Dear fellow investors, guys and gals, friends and family.

Welcome to another episode of “global pandemic affects everything”.

This month I’ll make the Crowdlending part short and sweet. When societies open up again, we’ll see how much damage the sector has taken. I’m still hopeful and keep reinvesting for the most part.

Grace periods given by P2B platforms sets their marks on this month’s earnings. Let’s have a look.

Monthly Income Statement: April 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -304.88€ | 2.68% | 9 853€ | 12 594€ |

| Bulkestate* | 0€ | 10.12% | 10 000€ | 10 989€ |

| Crowdestate* | 8.21€ | 5.78% | 5 648€ | 6 685€ |

| Crowdestor* | 0€ | 13.47% | 82 912€ | 91 438€ |

| FastInvest* | 28.46€ | 16.13% | 1 911€ | 2 176€ |

| Grupeer | 0€ | 13.52% | 20 474€ | 24 001€ |

| Mintos* | 243.73€ | 18.13% | 20 000€ | 25 647€ |

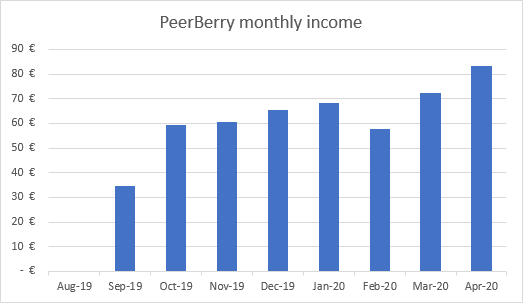

| PeerBerry* | 83.38€ | 14.31% | 6 000€ | 6 510€ |

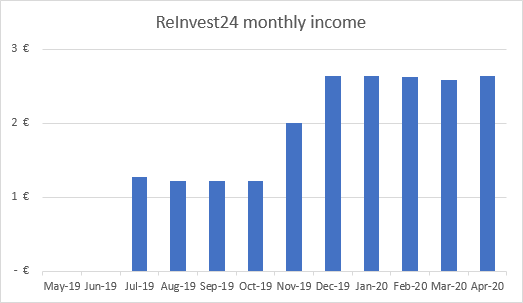

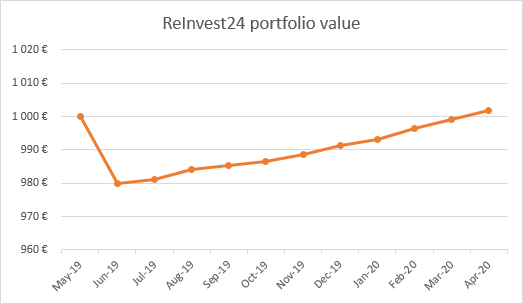

| ReInvest24* | 2.64€ | 0.18% | 1 000€ | 1 001€ |

| Robocash* | 98.95€ | 12.55% | 10 000€ | 12 546€ |

| Swaper* | 108.62€ | 14.02% | 10 000€ | 13 684€ |

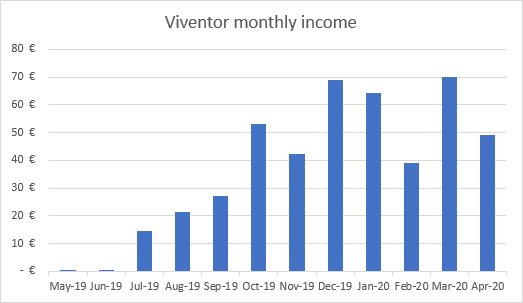

| Viventor* | 49.30€ | 13.70% | 5 000€ | 5 504€ |

| Wisefund | 0€ | 20.26% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 318.41€ | -3.80% | 245 353€ | 233 408€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 380€ | 44.67% | 18 080€ | 41 448€ |

| Property #2 | 1 167€ | 0.34% | 61 200€ | 61 373€ |

| 1 547€ | 79 280€ | 102 822€ | ||

| Total | 1 865.41€ | 1.97% | 324 633€ | 336 230€ |

Note: I marked Grupeer income as orange for now because it’s highly questionable. Read more in the Grupeer section below.

