercoaster action you should probably invest in something else.

Yes, I follow the sector closely. Yes, I visit platforms, engage with the community etc. In fact, I do everything I can to be the guy who has the most insights into the Baltic crowdlending industry. But in the end, please keep in mind;

I’m just a private investor, just like you.

Before you ask me, please remember that 15k monthly visitors probably have the same questions as you do. There’s no way I can respond to everyone individually. Try to remember…. If I can find information, so can you.

If I know anything new, you can be sure I’ll post about it!

By the way, here’s some news for you: 5-6 platforms are working on creating a group/association with the purpose of telling everyone “We approve each other’s work”. They want to differentiate themselves to avoid being put into the same category as – let’s just say “less trusted platforms”.

Please join our group in Telegram @CrowdlendingGlobal for discussion regarding Kuetzal. The comment section gets filled up too quickly here.

Now, let’s move on to see how much I made in December.

Monthly Income Statement: December 2019

| Crowdlending | Income | XIRR | Value |

| Bondora* | -439.97€ | 4.32% | 15 285€ |

| Bulkestate* | 8.24€ | 15.71% | 10 989€ |

| Crowdestate* | 12.51€ | 6.30% | 6 849€ |

| Crowdestor* | 1 495.76€ | 16.55% | 80 818€ |

| Envestio* | 436.48€ | 20.66% | 30 047€ |

| FastInvest* | 56.31€ | 16.36% | 5 224€ |

| Grupeer* | 258.95€ | 14.97% | 23 286€ |

| Kuetzal* | 445.16€ | 20.74% | 27 433€ |

| Mintos* | 218.35€ | 16.15% | 23 776€ |

| PeerBerry* | 65.30€ | 13.39% | 5 723€ |

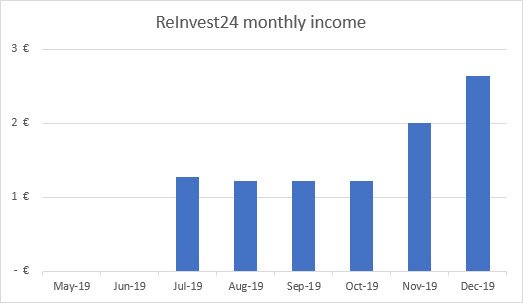

| ReInvest24* | 2.64€ | -1.42% | 991€ |

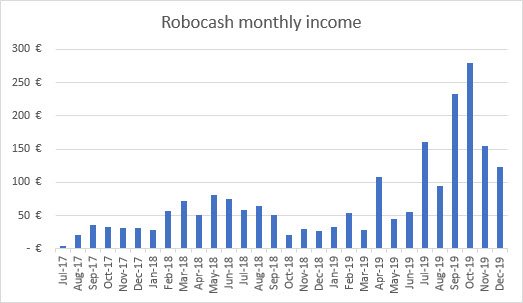

| Robocash* | 123.42€ | 13.00% | 12 141€ |

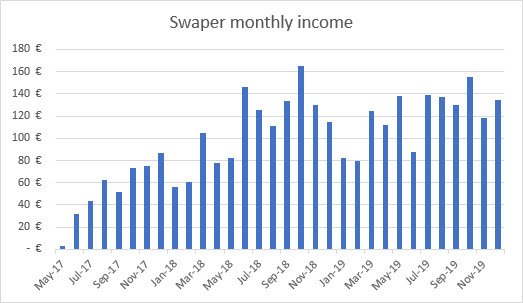

| Swaper* | 134.68€ | 14.33% | 13 176€ |

| Viventor* | 69.10€ | 11.31% | 5 228€ |

| Wisefund* | 665.23€ | 26.30% | 31 874€ |

| 3 552.16€ | 11.66% | 292 847€ | |

| Real Estate | Income | Equity | |

| Property #1 | 691€ | 40 436€ | |

| Property #2 | 1 162€ | 59 947€ | |

| 1 853€ | 100 383€ | ||

| Total | 5 405.16€ | 393 231€ |

That means I’m 180.17% Financially Free (up 7.36% from last month).

My second goal of 7 000€ per month reached 77.22% (up 3.16% from last month).

