Dear fellow investors, guys and gals, friends and family.

This is my first portfolio update written from southern Europe. Yes, we have officially moved to Portugal.

Selling most of our stuff including 2 cars have freed up a good amount of money, which is waiting to be invested. Maybe it’s time to put some into the stock market?

If you’re interested in more details about our journey, I’m working on a post-series called “Moving to Portugal for Financial Freedom”. Part 1 will be out soon 🙂

So how did my portfolio perform in February? I’m glad you asked, I prepared a nice overview for you.

I found a way to calculate XIRR correctly for negative values, so this month I calculated Crowdlending and Scams together.

Monthly Income Statement: February 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -489.11€ | 3.45% | 10 236€ | 13 748€ |

| Bulkestate* | 0€ | 12.33% | 10 000€ | 10 989€ |

| Crowdestate* | 15.12€ | 6.07% | 5 648€ | 6 675€ |

| Crowdestor* | 1 258.78€ | 16.57% | 85 000€ | 93 110€ |

| FastInvest* | 49.16€ | 16.25% | 2 902€ | 4 144€ |

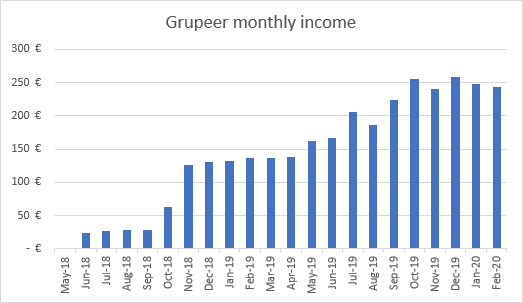

| Grupeer | 244.04€ | 14.84% | 20 474€ | 23 799€ |

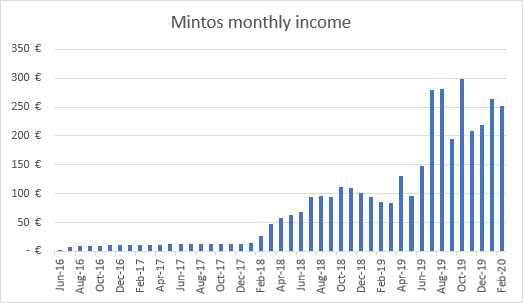

