Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello everyone and welcome to another monthly update!

While I’m on paternity leave and changing dipers on my new born baby girl, the passive income from crowdlending keeps coming in. That’s a great feeling!

What’s not so great is the time required to create these monthly updates. They start to feel like a lot of work and I’m not looking forward to it like I used to do.

I’ve added 2 new platforms to my portfolio in August (Wisefund and PeerBerry) and with every platform there’s more work to do.

Many of you write emails to me and express your grattitude for the blog and I truly appreciate that. Knowing that this content helps a lot of people is what keeps me going. Thank you!

‘Nuff whining, let’s get on to it 🙂

Monthly Income Statement: August 2019

| Crowdlending | Income | XIRR | Value |

| Bondora | -378.96€ | 6.15% | 18 130€ |

| Bulkestate | 0.00€ | 3.24% | 10 100€ |

| Crowdestate | 51.17€ | 6.92% | 7 945€ |

| Crowdestor | 762.27€ | 16.47% | 37 970€ |

| Envestio | 412.64€ | 21.33% | 28 372€ |

| FastInvest | 55.36€ | 17.02% | 5 002€ |

| Grupeer | 186.68€ | 15.60% | 22 299€ |

| Kuetzal | 258.58€ | 28.47% | 25 929€ |

| Mintos | 280.79€ | 17.52% | 22 849€ |

| PeerBerry | 0€ | 0% | 5 000€ |

| ReInvest24 | 1.22€ | -5.46% | 984€ |

| Robocash | 94.55€ | 10.69% | 11 349€ |

| Swaper | 137.60€ | 14.50% | 11 634€ |

| Twino | 8.92€ | 13.20% | 3 236€ |

| Viventor | 21.57€ | 9.18% | 5 036€ |

| Wisefund | 14.46€ | 0% | 10 050€ |

| 1 892.39€ | 11.11% | 225 892€ | |

| Real Estate | Income | Equity | |

| Property #1 | 691€ | 39 425€ | |

| Property #2 | 1 162€ | 58 518€ | |

| Total | 3 745.39€ | 323 835€ |

That means I’m 124.85% Financially Free (up 11.64% from last month).

My second goal of 7 000€ per month reached 53.51% (up 4.99% from last month)

Portfolio performance: Historical view

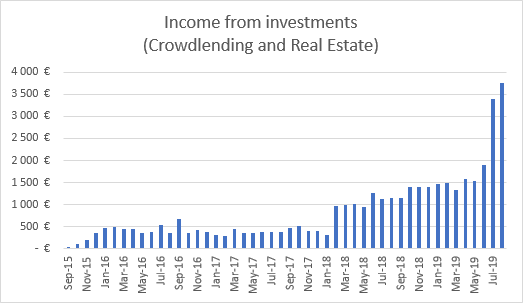

Income from Crowdlending & Real Estate combined was 3 745.39€.

(349.34€ more than last month).

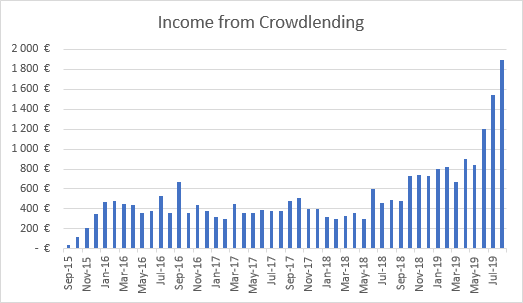

“Income from Crowdlending” alone was 1 892.39€.

(349.34€ more than last month).

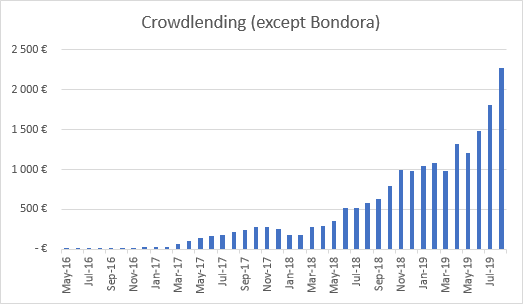

“Crowdlending (except Bondora)” reached 2 271.35€.

