Dear fellow investors, guys and gals, friends and family.

I hope you’re enjoying the summer wherever you are. We absolutely loving it here in Portugal. The climate is so much better than in Denmark.

The girls are attending surfing lessons on Sundays and I enjoy Friday nights out with the guys. I usually spend 10€ on Fridays (going out is so cheap here!) where the surfing lessons are a tad more expensive. But the girls love surfing and it’s a fun and healthy hobby for them, so it’s definitely worth it.

On the investing side, Crowdlending investments are slowly starting to pick up again. Regular monthly repayments should start again from this month on most platforms.

I received some nice repayments from Crowdestor in June, which brought my monthly income back above 3k EUR.

Let’s dig into the details:

Monthly Income Statement: June 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -398.60€ | 1.85% | 9 863€ | 11 758€ |

| Bulkestate* | 0€ | 8.58% | 10 000€ | 10 989€ |

| Crowdestate* | 6.33€ | 7.27% | 5 648€ | 6 709€ |

| Crowdestor* | 1 071.87€ | 12.36% | 82 912€ | 92 521€ |

| FastInvest* | 0.08€ | 15.67% | 864€ | 2 193€ |

| Grupeer | 0.00€ | 12.00% | 20 474€ | 24 047€ |

| Mintos* | 229.29€ | 18.12% | 20 000€ | 26 366€ |

| PeerBerry* | 75.99€ | 14.73% | 6 000€ | 6 676€ |

| ReInvest24* | 34.91€ | 2.89% | 1 000€ | 1 032€ |

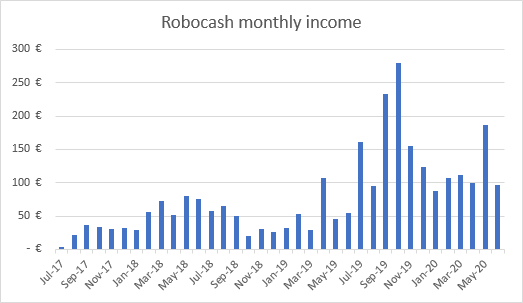

| Robocash* | 96.90€ | 12.69% | 10 000€ | 12 829€ |

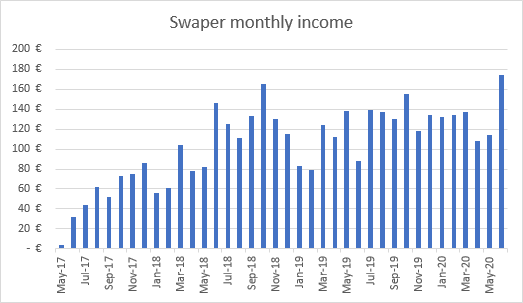

| Swaper* | 174.54€ | 13.97% | 10 000€ | 13 973€ |

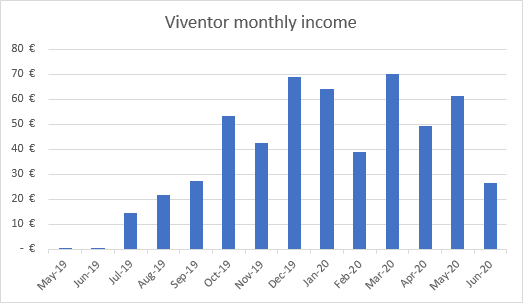

| Viventor* | 26.58€ | 15.33% | 5 000€ | 5 697€ |

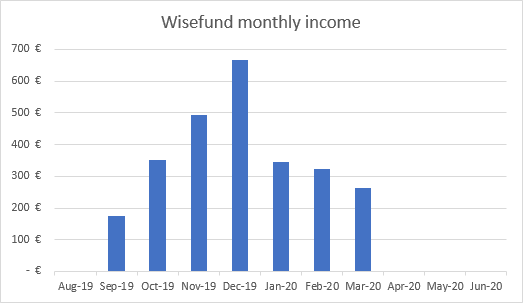

| Wisefund | 0€ | 16.39% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 1 317.89€ | -2.58% | 243 974€ | 235 422€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 704€ | 42.43% | 18 080€ | 42 459€ |

| Property #2 | 1 167€ | 2.58% | 61 200€ | 62 799€ |

| 1 871€ | 79 280€ | 105 258€ | ||

| Total | 3 188.89€ | 2.84% | 323 254€ | 340 681€ |

Note: I marked Grupeer income as orange for now because it’s future is highly questionable. Read more in the Grupeer section below.

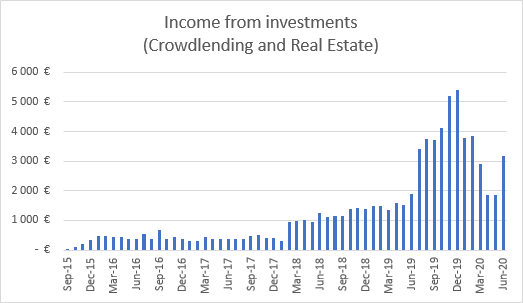

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 3 188.89€.

