Dear fellow investors, friends, family and future self.

2020 was an eventful year. We spent half if it in Portugal and we loved it even though if was different than usual due to global lockdown. If everything goes as planned we will be back in the warm climate in the second half of 2021.

Last year was also the first year of not being an employee. Even though I had a good job and a great employer, I can’t say I miss the daily 8-16 routine. While I’m not stressed by work anymore, I must admit that financial stress from not having a fixed paycheck coming in every month is more significant than I expected. We’re better off financially than 1 year ago so I guess I shouldn’t be worried. Maybe it just takes some time to get used to?

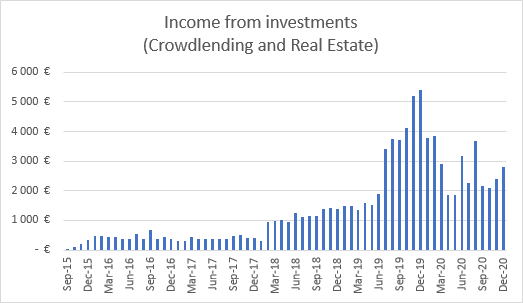

Income from Crowdlending is on the rise again. I hope this trend continues as the Covid-19 vaccine is being distributed and businesses slowly will be able to operate on a closer-to-normal basis.

4 platforms in my portfolio made it through 2020 without any change in performance to investors, even in the times of a global pandemic. Those are Swaper*, Robocash*, PeerBerry* and ReInvest24*. Kudos to them!

I’m in the process of buying a 3rd property. Read more in the real estate section near the bottom of this post.

Monthly Income Statement: December 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -333.57€ | -0.62% | 7 918€ | 7 288€ |

| Bulkestate* | 0€ | 5.89% | 10 000€ | 10 989€ |

| Crowdestate* | 2.37€ | 5.00% | 5 305€ | 6 406€ |

| Crowdestor* | 866.21€ | 12.71% | 72 101€ | 87 667€ |

| FastInvest* | 42.74€ | 15.26% | -199.01€ | 1 239€ |

| Grupeer | 0.00€ | 8.74% | 20 474€ | 24 047€ |

| Mintos* | 238.82€ | 16.77% | 20 000€ | 27 952€ |

| PeerBerry* | 83.77€ | 15.16% | 6 000€ | 7 190€ |

| ReInvest24* | 6.67€ | 5.83% | 1 000€ | 1 096€ |

| Robocash* | 134.39€ | 13.03% | 10 000€ | 13 735€ |

| Swaper* | 207.52€ | 14.75% | 10 000€ | 15 243€ |

| Viventor* | 13.42€ | 16.73% | 5 000€ | 6 228€ |

| Wisefund | 0.00€ | 10.41% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 1 262.34€ | -0.47% | 230 153€ | 229 711€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 380€ | 37.41% | 18 080€ | 44 482€ |

| Property #2 | 1 167€ | 5.03% | 61 200€ | 65 646€ |

| 1 547€ | 79 280€ | 110 128€ | ||

| Total | 2 809.34€ | 3.95% | 309 433€ | 339 840€ |

Note:

- I marked Grupeer and Wisefund as orange because I’m questioning future repayments (no transactions since March 2020)

- FastInvest “Invested” amount is negative because I have withdrawn more than I have deposited.

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 2 809.34€

(+417.59€ more than last month).

That means I’m 93.64% Financially Free (+13.92 percentage points up from last month).

Stocks / trading

Here’s the changes to my stock portfolio since last update:

Sold:

- Occidental Petroleum @ 19.85$ (Bought @ 10.50$) = 89.05% gain

- Macy’s @ 12.48$ (Bought @ 6.13$) = 103.59% gain

- Gilead Sciences @ 61.48$ (Bought @ 66.50$) = 7.55% loss

I was getting impatient with Gilead Sciences. I was hoping it would make a retrace within 3-4 months but it only fell further. It will probably start to rise now that I’m out of it. Anyway, I need to free up some capital for the down payment of my 3rd property so they had to go.

I will also sell AT&T soon.

Bought:

- Alibaba Group (BABA) @ 221.75$

- Added to Argan (AGX) @ 45.00$

- Added to Norwegian (NAS.OL) @ 89.00 NOK

I bought Alibaba purely from a technical analysis. It should have support around 221$, at least in the short term.

Norwegian Air is only a small position <3% of my portfolio. It’s my lottery ticket, as the company is on the edge of bankruptcy. I have bought the stock because the management team seem very keen on keeping the company alive. I also like their proposed restructuring model. It’s our preferred airline when we fly from Denmark to Norway. I really hope they survive, not just from a financial standpoint.