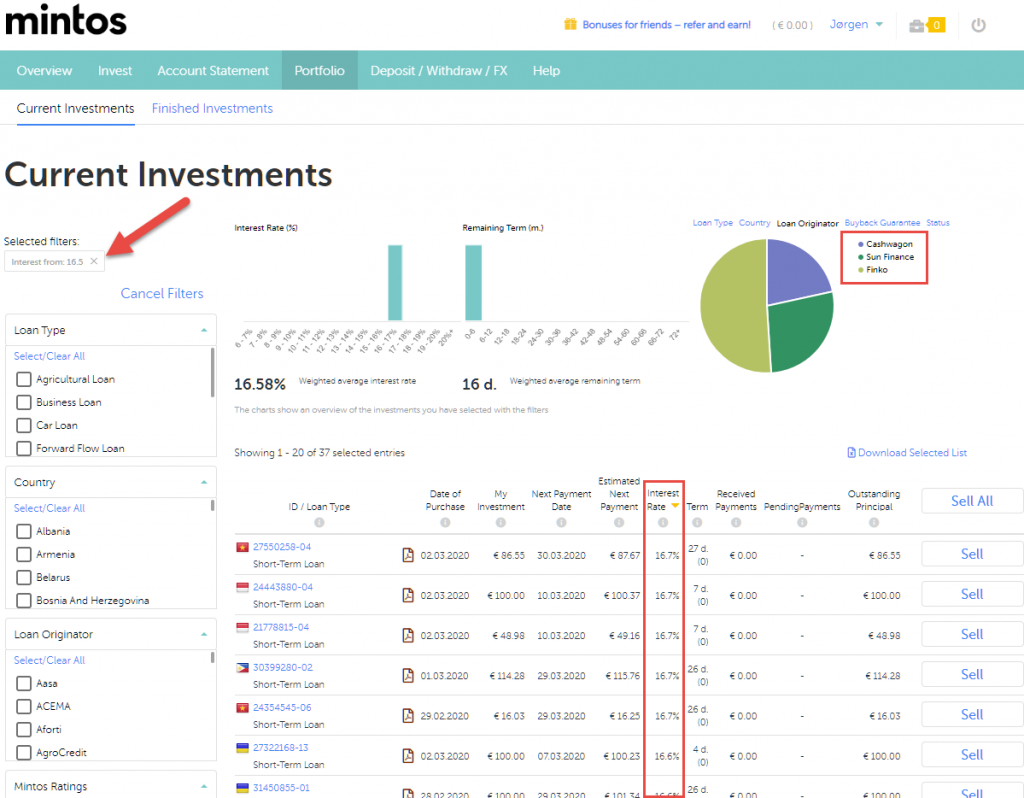

| Mintos* | 252.00€ | 16.00% | 20 000€ | 24 325€ |

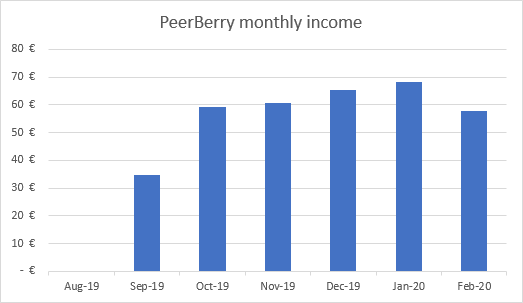

| PeerBerry* | 57.68€ | 13.85% | 6 000€ | 6 354€ |

| ReInvest24* | 2.63€ | –0.45% | 1 000€ | 996€ |

| Robocash* | 106.43€ | 12.74% | 10 000€ | 12 335€ |

| Swaper* | 134.15€ | 14.21% | 10 000€ | 13 438€ |

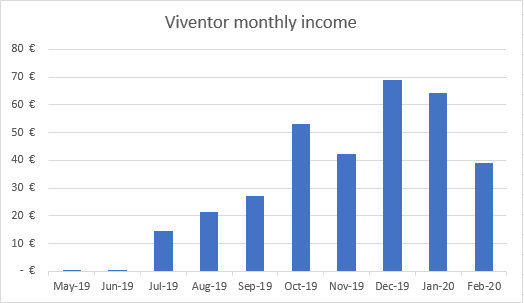

| Viventor* | 38.91€ | 11.68% | 5 000€ | 5 331€ |

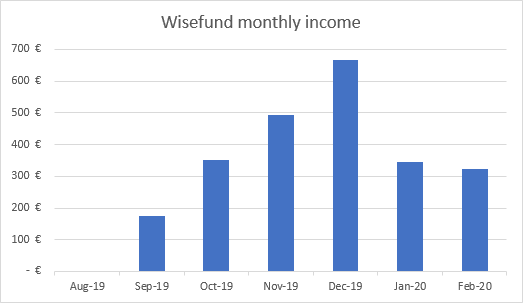

| Wisefund* | 324.05€ | 23.92% | 18 117€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 1 993.84€ | -4.67% | 249 079€ | 235 876€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 704€ | 49.03% | 18 080€ | 41 448€ |

| Property #2 | 1 167€ | 0.42% | 61 200€ | 61 373€ |

| 1 871€ | 79 280€ | 102 822€ | ||

| Total | 3 864.84€ | 1.93% | 328 359€ | 338 698€ |

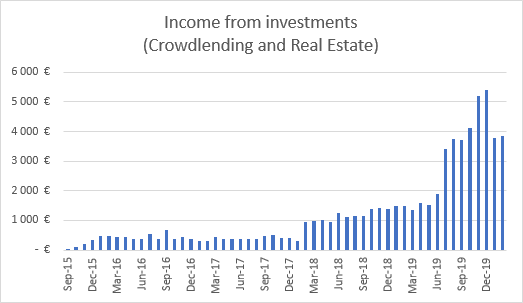

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 3 864.84€.

(+78.79€ more than last month).

That means I’m 128.83% Financially Free (+2.63 percentage points up from last month).

My second goal of 7 000€ per month reached 55.21% (+1.13 percentage points up from last month).

