Dear fellow investors, friends, family and future self.

Financially, November was a great month. My stock portfolio is currently up more than 100% from when I opened my trading account in late March. Markets are very volatile so time will tell if I get to keep it.

I received repayments from several Crowdestor* projects and even FastInvest* processed my withdrawal requests from May and June! Read more details below..

I’m thinking about adding a pie chart and a value-over-time graph of my stock portfolio. Maybe even add a page where I state which stocks I buy and sell, including dates and values. Would you find that interesting?

Anyway, this is a lengthy update, so let’s get right into it.

Monthly Income Statement: November 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -402.92€ | -0.31% | 7 918€ | 7 608€ |

| Bulkestate* | 0€ | 6.21% | 10 000€ | 10 989€ |

| Crowdestate* | 10.94€ | 5.10% | 5 305€ | 6 404€ |

| Crowdestor* | 466.37€ | 11.90% | 82 912€ | 96 603€ |

| FastInvest* | 65.52€ | 15.01% | -199.01€ | 1 198€ |

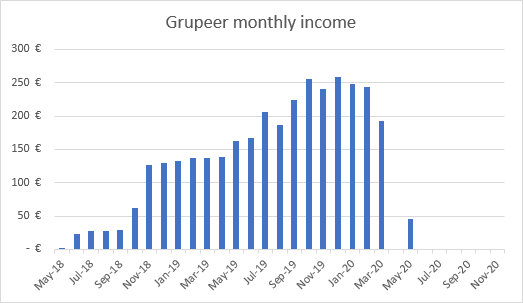

| Grupeer | 0.00€ | 9.16% | 20 474€ | 24 047€ |

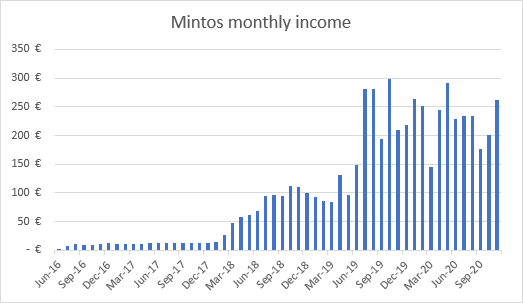

| Mintos* | 261.76€ | 16.96% | 20 000€ | 27 683€ |

| PeerBerry* | 88.68€ | 15.15% | 6 000€ | 7 103€ |

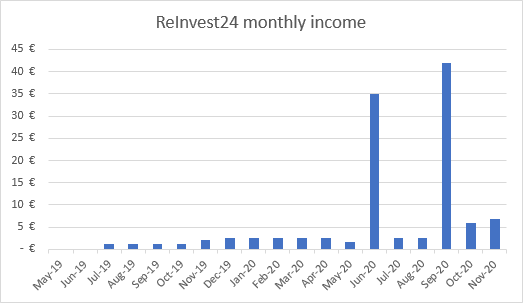

| ReInvest24* | 6.74€ | 5.74% | 1 000€ | 1 089€ |

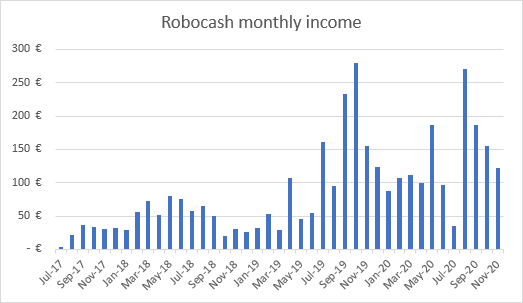

| Robocash* | 122.17€ | 13.06% | 10 000€ | 13 601€ |

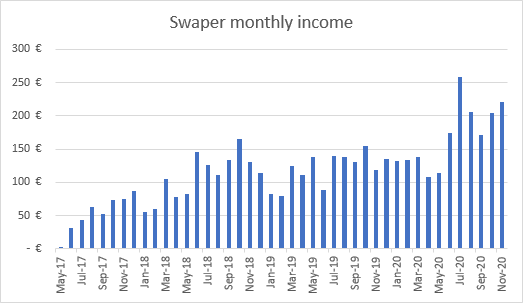

| Swaper* | 221.66€ | 14.67% | 10 000€ | 15 035€ |

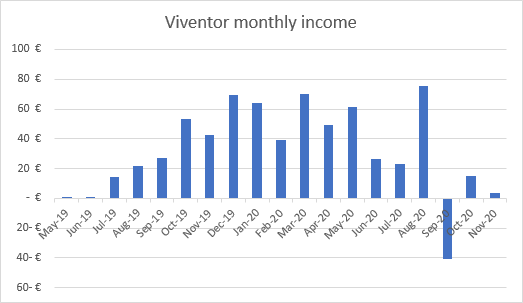

| Viventor* | 3.83€ | 14.73% | 5 000€ | 6 007€ |

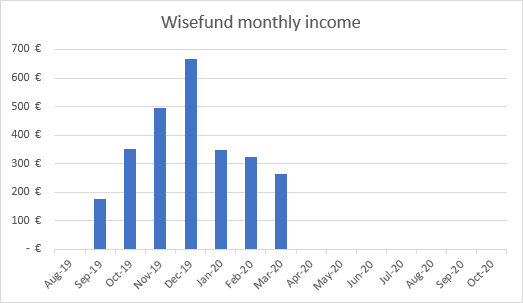

| Wisefund | 0.00€ | 11.09% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 844.75€ | -0.98% | 240 964€ | 237 999€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 380€ | 37.41% | 18 080€ | 44 482€ |

| Property #2 | 1 167€ | 5.03% | 61 200€ | 65 646€ |

| 1 547€ | 79 280€ | 110 128€ | ||

| Total | 2 391.75€ | 3.76% | 320 244€ | 348 127€ |

