First month of 2020 has passed and it’s time for another update.

January was a hetic month.

- We arranged a “name giving party” for our 7 month baby with 30 family members.

- A birthday-/”fare well” party was held for our oldest daughter’s 25 class mates.

- We took hundreds of pictures of our belongings and listed them for sale on Facebook Marketplace. More than 60 people came to our house throughout the month to buy something.

(We are only bringing 2 x 20 kg suitcases and 4 x handluggage on the plane to Portugal, thus, we need to get rid of almost everything we own.)

And if that wasn’t enough…

- Two platforms disappered and my money disappeared with them.

I’m still not sure what happened. I knew it was high risk investments but I didn’t expect the platforms to be outright scams.

I had not previously seen any scams in the Baltic P2P scene and after meeting borrowers and seing projects I couldn’t imagine everything was setup to be a scam. Maybe some projects and borrowers were real, while others were not?

I hope the Estonian police will find out, they’re investigating both cases: https://www.politsei.ee/en/news/were-envestio-and-kuetzal-a-fraud-1151

While I don’t expect the police to find any money, I hope they find enough evidence to place them behind bars for a considerable amount of time.

Let’s see how bad it looks after I lost 44 700€ in one month:

Monthly Income Statement: January 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -393.13€ | 3.93% | 10 994€ | 14 987€ |

