Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

May was a crazy month where I invested nothing less than 23.060,83€.

I’ve been saving up for some time. Now that I know how much I need for the second real estate purchase, I decided to invest a good chunk of the surplus into my Crowdlending portfolio.

Remember, you can always see my latest investments on the Portfolio page:

We are breaking the money taboo

Recently, a lot of people have been inspired to make similar portfolio updates for their Crowdlending portfolios. When I wrote my first portfolio update in April 2017, a few people shared their net worth growth shown in percentages. No one else were sharing their exact earnings or numbers.

I’m truly happy to see how people are expanding on my vision to provide transparency about their investments and help breaking down the money taboo! Thank you!!

Now, here’s the information you came for…

Monthly Income Statement: May 2019

| Crowdlending | Income | XIRR | Invested | Value |

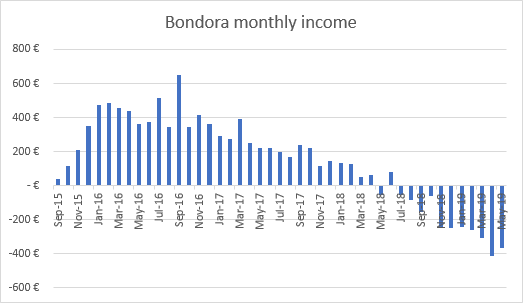

| Bondora | -367,61€ | ??? | 14.100€ | 22.927€ |

| Bulkestate | 0,00€ | 17,00% | 10.000€ | 10.000€ |

| Crowdestate | 23,62€ | 7,19% | 7.000€ | 7.798€ |

| Crowdestor | 204,54€ | 16,30% | 20.000€ | 21.568€ |

| Envestio | 448,67€ | 22,45% | 23.510€ | 27.096€ |

| FastInvest | 57,56€ | 16,38% | 4.100€ | 4.837€ |

| Grupeer | 162,01€ | 16,17% | 10.000€ | 11.635€ |

| Kuetzal | 0,00€ | 0,00% | 6.100€ | 6.115€ |

| Mintos | 96,68€ | 15,11% | 10.000€ | 11.989€ |

| ReInvest24 | 0,00€ | -28,48% | 1.000€ | 980€ |

| Robocash | 44,94€ | 12,46% | 10.000€ | 11.038€ |

| Swaper | 138,01€ | 16,43% | 9.000€ | 11.270€ |

| Twino | 36,12€ | 16,33% | 1.600€ | 3.156€ |

| 844,54€ | 126.410€ | 150.412€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 691€ | 58,87% | 18.080€ | 29.631€ |

| Total | 1.535,54€ | 144.490€ | 180.043€ |

That means I’m 51,18% Financially Free (down 1,28% from last month).

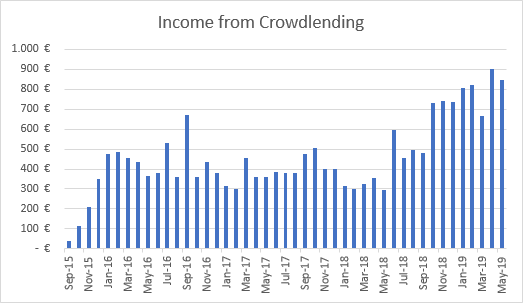

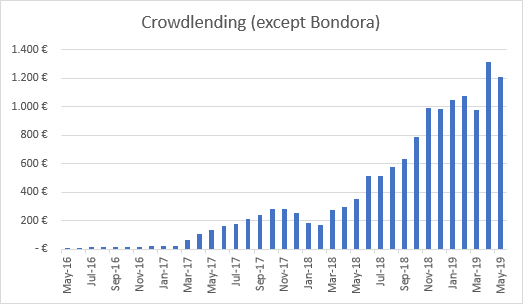

Portfolio performance: Historical view

Income from all investments (Crowdlending and Real Estate) was 1535,54€.

(38,23€ less than last month).

