Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Dear friends, family and financial freedom seekers from all over the world.

October was quite a month… I quit my day-job!

Since I have 3 months notice, my last day will be January 31st. However, I’m on paternity leave until January 2nd and I have more than 5 weeks of vacation left, so I might not come back at all.

Why quit now? Well, since I reached my first goal of 3 000€ per month back in July, I started looking at my options. As my good friend Mark described this blog post I could retrire in Portugal and live a pretty good life already, since costs of living are lower than in Denmark.

So, in October we spent 14 days in Portugal in this wonderful house to try to get a feeling for the country. If you’re new to AirBnB you can get up to 40€ off your first booking through this link.

We really enjoyed the country and it wasn’t hard to imagine us living there. So why not give a shot now that we have the chance?!

Here are the numbers that makes it all possible!

Monthly Income Statement: October 2019

| Crowdlending | Income | XIRR | Value |

| Bondora | -510.26€ | 5.21% | 17 669€ |

| Bulkestate | 0.00€ | 2.10% | 10 100€ |

| Crowdestate | 18.73€ | 6.60% | 6 825€ |

| Crowdestor | 334.60€ | 14.88% | 48 619€ |

| Envestio | 421.20€ | 20.82% | 29 163€ |

| FastInvest | 56.16€ | 16.66% | 5 112€ |

| Grupeer | 255.54€ | 15.16% | 22 780€ |

| Kuetzal | 425.92€ | 24.70% | 26 786€ |

| Mintos | 298.64€ | 16.90% | 23 344€ |

| PeerBerry | 59.35€ | 11.60% | 5 094€ |

| ReInvest24 | 1.22€ | -2.95% | 986€ |

| Robocash | 279.94€ | 12.79% | 11 863€ |

| Swaper | 155.19€ | 14.49% | 12 920€ |

| Twino | 61.66€ | 13.68% | 0€ |

| Viventor | 53.19€ | 9.70% | 5 117€ |

| Wisefund | 349.92€ | 28.99% | 30 676€ |

| 2 261.00€ | 11.16% | 257 059€ | |

| Real Estate | Income | Equity | |

| Property #1 | 691€ | 39 425€ | |

| Property #2 | 1 162€ | 58 518€ | |

| Total | 4 114.00€ | 355 003€ |

That means I’m 137.13% Financially Free (up 12.80% from last month).

My second goal of 7 000€ per month reached 58.77% (up 5.49% from last month).

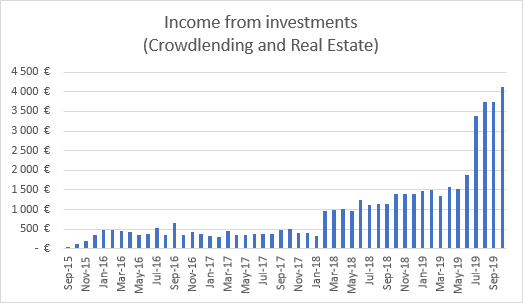

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 4 114.00€.

(383.97€ more than last month).

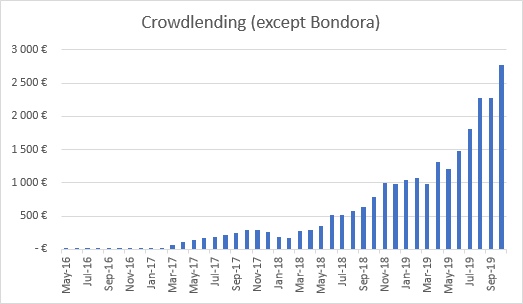

“Crowdlending (except Bondora)” reached 2 771.26€.

(499.27€ more than last month).

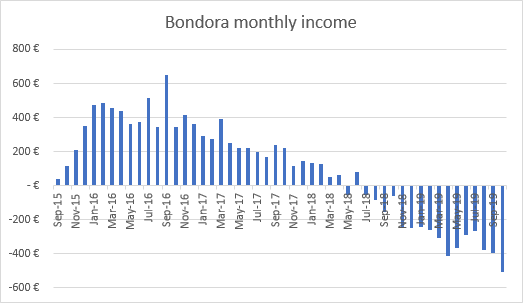

Bondora

Another disappointing month on Bondora … It won’t be long until the negative months have gobbled up all the interest earned in the beginning.