| Bulkestate* | 0€ | 13.76% | 10 000€ | 10 989€ |

| Crowdestate* | 3.57€ | 6.11% | 5 850€ | 6 853€ |

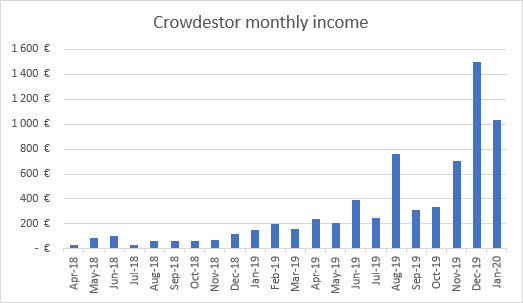

| Crowdestor* | 1 032.79€ | 16.25% | 85 000€ | 91 851€ |

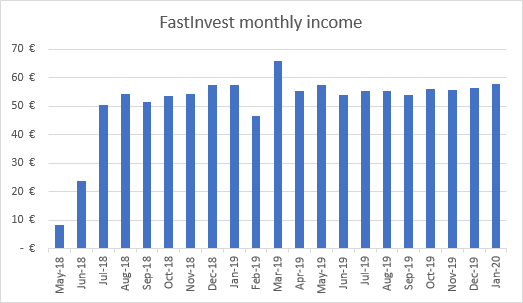

| FastInvest* | 57.94€ | 16.36% | 3 658€ | 4 851€ |

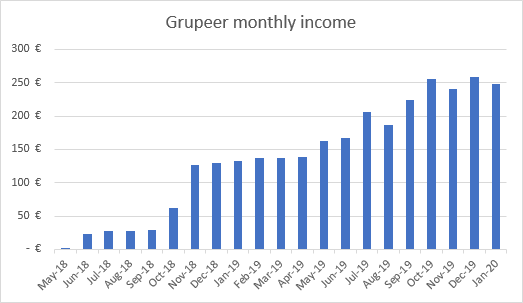

| Grupeer* | 248.70€ | 14.92% | 20 474€ | 23 554€ |

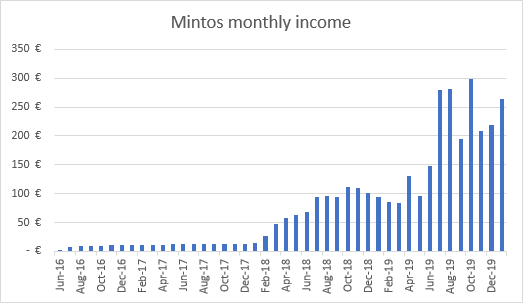

| Mintos* | 264.02€ | 16.10% | 20 000€ | 24 065€ |

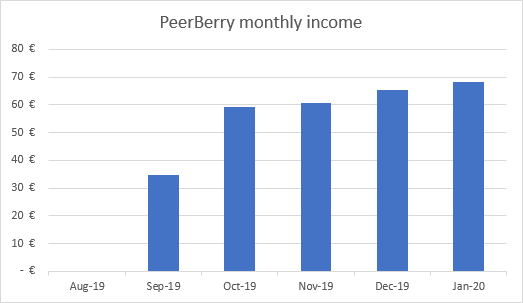

| PeerBerry* | 68.24€ | 13.56% | 5 500€ | 5 788€ |

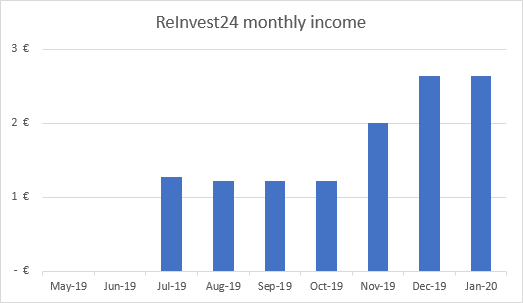

| ReInvest24* | 2.64€ | -0.96% | 1 000€ | 993€ |

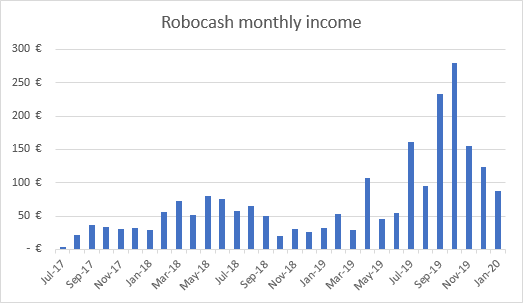

| Robocash* | 87.82€ | 12.79% | 10 000€ | 12 229€ |

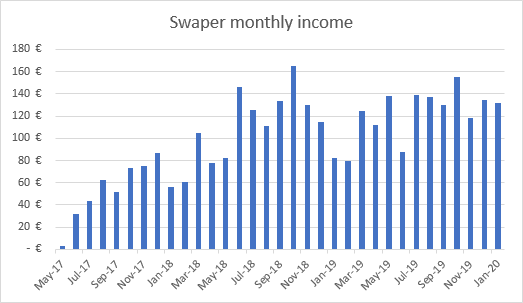

| Swaper* | 131.92€ | 14.23% | 10 000€ | 13 304€ |

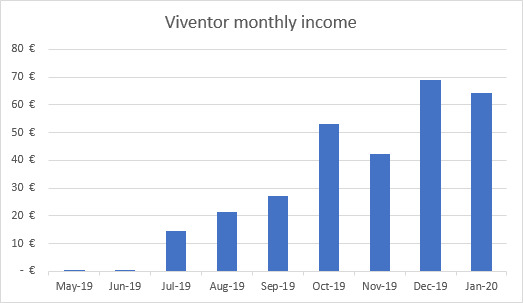

| Viventor* | 64.15€ | 12.00% | 5 000€ | 5 292€ |

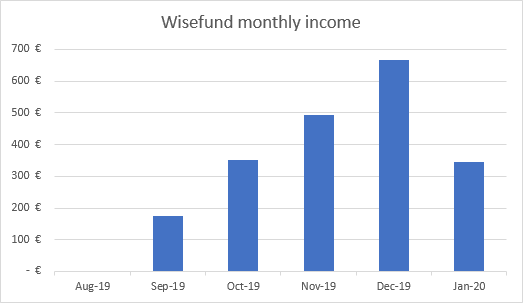

| Wisefund* | 346.39€ | 24.40% | 18 431€ | 20 626€ |

| 1 915.05€ | 10.41% | 205 910€ | 235 387€ | |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| -100% | 44 700€ | 0€ | ||

| Real Estate | Income | Invested | Value | |

| Property #1 | 704€ | 18 080€ | 40 436€ | |

| Property #2 | 1 167€ | 61 200€ | 59 947€ | |

| 1 871€ | 79 280€ | 100 383€ | ||

| Total | 3 786.05€ | 329 890€ | 335 770€ |

That means I’m 126.20% Financially Free (-53.97 percentage points from last month).