(463.93€ more than last month.)

Bondora

Another bad month on Bondora…

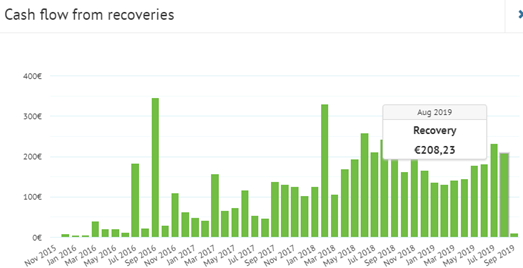

232.16€ was recovered in July but I still have 25 838.11€ in defaulted loans.

Somehow Bondora thinks my portfolio is worth 18 130€.

- 25 838€ defaulted

- 1 103€ overdue

- 3 069€ current

If I remember correctly, Bondora estimates that 40% of defaulted loans will be recovered (before 35% recovery fees!).

If I get all current and overdue loans repaid and 40% of my defaulted loans, my portfolio would be worth 10 889€ ((25 838 x 0.4) x 0.65 + 1 103 + 3 069). That’s much more realistic in my opinion.

Bondora’s way of calculating expected profit is so misleading that it’s close to fraud.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. The Go & Grow product is alright if you’re satisfied with a 6.75% interest rate and instant liquidity.

See more info and screenshot from my Bondora account

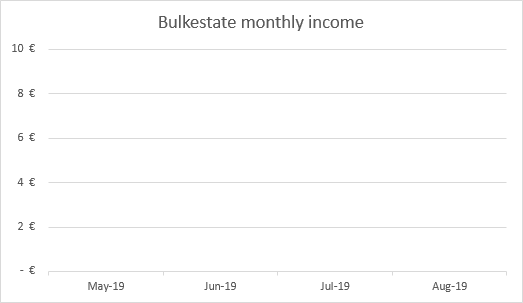

Bulkestate

I will visit Bulkestate from September 18-20 and I’m really looking forward to that. If you have any questions you’d like me to ask for you, drop me an e-mail or comment below.

I’ll try to convince them to find a way to pay monthly interest, I think that would make them much more popular. But maybe they want to keep the number of investors down so it fits the number of projects they’re able to publish? Who knows…

The average project duration is 12 months, not that long if you are investing for long term. It does make the graph look very boring though without data to present.

See more info and screenshot from my Bulkestate account

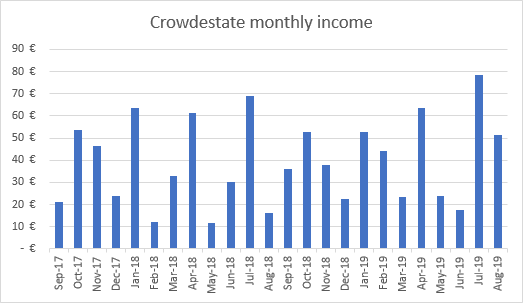

Crowdestate

I have 7 delayed payments on Crowdestate now.

On top of that, there’s rumors that the developer of “R. Feldmana 2, LV-1014, Riga” has abandoned the project. Crowdestate promised an update “somewhere in May-June 2019” but have not said a word yet.

I asked their support to give me an update on the project and they told me “Our CEO is in contact with the project developer. I don’t have the information at the moment to provide any details, but once we receive it, it will be added to the project straight away.”

Up until now I’ve been happy with Crowdestate but it’s not the same platforms as it was 2 years ago. They used to have several high yielding development projects, now most of them are 11%.

Due to the falling interest rates and rising problems with borrowers I will start to withdraw my money.