Note:

- I marked Grupeer and Wisefund as orange because I’m questioning future repayments.

- FastInvest “Invested” amount is negative because I have withdrawn more than I have deposited.

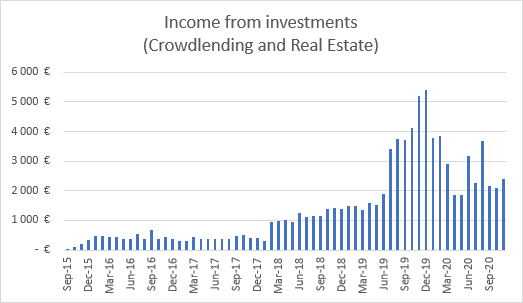

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 2 391.75€

(+302.28€ more than last month).

That means I’m 79.73% Financially Free (+10.08 percentage points up from last month).

Stocks / trading

I made a few changes to my stock portfolio since last update:

Sold:

- The Hershey Company @ 152.50$ (Bought @ 132.90$) = 14.75% gain

- STORE Capital Corp @ 31.50$ (Bought @ 19.50$) = 61.54% gain

- Delta Airlines @ 36.50$ (Bought @ 21.70$) = 68.20% gain

- Boeing Company @ 191.60$ (Bought @ 135.68$) = 41.21% gain

- Enterprise Products Partners LP @ 18.42$ (Bought @ 13.50$) = 36.44% gain

- Schlumberger Limited @ 18.10$ (Bought @ 16.95$) = 6.78% gain

- WisdomTree Platinum 2x Daily @ 2.06$ (Bought @ 2.41$) = 14.52% loss

- Nikola @ 30.25$ (Bought @ 29.06$) = 4.09% gain

I was happy to get out of Nikola with a small profit before it tumbled back to 18$. I saw an interview with the Nikola CEO and the way he described their options for continuing the business, in case the deal with GM should fall though, made me think that GM would pull out of the deal. Good timing, because GM did indeed pull out of the deal and the stock plunged.

Bought:

- Argan (AGX) @ 49.20$

- Unity Software (U) @ 114.50$

- Palantir Technologies (PLTR) @ 18.56$

- Norwegian Air Shuttle @ 0.3901$

Norwegian Air is only a small position <2% of my portfolio. It’s my lottery ticket, as the company is on the edge of bankruptcy. I have bought the stock because the management team seem very keen on keeping the company alive. I also like their proposed restructuring model.

This is my current equity portfolio:

[table id=1 /]I buy my stocks and trade on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction). I don’t receive any commission besides the mutual fee deduction.