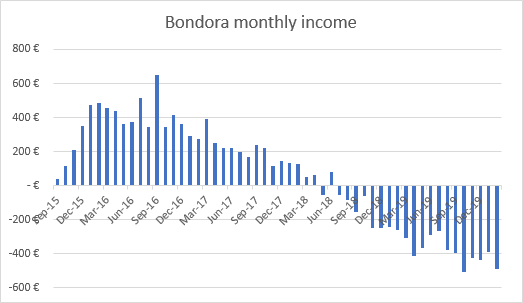

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

I read somewhere that Bondora’s own employees only invest in Go&Grow. None of them uses Portfolio Manager or Portfolio Pro. They have probably seen my income graph as well 🙂

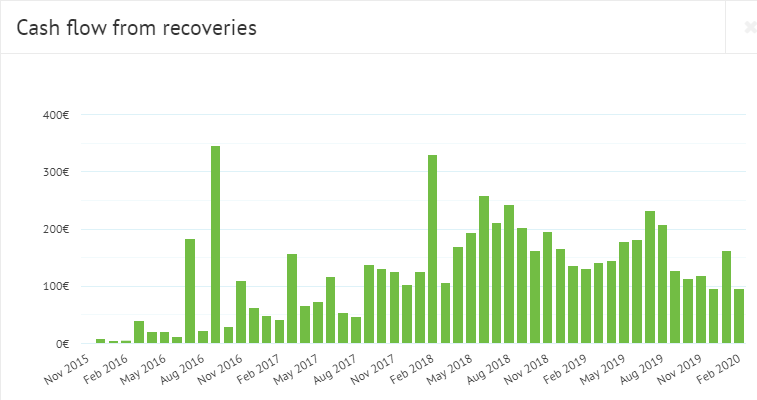

96.55€ was recovered in February but I still have 25 458€ in defaulted loans.

I do not recommend investing with Bondora unless you use the “Go & Grow” product only.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate with instant liquidity, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

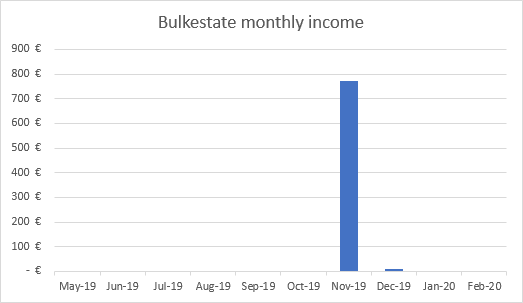

Bulkestate

I’m only invested in 1 project on Bulkestate* and the next payout is scheduled for 21.12.2020.

This graph will be quite boring to look at unless I invest in more projects.

See more info and screenshot from my Bulkestate account

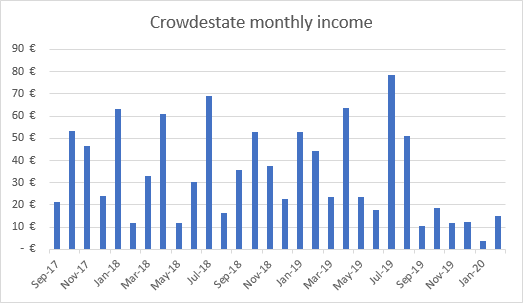

Crowdestate

The problems on Crowdestate* starts to show in my income graph.

I’m slowly withdrawing funds as they are repaid.

I have 6 late and 1 defaulted project with Crowdestate.

It’ll be interesting to see how well Crowdestate will handle the defaults and delays in 2020.

See more info and screenshot from my Crowdestate account

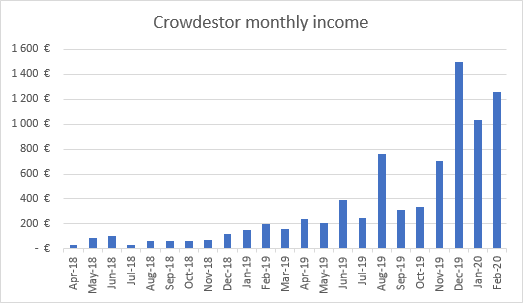

Crowdestor

Crowdestor* is still my favorite platform. They offer a variety of projects with different risks and different yields.

I like their team and the way the CEO Janis Timma replies to questions on Facebook.