“Income from Crowdlending” alone was 844,54€.

(57,23€ less than last month).

“Crowdlending (except Bondora)” reached 1.212,15€.

(106,04€ less than last month.)

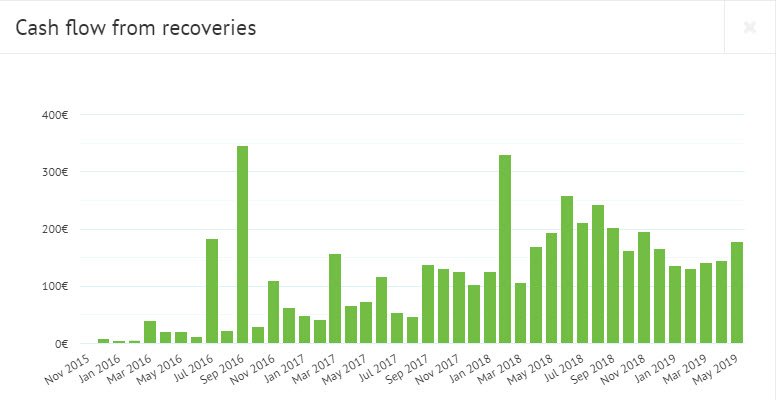

Bondora

I look forward to the day where I can exit from Bondora entirely.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. The Go & Grow product is alright if you’re satisfied with a 6,75% interest rate and instant liquidity.

See more info and screenshot from my Bondora account

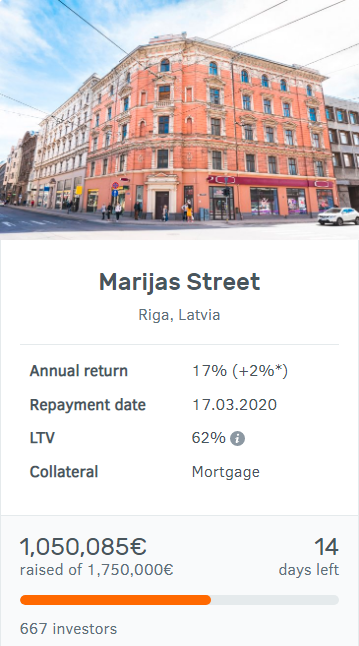

Bulkestate

The 17% project I was waiting for on Bulkestate is released and I have invested my 10.000€ into that project to get an extra 100€ CashBack.

The extra 1% CashBack only applies if you invest 10.000€ into a single project. If you invest 25.000€ into a single project you get 2%.

Repayment date is on the 17.03.2020 (only 9½ months from now).

The project is still open if you want to join me.

If you sign up through my site you’ll get 5€ signup bonus and 1% Cash Back on all your investments until 30st of June 2019.

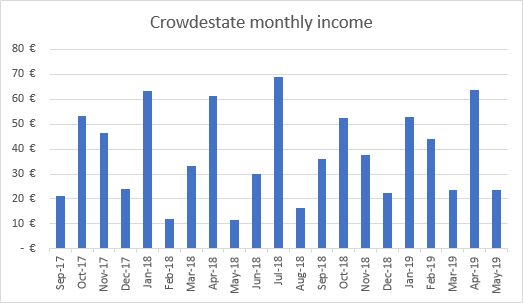

Crowdestate

Not much to say about my Crowdestate portfolio. The development projects I have invested in have a 2-4 year duration, so I haven’t seen any full repayments yet.

Some of my loans are overdue from time to time and there’s no buyback guarantee. They have a really good track record though, so I’m not worried.

They have invited me to their office in August to talk with their CEO, see some projects, take pictures etc. I will most likely accept the invitation, it’s always interesting to meet the people behind!