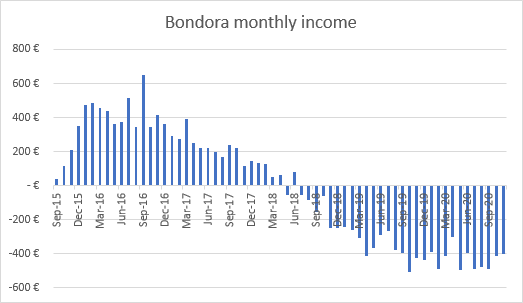

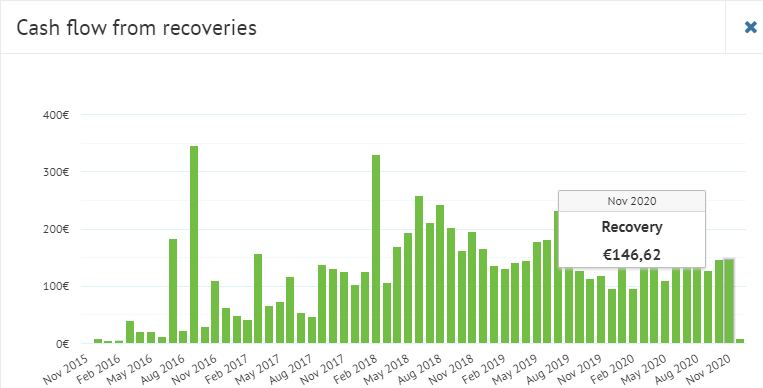

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

146.62€ was recovered in November but I still have 24 205€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

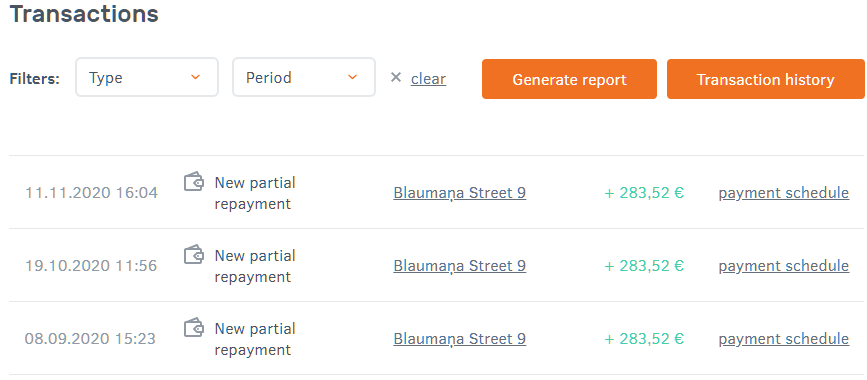

Bulkestate

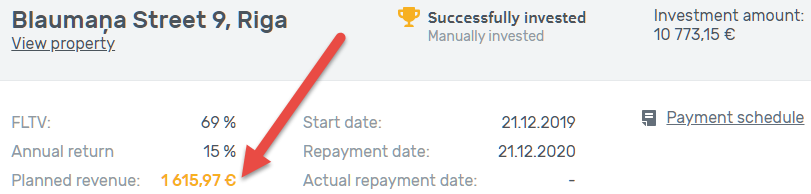

I have received another partial early repayment on project “Blaumaņa Street 9” on Bulkestate*. It’s principal repayments so it’s not showing in the graph.

My current investment is scheduled to repay the total amount on 21.12.2020 where I (if everything goes as planned) will receive a 1 615€ interest payment.

All new investors will receive a 5 EUR cash-back bonus upon their first investment if you use this link*.

For the next 3 months – invest at least €4,000 and get 1% cashback! The offer is active till March 12, 2021.

See more info and screenshot from my Bulkestate account

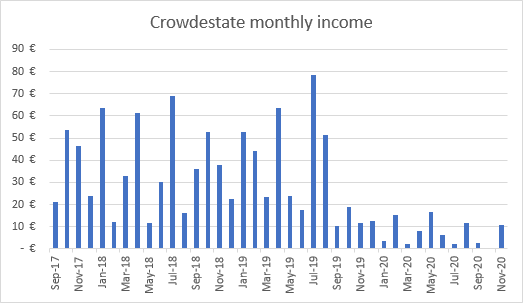

Crowdestate

I’m still withdrawing from Crowdestate*. While there’s no doubt in my mind that the platform is legit, I have not been convinced about their ability to pick the right borrowers.

In my opinion, too many projects have experienced payback issues, even before Covid19 made it’s presence.

See more info and screenshot from my Crowdestate account

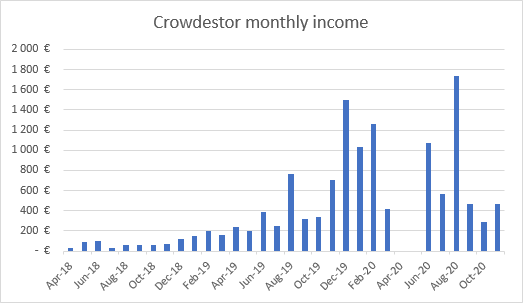

Crowdestor

I received 90% of the principal from the Limp Bizkit concert, which is postponed to 2021 or maybe even 2022. The last 10% will be repaid later.

