Dear fellow investors, guys and gals, friends and family.

We’re living in a historic moment. The world has collectively decided to put the ecomony to a standstill, to potentially save hundreds of thousands of lives.

The question is how long we’ll be able to sustain the lockdown. How many companies will have to go out of business before we start to see riots on the streets?

Most crowdlending platforms have published statements on how they’ll handle the Coronavirus and lockdown period. In short:

- Some are optimistic and opportunistic

- Some acknowledges they have tough times ahead

- Others decided to use the virus as an excuse to exit their scam business

I believe every downturn carries an equal opportunity for those who are ready for it. Personally, I will use the extreme conditions to look for investments on the stock market.

Monthly Income Statement: March 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -412.91€ | 3.02% | 9 813€ | 12 896€ |

| Bulkestate* | 0€ | 11.10% | 10 000€ | 10 989€ |

| Crowdestate* | 2.25€ | 5.90% | 5 648€ | 6 677€ |

| Crowdestor* | 416.30€ | 15.14% | 82 912€ | 91 438€ |

| FastInvest* | 41.74€ | 16.19% | 1 911€ | 2 640€ |

| Grupeer | 192.62€ | 14.53% | 20 474€ | 24 001€ |

| Mintos* | 144.88€ | 17.24% | 20 000€ | 25 019€ |

| PeerBerry* | 72.17€ | 13.91% | 6 000€ | 6 427€ |

| ReInvest24* | 2.59€ | –0.11% | 1 000€ | 999€ |

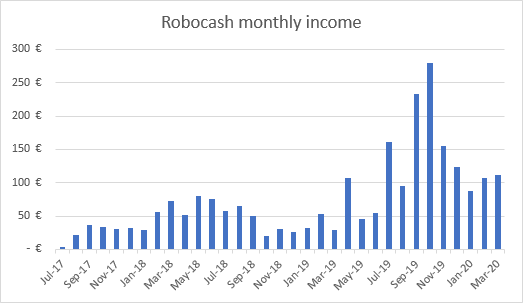

| Robocash* | 111.20€ | 12.66% | 10 000€ | 12 447€ |

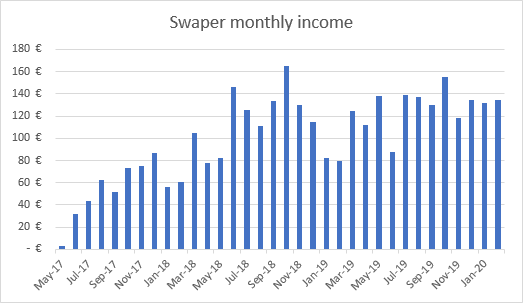

| Swaper* | 137.49€ | 14.15% | 10 000€ | 13 575€ |

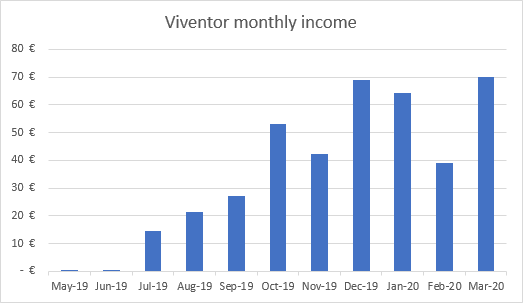

| Viventor* | 70.03€ | 12.29% | 5 000€ | 5 401€ |

| Wisefund | 264.47€ | 20.65% | 18 117€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 1 042.83€ | -4.00% | 245 577€ | 233 140€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 704€ | 46.71% | 18 080€ | 41 448€ |

| Property #2 | 1 167€ | 0.37% | 61 200€ | 61 373€ |

| 1 871€ | 79 280€ | 102 822€ | ||

| Total | 2 913.83€ | 1.98% | 324 857€ | 335 962€ |

Note: I marked Grupeer income as orange for now because it’s highly questionable. Read more in the Grupeer section below.

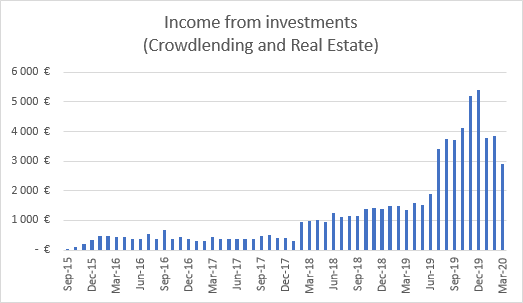

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 2 913.83€.