(1 315.33€ more than last month).

That means I’m 106.30% Financially Free (43.84 percentage points up from last month).

Stocks

This is my current stock portfolio:

[table id=1 /]I added United States Steel Corp to my portfolio in June. It’s currently trading around 7$ which seems attractive to me. It’s close to the 2016 lows and trading above the recent lows in March of 4.90$.

I buy my stocks on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction). I don’t receive any commission besides the fee deduction.

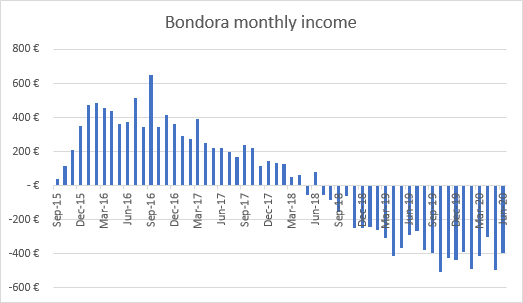

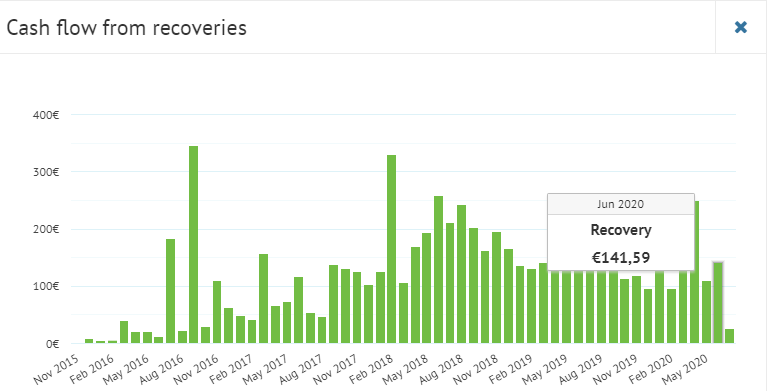

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

141.59€ was recovered in June but I still have 24 913€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

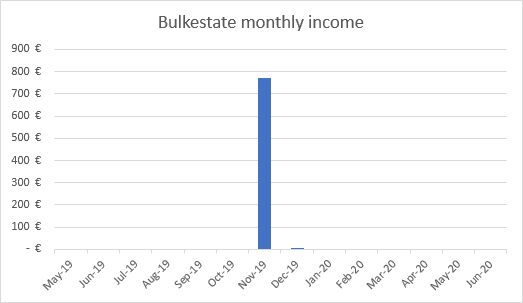

Bulkestate

I’m have invested in 2 projects on Bulkestate* and the next payout is scheduled for 21.12.2020.

Bulkestate had no issues during the pandemic, which to me, proves they’re a good and reliable real estate crowdfunding platform.

There’s a nice looking project coming up with 15% (+2%) interest rate, 12 month duration and a FLTV of 59%.

All new investors will receive a 5 EUR cash-back bonus upon their first investment!

See more info and screenshot from my Bulkestate account

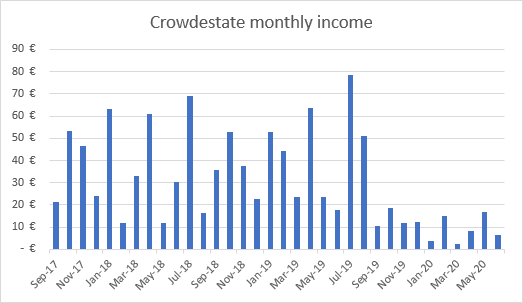

Crowdestate

I’m still withdrawing from Crowdestate*. While I don’t think there’s any doubt that the platform is legit, I have not been convinced about their ability to pick the right borrowers. In my opinion, too many projects have experienced payback issues.

See more info and screenshot from my Crowdestate account

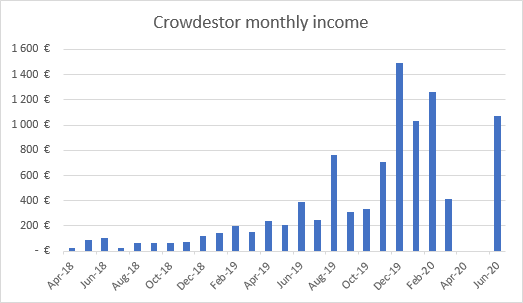

Crowdestor

My favorite platform started repaying again after 2½ months of “Covid-19 payments holiday” for the borrowers.

I’ve still not received the repayment from the “Fertilizer Export Financing” project, which should have been paid back on 2020-05-30. I’m guessing it’ll be paid back in July.