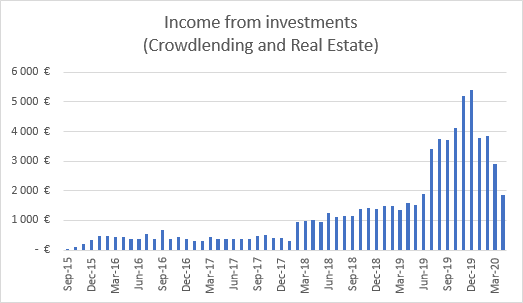

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 1 865.41€.

(-1 048.42€ less than last month).

That means I’m 62.18% Financially Free (-31.70 percentage points down from last month).

Stocks

Some of you asked if I would share my stock market moves. Sure, why not? Just remember that I’m a complete amateur with no financial background. Nothing shared here is investment advice. My best advice for you is to grab a bowl of popcorn – it’s for entertainment purposes only.

Right from the get-go, I deviated from my original plan of getting into index funds like the Vanguard S&P500 ETF “VUSA”. (Well done me!) I was simply too slow to get my account funded.

Experts say we should never try to time the market… But buying here at ~50€ (just 16% from all time highs) feels wrong to me in the environment. If we get another leg down to 40€ or less I’ll be ready to get a position.

Instead, I used the opportunity to buy some equity in the most troubled sectors like oil and airline stocks. It’s a high risk move, I’m well aware of that. We could easily see further price fluctuations in the coming months.

I like these price levels though, so I’ll give it a shot. Boeing $BA for example is trading around 128€ today, which is a long way from the top of 440€ in 2019.

Here is my current list of stocks:

[table id=1 /]I trade on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction).

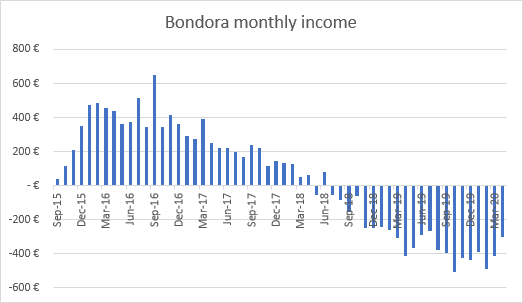

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

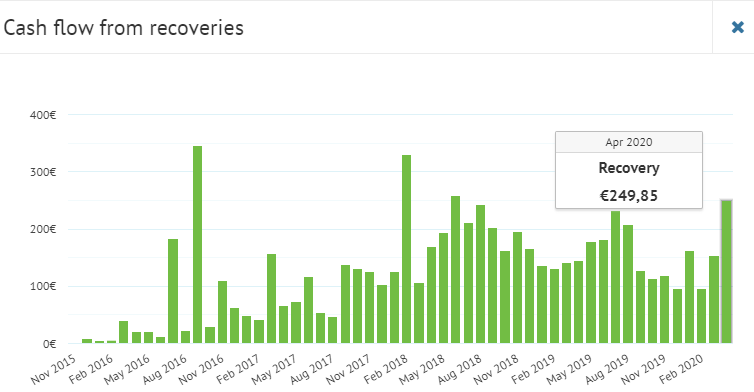

249.85€ was recovered in April but I still have 25 089€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

Bulkestate

I’m have invested in 2 projects on Bulkestate* and the next payout is scheduled for 21.12.2020.

See more info and screenshot from my Bulkestate account

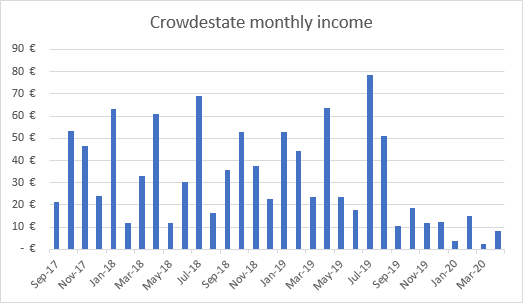

Crowdestate

The problems on Crowdestate* shows clearly in my income graph.

I’m slowly withdrawing funds as they are repaid.

I have 6 late and 1 defaulted project. It’ll be interesting to see how well Crowdestate handle the defaults and delays in 2020. The Corona virus is not going to make it any easier to recover my funds.

