Dear fellow investors, guys and gals, friends and family.

Another month has passed and it’s time for another financial update.

It’s been a very busy month, so I’ll skip the introduction and get right to it 🙂

Here’s the numbers for August 2020:

Monthly Income Statement: August 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -476.65€ | -0.07% | 9 902€ | 9 832€ |

| Bulkestate* | 0€ | 7.44% | 10 000€ | 10 989€ |

| Crowdestate* | 11.65€ | 5.41% | 5 305€ | 6 389€ |

| Crowdestor* | 1 741.18€ | 12.83% | 82 912€ | 94 814€ |

| FastInvest* | 0.00€ | 3.31% | 864€ | 1 130€ |

| Grupeer | 0.00€ | 10.66% | 20 474€ | 24 047€ |

| Mintos* | 234.83€ | 17.91% | 20 000€ | 27 032€ |

| PeerBerry* | 81.46€ | 14.95% | 6 000€ | 6 846€ |

| ReInvest24* | 2.64€ | 2.91% | 1 000€ | 1 037€ |

| Robocash* | 270.94€ | 12.85% | 10 000€ | 13 135€ |

| Swaper* | 206.09€ | 14.40% | 10 000€ | 14 437€ |

| Viventor* | 75.58€ | 16.26% | 5 000€ | 5 888€ |

| Wisefund | 0.00€ | 13.73% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 2 147.72€ | -2.18% | 244 012€ | 236 208€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 380€ | 40.73% | 18 080€ | 43 471€ |

| Property #2 | 1 167€ | 2.38% | 61 200€ | 64 223€ |

| 1 547€ | 79 280€ | 107 694€ | ||

| Total | 3 694.72€ | 3.09% | 323 292€ | 343 903€ |

Note: I marked Grupeer as orange for now because I’m questioning it’s future.

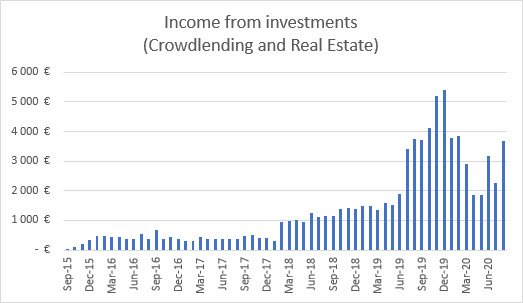

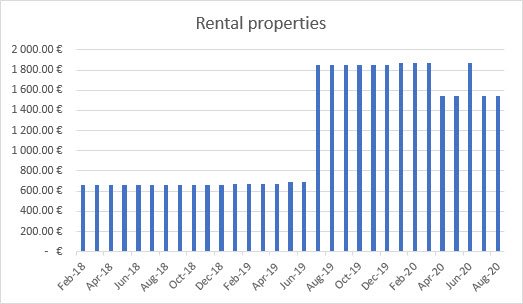

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 3 694.72€

(+1 437.01€ more than last month).

That means I’m 123.16% Financially Free (+47.90 percentage points up from last month).

Stocks / trading

I added 1 new stock to my portfolio since last update:

- Gilead Sciences (GILD)

Gilead Sciences should have massive technical support in the 63-67$ level. I’m setting a stop loss at a daily close below 60$.

I also added to my “WisdomTree Platinum 2x Daily Leveraged” (LPLA) position today @ 2.18€, bringing my average price down to 2.41€

This is my current equity portfolio:

[table id=1 /]I buy my stocks and trade on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction). I don’t receive any commission besides the fee deduction.

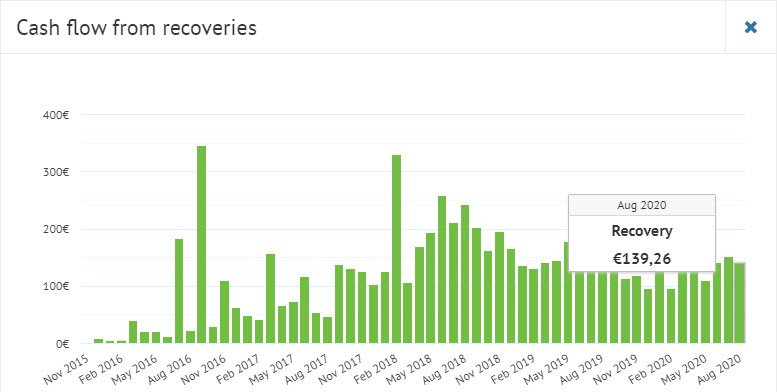

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

139.26€ was recovered in July but I still have 24 616€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