See more info and screenshot from my Crowdestate account

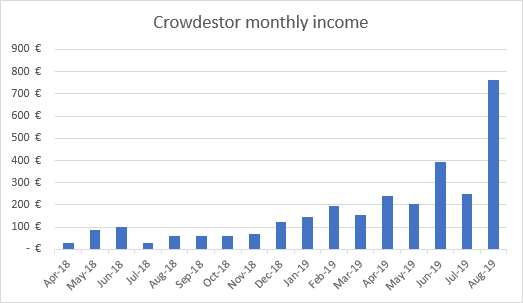

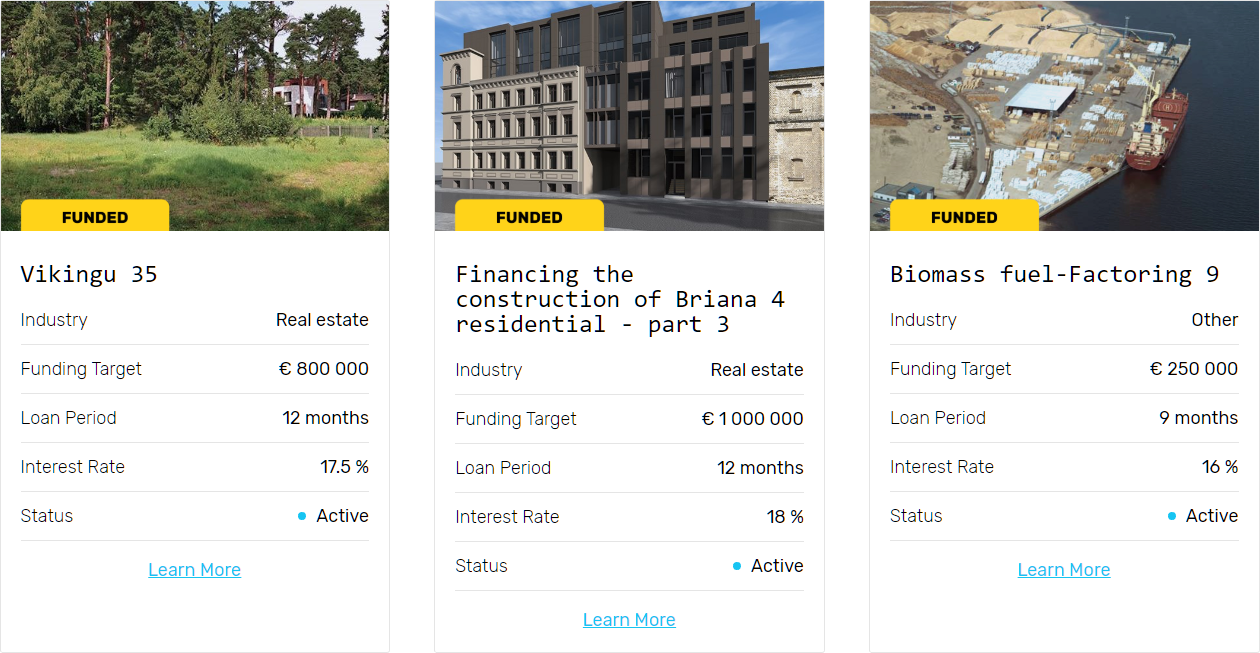

Crowdestor

Crowdestor is my favorite platform at the moment. They offer high interest rates, amazing performance (all loans have been paid on time) and a great variety of projects.

The big spike happened because I received my first payment from the “Energy production plant” project which pays interest after the first 6 months and every month after that.

I have 5 092.99€ invested in the project and I received a 496.57€ interest payment on the day it was scheduled. Nice!

I have a few more projects like that so monthly interest on Crowdestor will be significantly higher from December and onwards.

Mafia Stars: The next project everyone is waiting for.

Fixed interest rate of 18% + a possibility to earn up to 14% extra and only 12 month duration.

Needless to say, I can’t wait to read the project details. It looks very promising from the description!