See more info and screenshot from my Crowdestate account

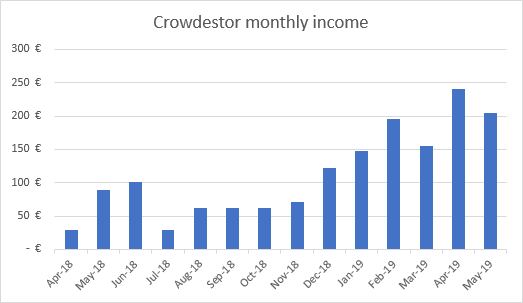

Crowdestor

Today I transferred another 10.000€ to Crowdestor, bringing my total investment to 30.000€.

I’ve already received full repayment of 3 high yielding projects I’ve invested in!

The more I talk with Janis Timma and Gunars Udris, the more I believe in the platform and the projects they publish.

There’s no buyback guarantee but they’ve created a Buyback Fund for emergencies, in case something doesn’t go as planned. It’s only 69.600€ at the moment but it’s estimated to rise to about 100.000€ by the end of this year.

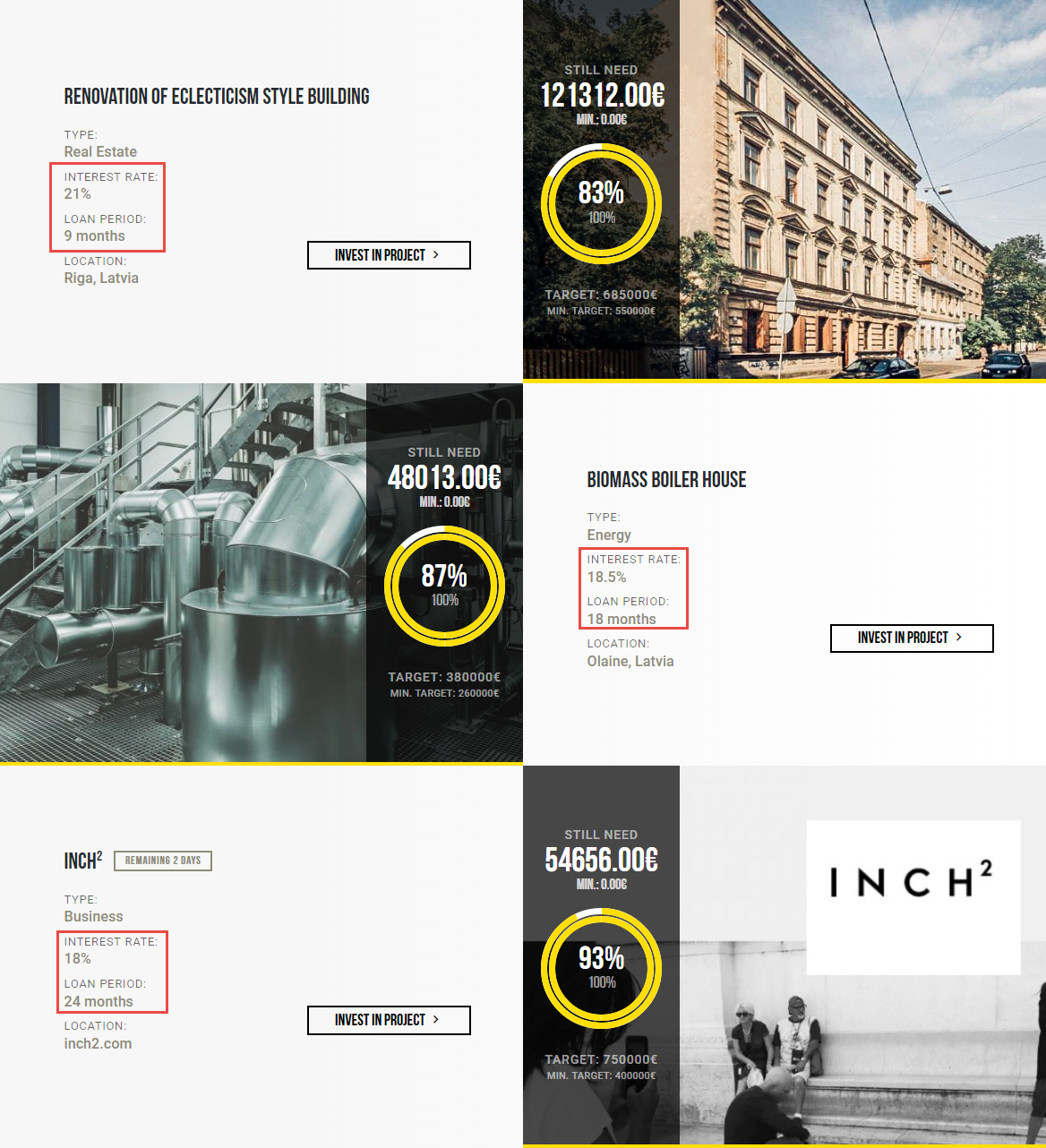

There’s currently 3 projects open for investment with interest rates above 18%. Even one at 21% !!!

See more info and screenshot from my Crowdestor account

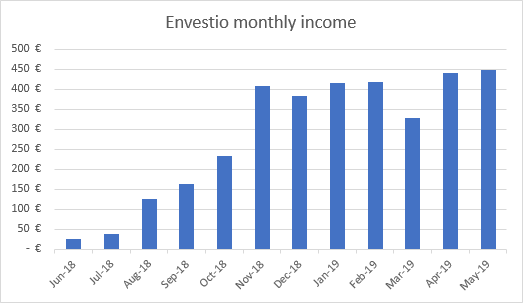

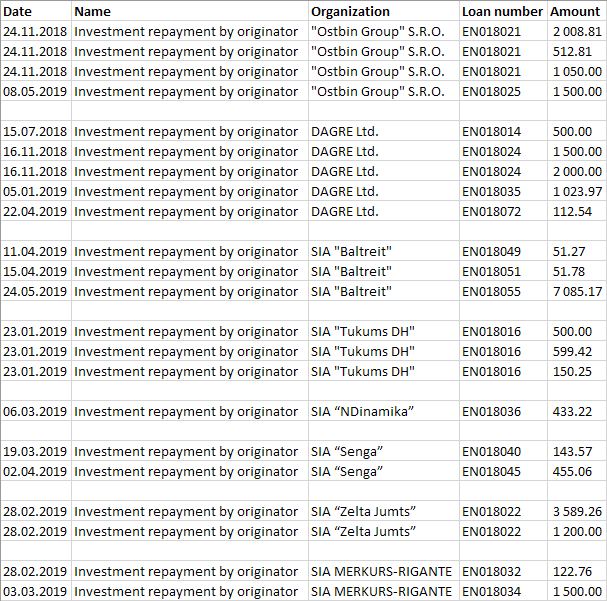

Envestio

The end of May marks my 1 year anniversary with Envestio. Hooray!

Do I look forward to another good year? You bet!

They keep marching on with new projects, new borrowers and high interest rates.

I have already received full repayment – on time – from no less than 8 borrowers in 16 projects!