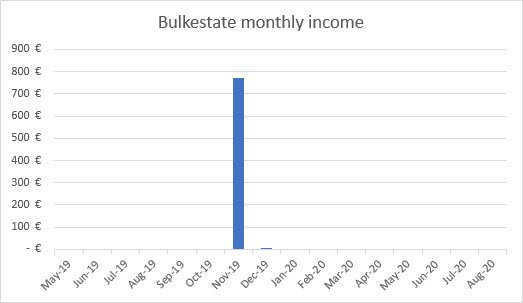

Bulkestate

Bulkestate* has not had any failed projects since it was founded in December 2016.

I’m invested in 2 projects and the next payout is scheduled for 21.12.2020.

There’s currently 2 properties available for investment at 15-16% (+2% if you invest more than 20k EUR).

All new investors will receive a 5 EUR cash-back bonus upon their first investment.

See more info and screenshot from my Bulkestate account

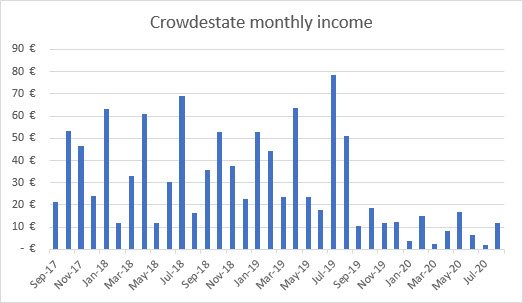

Crowdestate

I’m still withdrawing from Crowdestate*. While there’s no doubt in my mind that the platform is legit, I have not been convinced about their ability to pick the right borrowers. In my opinion, too many projects have experienced payback issues.

See more info and screenshot from my Crowdestate account

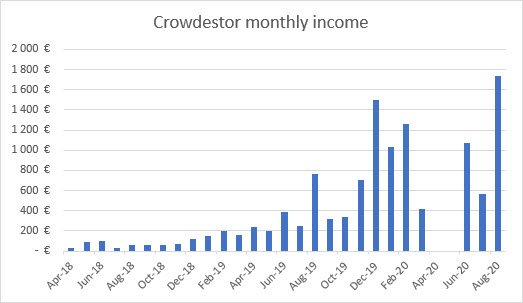

Crowdestor

I received several repayments on Crowdestor* in August, making it my most profitable month to date.

Project “Mafia Stars” (later renamed Dystopia) made the biggest contribution to this months earnings with a total interest payment of 1375.11€

Unfortunately, the number of delayed projects are adding up. While I’m happy with the level of communication in the official Crowdestor Facebook group and email updates, I’m starting to miss a better overview of delays on the dashboard. It’s not optimal to go through “My investment” to look for upcoming payment dates that have already passed. I know Crowdestor is working on this feature, so I’m looking very much forward to that.

See more info and screenshot from my Crowdestor account

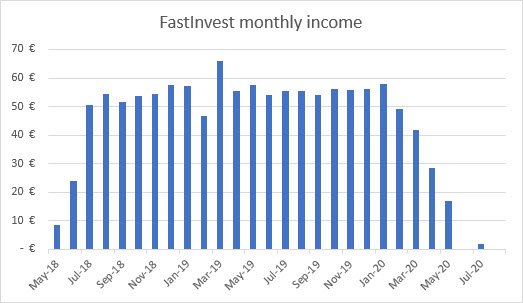

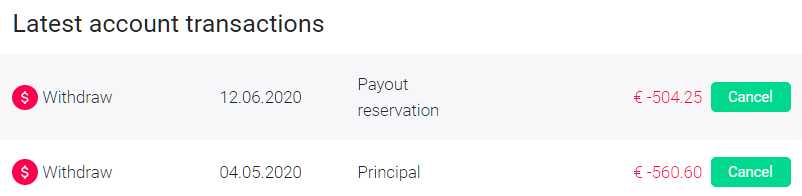

FastInvest

My latest successful withdrawal from FastInvest* was requested in late April and processed on 12.05.2020. I still have 2 pending withdrawals from May and June.