Combined with other repayments, I had 10 811€ available which I decided to withdraw on December 4th. The withdrawal was easy and the money appeared in my bank account 3 days later.

I’m still happy with Crowdestor. I only decided to take some of the profits off the table because my account value was getting close to 100 000 EUR. Too much for one platform.

See more info and screenshot from my Crowdestor account

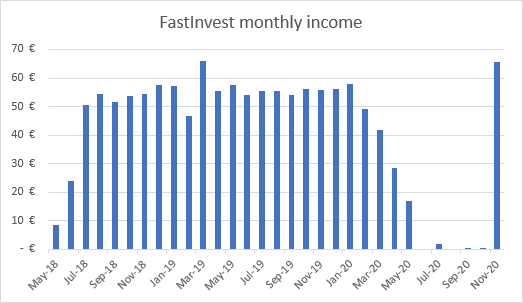

FastInvest

Christmas came early on this year. The weekly mail from FastInvest* was not just to buy time, they actually kept their promise!

On December 1st I received both my withdrawals from May and June into my bank account.

“Lag ante” of 48.34€ (which they call the interest rate applied to delayed withdrawals) was also credited to my account.

The latest withdrawal means that I have now withdrawn 199€ more than I ever deposited and the account value is still ~1 200€.

Daily repayments of principal of interest also started to appear from November 27th. It looks like FastInvest* will survive after all?

See more info and screenshot from my FastInvest account

Grupeer

Seeing FastInvest repay again, I can’t help but get my hopes up for Grupeer.

Grupeer was not like Envestio and Kuetzal which was operated by 3-4 people. Grupeer had a big office with more than 30 employees (just like FastInvest).

Of course, a large team is not a guarantee that fraudulent actions will not take place. But Grupeer was one of the last platforms I expected to go down. I hope they’ll make it and find some way to repay investors.

No new blog posts since last update. Latest blog post here.

See more info and screenshot from my Grupeer account

Mintos

As mentioned in a previous update, I have tightened my auto-invest filter on Mintos* significantly.

In the last couple of months I’ve only invested in loans from IuteCredit, DelfinGroup and Sun Finance, which are among the highest rated loan originators on Mintos.

Interest rates offered by these high quality loan originators are still above 14%. Not bad compared to the rates offered last year.

Mintos does a good job giving updates on their blog.

See more info and screenshot from my Mintos account

PeerBerry

I use PeerBerry* as my children’s savings account. Everything is running smooth here..

November set a new record with interest repayments of 88.68€

The Gofingo Group (one of PeerBerry’s business partners) plans to finish this year with a net profit of about 2 million EUR.

See more info and screenshot from my PeerBerry account

Reinvest24

I only have a small position at ReInvest24* but I’m starting to like it more and more. The income has been small but reliable.

It’s essential for any investment platform to give investors an option to exit their investments early.

In late November ReInvest24 introduced a secondary market where investors can buy and sell loan parts. Currently all loan parts are listed with a premium, which means that you’ll have to pay more for the loan part than it’s initial value.

The next best thing about the secondary market is that I can reinvest my earnings on the secondary market, because there’s no minimum investment amount. If an investor puts 100€ worth of shares on the market, I don’t have to buy it all, I can buy eg. 14€ worth of shares if I want. That’s awesome!

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

Robocash

Robocash* had one of their best months in November.

- Investors set a new record funding loans worth € 9.2 mln! This is 34% more than in October.

- 293 people started investing and earning with Robocash, 47% more than in the previous month.