Portfolio performance: Historical view

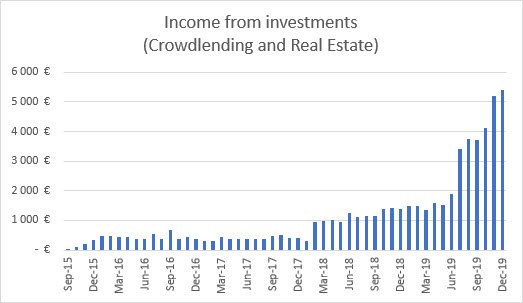

Income from Crowdlending & Real Estate combined was 5 405.16€.

(220.92€ more than last month).

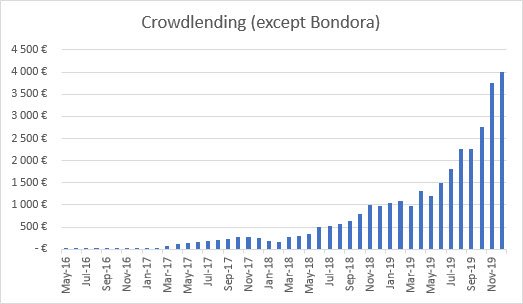

“Crowdlending (except Bondora)” reached 3 992.13€.

(236.08€ more than last month).

Bondora

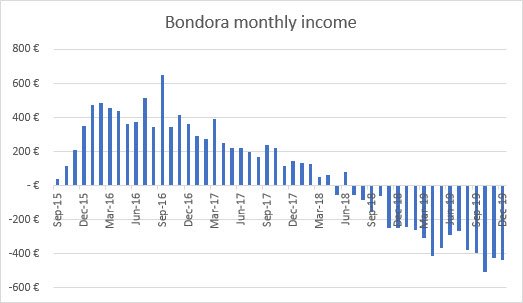

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

I read somewhere that Bondora’s own employees only invest in Go&Grow. None of them uses Portfolio Manager or Portfolio Pro. They have probably seen my income graph as well 🙂

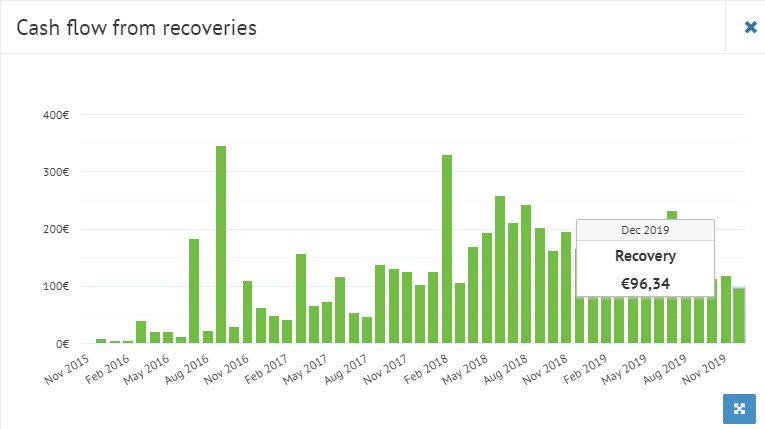

96.34€ was recovered in December but I still have 25 588€ in defaulted loans.

I do not recommend investing with Bondora unless you use the “Go & Grow” product only.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate with instant liquidity, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

Bulkestate

I saw my second repayment from Bulkestate* in December.

8.24€ of interest earned from the project I invested 100€ in on 19.06.2019. The project repaid 17 days in advance, it was scheduled for repayment on 27.12.2020.

Like I mentioned last month, the 10 000€ I invested in Marijas Street returned 10 773.15€ on November 29th. After the repayment, I needed a new project to invest the money in.

I was happy to see the Blaumana 9 project on December 6th which has an annual return of 15% + 1% for investments larger than 10 000€. This is where my spare cash went.

To sum everything up, I’ve already earned 989.12€ from the 10 000€ deposit I made on 08.05.2019. Not bad from mortgage backed real estate investments!