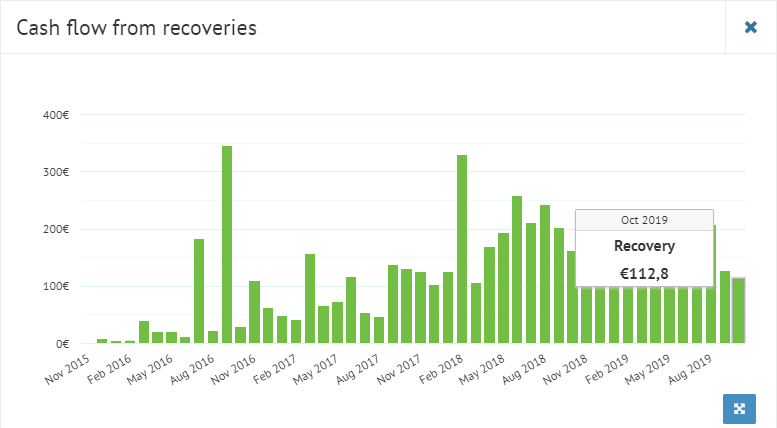

112.80€ was recovered in October but I still have 25 732€ in defaulted loans.

I do not recommend investing with Bondora unless you use the “Go & Grow” product only.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate with instant liquidity, use this link to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

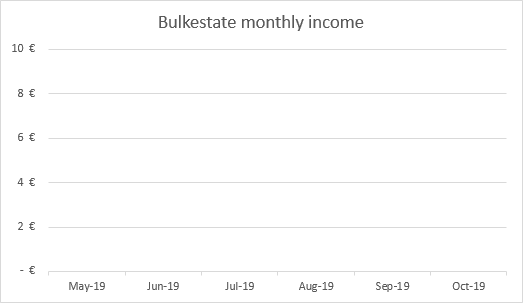

Bulkestate

I still have an article about Bulkestate on my to-do list. I already visited them from September 18-20. We saw some of the development projects and had some good conversations so I already have all the material needed for the article. I will find the energy for it this month, I promise.

I hope I convinced them that monthly interest payments is the way to go! If they implement this, I will surely deposit more money to my account.

Many people ask me why I don’t have Estateguru in my portfolio. The reason is, I believe Bulkestate has better projects (lower default rate) and higher interest rates. I prefer quality over quantity.

See more info and screenshot from my Bulkestate account

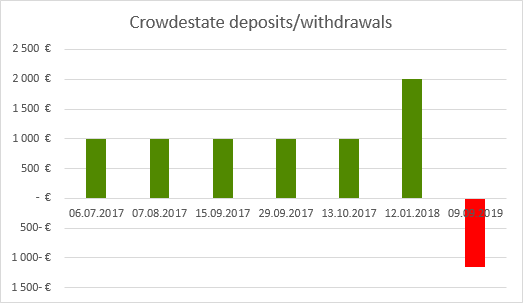

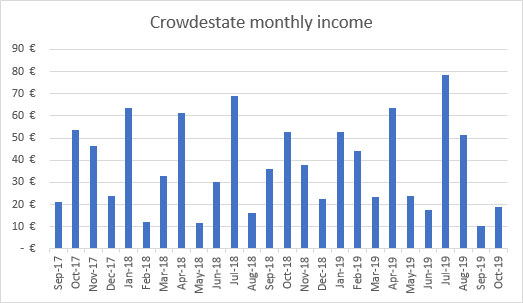

Crowdestate

I’m slowly leaving Crowdestate.

The amount of delayed projects and especially lack of communication from Crowdestate has reached a point where I’ve had enough.

I’ve been happy with Crowdestate until now but it’s not the same platform as it was 2 years ago. They used to have several high yield development projects, now most of them are 11%.

In my opinion, Bulkestate is a much better platform for Real Estate investments.

See more info and screenshot from my Crowdestate account

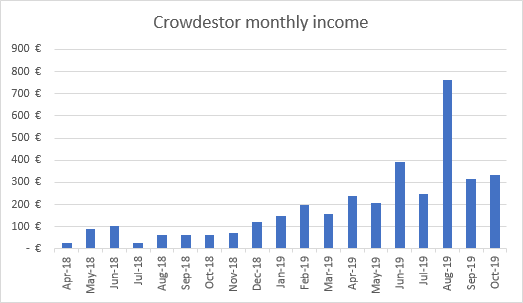

Crowdestor

Crowdestor is still my favorite platform at the moment (even though Wisefund is getting close to be on par). They offer high interest rates, amazing performance (all loans have been paid on time) and a great variety of projects.