My second goal of 7 000€ per month reached 54.09% (-23.13 percentage points from last month).

Good news: I’m still financially free. Bad news: I lost all earnings from crowdlending investments and then some.

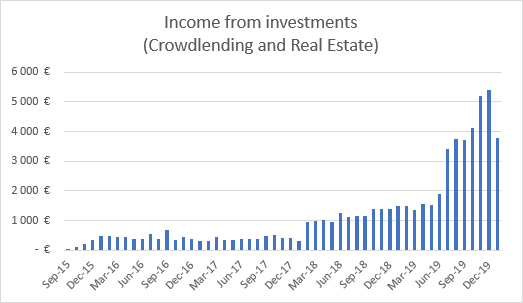

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 3 786.05€.

(-1 619.11€ less than last month).

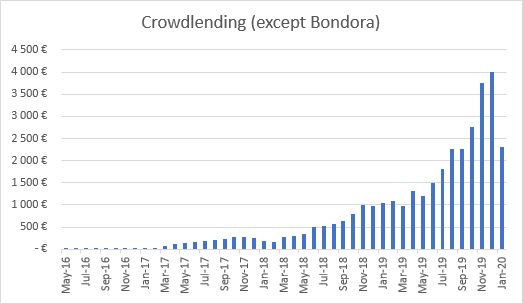

“Crowdlending (except Bondora)” reached 2 308.18€.

(-1 683.95€ less than last month).

Bondora

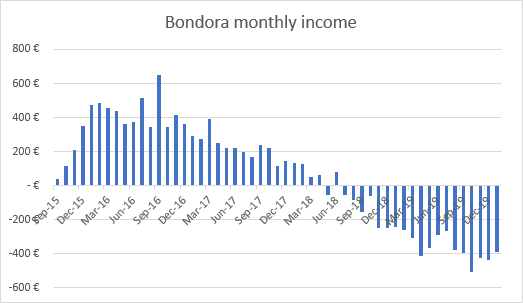

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

I read somewhere that Bondora’s own employees only invest in Go&Grow. None of them uses Portfolio Manager or Portfolio Pro. They have probably seen my income graph as well 🙂

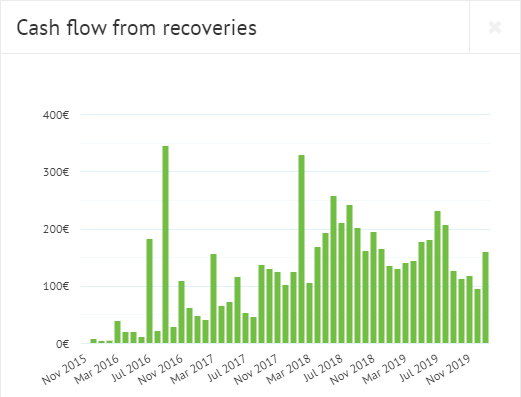

161.60€ was recovered in January but I still have 25 506€ in defaulted loans.

I do not recommend investing with Bondora unless you use the “Go & Grow” product only.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate with instant liquidity, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

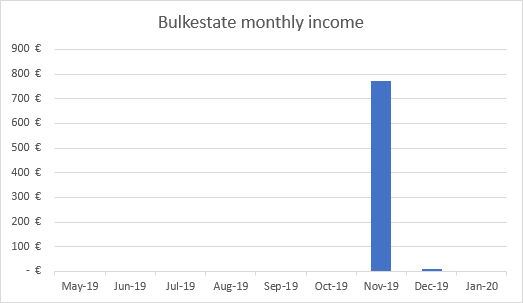

Bulkestate

I’m only invested in 1 project on Bulkestate* and the next payout is scheduled for 21.12.2020.