See more info and screenshot from my Crowdestor account

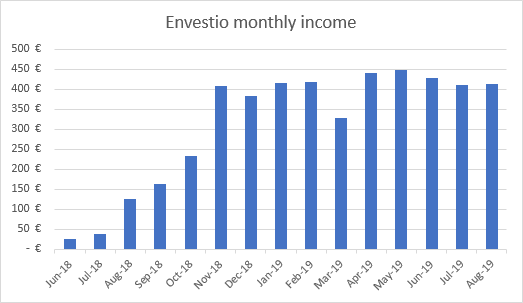

Envestio

All projects on Envestio have paid me on time from the day I started in Jun-18.

They have close to 9 500 investors now so they’re transitioning from small projects into bigger projects.

The transition phase has caused some cash drag and fewer projects published than usual. The waiting time could soon be over though.

They released 3 projects in August with a total sum of 2 050 000€. Envestio plan to release 4 big projects per month by the end of the year.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

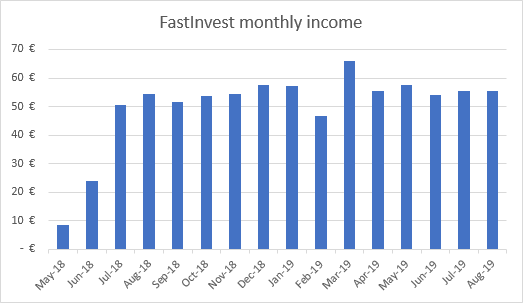

FastInvest

I’m still happy with the performance on FastInvest.

I’m starting to get a little impatient about information about their loan originators though. If this information was publicly available I’d be happy to throw another 5-10k after FastInvest.

See more info and screenshot from my FastInvest account

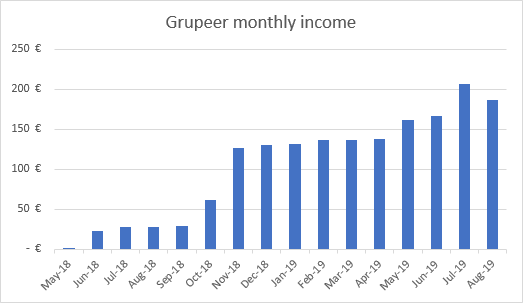

Grupeer

I added another 5 000€ to Grupeer in August.

Stable and reliable performance like always.