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

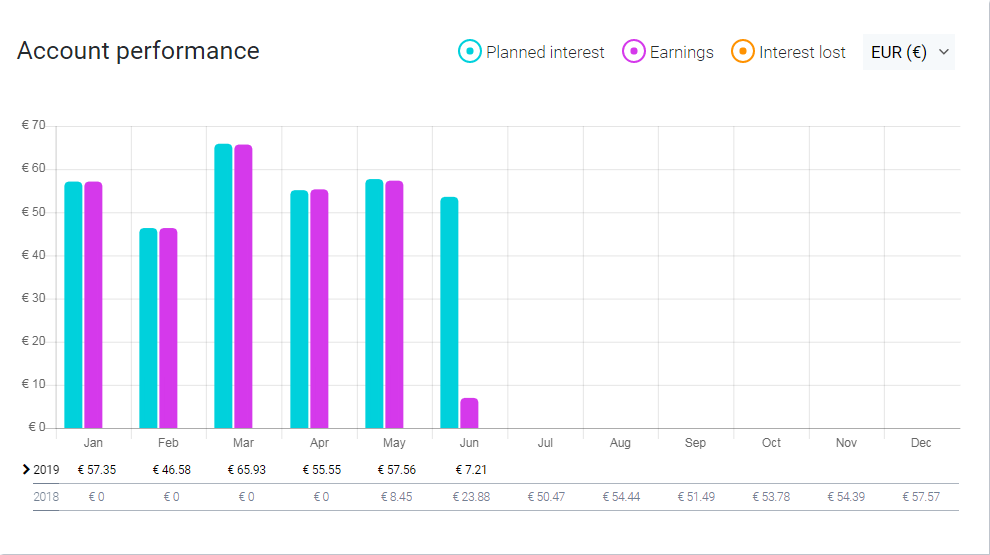

FastInvest

FastInvest is still performing like a clockwork.

I love the visual overview of expected and realized payments, I wish more platforms would do this:

However, 2 things are holding me back from increasing my investment:

- There’s still no information about their loan originators. They expect to release it in 2019.

- Interest rates for EUR loans are currently “only” 13%.

Those two things make FastInvest look weak compared to Mintos. They need to step up if they want a bigger slice of the cake.

See more info and screenshot from my FastInvest account

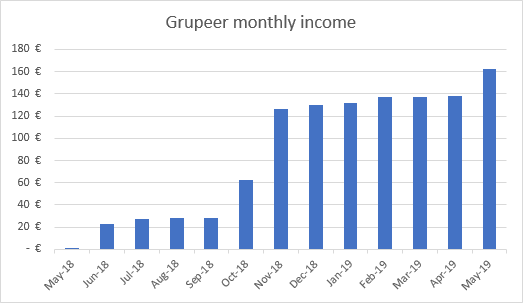

Grupeer

I’m not sure what happened with Grupeer last month. Interest earned jumped from 138€ to 162€ even with no new funds added. Did any of you experience something similar?

A few days ago, I published an article with pictures about Grupeer – if you missed it you can find it here.

Because I really like Grupeer and because of the new CashBack campaign I decided to transfer another 5.000€ to my account today, bringing my total investment to 15.000€.

Here’s the details of the CashBack campaign in June:

See more info and screenshot from my Grupeer account

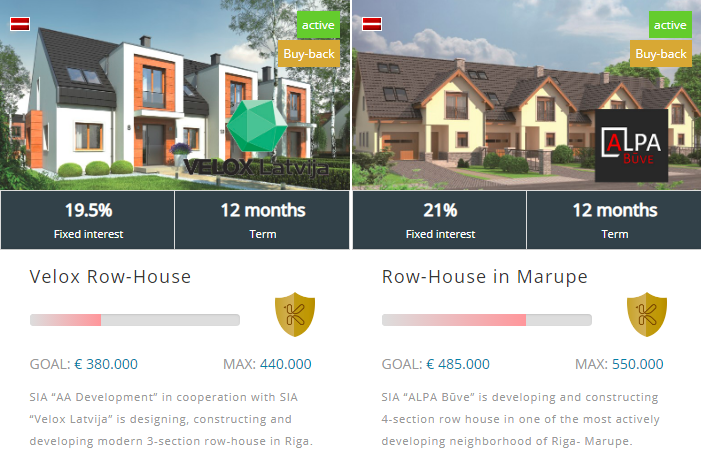

Kuetzal

I made my first 6.000€ deposit on Kuetzal on May 23rd.

The money was invested into these two projects, 3.000€ in each:

In case you missed it, I visited Kuetzal on May 2-3, 2019. Make sure to read the article to see what I found.

Kuetzal just released a Summer CashBack Marathon, which pays up to 3% CashBack on all your investments made from June to August!

Click the picture below for more details on the campaign.

If you want to give Kuetzal a go you can use the promo code FINANCIALLYFREE to get a 15€ gift, instantly credited to your account.