The big spike in August happened because I received my first payment from the “Energy production plant” project which pays interest after the first 6 months and every month after that.

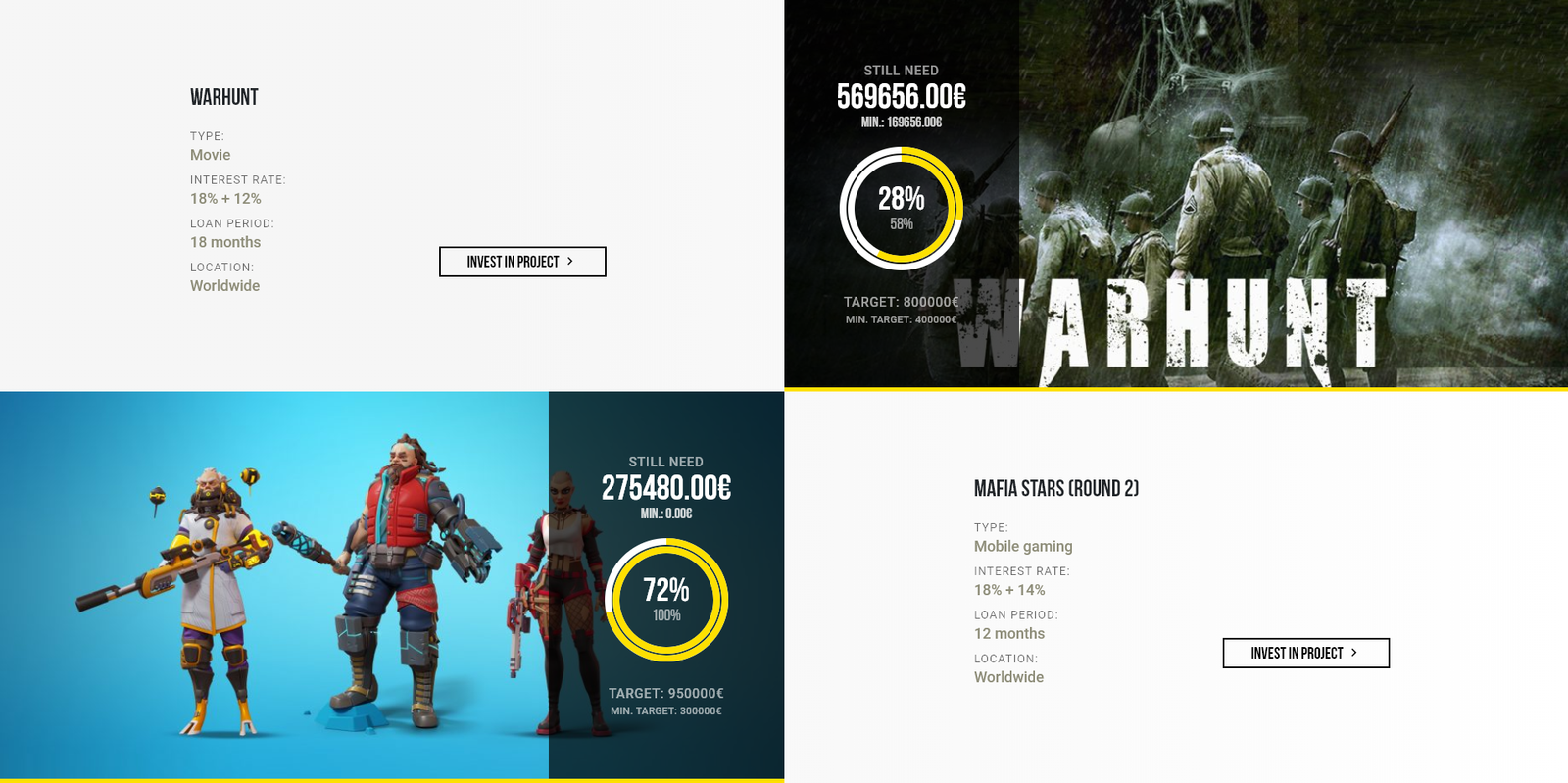

The Movie project was published yesterday! As far as I know, this is the first time a movie is funded through crowdlending. The interest rate is very generous, 18% fixed + up to 12% bonus if ticket sales goes well!