This graph will be quite boring to look at unless I invest in more projects.

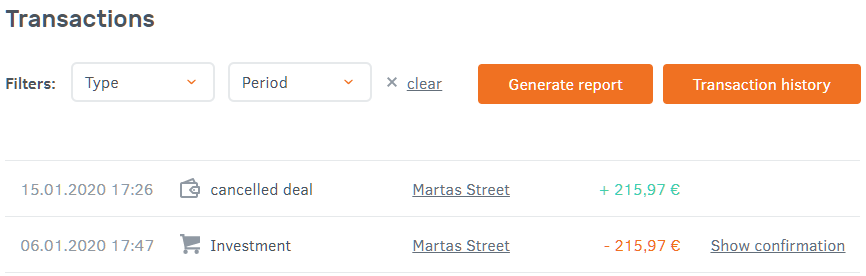

Project “Martas Street” was cancelled on Bulkestate* in January. A final check on the borrower revealed falsified documents. No money was paid out to the borrower and the money returned safely to investors accounts.

A list of new features was announced yesterday:

See more info and screenshot from my Bulkestate account

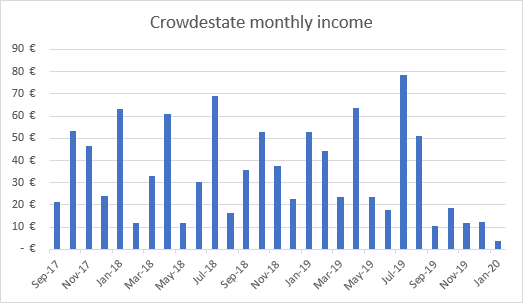

Crowdestate

The problems on Crowdestate* starts to show in my income graph.

I have 6 late and 1 defaulted project with Crowdestate.

It’ll be interesting to see how well Crowdestate will handle the defaults and delays in 2020.

See more info and screenshot from my Crowdestate account

Crowdestor

Crowdestor* is still my favorite platform. They offer a variety of projects with different risks and different yields.

I like their team and the way Janis Timma replies to questions on Facebook.

On January 8th I invested 10 000€ in the Limp Bizkit 2020 summer tour.

See more info and screenshot from my Crowdestor account

Envestio

If you invested in Envestio, you should read this article by the Estonian Police and follow the steps described.

I have so many unanswered questions about Envestio, I don’t even know where to start. Some part of me wants to get answers for everything and another part of me says “why bother, spending time on this will not get my money back”.

From the rumors I hear, “Envestio was not originally intended to be a scam but something happened along the way”.

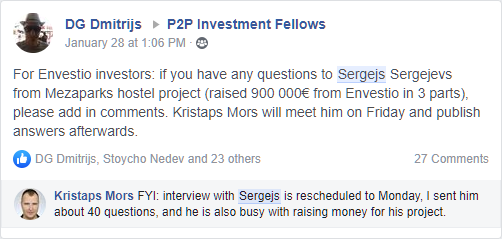

I’m looking forward to hearing from Sergejs, who agreed to answer questions from investors. I expect his project to be real and I’d like to know how he plans to pay investors back.

These articles are the best I’ve found on the subject so far:

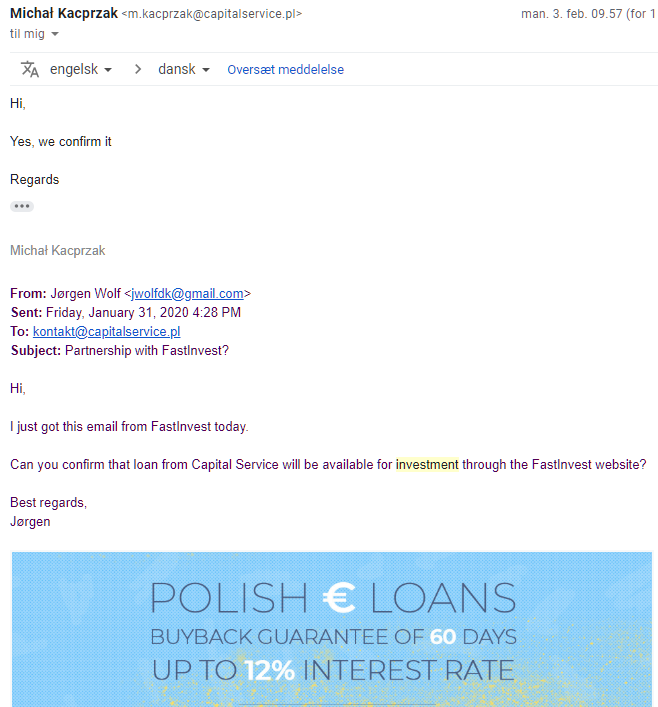

FastInvest

I’m really twisted about this platform. A lot of people say it’s obvious they’re a scam.

I have invested with FastInvest* for 21 months without any issues.

In 2019 FastInvest provided some names of 2 of their loan originators.

- eCommerce from Iceland which no one seems to have heard of.

- Kviku which is well known from Mintos where it has a B rating.

The revelation of only 1 well known loan originator wasn’t enough to convince me to stay with FastInvest. So I stopped reinvesting on January 24th and made my first withdrawal request on January 31st.

A few days after my withdrawal request, FastInvest announced the name of another loan originator, CAPITAL SERVICE S.A. which is also known on Mintos where it has a B- rating.

I immediately reached out to CAPITAL SERVICE S.A. to hear if they could confirm the partnership, which they did:

If FastInvest is a scam why would Kviku and Capital Service S.A. want to do business with them? Why does it have to be this hard to know who to trust?

See more info and screenshot from my FastInvest account

Grupeer

Grupeer* remains one of the most stable investments in my portfolio.

In an attempt to anwer the most asked questions and bring peace of mind in this chaotic market, Grupeer recently released a statement on YouTube:

See more info and screenshot from my Grupeer account

Kuetzal

Since my last monthly update it was clear that Kuetzal was a scam. Maybe a few borrowers were real but most seemed never to have worked with Kuetzal.

The website is now deleted and it’s obvious that they’re not going to pay anyone back in February, as they initially stated.

Similar to Envestio, If you invested in Kuetzal, you should read this article by the Estonian Police and follow the steps described.

Mintos

The interest rates on Mintos* keeps climbing up, it’s not uncommon to see 15-16% loans these days.

A German guy created this Google Sheet which is automatically updated with the latest interest rates from all Loan Originators on Mintos. It’s really nice to get an overview of current and past interest rate levels.

If you sign up with my Mintos referral link*, you’ll get 0.5% cash back on all investments you make within the first 90 days of registration.

See more info and screenshot from my Mintos account

PeerBerry

I use PeerBerry* for my children’s savings account.

Overall, I’m happy with the platform even though the highest yielding interest rates have dropped from 13.1% to 12.7% since I opened my account.

There’s plenty of short-term loans available at 12.5%. (A rise from 11.5% last month).

See more info and screenshot from my PeerBerry account

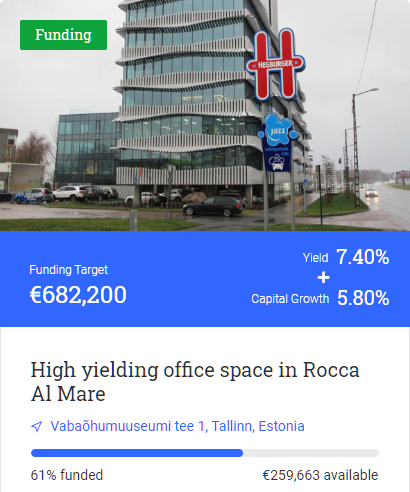

Reinvest24

Not much new on ReInvest24* since last update.

