Dear fellow investors, friends, family and future self.

We’ve already lived in Portugal for a month and we love it here. The warm climate makes such a big impact on our moods. Honestly, it feels like being on vacation every day. That feeling will most likely fade when time passes and the kids start in school but I don’t think it will ever go away completely.

I started playing tennis, which I’ve never done before, once a week for 2 hours. We’re all amateurs but it’s surprisingly fun. We are usually 12 people playing doubles on 3 courts.

Our oldest girls will most likely join the local swimming team later this month. They’re looking forward to that as well.

We’re still looking for a car to buy. Currently we’re renting a 2009 Skoda Octavia Estate which honestly is really nice but it doesn’t offer too much space on the back seat. I’ll most likely purchase a used VW Touran, it seems to be a good option for a family of 5. Cars are somewhat expensive here compared to the rest of Europe, but still cheaper than Denmark.

We all got our NIF numbers now (Individual Tax Identification Number used in Portugal) which is essential to do anything here. Our address has been registered at the local “Junta de Freguesia” and we’ve set up a meeting with the “Camara municipal” in November to apply for residency.

Regarding school for our kids, we talked to the local school last week and presented all our papers to them. We had all the information they needed but they requested one of the Danish documents to be translated into Portuguese by approved authority. So we contacted a professional translator who’s now in the process of translating it for us. Once that’s done we should be able to register the kids in school. School starts on September 16th here so we might be able to get it done in time.

That’s all I had to share about our personal life this month, let’s move on to the numbers. Here’s the overview of my current finances:

Net worth: August 2021

| Crowdlending | Income | Invested | Value |

| Bondora* | -131.62€ | 6 177€ | 4 196€ |

| Bulkestate* | 2.52€ | – 2 567€ | 228€ |

| Crowdestate* | 0.00€ | 4 851€ | 5 871€ |

| Crowdestor* | 1 102.49€ | 67 067€ | 83 591€ |

| Mintos* | 13.07€ | 1 073€ | 10 007€ |

| PeerBerry* | 88.32€ | 6 000€ | 7 883€ |

| ReInvest24* | 7.56€ | 1 000€ | 1 203€ |

| Swaper* | 0.00€ | – 5 886€ | 78€ |

| Viventor* | 0.24€ | 4 083€ | 3 348€ |

| 1 082.58€ | 75 158€ | 116 428€ | |

| Real Estate | Income | Invested | Equity |

| Property #1 | 710€ | 18 080€ | 47 516€ |

| Property #2 | 1 167€ | 61 200€ | 69 906€ |

| Property #3 | 464€ | 41 383€ | 50 831€ |

| 2 341€ | 120 663€ | 168 254€ | |

| Stocks (DEGIRO*) | 84 961€ | 127 717€ | |

| Crypto | 20 650€ | 58 488€ | |

| Cash | 11 225€ | ||

| Total | 3 423.58€ | 301 432€ | 482 114€ |

Comparing to last month

My Net Worth rose 40 347€ compared to last month. Most of the gains came from HEX crypto which jumped 68.75% from 0.16$ to 0.27$.

Stocks were almost flat (2,4% gain).

Crowdlending

PeerBerry*, ReInvest24*, Swaper*, Robocash* and Bulkestate* performs nicely as usual.

Crowdestor*: All interest on “The Catch” project was paid back but the principal, which was also due, has been delayed. A couple of “Dizozols” projects (Forestland investments and Timberland investments) which I invested in, were both paid back in full in August. My sentiment is neutral until I see repayments from important projects such as Dystopia, INCH2 and the WarHunt movie.

Real Estate

All units are rented out, except one apartment in the third property. The bathroom needs to be extended and renovated before it can be rented out because it doesn’t have a shower yet.

A tenant called because the LCD lights below the kitchen cabinets stopped working. I called a local electrician and asked him to fix it.

I also made an agreement with a property service company to have them maintain the area in front of the second property (remove weeds, snow etc.) Such things are no longer possible to do myself when I live 3000 km away.

Stocks

My stock portfolio was almost flat in August, ending up ~2.5% higher than July. I added to a couple of positions (NNDM and SKLZ) and bought DOYU.

You can track my stock portfolio here.

Follow me on Twitter to get live updates when I make a trade!

I buy my stocks and trade on DEGIRO*, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link* to sign up we will both receive a 20€ in transaction reimbursement (fee deduction).

Crypto

The price of HEX rose 68.75% from 0.16$ to 0.27$ since last update and almost 7x’ed from where I bought it at 0.04$.

Kind of crazy but… it’s crypto! I wouldn’t be surprised to see the price reach the 1.00$ mark by the end of this year and >10$ within a couple of years.

If you think you’re late to buy and missed the opportunity, ask yourself how many people you know who have even heard about HEX. It’s being gatekept from coinmarketcap etc, only nomics.com which extracts data directly from the blockchain shows the true numbers. Imagine what happens to the price when it’s being recognized and it goes viral.

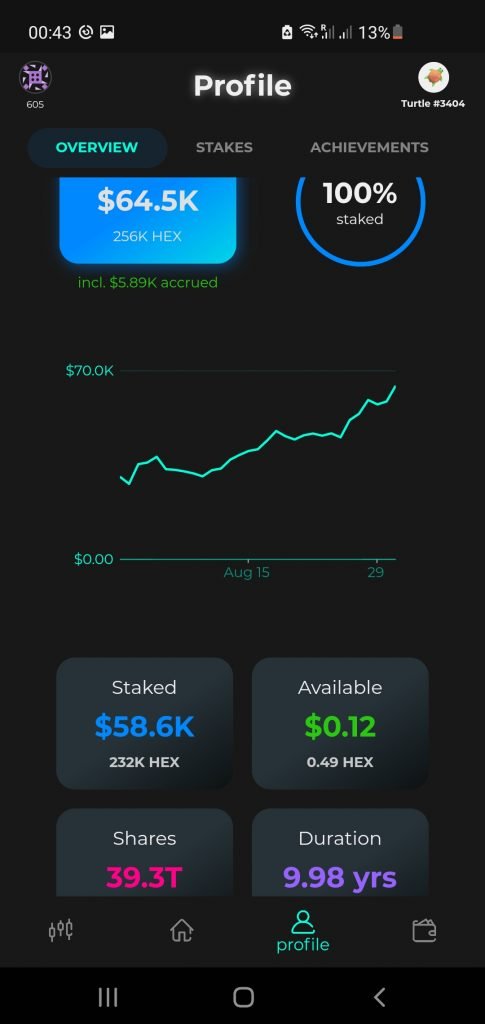

Earning trustless interest every day on my 10 year HEX stake is quite amazing. My stake is generating ~228 HEX per day. At the current price of 0.28$ per HEX that is equivalent to 63.84$ per day or just shy of 2 000$ per month (!)

If you’re thinking about buying HEX I recommend you listen to this 4 hour debate between Eric Wall and HEX developer Kyle and decide for yourself.

If you own HEX (or plan to) you should definitely check out the Staker app. It has a lot of cool features, is free to use and it’s ad free! You can get a new HEX wallet directly in the app or connect your existing MetaMask wallet.

You can see my crypto portfolio here.

Free EUR bank account with no fees

I use N26 to transfer to and from my investments. It even comes with a free debit MasterCard. N26 is by far my favorite banking provider!

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough).

Comments are closed.