Mafia Stars round 2 is also open (18% fixed + up to 14% bonus), so if you’re looking for high yielding projects this is your chance to get involved. Both will most likely be funded within a week.

I transferred another 10 000€ to Crowdestor today and invested 5 000€ in each. My Crowdestor portfolio value is now 58 650€.

Crowdestor is working on a website update which will be available soon. I have been testing the new site for them for the past few days and it will introduce some new features such as an “upcoming payments list”, “interest earned graph” and “2 factor authentication”. I’m sure you’ll like it.

See more info and screenshot from my Crowdestor account

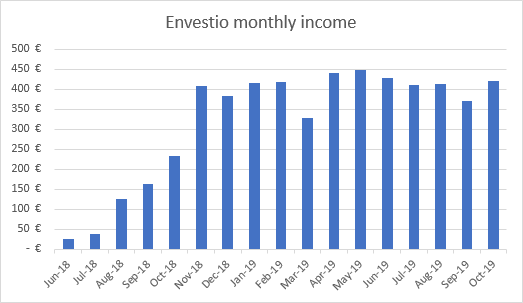

Envestio

All projects on Envestio have paid me on time from the day I started in Jun-18.

I’ve already earned more than 5 000€ from interest payments on Envestio, that’s pretty neat.

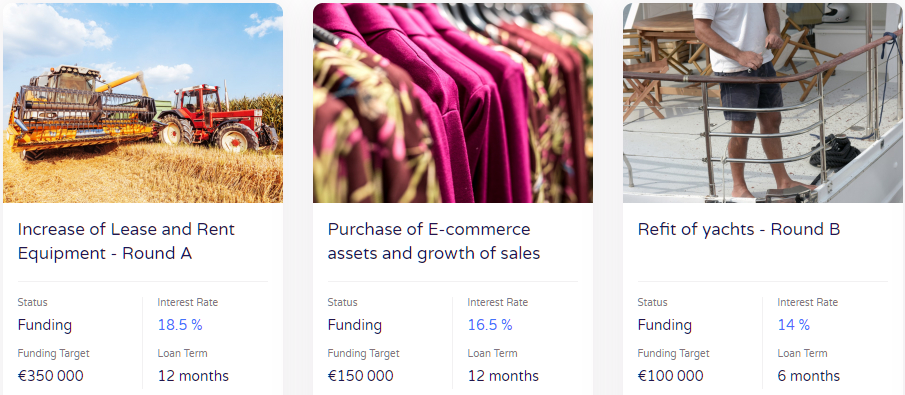

They don’t publish as many projects as Crowdestor but interest rates are still high (typically between 16.5% to 18.5%) even though they have 12 000 investors now and 28M EUR has been funded!

Currently 2 projects are available for investment at 17.5% and 18.5% interest:

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

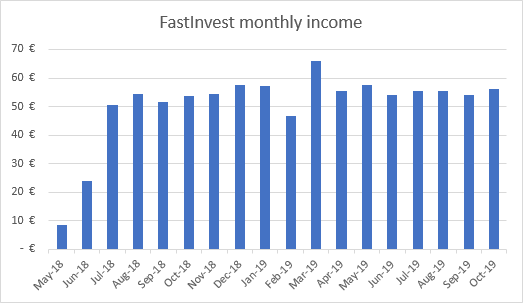

FastInvest

FastInvest is still doing what it’s supposed to do: invest and reinvest automatically.

They announced a new loan originator “Kviku” which we already know from platforms like Mintos and Viventor.

We still have no idea who the other loan originators are but announcing Kviku it’s a step in the right direction. Hopefulle the rest will be revealed soon.