See more info and screenshot from my Bulkestate account

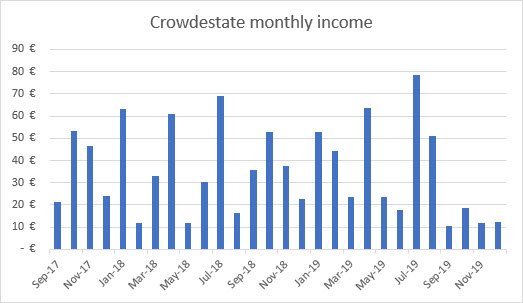

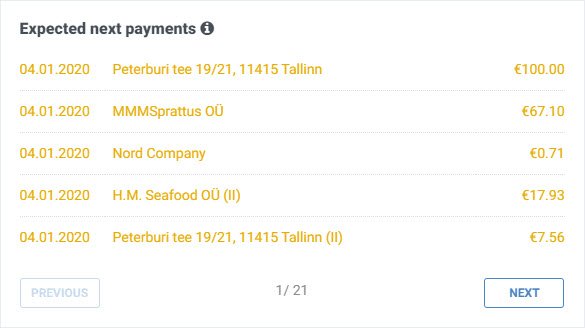

Crowdestate

The problems on Crowdestate* starts to show in my income graph.

I have 5 late projects with Crowdestate.

Not much new to report since last month, except that H.M. Seafood OÜ was declared bankrupt:

“Bankruptcy petition has been filed against H.M Seafood OÜ for non-payment of debts. A temporary bankruptcy trustee has been appointed and a hearing is scheduled for January 20, 2020.”

It’ll be interesting to see how well Crowdestate will handle the defaults and delays in 2020.

See more info and screenshot from my Crowdestate account

Crowdestor

Crowdestor* is my favorite platform. They offer high interest rates, amazing performance (all loans have been paid on time) and a great variety of projects.

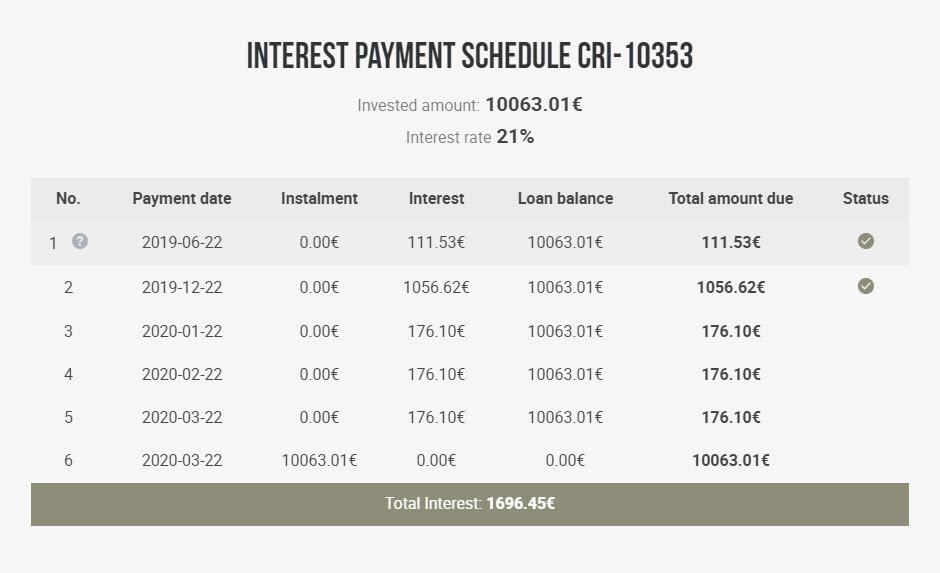

I received the first interest payment for the project “Renovation of eclecticism style building”. Interest for the first 6 months were accumulated and paid as a bullet payment.

1 056.62€ after 6 months for a 10 000€ investment. Wham! Bam! Thank You Ma’am!

Next week we’ll be able to invest in two high yielding projects.

- Limp Bizkit – Summer Tour 2020 (9 month duration) <- How awesome is that?!

- Fertilizer Export Financing (3 month duration)

Both projects have projected interest rates at 21% per annum!

Take my money!!!

See more info and screenshot from my Crowdestor account

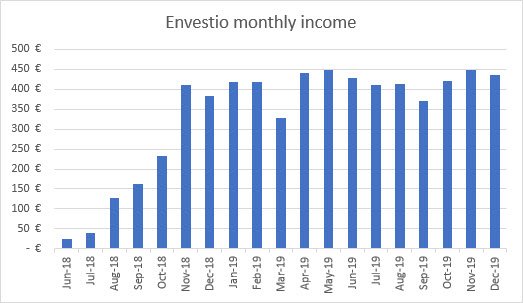

Envestio

It’s been 19 months since I made my first deposit at Envestio*.