See more info and screenshot from my Crowdestate account

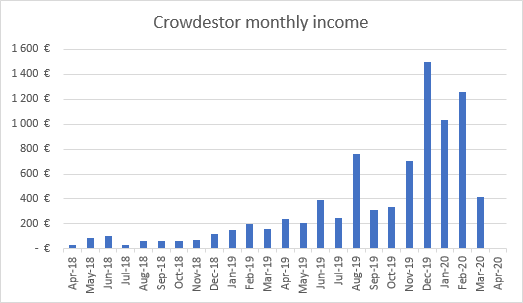

Crowdestor

Crowdestor* investors voted for individual Covid-19 recovery approach for each borrower.

In the official Crowdestor Facebook group, CEO Janis Timma has posted that several companies will not make use of the recovery period. Several companies will return to the original payment schedule soon.

If you want to become a shareholder in Crowdestor, the time is now. Crowdestor has started and funded the first two rounds of their equity campaign. The campaign is designed like a 26% interest loan with a 1 year duration, which can be converted into shares if certain conditions are met.

If their grandeur plan of becoming top 3 business Crowdlending platform in Europe works out, investors could have their money multiplied more than 50 times within 5 years.

I’d like to become a shareholder myself. Hopefully some of the projects I invested in will pay back soon, so I can reinvest the money into the next equity campaign.

See more info and screenshot from my Crowdestor account

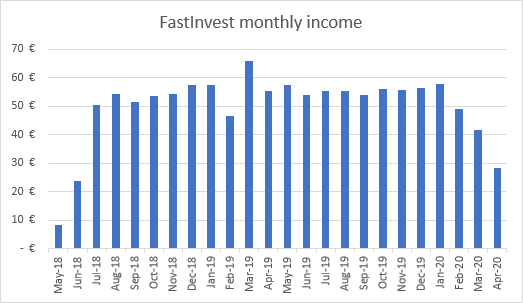

FastInvest

FastInvest* is still processing withdrawals, even though they take longer due to the increased liquidity demand. I’m still waiting for my last withdrawal from April 16th. The last one took about 2 weeks.

See more info and screenshot from my FastInvest account

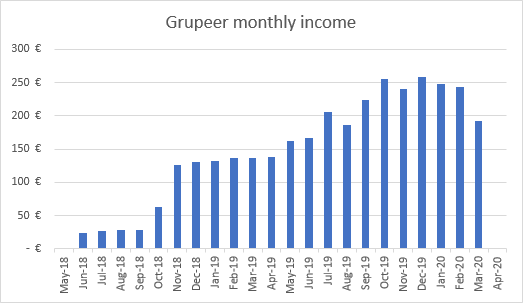

Grupeer

The Grupeer website is still up and they posted 3 times on their blog in April. The latest message says they predict stabilization within two years…

Really? 2 years? Don’t hold your breath..! A website which prepares for legal action has been created by Ido Shkedi.

See more info and screenshot from my Grupeer account

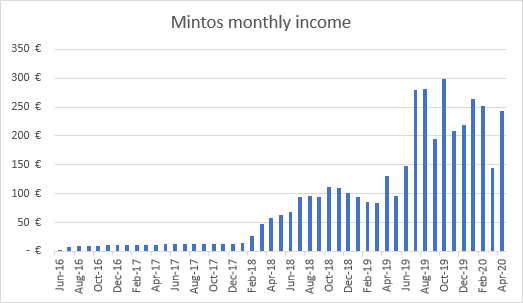

Mintos

I also bought some discounted loans from A-B+ rated loan originators in April, hoping the loan originators will survive and be able to buy the loans back. A risky strategy for sure, let’s see how it works out.

Mintos* tells me I earned 634.58€ in April (because of the discounts) but I don’t see it as profit until the loans are paid back. That’s why I only report pure interest earnings of 243.73€.

See more info and screenshot from my Mintos account

PeerBerry

I use PeerBerry* for my children’s savings account.

See more info and screenshot from my PeerBerry account

Reinvest24

My ReInvest24* account reached break even after 1 year of investing. Not impressive. This is mainly because funding of the projects takes months and no interest is paid out for most projects in the funding period.

Tanel, CEO of ReInvest24, will start to write quarterly updates on their blog, so we can see how their rental properties performs. That’s nice.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

For the whole month of May, Reinvest24 will give 2% Cashback to every user who invests at least EUR 500 on the platform.