See more info and screenshot from my FastInvest account

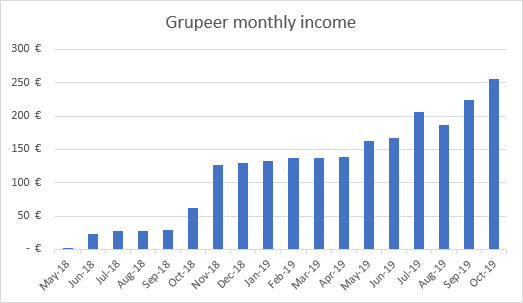

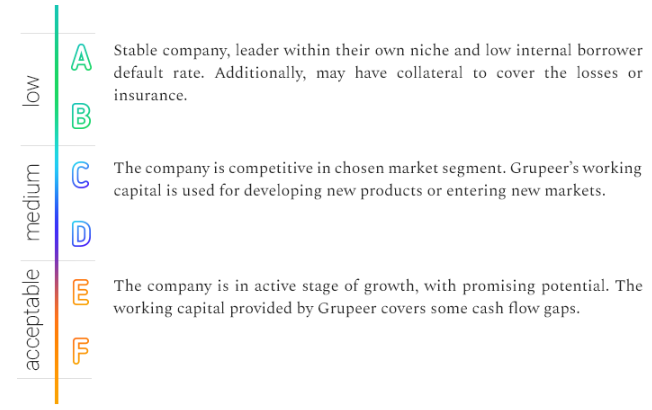

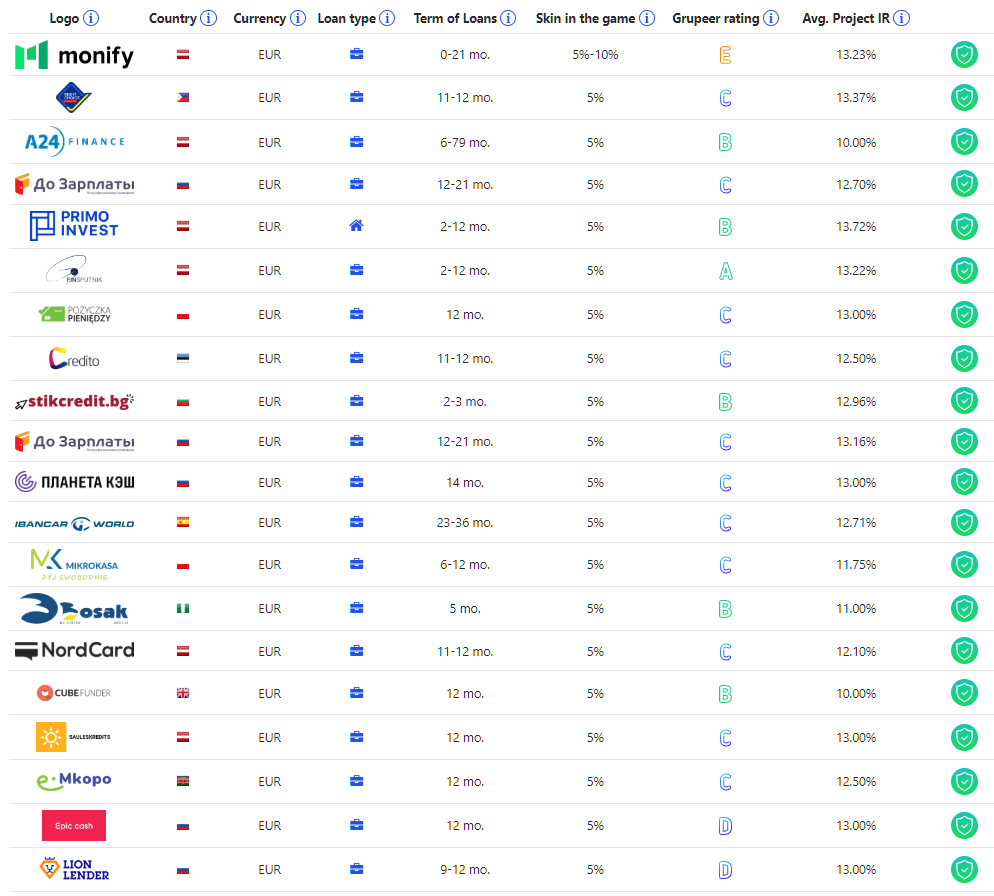

Grupeer

I earned 250€ on Grupeer for the first time. Looking at the stability of the income graph below, I expect this to be the new standard.