FastInvest recently sent an email ensuring investors that withdrawals will be processed, it’s just a matter of time:

However, I have seen similar mails from platforms who no longer exist, so I’ll believe it when the money is in my bank account.

See more info and screenshot from my FastInvest account

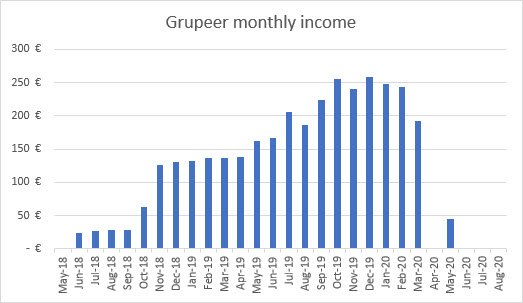

Grupeer

Grupeer is still communicating. In their latest blog post they explain that they have issues reopening their bank account because only about 50% of investors have responded to the KYC questionnaires:

“We hoped that the resuming of economic activity will take place sooner, but it is directly affected by the low share of submitted KYC questionnaires. From all active investors approximately, half has submitted and verified updated KYC questionnaires, it still creates difficulties to reopen bank accounts and to resume the economic activity of the company.

We have created a solution to fulfil liabilities towards the investors who have submitted and verified their questionnaires.”

They also say that several loan originators are ready to pay as soon as the banking details are set up.

So if you haven’t updated your profile on Grupeer yet, make sure to do it right away.

See more info and screenshot from my Grupeer account

Mintos

As you can see from the graph, my Mintos* portfolio has not suffered much from the pandemic.

While many loan originators are struggling on Mintos, I get the impression that they’re doing a good job handling the situation and getting money back to investors. Several of the defaulted loan originators made substantial repayments to investors in August.

Mintos does a good job giving updates on their blog.

See more info and screenshot from my Mintos account

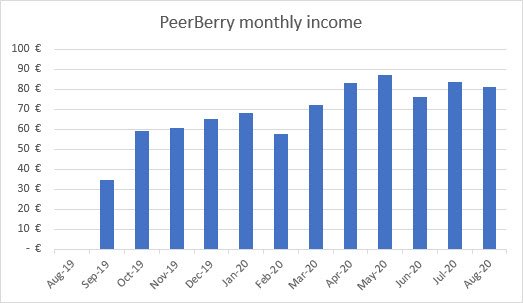

PeerBerry

I use PeerBerry* as my children’s savings account. Everything is running smooth here.

On September 2, PeerBerry expanded the network of business partners by adding a new loan originator Nado Deneg – Aventus Group company in St. Petersburg, Russia. Nado Deneg offers PeerBerry investors to invest in short-term loans with a 10% annual return on investment.

See more info and screenshot from my PeerBerry account

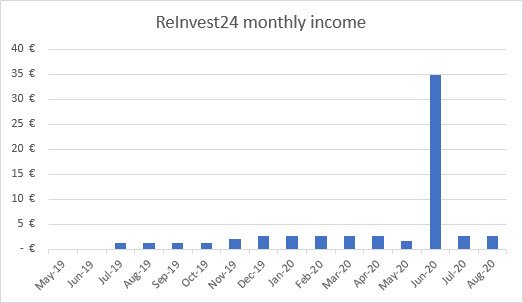

Reinvest24

I only have a small position at ReInvest24* but I’m starting to like it more and more. The income has been small but reliable.

Check out the video they posted today from one of their development projects:

I like to see video updates. All project-oriented platforms should do this!

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

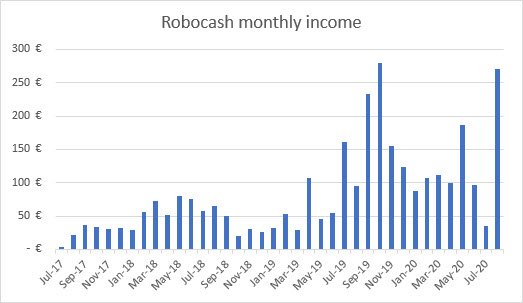

Robocash

As stated last month, Robocash* have never failed to honor their 60 day buyback guarantee. A massive 270.94€ earning was generated in August.

Robocash published their audited financial statements for FY2017-2019.

You can find the audited report here. The management report is available here.

Due to the healthy economy of the group, Robocash* decided to lower interest to 12%. 14% interest rates were only offered from March 20th to September 1st 2020, so it’s more like “back to normal” than a real hair cut.