Mintos

Mintos seems to be back on track after the down-sloping trend and a sudden jump last month.

I added another 2.000€ to Mintos on the 23rd of May, bringing my total investment to 10.000€.

I’d like to bring my Mintos portfolio to 20-30.000€ but when platforms like Envestio, Crowdestor and Kuetzal offers investments with 18% interest (or more) it’s hard to resist!

It’s fun to see how the market is hugely influenced by the loan originators. 5-6 months ago people were raging when interest rates dropped below 11%. Many investors withdraw their money to invest elsewhere. Now that interest rates have risen to 13-15% everyone is cheering and Mintos is more popular than ever.

See more info and screenshot from my Mintos account

Reinvest24

I’ve been looking at ReInvest24 since they published their first projects.

Now I’ve made a 1.000€ deposit, just to test the concept. Unlike other platforms, you actually get a share in the properties you invest in – it’s not just a loan.

Maybe I’m just slow but I find the platform hard to understand. From the first glance, it was not obvious to me which projects were development projects and which ones were rental properties. I think I got that part figured out now.

There’s no buyback guarantee but your investment is backed by the value of the property.

If I’m not mistaking, I should get the first interest payments in June. Let’s see how that goes.

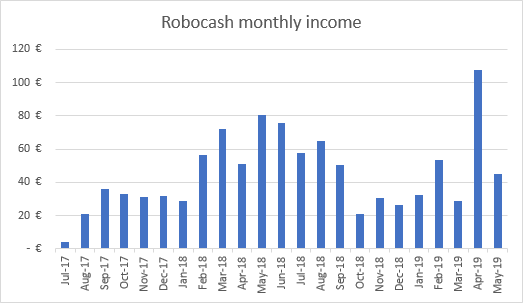

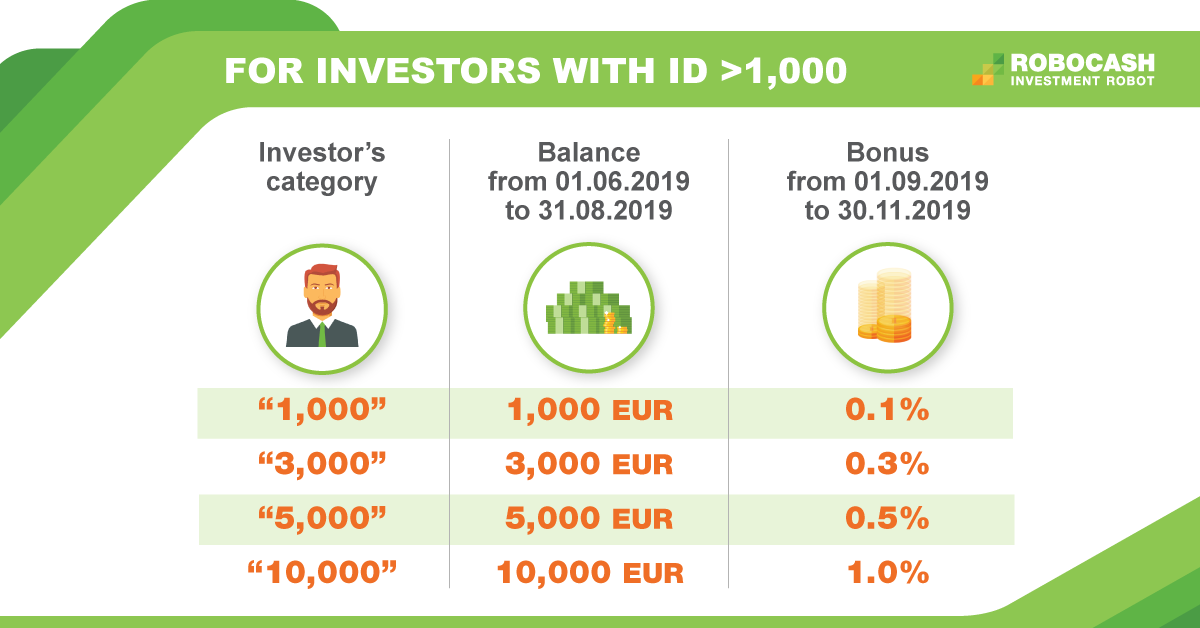

Robocash

It’s been almost 2 years since I made my first deposit to Robocash.