Grupeer recently updated their website with a list of all loan originators and introduced loan originator ratings.

See more info and screenshot from my Grupeer account

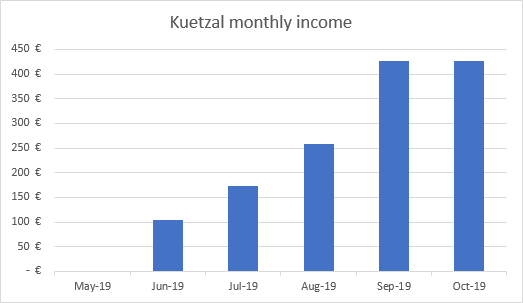

Kuetzal

Kuetzal returned the same amount as last month. As usual, they all paid on time.

Next month should be 13.93€ higher because I reinvested my earnings into “Shredder Machine” and “Green Dev – Pyrolysis and Distillation systems”.

There’s currently 3 projects with buyback guarantee open for investment. Interest rates from 16-19%.

Kuetzal informed investors today that one of their borrowers SIA Alpa Büve was having issues with his company. For this reason, repayments are now being made from another company by the same borrower – SIA Alpa Building. The change doesn’t affect the project or investors. I’m happy that Kuetzal announces such information instead of just being silent about it.

One of my readers also found some flaws with another borrower on Kuetzal, Marina Code SP. The company was using stock pictures for it’s employees. Kuetzal confronted the borrower immediately but Marina Code could not give a good explanation. Due to lack of trust and violation of “ethical business conduct”, Kuetzal offered the borrower to close the project and pay back principal and interest to current date to investors. The borrower agreed and all funds have been returned today. Those involved in the project will be informed later today or tomorrow.

Despite these problems, Kuetzal’s prompt response reassures me they’re serious about their platform and do everything possible to offer good and safe investments.

Thank you for helping doing research on businesses, projects and borrowers on all platforms!! Together we can improve the quality of loans and make crowdlending a safer investment for everyone.

If you want to give Kuetzal a go you can use the promo code FINANCIALLYFREE to get a 15€ gift, instantly credited to your account.

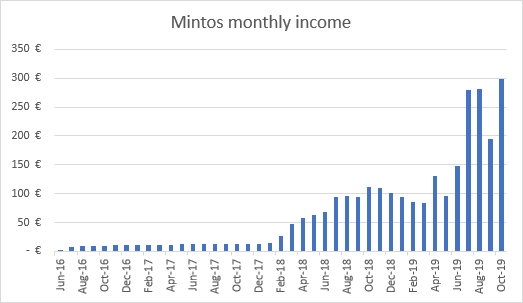

Mintos

The biggest Baltic p2p platform reached 200 000 investors. Mintos more than doubled their investor base in 2019!

The interest rates on Mintos are slowly climbing back up. You can find 12% loans from A and B rated originators from time to time.

When interest rates are falling on Mintos (like they do every year) some investors like to cash-out or only invest in loans with a 1-3 month duration.

Not me.

I’d like to thank everyone who uses Invest&Access. You make it possible for me to grab the loans with highest interest rate available, no matter what duration they have. When better loans are presented on the primary market, I can put my lower yielding loans for sale on the secondary market and Invest&Access picks them up. This little “trick” makes it a lot easier to get the highest possible yield at all times.

If you sign up with Mintos through my referral link you’ll get an exclusive 1% cash back bonus on all investments you make within the first 90 days from your registration.

Note: From November 18th Mintos reduces the cash back bonus to 0.5%

See more info and screenshot from my Mintos account

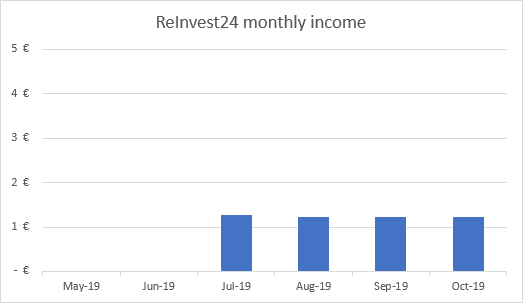

Reinvest24

I received my fourth interest payment on ReInvest24 in October. Income is still low because only 1 of 3 projects I invested in started paying.