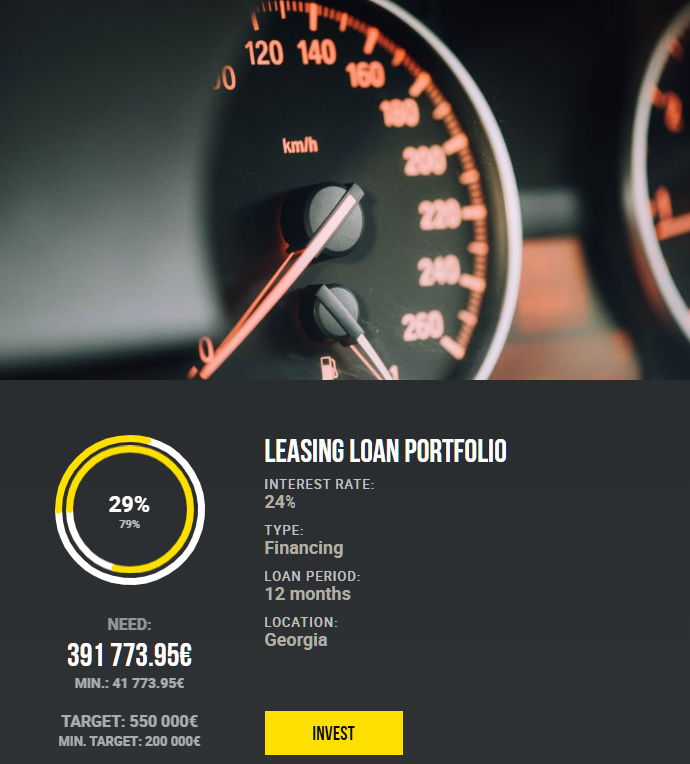

Sometimes it feels like I’m addicted to Crowdestor.. I’m really tempted to invest another 15k EUR into the “Leasing Loan Portfolio” project which comes with a 24% interest rate. It pays interest and principal every month, starting from next month (not 6 month delayed like other projects).

On the other hand, I already invested 85k EUR in Crowdestor so I should probably diversify more. Hmm.. it’s so tempting!!

See more info and screenshot from my Crowdestor account

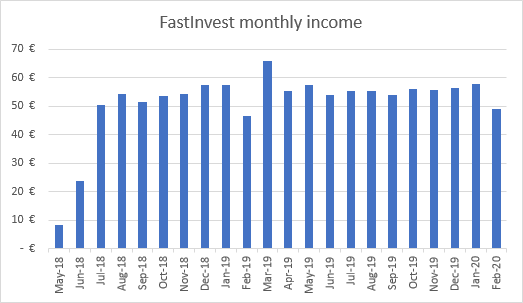

FastInvest

I feel really twisted about FastInvest*. Some people say it’s obvious they’re a scam.

Some loan originators on Mintos* now pay up to 16.7% interest, so I don’t think the unnamed loan originators on FastInvest is worth the risk anymore. Hence, I decided to reduce my exposure on FastInvest a bit. I’ve been withdrawing some money as the loans matured.

I’ll probably keep a small position just to follow the evolvement of the platform, because I still like how it works.

See more info and screenshot from my FastInvest account

Grupeer

Grupeer* remains one of the most stable investments in my portfolio.

They just released the latest platform update which shows statistical data of your portfolio. I would be more interested in better overview of actual data but it’s a start.

See more info and screenshot from my Grupeer account

Mintos

Mintos* is closing in on the 5 billion EUR milestone.

Meanwhile, the interest rates keep climbing up. 6 loan originators offer interest rates above 16%. Loans from SunFinance and CashWagon and Finko comes with 16.5% and 16.7% interest these days. I’m getting some while they’re available.

A German guy created this Google Sheet which is automatically updated with the latest interest rates from all Loan Originators on Mintos. It’s really nice to get an overview of current and past interest rate levels.