2 out of 3 projects I invested in are paying dividends, 1 is waiting to be sold.

I hope ReInvest24 will turn out to be an amazing platform. They’re still lacking volume to fund their projects fast enough.

This is their latest project, which is already rented out (8 year fixed rental contract). Investors will start earning interest from the day they invest. 61% of the project has been funded now.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

Robocash

January started out as a weak month for my Robocash* portfolio. At one point I had 10k EUR idle (not invested in any loans) out of my 12k EUR portfolio.

However, they added a lot of short term loans last week and all my 12k are invested again.

See more info and screenshot from my Robocash account

Swaper

Not much to report on Swaper*. Cash drag was not too bad in January, I had 1k EUR idle on average.

See more info and screenshot from my Swaper account

Viventor

I’m still testing out Viventor* to see whether it’s a platform I like to keep in the long run. The platform is working very smooth – so far so good.

Not a single repayment from the troubled loan originator “Aforti” in November, December or January. No news either. Not a good sign. But the same goes for Aforti on Mintos, no difference there.

See more info and screenshot from my Viventor account

Wisefund

Interest on Wisefund* in January was lower like expected.

I decided to reduce my exposure to Wisefund until I’m 100% certain they’re legit. So I withdrew my 11k EUR which was returned from a finished project and I withdrew the interest earned in January. Both withdrawals were in my bank account a few days later.

If you sign up and invest through my referral link*, you will get 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Wisefund account

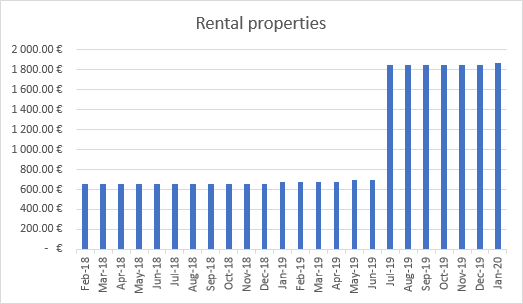

Real Estate

I received rent from all 5 tenants on time as usual.

The rent for most tenants is adjusted according to the “consumer price index” every year. Thus earnings increased a litte from 1 853€ to 1 871€.

See more info about my First property and Second property

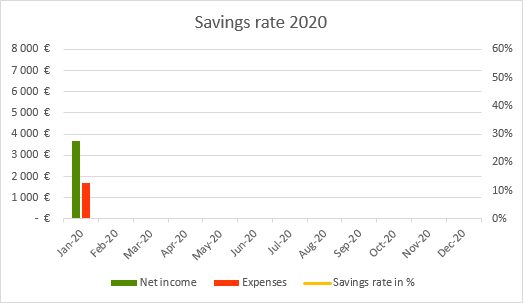

Savings rate

My savings rate in January was 53.63%.

I have officially received my last paycheck from my former IT job.

From now on, I’m relying 100% on myself to generate enough income for our family. A bit scary to think about but I’m up for the challenge.

Moving to Portugal will definitely help us to keep our expenses low.

See more info about my Savings rate

Blog statistics

Visitors: 23 476 (+41.18% compared to last month)

Page views: 104 394 (+42.20% compared to last month)

2909 Subscribers (+262 compared to last month)

1 441 Facebook followers (+136 compared to last month)

Start your own blog

FinanciallyFree is hosted on SiteGround* for the incredible low price of 3.95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

Free EUR bank account with no fees

I recently opened a bank account with N26* and received a free MasterCard. They are similar to Revolut* but N26 has much higher transfer limits and you can withdraw euros from any ATM up to five times every month for free.

N26 is a German bank with base in Berlin and your account is secured up to 100 000€ like any traditional bank!

2 of my good friends have been using N26 for a couple of years and they both endorse their services. I LOVE N26 already!

Quote of the month

“If you lose money you lose much, if you lose friends you lose more, if you lose faith you lose all.” – Eleanor Roosevelt

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.