The biggest problem with ReInvest24 is the amount of time it takes to fund a project. It’s not ideal to pay a 2% fee to invest in a project and not accumulate any interest for 6 months.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with this referral link.

See more info and screenshot from my ReInvest24 account

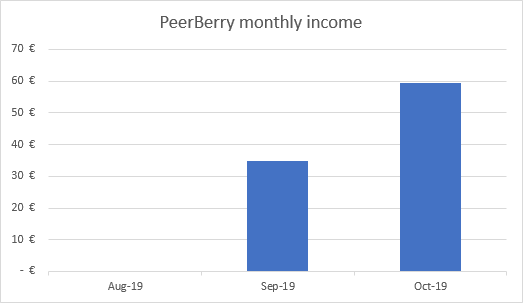

PeerBerry

I received my second interest payment on PeerBerry in October.

Everything is running smoothly but I’d like to see a secondary market. If you want the highest yields you’ll have to accept loan durations of 3-4 years.

Because of the low liquidity, this is now my children’s savings account. (More on this in Twino section below).

See more info and screenshot from my PeerBerry account

Robocash

I received the biggest monthly return Robocash ever.

Several 1 year “installment loans” were paid back and I received all the accumulated interest for those loans.

I only have 1 installment loan left now, it will be repaid in November. I don’t invest into installment loans anymore, I prefer a monthly cash flow.

Starting from December we should start seing regular returns around 125€ per month.

See more info and screenshot from my Robocash account

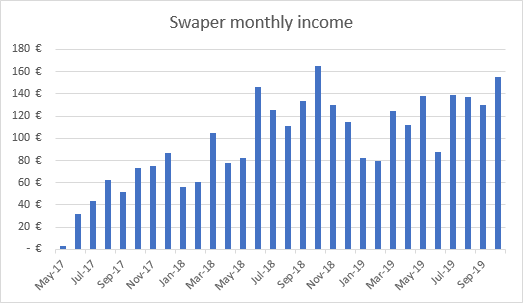

Swaper

Swaper is doing their best to keep up with demand but there’s still a bit of cash drag.

I typically have 1 000€ idle waiting to be invested. Swaper’s auto-invest system ensures new loans are distributed fairly between investors.

My auto-invest typically invests 500€ per day but I also receive repayments daily because most of Swaper’s loans are short term loans.

I’m still happy with the performance and a XIRR of 14.49%. I’ve almost earned 3 000€ on Swaper since I started in 2017.

See more info and screenshot from my Swaper account

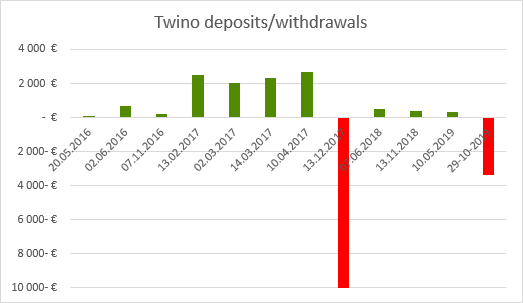

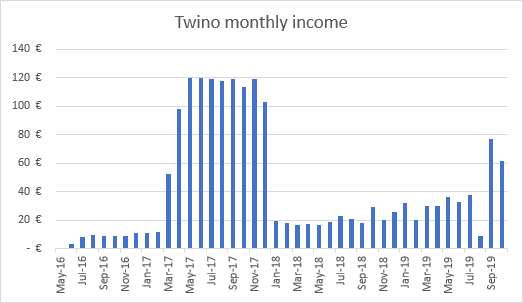

Twino

I have left Twino after 3½ years of investing. Farewell Twino!

On my daughters birthday I decided to exchange their 3 375€ Twino account for my 5 000€ PeerBerry account. They were happy and so was I. I can finally stop spending time grabbing 10-11% loans manually.

It’s very easy to quit from Twino. I simply put everything for sale and I was able to cash out in less than 30 minutes.

The RUB currency exposure gave us some good months but I really don’t like the currency risk. I prefer a more predictable income.

If Twino decides to offer good and profitable loans again (and lots of them) I’ll be happy to come back.

I have removed Twino from the Crowdlending menu. However, you can still access the page with my Twino statistics here.

Viventor

I’m testing out Viventor to see whether it’s a platform I like to keep in the long run.