While most other platforms struggle to fund their projects, Crowdestor’s projects are funded quickly.

The latest Equity Campaign of 200 000€ was funded in less than 2 minutes. I invested 10 000€ (money which was paid back from a finished project) into the Equity campaign. My plan is to convert the loan into shares in a year from now.

There’s several upcoming projects with interest rates ranging from 15-26%.

See more info and screenshot from my Crowdestor account

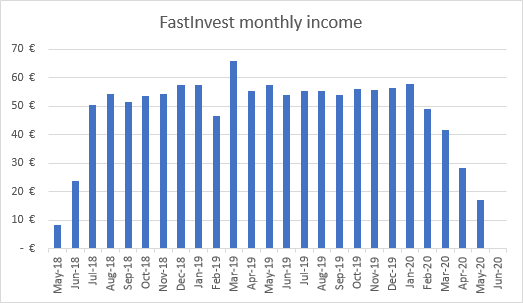

FastInvest

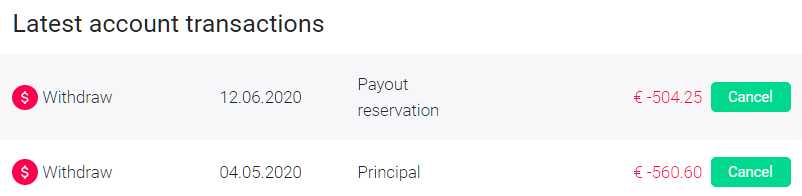

While FastInvest* managed to update the website layout in June, our withdrawals are still pending.

I’m still waiting for a withdrawal from May 4th and another one from June 12th.

FastInvest also introduced “payment holidays” for their borrowers which mean I hardly received any repayments in June (only 0.08€).

According to the investments list, I should start to receive repayments again from 27.07.2020.

I’m curious to see if I have received my last ever withdrawal from FastInvest or if withdrawals will be processed in July. I’m still hopeful though – if they were planning to shut down it would be weird to spend time and money updating their website layout.

See more info and screenshot from my FastInvest account

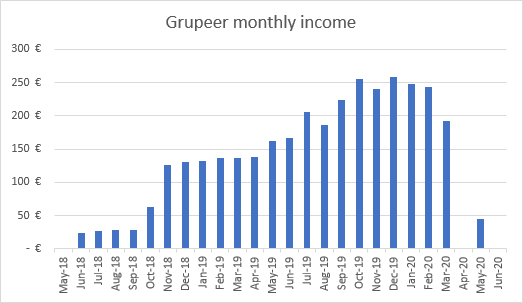

Grupeer

While it’s clear that Grupeer is facing a lot of problems, they continue to communicate to investors from their blog. Apparently, they’re planning to resume repayments from some Loan Originators within the next couple of months. I’ll have to see it before I believe it though.

According to Grupeer’s own “Portfolio performance audit”, 44% (20.84M EUR) of their portfolio is facing financial difficulties. We should get an update on the 20.07.2020.

See more info and screenshot from my Grupeer account

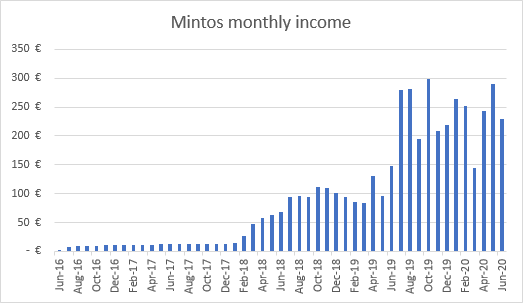

Mintos

While many loan originators are struggling on Mintos*, I get the impression that they’re doing a good job handling the situation and getting money back to investors. Several of the defaulted loan originators made substantial repayments to investors in June.

Mintos does a good job giving updates on each and every Loan Originator on their blog.

See more info and screenshot from my Mintos account

PeerBerry

I use PeerBerry* as my children’s savings account.

The interest rates on PeerBerry are quite low at the moment. I hope it reflects lower risk as well, but who knows?