See more info and screenshot from my Grupeer account

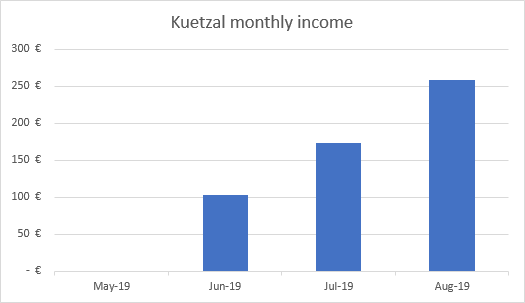

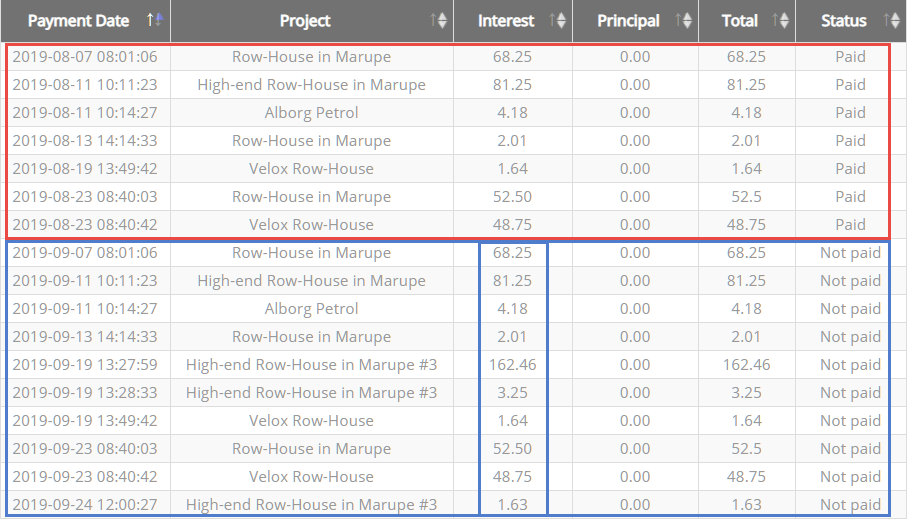

Kuetzal

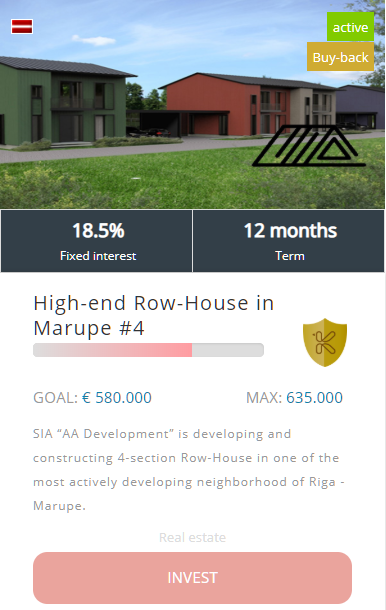

2 new projects with buyback guarantee were added on Kuetzal in June.

I added 10k to my account in August to invest and the summer cash back campaign gave me another 200€ (2% of 10 000) to invest.

I invested in “High-end Row-House in Marupe #3” which has been fully funded now but Marupe #4 is still available.

All repayments have been paid according to schedule on Kuetzal as well. If everything goes as planned, I will receive 425.92€ from Kuetzal next month.

If you want to give Kuetzal a go you can use the promo code FINANCIALLYFREE to get a 15€ gift, instantly credited to your account.

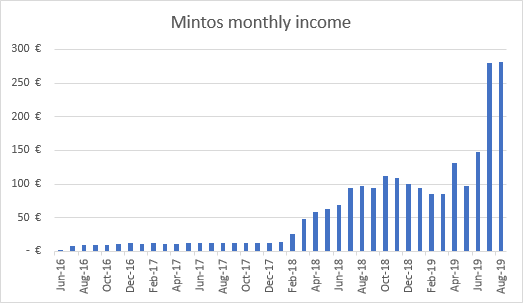

Mintos

I added 2 000€ to my Mintos account in August.

I’d like to bring my Mintos portfolio to 30 000€ hopefully this year.

If you sign up with Mintos through my link you’ll get an exclusive 1% cash back bonus on all investments you make within the first 90 days from your registration.

See more info and screenshot from my Mintos account

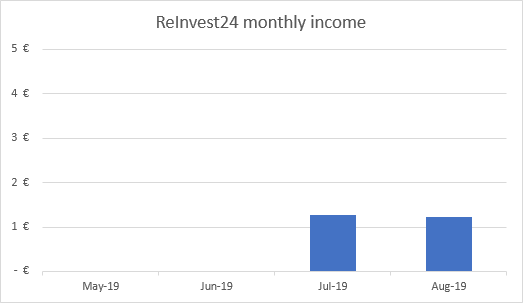

Reinvest24

I received my second interest payment on ReInvest24 in August. Income is still low because only 1 of 3 projects I invested in started paying. In a month or two all 3 projects will be paying.

ReInvest24 realized they need to get projects funded faster so they can start paying investors the monthly return. So they just released a cash back campaign.

The campaign will be valid from 09.09.2019 00:00 until 23.09.2019 23:59

Cashback % levels:

0.5% Cashback from total of 100 – 999 EUR gross investments

1.0% Cashback from total of 1000 – 9999 EUR gross investments

1.5% Cashback from total of 10000 – 19999 EUR gross investments

2.0% Cashback from total of 20000 – 29999 EUR gross investments

2.5% Cashback from total of 30000 – 39999 EUR gross investments

3.0% Cashback from total of 40000 – … EUR gross investments

Cashback amount will be paid out within 24 hours after the campaign ends.

See more info and screenshot from my ReInvest24 account

PeerBerry

I’ve been following PeerBerry for a while and decided to give it a go.