See more info and screenshot from my Robocash account

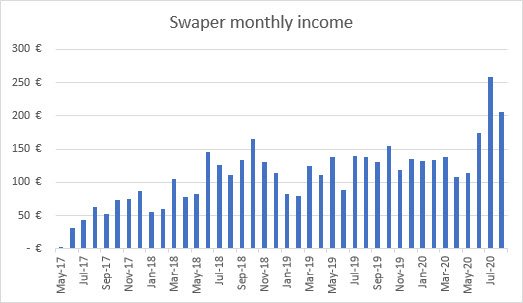

Swaper

Swaper* is actually one of my favorite P2P lenders.

To me, Swaper has been a stable a predictable platform without any issues (other than the occasional lack of loans available for investment, but that’s currently not an issue).

See more info and screenshot from my Swaper account

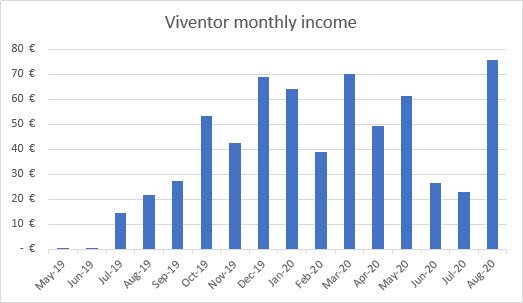

Viventor

Several loan originators on Viventor* are struggling but at least they are good at communicating what’s going on.

Low and behold, troubled loan originator Aforti Finance repaid 50% of their debts to me, reducing my exposure from 750€ to 375€. That’s really nice to see!

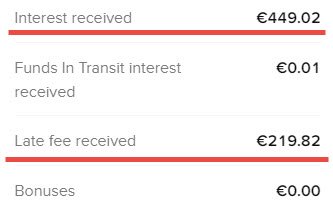

Interestingly enough, almost half of the income I receive on Viventor comes from late fees:

See more info and screenshot from my Viventor account

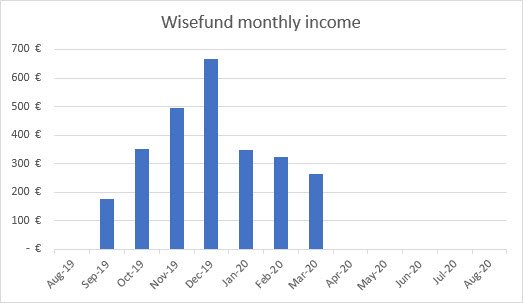

Wisefund

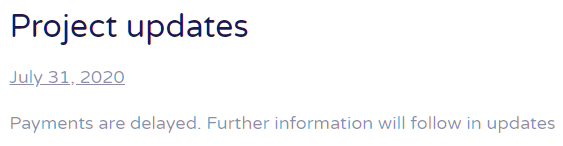

Wisefund implemented a 3 month grace period in March. According to the “Expected Account Transactions” list in my Dashboard, projects should start paying again from 30.07.2020.

However, no repayments were received in July or August and no information was given other than this notice in the project descriptions:

Some delay can be expected, especially during a crisis, but this level of communication is unacceptable.

See more info and screenshot from my Wisefund account

Real Estate

I received rent from 4 tenants in August. One apartment is currently vacant while it’s being renovated. The renovation is taking longer than expected do to a high level of moist.

See more info about my First property and Second property

Savings rate / expenses overview

My total expenses for the month were 2 181€. It’s way more than it should be, given the fact that we didn’t have any rent expenses in August. However, moving back to Denmark introduced a need for some new purchases, especially for our girls. Next month should be better!

See more info about my Savings rate

Blog statistics

Visitors: 6 554 (+5.27% compared to last month)

Page views: 17 566 (-3.92% compared to last month)

3 151 Subscribers (+16 compared to last month)

1 590 Facebook followers (+17 compared to last month)

Quote of the month

Start your own blog

Have you been thinking about starting your own WordPress blog?

FinanciallyFree.eu is hosted on SiteGround* – probably the best WordPress host in Europe!

Free EUR bank account with no fees

I use N26* to transfer to and from my investments. It even comes with a free debit MasterCard!

If you live in Denmark, Poland or Sweden, having an N26 bank account will save you from currency exchange fees when dealing with euros.

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.