Potential buys:

I’m keeping a close eye on these stocks:

- Snowflake (SNOW), which I might buy if it hits 235$

- Quantumscape (QS) which I might buy if it hits 37$

- Fubotv (FUBO) which I might buy if it hits 20$

- GSX Techedu (GSX) which I might buy if it hits 43$

This is my current equity portfolio:

[table id=1 /]I buy my stocks and trade on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction). I don’t receive any commission besides the mutual fee deduction.

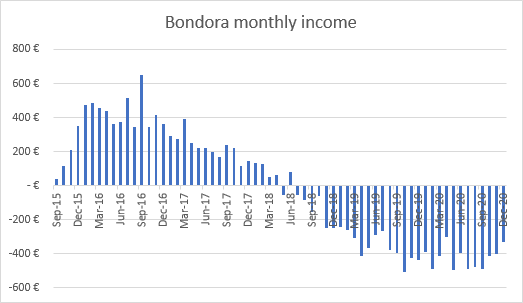

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

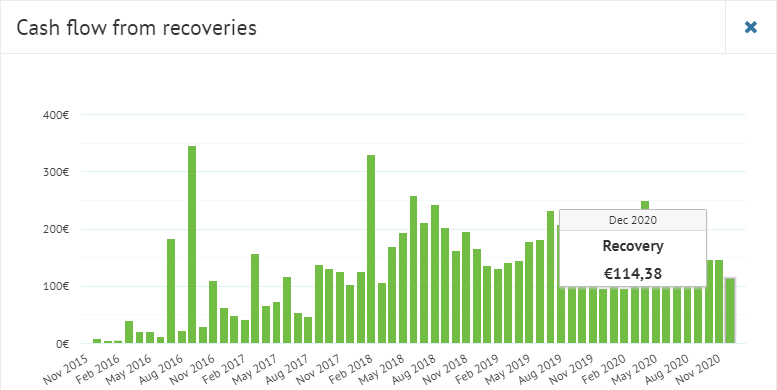

114.38€ was recovered in December but I still have 24 092€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

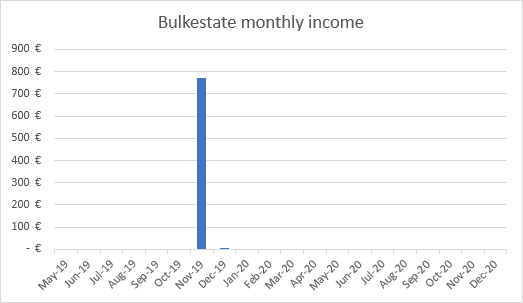

Bulkestate

Bulkestate* almost made it to the list of unaffected platforms in 2020.

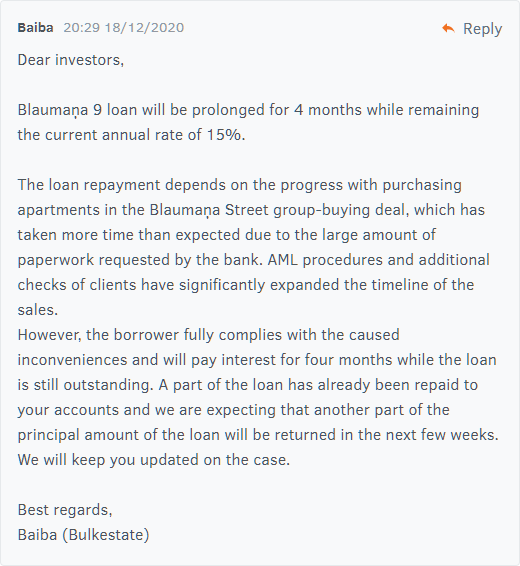

I was supposed to get my “Blaumaņa Street 9” investment back on Dec 21st. Three days prior to the repayment date a 4 month extension was announced:

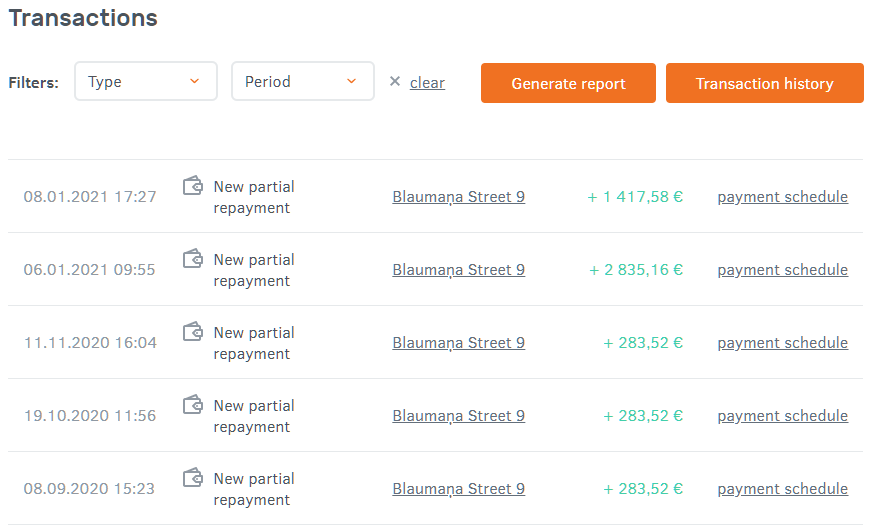

Partial repayments have been made, which means I already received close to 50% of the principal.

Even though there are small changes to payment schedules, Bulkestate* seems to be one of the safest investments in my P2P portfolio.

All new investors will receive a 5 EUR cash-back bonus upon their first investment if you use this link*.

For the next 3 months – invest at least €4,000 and get 1% cashback! The offer is active till March 12, 2021.

See more info and screenshot from my Bulkestate account

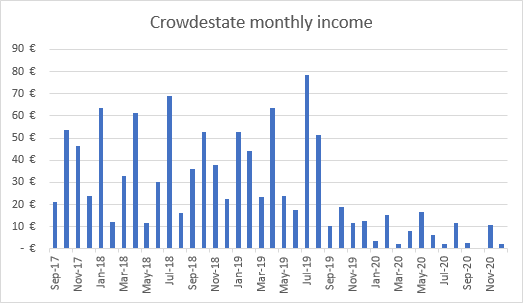

Crowdestate

I’m still withdrawing from Crowdestate*. While there’s no doubt in my mind that the platform is legit, I have not been convinced about their ability to pick the right borrowers.

In my opinion, too many projects have experienced payback issues, even before Covid19 made it’s presence.

See more info and screenshot from my Crowdestate account

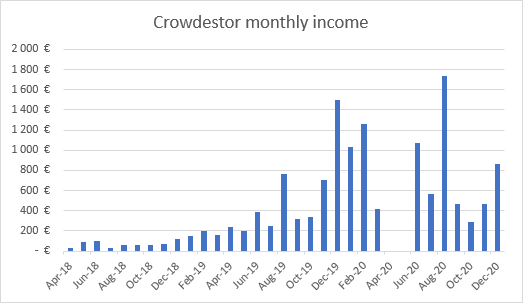

Crowdestor

While there’s some problematic projects on Crowdestor* it still has a lot going for it. The high interest rates (often 20-30%) is the compensation I get for being willing to take the risk and uncertainty that comes with investing in these kinds of projects.

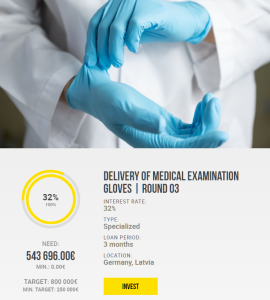

I decided to reinvest December’s earnings and partial repayments into these projects:

- “Survive – Feature Film | Round 02” with 25% interest rate

- “Delivery of medical examination gloves | Round 03” with 32% interest rate.

See more info and screenshot from my Crowdestor account

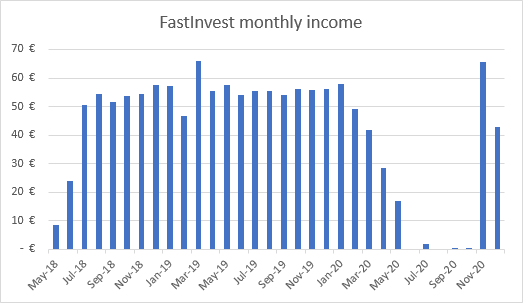

FastInvest

FastInvest* started off 2021 with updating the webpage design. I liked the old site better but maybe that’s just me?

Transaction wise, all repayments were made into my account. I have not tried to withdraw since last update. There’s only 300€ left in outstanding loans which I assume will be repaid within 2 months. By then, I’ll withdraw the rest.

My main reason for not reinvesting in FastInvest is, they promised to disclose their loan originators in 2020. That has not happened yet. I reached out to support to hear if the list was available now and this was the answer I received:

“I was informed, that list of originators is not disclosed yet but we are still working on it, finalizing the information and we hope that we will be able to disclose the list soon.”

If/when FastInvest discloses their loan originators, I’ll consider investing with them again.