During my trip to Riga on December 16-18th, I was lucky enough to schedule a quick meeting with the new COO Mr. Eduard Ritsmann ![]()

Eduard showed us the “Financing of refurbishment of hostel– Mezaparks” project. Here’s some pictures for you.

[Best_Wordpress_Gallery id=”4″ gal_title=”Mezaparks Hostel”]We also met the Mezaparks borrower who told us everything about the renovation project. Very inspiring guy who gave sharp, detailed and fast answer to all our questions. He expects the renovation to be finished in May 2020, it would be fun to come back to see the final result!

Unfortunately, all the fuzz about Eduard’s background (where he’s been involved in projects most people would consider scam) came up a few days after after my visit, so I didn’t have a chance to ask him directly about it.

Eduard may be a great sales man and it’s nice that he speaks 5 languages. However, I find it disturbing that the new Envestio owner chose to hire him. Eduards reputation from previous activities could hurt Envestio’s image.

Let’s not be too pessimistic about this, keep in mind, his past experience will not impact Envestio’s business plan or the quality of their projects.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

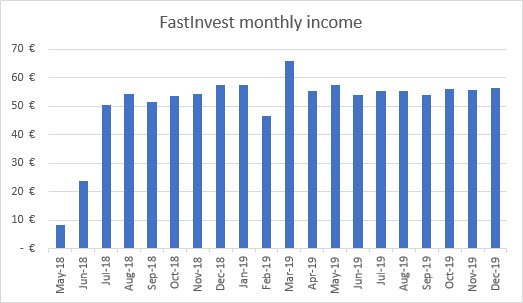

FastInvest

FastInvest* keeps bobbing along. I have invested in them for 20 months without any issues.

They now have 39k registered users, paid out €1.44M in interest and no investors have lost money.

See more info and screenshot from my FastInvest account

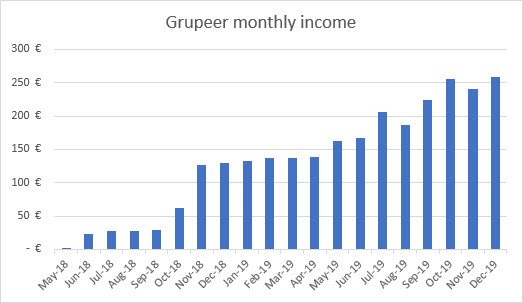

Grupeer

Grupeer* remains one of the most stable investments in my portfolio.

Loans placed by Finsputnik Platforma, PlanetaCash and Primo Invest offers 14% interest rate until January 12th. The usually come with 13% interest rate.

See more info and screenshot from my Grupeer account

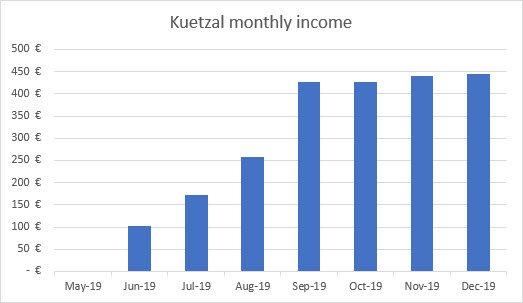

Kuetzal

Here’s the black sheep of the month.

While the graph looks nice and steady, it’s still unclear if we can trust the returns and actually get our money out.

My last post “Concerns about Kuetzal – Is Kuetzal a scam?” has resulted in hundreds of emails to Kuetzal (and to me). Many people have expressed desire to make use of the buyback guarantee, including myself.

Most of the panic happened up to – and during Christmas holidays. On top of that, Kuetzal only has a few employees, which has resulted in almost complete silence from them.

I’ll wait a few weeks to see what happens next, there’s not much we can do anyway (there’s no evidence of fraud). Writing more emails to them will only make the workload bigger and extend the time it will take them to catch up.

I cannot recommend Kuetzal* at the moment. Don’t deposit any money until further notice.