I added 5 000€ in August to start out. I’m looking forward to see how it performs.

See more info and screenshot from my PeerBerry account

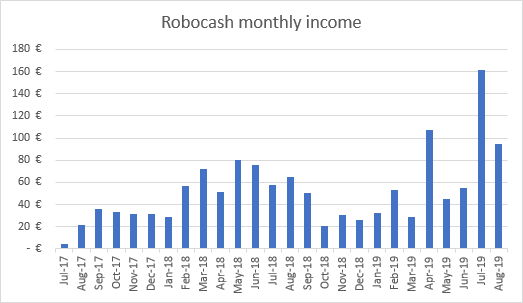

Robocash

Robocash discontinued cooperation with 2 loan originators but all loans will still be paid according to schedule.

I hope it doesn’t lead to another period with cash drag.

See more info and screenshot from my Robocash account

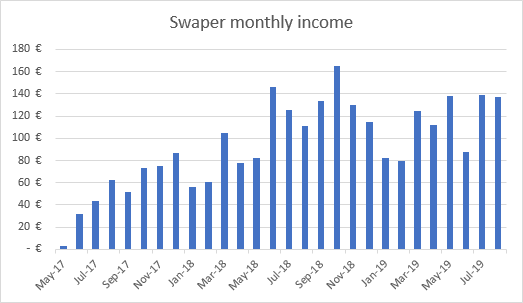

Swaper

I added 1 000€ to my Swaper account bringing my portfolio to 10k invested. They have published more loans than before so I hope the days with cash drag are over.

Swaper runs a promotional offer from 3rd of September to 3rd of October 2019.

New investors who signs up by using my affiliate link gets the Swaper Loyalty Bonus (+2%) on all investments made during the first three months. This means instead of a 12% profit you will earn 14%!

If you invest 5 000€ or more you will get the Loyalty Bonus and continue to earn 14%.

But please, not too many sign-up’s, I need my money invested as well 😉

See more info and screenshot from my Swaper account

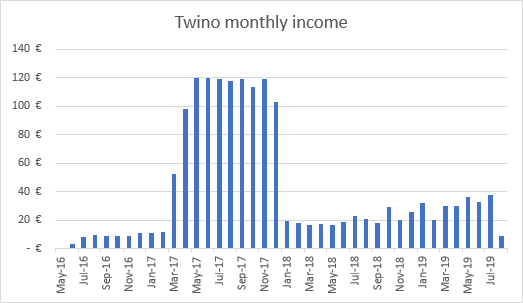

Twino

Poor month on Twino. I’ve been lucky with the RUB currency exposure in the past months but what comes up must come down.

See more info and screenshot from my Twino account

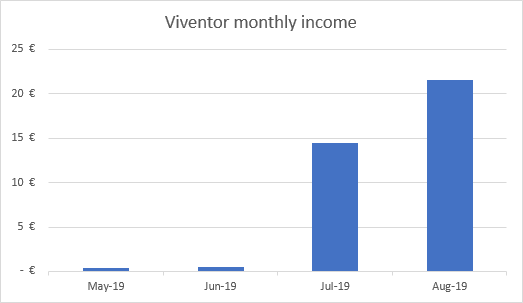

Viventor

I added 3 000€ to Viventor in August.

The loan originators “Aforti Factor” and “Aforti Finance” which apperantly had issues with their system interface last month started paying again. I received principal + interest + late fees for some of my loans on Viventor. Let’s hope the issues will be solved.