The returns in October were close to what I expect from a 5 000€ portfolio with 14% interest rate loans.

I still have some loans from the troubled loan originator “Aforti”. If they recover my belief in Viventor will be strenghtened. Let’s see.

See more info and screenshot from my Viventor account

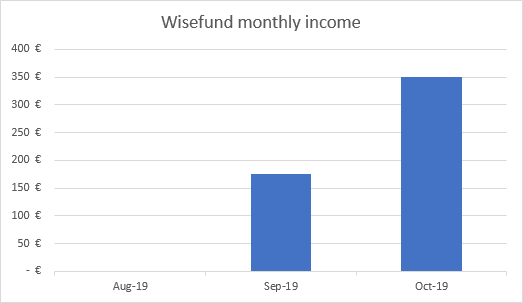

Wisefund

I decided to double my investment on Wisefund in October. My account value is now +30 000€.

I like what Wisefund is doing… I like their website, I like their team, I like the buyback guarantee, I like the high interest rates, I like they monthly repayments and I could go on.

Wisefund reminds me of Envestio in it’s early days. They have a professional approach and quality answers for your questions. I have high hopes for this platform!

I put my 15 000 € deposit into the “Organic fertiliser manufacture” project which came with a 20% interest rate and buyback guarantee. The project is fully funded now.

Currently 3 projects are open for investment and new projects are being added weekly:

I will most likely meet Wisefund again in December and make a detailed article about them. Who knows, maybe even a video interview this time.

If you sign up and invest through my referral link, you will get 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Wisefund account

Real Estate

I received rent from all 5 tenants on time in October as usual.

A tenant from the second property called because the gas furnace started making a weird buzzing sound. I have called a plumber to have a look at it.

Also, a tenant from the first property noticed me she wanted to move out on December 1st. She helped to find a new tenant and within a few days I received deposit from the new tenant. Easy as can be!

See more info about my First property and Second property

Savings rate

My savings rate for October was 53.95%.

We spent half of the month in Portugal where costs of living is rather low. It’ll be interesting to see what our monthly expenses will amount to when we move there!

From November to January my salary will be back to normal, which is ~3 800€ after taxes.

See more info about my Savings rate

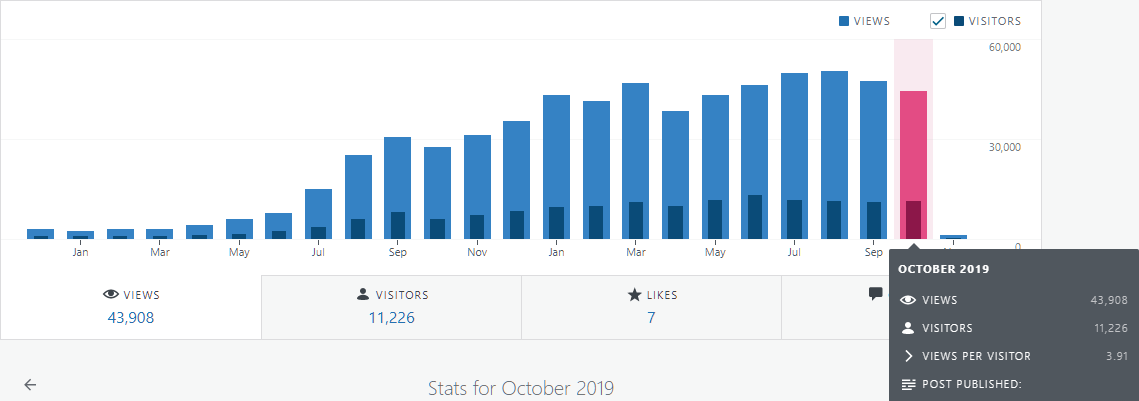

Blog statistics

Visitors: 11 226 (+1.69% compared to last month)

Page views: 43 908 (-6.61% compared to last month)

2 268 Subscribers (+123 compared to last month)

1 065 Facebook followers (+58 compared to last month)

Start your own blog

FinanciallyFree is hosted on SiteGround for the incredible low price of 3.95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

Free international transfers

Do you know you can use Revolut for very fast international transfers and zero fees? It’s probably the cheapest and fastest method to deposit to your crowdlending investments.

Sharing is caring

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

Comments are closed.