Even though interest rates are “only” 12% now (used to be 14%), I still enjoy the platform. It’s so simple and it requires no work at all.

I increased my investment on Robocash from 6.000€ to 10.000€ in May to get the most out of their newly released Loyalty Program. I means I will get +1% extra interest from September to November.

See more info and screenshot from my Robocash account

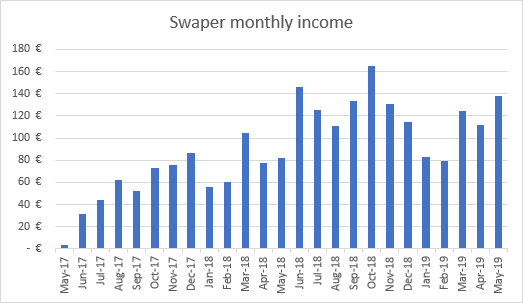

Swaper

Swaper is getting a bit better with the cash drag. Most days I’m down to 1.000-2.000€ which are not invested. Besides the cash drag, Swaper is as good and simple as Robocash.

See more info and screenshot from my Swaper account

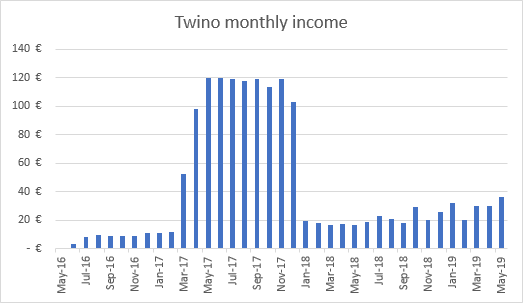

Twino

Twino launched a 1% CashBack campaign for Latvian loans that come with a 8% interest rate, Payment Guarantee, and the term from 3 to 60 months.

8% is just not good enough.. and to make it worse, it’s Payment Guarantee loans, which cannot be sold on the secondary market if/when they default!!! That means you’ll be stuck with 8% loans for up to 5 years. No thank you!

While I appreciate their efforts to do something, they just prove, time and time again, that they’re always lagging behind the competition.

See more info and screenshot from my Twino account

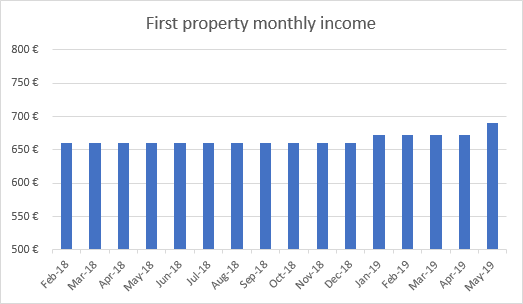

Real Estate

After the recent kitchen upgrade, I was able to raise the rent. That brings my monthly income from 672€ to 691€.

It was a +10.000€ (deductible) investment, so it will take a while to get the money back. But it also raised the value of the property slightly, so I think it was worth it.

I also spent some money on new outdoor lighting with light-sensitive sensors. The tenants have been asking for this since I bought the property and I decided to go for it.

With the new kitchen and outdoor lighting, I’m sure I’ve raised the overall tenant satisfaction = less problems and less complaints.

See more info about my First property

Second property

I’m behind schedule on the second property purchase. I won’t bother you with the details – sometimes things just take longer than you expect.

All-in-all, we’re still in the closing process and I should be the new owner of this property by June 15th.

The second property will return 2.350€ per month before expenses.