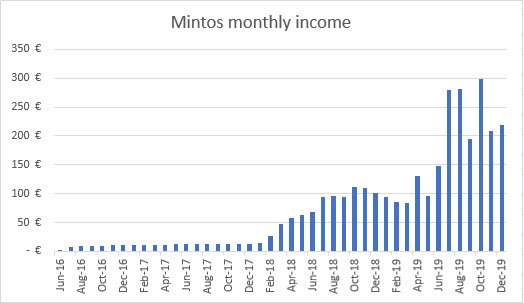

Mintos

The interest rates on Mintos* are climbing back up again, just like I predicted. We saw interest rates as high as 14.2% in December.

Many people blamed Invest&Access for the interest rate drop in the summer but I think the main reason was seasonal swings as we see every year.

A German guy created this Google Sheet which is automatically updated with the latest interest rates from all Loan Originators on Mintos. It’s really nice to get an overview of current and past interest rate levels.

If you sign up with my Mintos referral link*, you’ll get 0.5% cash back on all investments you make within the first 90 days of registration.

See more info and screenshot from my Mintos account

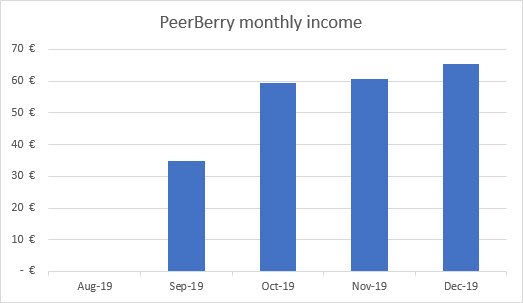

PeerBerry

I use PeerBerry* for my children’s savings account. They received their fourth interest payment in December.

Overall, I’m happy with the platform even though the highest yielding interest rates have dropped from 13.1% to 12.7% since I opened my account.

There’s plenty of short-term loans available at 11.5%.

See more info and screenshot from my PeerBerry account

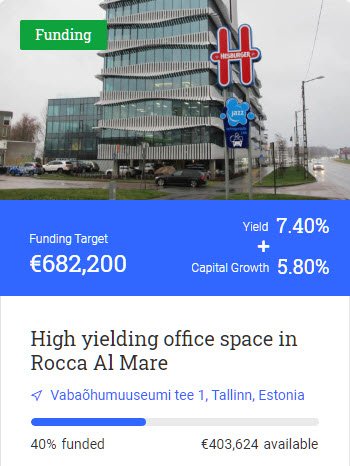

Reinvest24

2 out of 3 projects I invested in on ReInvest24* are now paying dividends, 1 is waiting to be sold.

I hope ReInvest24 will turn out to be an amazing platform. They’re still lacking volume to fund their projects fast enough.

This is their latest project, which is already rented out (8 year fixed rental contract). Investors will start earning interest from the day they invest.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

Robocash

35% of my Robocash* portfolio is currently idle.

Robocash (and several other loan originators) are no longer allowed to operate on the Philippine market. Read the official message on the Robocash blog.

They still have several other markets to operate on, it’s a shame nonetheless. The cash drag was increasing already and with one market less it’s probably only going to be worse (in the short term).

Robocash announced the news publicly a few days after the license had been revoked, kudos for that.

My portfolio doesn’t have any “Installment loans” anymore. I predicted a monthly return of 125€ per month, starting from December. I was pretty close, December returned 123.42€.

See more info and screenshot from my Robocash account

Swaper

Not much to report on Swaper* either. That’s a good thing these days!

I typically have 2 000€ idle waiting to be invested. If this cash drag stopped, I’d be happy to invest a lot more in Swaper.

If any of you have more than 25k invested on Swaper, I’d love to hear from you. How much cash drag to you typically have?

See more info and screenshot from my Swaper account

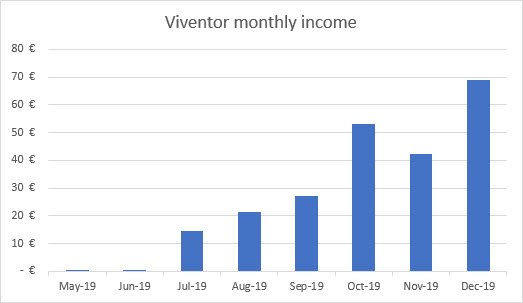

Viventor

I’m still testing out Viventor* to see whether it’s a platform I like to keep in the long run. The platform is working very smooth – so far so good.