See more info and screenshot from my FastInvest account

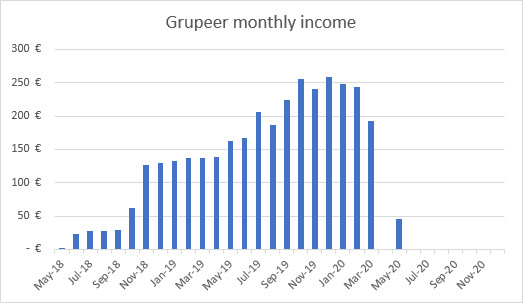

Grupeer

No signs of life in Grupeer since last update. Not even a blog update.

Latest blog post from November can be found here.

See more info and screenshot from my Grupeer account

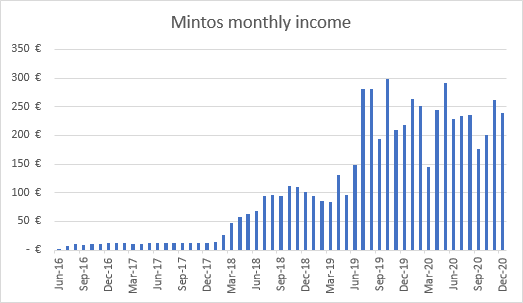

Mintos

I keep reinvesting in Mintos* but only in loan originators with a rating of 7 or above.

Mintos is currently developing a “Historic Performance” page which will be an addition to the existing Mintos Statistics page. On this page, investors will see how investments in loans on Mintos have performed in the past.

According to the data Mintos has outperformed all other asset classes from 2015-2019.

See more info and screenshot from my Mintos account

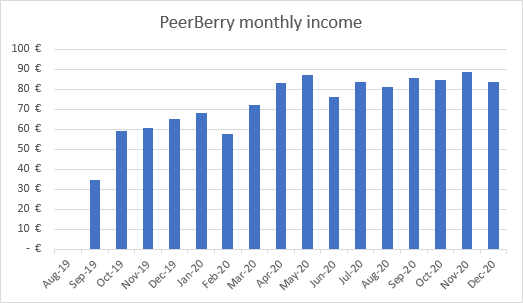

PeerBerry

I use PeerBerry* as my children’s savings account. It has been one of the most stable investments in my portfolio in 2020.

See more info and screenshot from my PeerBerry account

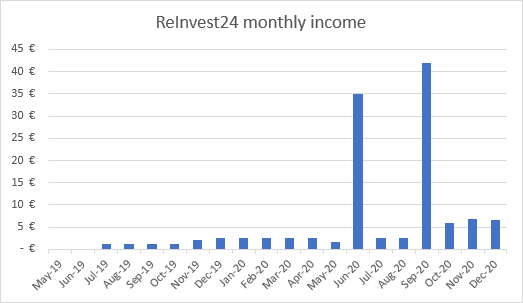

Reinvest24

I only have a small position at ReInvest24* but I’m starting to like it more and more. The income has been small but reliable.

ReInvest24 was also one of the few platforms which weren’t impacted by the pandemic in 2020.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

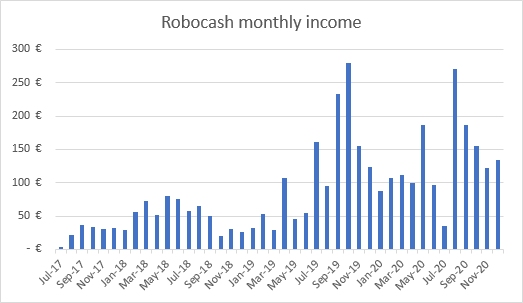

Robocash

Robocash* was one of my best performers in 2020.

If you want to start investing with Robocash you can get 1% cash back from all your investments until January 31, 2021, where the offer expires. Make sure to use this exclusive link* to get your cash back.

See more info and screenshot from my Robocash account

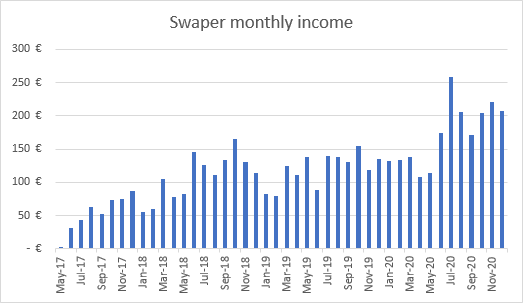

Swaper

Swaper* had a stellar 2020. Their business and profits are growing and the pandemic had no negative effect on investors.