See more info and screenshot from my Mintos account

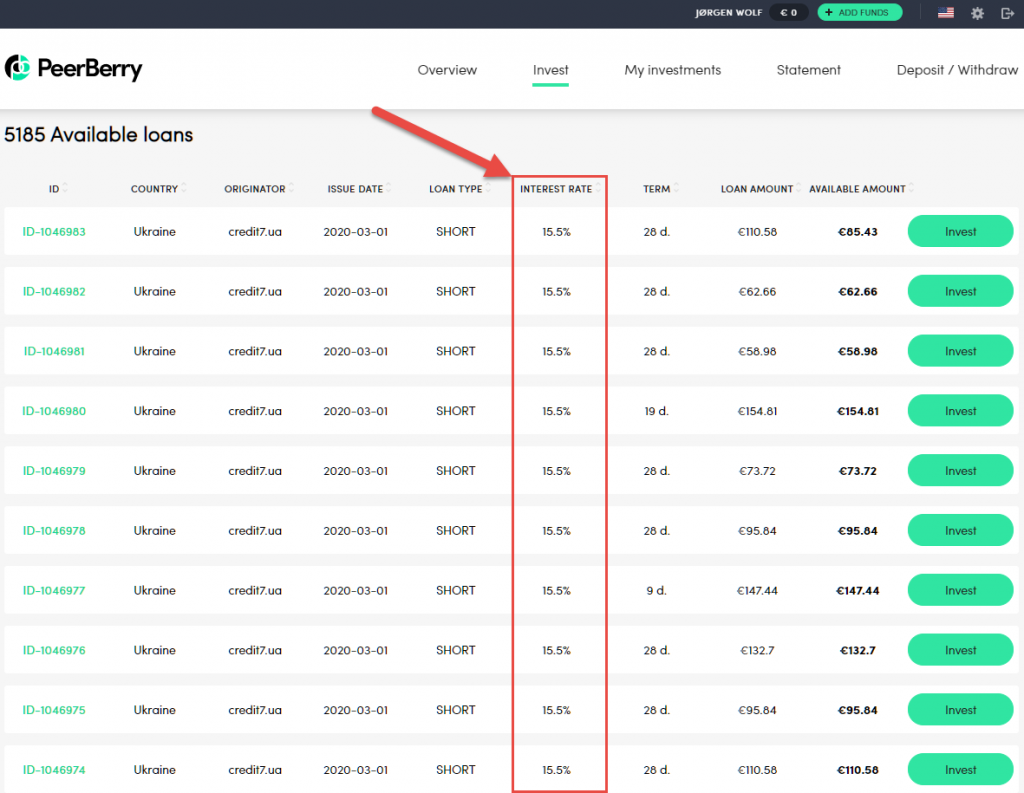

PeerBerry

I use PeerBerry* for my children’s savings account.

Interest rates rose from 12.5% up to 15.5% in late February. I hope the rates will stay competitive to the rates offered on Mintos.

See more info and screenshot from my PeerBerry account

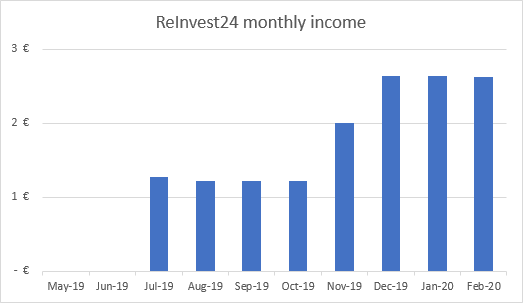

Reinvest24

Not much new on ReInvest24* since last update.

2 out of 3 projects I invested in are paying dividends, 1 is (still) waiting to be sold.

At the moment I’m happy I only invested 1 000€ on ReInvest24. While the platform might be one of the safer options, my patience is currently being tested.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

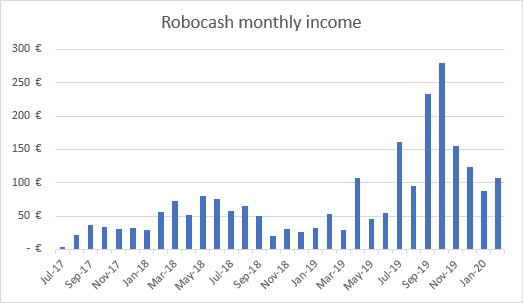

Robocash

The days of cashdrag are over on Robocash* again. I’m happy with the current performance of the platform.

See more info and screenshot from my Robocash account

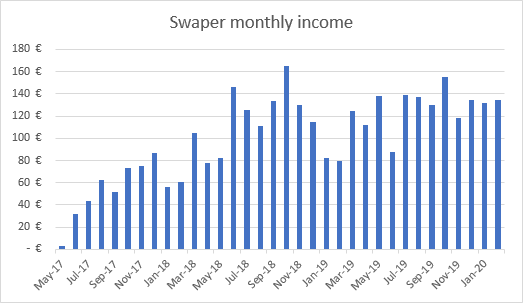

Swaper

Not much to report on Swaper*. The availability of loans is currently alright. Just like last month, I had ~1k EUR idle on average.

See more info and screenshot from my Swaper account

Viventor

I’m still testing out Viventor* to see whether it’s a platform I like to keep in the long run. The platform is working very smooth – so far so good.