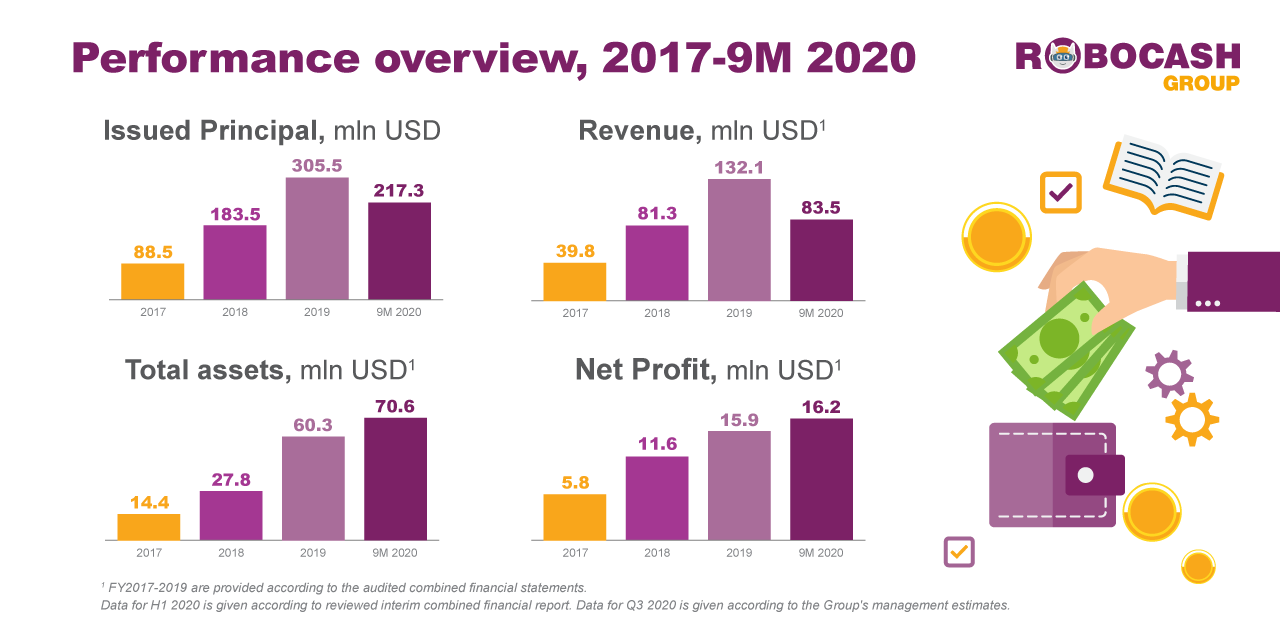

Financial results for the first 9 months of 2020 have also been published. Even with Covid-19 Robocash have managed to achieve a higher Net Profit than in 2019. This picture shows a brief summary:

With such strong financial reports, it’s no wonder that more and more people start investing with Robocash*. I’m very happy with them too.

If you want to start investing with Robocash you can get 1% cash back from all your investments until January 31, 2021. But only if you use this exclusive link*

See more info and screenshot from my Robocash account

Swaper

Another of my favorite P2P lenders is Swaper*. Interest rates are a few points higher than on Robocash and they share the same business model: Funding the groups own loans (not 3rd party loan originators).

To me, Swaper has been a stable a predictable platform without any issues (other than the occasional lack of loans available for investment, but that’s currently not an issue).

See more info and screenshot from my Swaper account

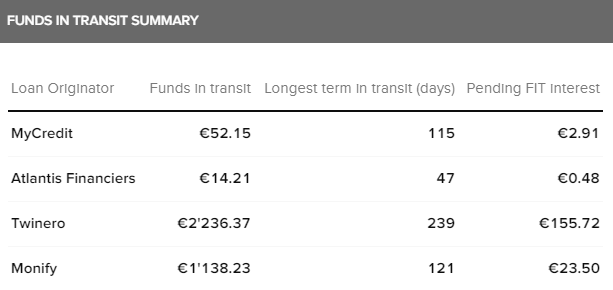

Viventor

Writing this update on Viventor, I was about to say that I would withdraw from Viventor*, because I don’t really see any benefits compared to other platforms.

However, when I checked Viventor’s secondary market, plenty of overdue loans from Atlantis Financiers were offered at at -23% discount. The owners of Atlantis Financiers bought Viventor a few months back and they currently don’t have any “Funds In Transit” pending.

If Viventor is going to survive I feel confident that Atlantis Financiers will keep buying back late loans, like they’ve done in the past. So I decided to spend my 560€ available on discounted loans and postpone my decision to leave Viventor.

I’m waiting for funds in transit from Twinero and Monify. No funds were received from those two in November.

See more info and screenshot from my Viventor account

Wisefund

No news from Wisefund since last month. All the projects I have invested in have defaulted and are awaiting recovery.

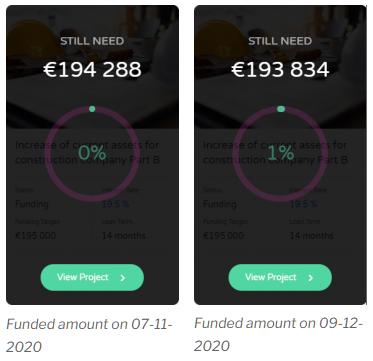

The lastest project has attracted less than 1% funding. Only 454€ was invested in the open project since last month.