Swaper has been one of my best P2P investments since May 2017. If you’d like to try them out, you can create your account here*

See more info and screenshot from my Swaper account

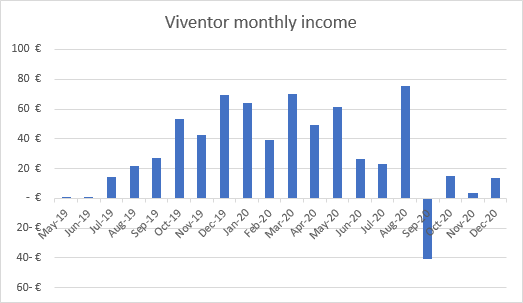

Viventor

Reinvesting into discounted Atlantis Financiers loans on Viventor* last month might have been a mistake.

Viventor’s CEO Andrius Bolšaitis has left the company and 4 loan originators were suspended in 2020.

I’ll most likely start to withdraw what I can from Viventor as the loans are being repaid.

See more info and screenshot from my Viventor account

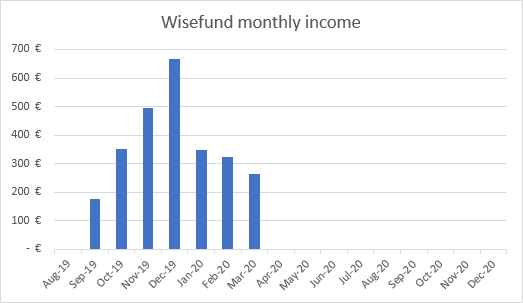

Wisefund

Wisefund published 2 new projects in December but have not posted any updates on all the problematic loans, which was expected to be posted monthly or bi-monthly.

On the other hand the had time to post 2 irrelevant blog posts, which only purpose is to strengthen their SEO (more exposure to Wisefund on Google searches).

If Wisefund wants to be taken seriously, they need to get their priorities right.

See more info and screenshot from my Wisefund account

Real Estate

I received rent from 4 tenants in December. One apartment is currently vacant and I’m looking for a new tenant to move in.

I’m in the process of buying a 3rd property, the purchase agreement has already been signed. Now I just need to secure financing and get a mortgage, which shouldn’t take more than a month.

The property was not announced for sale, I was just talking to the owner and asked if he ever had considered selling it. Surprisingly he said yes and after a day of thought he came up with the price, which I found fair.

The price of the property is just below 150 000€ and I expect the down payment to be 30-40% of that amount.

It was built in 1988 and there’s a 230 m2 property built on a 1 957 m2 plot. A new roof was installed 2 years ago so it should be very low maintenance.

The property has been approved to rent out 4 rooms separately, if I wish to do so. Part of the property is dedicated to a small business and is currently rented out to a physiotherapist.

It should be easy to collect 1 300€ per month in rent so it seems to be a good investment. If I want the extra administration from renting out per room it could generate as much as 2 300€ per month.

In regards to short-term expenses, I need to make a new bathroom and some of the windows needs to be changed within a few years.

See more info about my First property and Second property

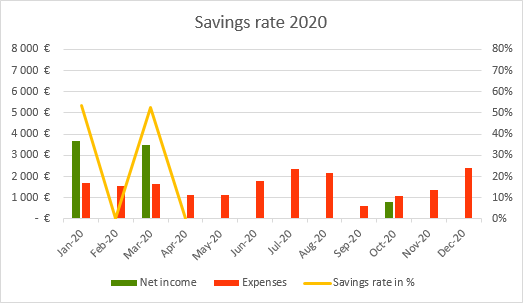

Savings rate / expenses overview

Our total expenses for the month were 2 382€. Not bad considering December is usually more expensive.

In mid December bought a 1 600€ Renault Scenic from 2003, which I didn’t included in my December expenses. The reason is, I didn’t include “income” from selling our 2 previous cars and all our stuff when we moved to Portugal in February, which amounted to ~7 000€. Maybe I should have included that as earnings back then, but at the time I thought it would be wrong.

See more info about my Savings rate

Quote of the month

Don’t get caught up in the small stuff. Focus on the big picture and do your best. Sometimes you win, sometimes you learn. Keep going!

Start your own blog

Have you been thinking about starting your own WordPress blog?

FinanciallyFree.eu is hosted on SiteGround* – probably the best WordPress host in Europe!

Free EUR bank account with no fees

Do you live in Denmark, Poland or Sweden? Having an N26 bank account will save you from currency exchange fees when dealing with euros!

I use N26* to transfer to and from my investments. It even comes with a free debit MasterCard. N26 is by far my favorite banking provider!

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough).

Comments are closed.