See more info and screenshot from my PeerBerry account

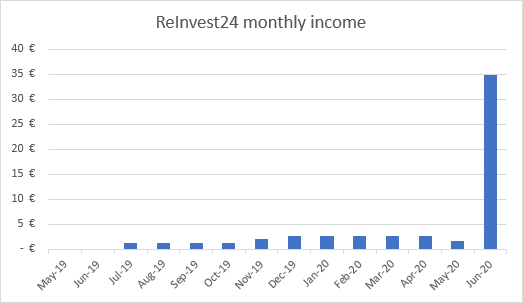

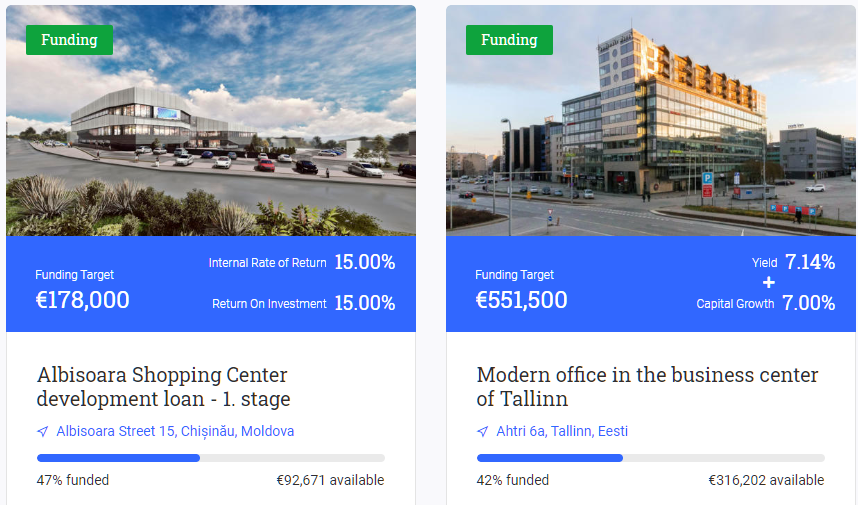

Reinvest24

I received my first principal repayment from a successfully exited project on ReInvest24*.

I reinvested the principal and interest into 2 new projects, which should raise my monthly earnings a bit. Looking forward to see how that goes!

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

Robocash

Robocash* recently announced, they have finally raised the 10k EUR investment limit to 180k EUR. That should give plenty of head space to most investors.

See more info and screenshot from my Robocash account

Swaper

Record earnings month on Swaper*.

The 60 day buyback kicked in for many loans which explains the higher than usual repayment.

See more info and screenshot from my Swaper account

Viventor

Viventor* was bought by Lotus 597 B.V., a Dutch Investment company, part of the Gielen Group that also owns Atlantis Financiers NV – one of the loan originators on Viventor. I’m not sure what to think of this. Hopefully it’s for the better, but you never know what happens when a new owner takes over a company.

See more info and screenshot from my Viventor account

Wisefund

Wisefund implemented a 3 month grace period in March. According to the “Expected Account Transactions” list in my Dashboard, projects should start paying again from 30.07.2020.

Last month it said 30.06.2020 but maybe they forgot to update the schedules? Anyway, 3 months have passed now so I should definitely see some repayments in July.

See more info and screenshot from my Wisefund account

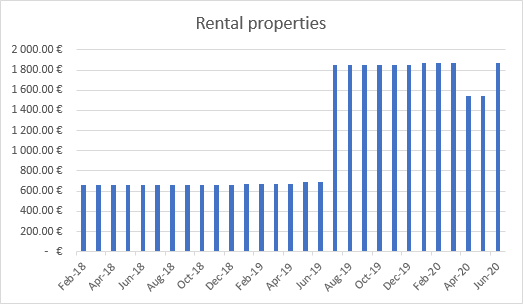

Real Estate

I received rent from 4 tenants in June. One apartment is currently vacant while it’s being renovated.

See more info about my First property and Second property

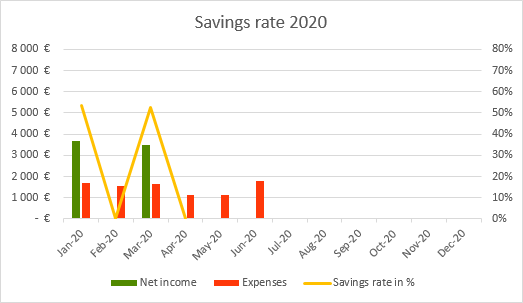

Savings rate / expenses overview

My total expenses for the month were 1 802€ including 900€ rent (the full rental amount).

See more info about my Savings rate

Blog statistics

Visitors: 7 116 (-7.07% compared to last month)

Page views: 21 364 (-9.81% compared to last month)

3 120 Subscribers (+25 compared to last month)

1 561 Facebook followers (+16 compared to last month)

Quote of the month

Safe access to work, streams and games

With NordVPN* your internet connection is secure and you can browse the web with full privacy.

You can even watch your favorite TV show from any country without limitations. I have created a quick overview page of NordVPN benefits, check it out.

NordVPN gives a 30-day, no questions asked, money-back guarantee. Why not try it and see if you like it?

Start your own blog

Have you been thinking about starting your own WordPress blog?

FinanciallyFree.eu is hosted on SiteGround – probably the best WordPress host in Europe!

Free EUR bank account with no fees

I use N26* to transfer to and from my investments. Even living in Portugal, it’s my main choice of bank.

If you live in Denmark, Poland or Sweden having an N26 bank account will save you from currency exchange fees when dealing with euros.

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.