See more info and screenshot from my Viventor account

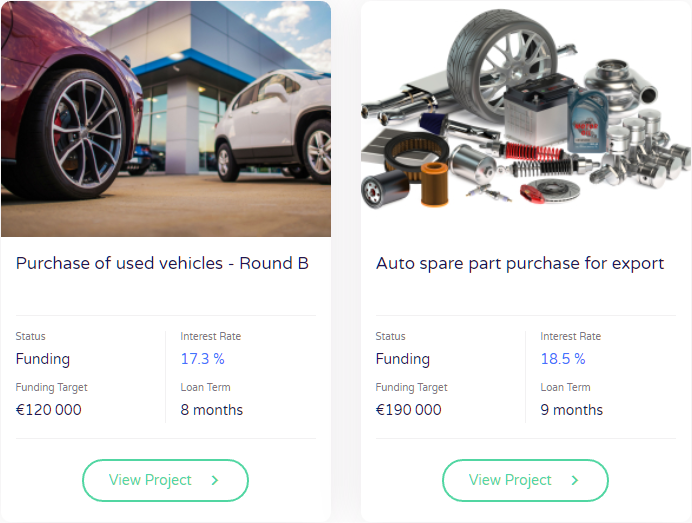

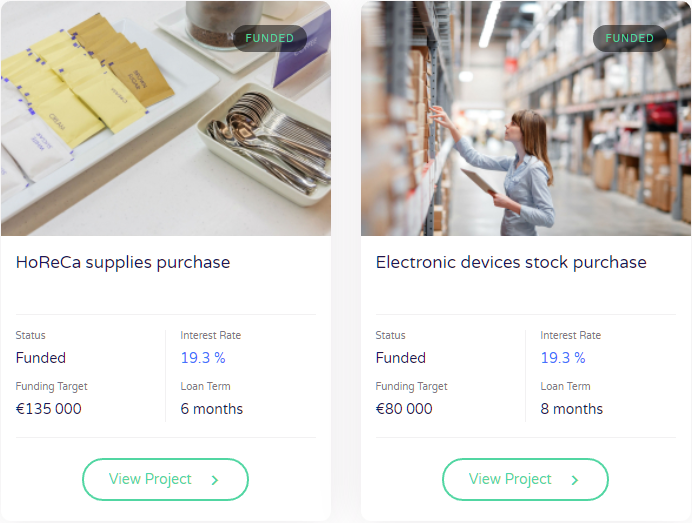

Wisefund

I was introduced to Wisefund in early August.

After chatting with Ingus Linkevics ![]() for some days I wanted to try the platform myself. He did a great job answering my questions and, among other things, he showed me proof of funds for their buyback guarantee. That is very rare to find among other platforms!

for some days I wanted to try the platform myself. He did a great job answering my questions and, among other things, he showed me proof of funds for their buyback guarantee. That is very rare to find among other platforms!

The Wisefund website is also very well developed and already has features like an “Expected payments timeline”. There’s no secondary market but loan duration has been from 4-9 months so it’s not that important to me.

They have several projects in pipeline, some of them with interest rates above 20%

I added 10 000€ to my account and invested it all in the “HoReCa supplies purchase” project. I got the 0.5% cashback right away and invested that as well right away.

Wisefund reminds me of Envestio in it’s early days. They have a professional approach and quality answers for your questions. I have high hopes for the future of Wisefund!

If you sign up and invest through my referral link, you will get 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Wisefund account

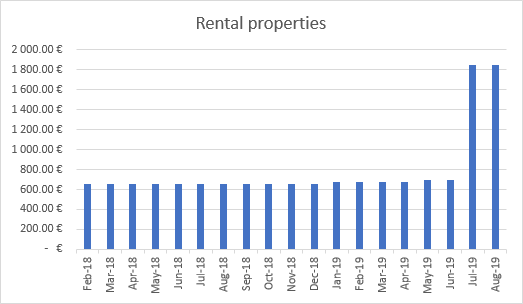

Real Estate

I received rent from all 5 tenants on time in August.

I’m going to change a bathroom window in the Second property, the frame is not good anymore.

See more info about my First property and Second property

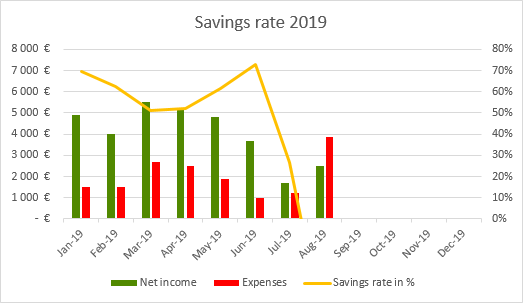

Savings rate

My savings rate for August was -54.25% (-80.99% compared to last month).