(-951.01€ less than last month).

That means I’m 97.13% Financially Free (-31.70 percentage points down from last month).

My second goal of 7 000€ per month reached 41.63% (-13.59 percentage points down from last month).

The main reason for the income drop is because Crowdestor decided not to pay out any interest (or principal) from March 14th and the next 3 months.

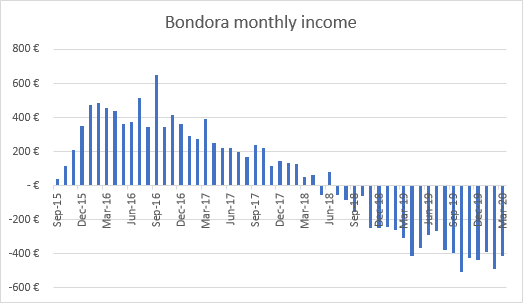

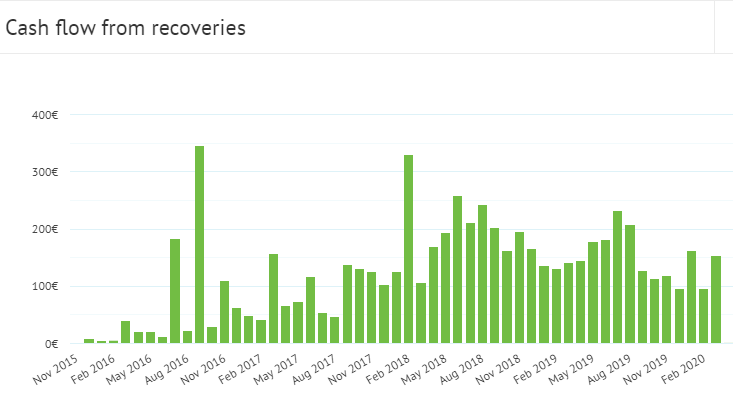

Bondora

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

153.55€ was recovered in March but I still have 25 342€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

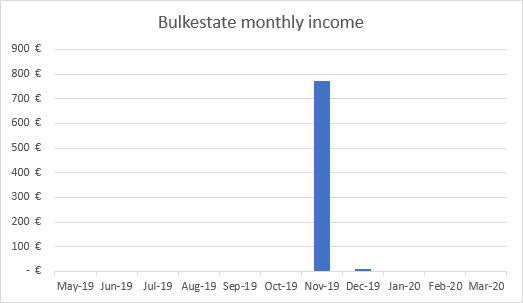

Bulkestate

I’m have invested in 2 projects on Bulkestate* and the next payout is scheduled for 21.12.2020.

Bulkestate have 1 interesting project available at the moment, which offers 17% interest rate and a low LTV (Loan To Value) of 49%.

See more info and screenshot from my Bulkestate account

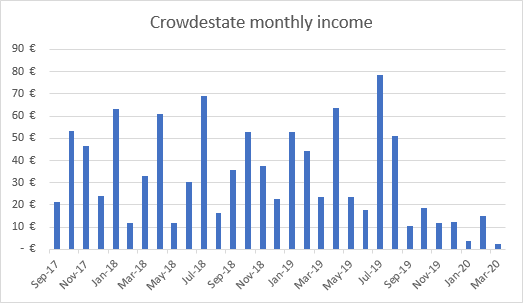

Crowdestate

The problems on Crowdestate* shows clearly in my income graph.

I’m slowly withdrawing funds as they are repaid.

I have 6 late and 1 defaulted project. It’ll be interesting to see how well Crowdestate handle the defaults and delays in 2020. The Coronavirus is not going to make it any easier to recover my funds.

See more info and screenshot from my Crowdestate account

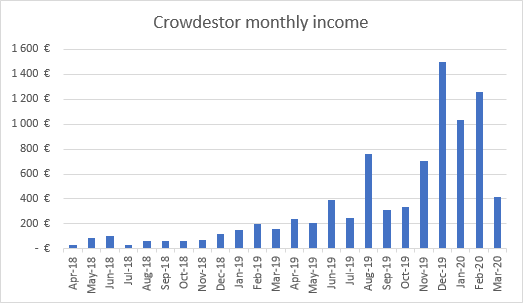

Crowdestor

Crowdestor* decided to pause all payments from borrowers and give them a 3 month grace period. Initially the message was, that the borrowers will receive a short “free ride” in order to adapt to the Covid-19 situation.