The future does not look bright for Wisefund. Investors have lost trust in the company and rightly so. The information level on the non-performing loans has been terrible.

See more info and screenshot from my Wisefund account

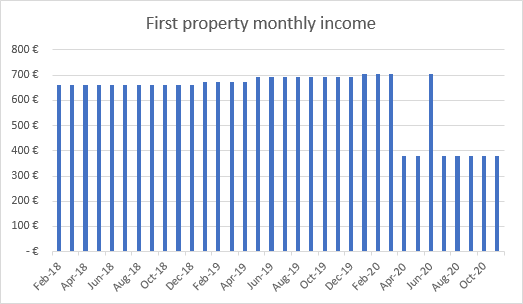

Real Estate

I received rent from 4 tenants in November. One apartment is currently vacant while it’s being renovated. The renovation is finally finished and I expect to find a new tenant very soon.

I’m still thinking about buying a 3rd property, as it’s clear that we won’t buy a house for ourselves just yet. We made a bid on 2 properties, to live in ourselves. We even offered full price on one of them. But in both cases someone else made a higher offer.

On the bright side, we have found an apartment to live in from next week. We’re looking forward to getting our own place again.

See more info about my First property and Second property

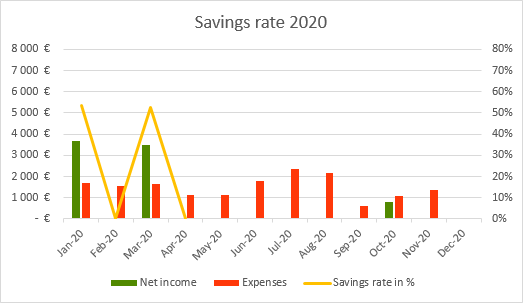

Savings rate / expenses overview

Our total expenses for the month were 1 365€, including medical bills of ~500€ (!!!) We got scabies after sleeping over in a friends house. The pills and cream to treat it is ineffective and expensive and all 5 of us must be treated.

Note that I pay for all expenses for my family now. Previous expenses were partly covered by my girlfriend, but now that she left the job market too, all expenses are on me 🙂

From next month we’re back to paying regular rent in a new apartment (~875€ per month). The past 3 months we’ve only paid 135€ per month living in my dads house, to help pay for some of our consumption of electricity and water.

See more info about my Savings rate

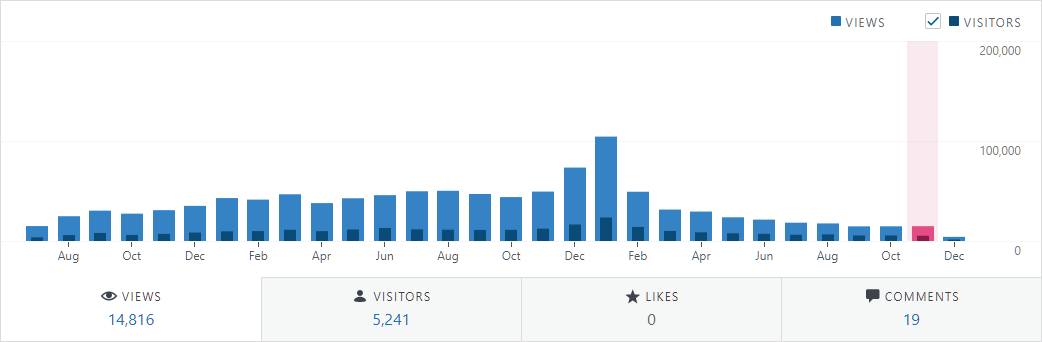

Blog statistics

Page views: 14 816 (+0.92% compared to last month)

Visitors: 5 241 (-4.95% compared to last month)

3 194 Subscribers (+14 compared to last month)

1 610 Facebook followers (-4 compared to last month)

Quote of the month

Stock markets are flying high these weeks. If the madness continues into 2021, I will be looking to sell most of my positions in the first half of January.

Start your own blog

Have you been thinking about starting your own WordPress blog?

FinanciallyFree.eu is hosted on SiteGround* – probably the best WordPress host in Europe!

Free EUR bank account with no fees

Do you live in Denmark, Poland or Sweden? Having an N26 bank account will save you from currency exchange fees when dealing with euros!

I use N26* to transfer to and from my investments. It even comes with a free debit MasterCard!

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.