This is the first time I’ve had a negative month since 2016! Several reasons for the many expenses:

- I pre-paid 65% of our 2 week holiday in Portugal next month. The vacation will cost me ~3 500€ for flights, accomodation and a rental car.

- A speeding camera caught me on the roads and I received a 400€ ticket.

- My income is a lot lower while I’m on paternity leave.

While low income sucks it’s nice to get a feeling of being retired. It doesn’t feel like retirement at all though, I have lots of things to do!! I wonder how I could fit in a full time dayjob before, no wonder I was feeling stressed out.

See more info about my Savings rate

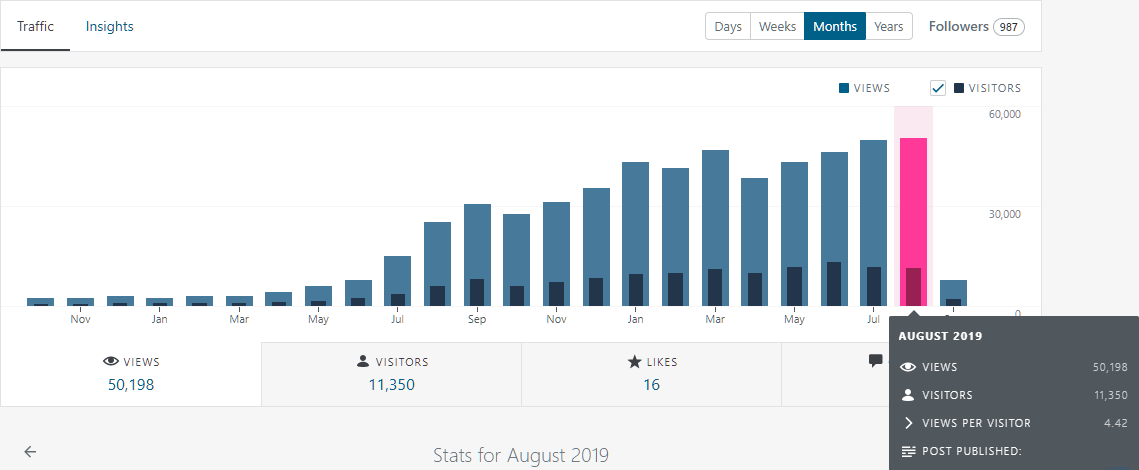

Blog statistics

Visitors: 11 350 (-3.28% compared to last month)

Page views: 50 198 (+0.93% compared to last month)

1 977 Subscribers (+124 compared to last month)

952 Facebook followers (+50 compared to last month)

Start your own blog

If you have been thinking about starting your own blog then you can save up to 77% if you register before September 8th.

FinanciallyFree is hosted on SiteGround for the incredible low price of 3.95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

Free international transfers

In Facebook groups and on investor forums I see people praising Revolut for very fast transfers and zero fees. I tested it and I must admit – it’s really good.

It’s probably the cheapest and fastest method to deposit to your investments. You can even get a free VISA card.

Subscription model to support the blog

I have been contacted by a company that implements subscription models on websites. I initially rejected the idea but they claim that ~5% of my readers would gladly throw a fiver at me every month in appreciation for the content I’m sharing.

I’m skeptical so I have created a poll to see if they’re right.

I’m thinking about creating a detailed “Blog earnings report” to subscribers to those who are interested in this.

Subscription levels could be something like:

- Junior level: 5€ per month – Pure support and appreciation.

- Senior level: 10€ per month – Access to detailed monthly Blog earnings report

Please vote and show what you think about this idea (look in the right side column if you’re on PC – Bottom of the page if you’re on Mobile).

Note: Everything you find on the blog today will always be free, subscription and support is a choice!

Sharing is caring

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

Comments are closed.