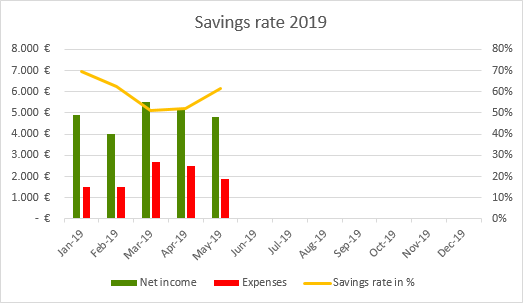

Savings rate

My savings rate for May was 61,05% (+9,31% compared to last month).

See more info about my Savings rate

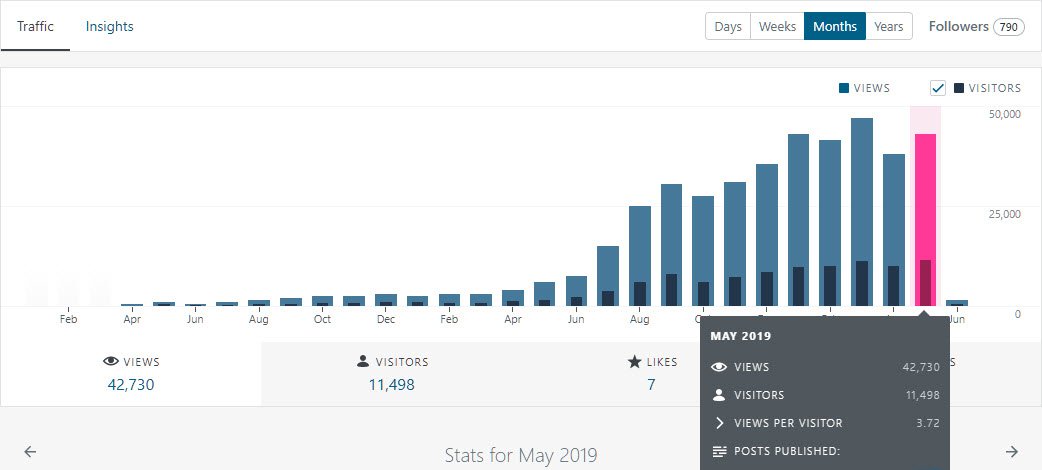

Blog statistics

Visitors: 11.498 (+16,51% compared to last month)

Page views: 42.730 (+12,79% compared to last month)

1.581 Subscribers (787 WordPress, 794 Sumo) (+107 compared to last month)

769 Facebook followers (+143 compared to last month)

FinanciallyFree is hosted on SiteGround for the incredible low price of 3,95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

P2P conference in Riga

LAST CALL for getting tickets to the P2P Conference in LATVIA, RIGA ON JUNE 7-8, 2019!

Use Promo code P2PEARLYBIRD40 for a 40% discount!

You’ll be able to meet representatives from the platforms, other investors, bloggers and more!

18 speakers will give in-depth insights into the latest product, technical and regulatory developments in the P2P and crowdfunding industry. There will be plenty of learning, inspiration, and networking for everyone.

I’ve heard that several platforms will have contests and give-away’s. It will be fun!

Moving to Portugal?

As you might have noticed, I recently mentioned that we’re considering moving to Portugal.

I’ve been chatting with Mark from ObviousInvestor.com quite a lot over the past months. He is from the UK but moved to Portugal a few years ago.

One day he said.. “Do you realize, that you can retire now if you move to Portugal? The average salary here is about 1.000€ per month and you’re already making that from your investments”. I was like.. What.. Really? He started explaining about the NHR regime for foreigners, lower cost of living, the good weather, wine etc..

I said, “Hold on Mark, you should write an article about this, I’d love to learn more!” And so he did! If you wonder why we’ve set our eyes on Portugal you should read his article “FIRE – Financial Independence, Retire EARLIER In Portugal!”

Sharing is caring

If you enjoyed this post, maybe your friends will like it too? Please consider hitting the like button below and/or share it with your friends.

Comments are closed.