Not a single repayment from the troubled loan originator “Aforti” in November or December. No news either. Not a good sign. But the same goes for Aforti on Mintos, no difference there.

See more info and screenshot from my Viventor account

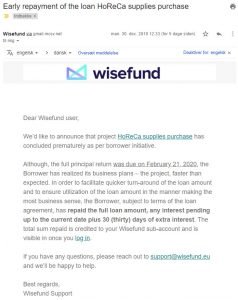

Wisefund

I had the pleasure of visiting Wisefund* in December. I was acompanied by Terry, a follower of my blog and investor, who flew in from Germany.

We spent 2 days with Wisefund and we also met:

- A business partner (Nord Capital Markets)

- An existing borrower (KRM Service LTD)

- A potential borrower (FLC Logistics)

Great experience!

We recorded 2 video interviews. One about Wisefund with Ingus and one with the owner of KRM Service LTD.

I expect the videos to be edited and published by the end of this month.

I was only supposed to earn 505.81€ on Wisefund* in December but due to early repayment of a project I received 665.23€. The borrower paid an extra month of interest (159.42€) in order to pay back the loan prematurely.

Now I have more than 11k idle waiting for new projects to invest in. For this reason, interest earned next month will be significantly lower at 346.39€.

If you sign up and invest* through my referral link, you will get 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Wisefund account

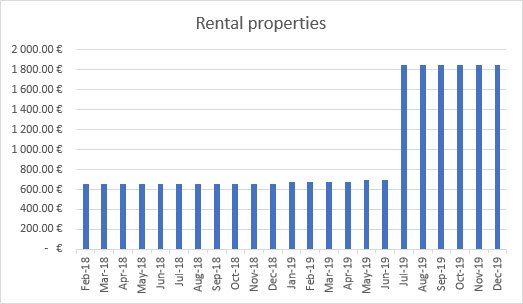

Real Estate

I received rent from all 5 tenants on time as usual.

Expenses in 2020 didn’t start out gentle to me, as I was hoping for. Someone decided to blow up one of my tenant’s mail boxes on New Year’s Eve.

A new mail box is on 13.5€ but it took me a few hours to buy it, drive to the property and mount the new one.

This is a good example of one of the tasks I’ll need to figure out how to handle when I live abroad!

See more info about my First property and Second property

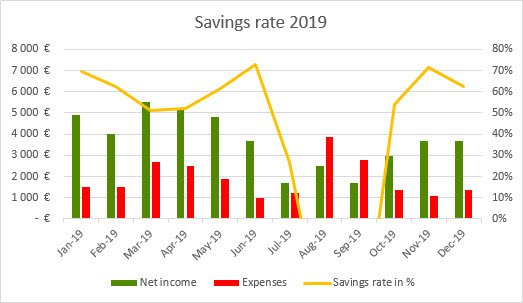

Savings rate

My savings rate for December was 62.64%.

I finished off the year with an average savings rate for 2019 at 48.76%.

If it wasn’t for my reduced income while being on paternity leave and extra high expenses in August and September (buying a suite for weddings and expensive holiday in Portugal) I could have hit a 60% savings rate for 2019.

From 31.01.2020 I’m relying 100% on myself to generate enough income for our family. The math says we should be fine but it’s still a bit scary to think about it. I’ve always been dependent on salary from a job.

See more info about my Savings rate

Blog statistics

Visitors: 16 629 (+34.27% compared to last month)

Page views: 73 416 (+48.58% compared to last month)

2 647 Subscribers (+210 compared to last month)

1 305 Facebook followers (+128 compared to last month)

Start your own blog

FinanciallyFree is hosted on SiteGround* for the incredible low price of 3.95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

Free EUR bank account with no fees

I recently opened a bank account with N26* and received a free MasterCard. They are similar to Revolut* but N26 has much higher transfer limits and you can withdraw euros from any ATM up to five times every month for free.

N26 is a German bank with base in Berlin and your account is secured up to 100 000€ like any traditional bank!

2 of my good friends have been using N26 for a couple of years and they both endorse their services. I LOVE N26 already!

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your first name or your full name. Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.