See more info and screenshot from my ReInvest24 account

Robocash

Robocash* held a Live Web Cast on April 7th. In case you missed it, you can find the recording on YouTube.

See more info and screenshot from my Robocash account

Swaper

Swaper* is sending out weekly reports of their loan portfolio performance during the Covid-19 outbreak. According to their emails, they’re actually seeing lower default rates in 2020. That’s interesting, how is this possible?

According to Swaper, “These numbers are result due to of our changes in risk policy and debt collection procedures, which also decreased the amount of issued loans, however in order to maintain the quality of portfolio, we aim to keep the current policy for as long as it will be necessary.”

I really hope Swaper (and Wandoo Finance which is the mother company) will make it through the crisis, it’s such an easy and pleasant way to invest.

See more info and screenshot from my Swaper account

Viventor

Viventor* is a marketplace for loans like eg. Mintos and PeerBerry. I’m still testing it out to see whether it’s a platform I like to keep in the long run. The platform is working smoothly – so far so good.

I also bought some discounted loans on Viventor in April.

Viventor also posts Webcasts on their YouTube channel. I enjoyed watching this interview with Lars Wrobbel and Alexander Melis from IbanCar. IbanCar is a loan originator on Grupeer and Alexander shares his view on the Grupeer situation.

See more info and screenshot from my Viventor account

Wisefund

None of my Wisefund projects paid interest in April.

Wisefund sent out a survey, asking how investors would like Wisefund to act in order to optimize chances of getting our money back.

While I appreciate the “ask first” approach, I didn’t see any official “Sorry, our buyback guarantee was nothing but a marketing gimmick” message or post. Maybe I missed it…

Nevertheless, I hope the borrowers will thrive and we’ll get our investments back with a few months delay.

See more info and screenshot from my Wisefund account

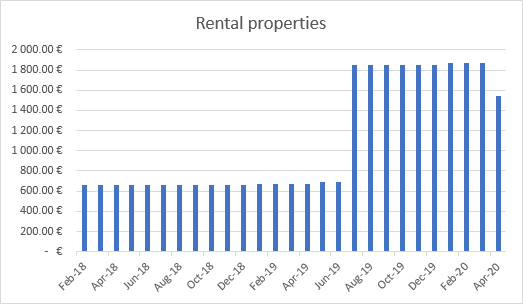

Real Estate

I received rent from 4/5 tenants in April. 1 Tenant moved out on May 1st.

According to the contract the tenant has 3 months notice. I always collect 1 month prepaid rent and 3 months deposit, so even if the tenant doesn’t pay I’ll still be able to cover the rent for the legally binding period.

See more info about my First property and Second property

Savings rate / expenses overview

My total expenses for the month were 1 146€ including 800€ rent (the full rental amount).

My partner paid for most of the groceries and for our rental car. We’re paying 215€ per month for our current rental car, everything but gasoline included.

See more info about my Savings rate

Blog statistics

Visitors: 8 741 (-12.96% compared to last month)

Page views: 29 418 (-6.36% compared to last month)

3 065 Subscribers (+36 compared to last month)

1 528 Facebook followers (+15 compared to last month)

Quote of the month

“Every problem is an opportunity in disguise”

― John Adams

Safe access to work, streams and games

With NordVPN* your internet connection is secure and you can browse the web with full privacy.

You can even watch your favorite TV show from any country without limitations. I have created a quick overview page of NordVPN benefits, check it out.

NordVPN gives a 30-day, no questions asked, money-back guarantee. Why not try it and see if you like it?

Start your own blog

What better time to start blogging than during a lock-down? During the Covid-19 pandemic, SiteGround* offers 3 months StartUp hosting for 0.99€.

First renewal will be on promotional terms for 1 year (50% discount) keeping the overall cost very affordable.

OBS! The offer ends on May 12, 2020. After this date the price is 3.95€ per month.

Free EUR bank account with no fees

I use N26* to transfer to and from my investments. Even living in Portugal, it’s my main choice of bank.

If you live in Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, Sweden or the United Kingdom, having a EUR bank account will save you from currency exchange fees.

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.