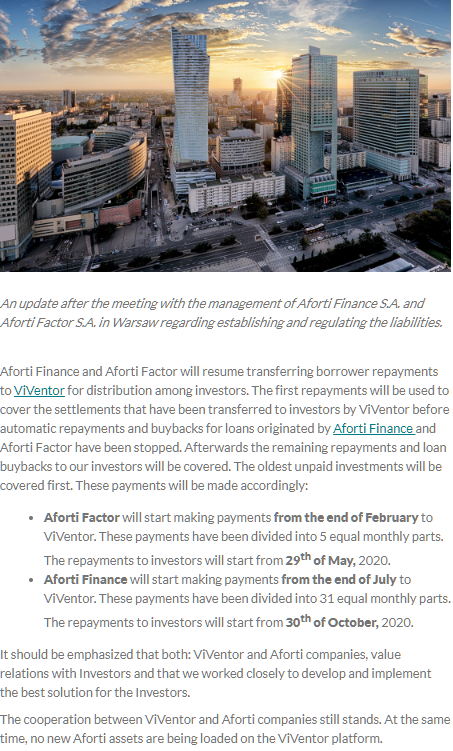

Viventor published an update about the troubled loan originator “Aforti” to everyone who invested in Aforti:

I hope everything will turn out fine, I have 725€ in Aforti Factor on Viventor.

See more info and screenshot from my Viventor account

Wisefund

I decided to reduce my exposure to Wisefund* until I’m 100% certain they’re legit. Since I reduced my investment from 30k to 20k EUR, interest payments are equally lower. All my withdrawal requests have been processed.

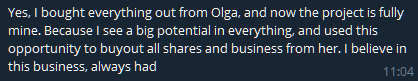

Ingus, who was already a partner, apparently bought the rest of Wisefund on February 14th. He confirmed the buyout when I asked him about it on Telegram:

He’s now the sole owner of the platform. I’m happy about this because he is the only person from Wisefund I met and there’s no mysterious people in the background anymore. Legally, everything is his responsibility now. I like Ingus and I hope time will show that he’s not a scammer.

If you sign up and invest through my referral link* you will get 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Wisefund account

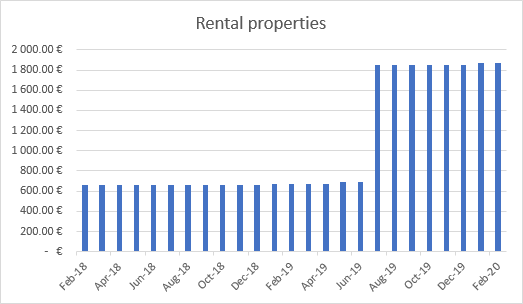

Real Estate

I received rent from all 5 tenants on time as usual.

One tenant complained about moisture in the apartment, even though she claims to ventilate every day. None of my previous tenants reported anything like this. I might want to install a better ventilation system, just to be proactive and prevent issues with mold. It’ll cost me less than 1 000€ to do so it might be worth it.

Another tenant contacted me today because she isn’t able to close one of the windows properly. I’ll have craftsman look at it tomorrow. Since we moved to Portugal, I rely on craftsmen and friends whenever something needs fixing.

See more info about my First property and Second property

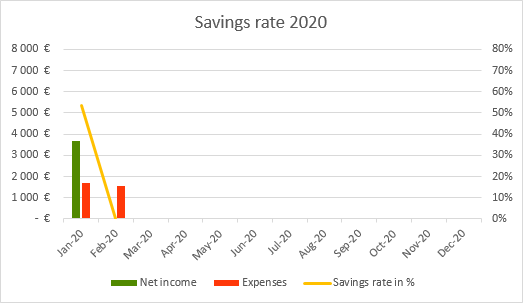

Savings rate / Expenses overview

I’m not sure if it makes sense to publish my savings rate anymore, as I don’t have any salary income like I used to. I’m contemplating whether I should start showing my online income again but I haven’t decided yet.

I will, however, at least publish our expenses so we can compare our Portuguese expenses to our Danish expenses.

See more info about my Savings rate

Blog statistics

Blog visits are back to normal. December and January were exceptionally high due to the failure of Kuetzal and Envestio.

Visitors: 14 082 (-40.02% compared to last month)

Page views: 49 252 (-52.82% compared to last month)

2991 Subscribers (+82 compared to last month)

1 481 Facebook followers (+40 compared to last month)

Quote of the month

“Wealth is the ability to fully experience life.” – Henry David Thoreau

Start your own blog

FinanciallyFree is hosted on SiteGround* for the incredible low price of 3.95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

Free EUR bank account with no fees

I recently opened a bank account with N26* and received a free MasterCard. They are similar to Revolut* but N26 has much higher transfer limits and you can withdraw euros from any ATM up to five times every month for free.

N26 is a German bank with base in Berlin and your account is secured up to 100 000€ like any traditional bank!

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.