When a global crisis comes up, it’s clear that some action must be taken to serve the best interest of the investors. However, I think it’s problematic that Crowdestor, which is supposed to be an independent loan intermediary, is able to make decisions which impacts projects where they are borrowers themselves. To me, that’s a conflict of interest which should never happen.

Seeing Crowdestor making decisions which overrules current loan agreements and altering payment schedules, without asking investors first, made me lose some trust in the platform. I’m sure Crowdestor made the right decision based on the current situation, but that’s not the point. Investors should decide for themselves and always be asked before any action is taken. Am I the only one with this point of view?

Maybe Crowdestor realized this conflict of interest mistake, because on April 3rd they launched a survey, asking investors which scenario they would prefer, giving 5 different options for repayment:

Note, there’s no option to proceed with bankruptcy procedures if the borrower cannot fullfil his obligations. Would I vote for bankruptcy procedure? No, of course not. But since it’s the normal procedure to follow in case a borrower cannot pay (in normal market conditions), I think it should be an option.

Which option will I vote for?

Holding borrowers accountable to 3 months of interest 9-18 months after principal has been returned seems wrong. That eliminates option C and D. Option E raises the question whether Crowdestor is able to make an objctive decision for their own projects. That leaves me with A and B. Either no interest or 1/3 of the interest paid together with the principal. I guess I’ll pick B.

See more info and screenshot from my Crowdestor account

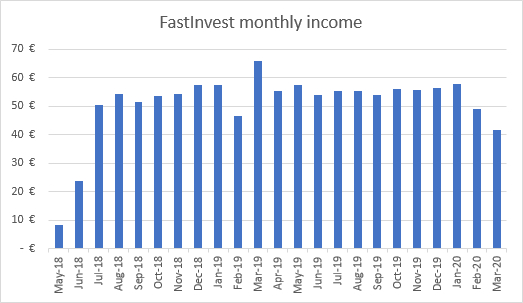

FastInvest

I feel twisted about FastInvest*. Some people say it’s obvious they’re a scam.

As we’ve seen recently with Grupeer, having a big office and 30-40 employees doesn’t necessarily mean it’s a legit business. If just 1 influential person makes some dishonest decisions, it doesn’t matter what the rest of the team is doing.

I’ve reduced my position by withdrawing principal and interest as it’s been paid back. I’ll probably keep a small position in FastInvest just to follow the evolvement of the platform.

See more info and screenshot from my FastInvest account

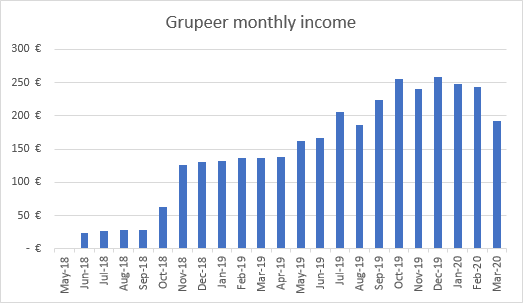

Grupeer

Unfortunately, I expect Grupeer to be listed side by side with Kuetzal and Envestio in next month’s update.

Grupeer has turned out to be the biggest disappointment of my P2P investing experience. They were one of the platforms I trusted the most and now it looks like they’ve decided to exit scam.

Technically it might not be a scam but a case of embezzlement. Either way I’ll lose my money 🙁

How do we know?

There’s evidence that projects and loan originators presented from October 2019 and onwards are fake.

First of all, loan originators like Lion Lender and Epic Cash doesn’t hold any license to lend out money. Also, their websites don’t have any traffic, so how did they find borrowers to more than 1M EUR in such a short time?

People have emailed and called partners of Grupeer and some of them have told they don’t have any business relations with Grupeer. Other partners have confirmed partnership but have not received any money from Grupeer since January.

Feel free to check the evidence collected in this Google Drive folder.

It seems like Grupeer was inspired by Kuetzal and decided to go down the same road. No words can describe how disappointed I am.

See more info and screenshot from my Grupeer account

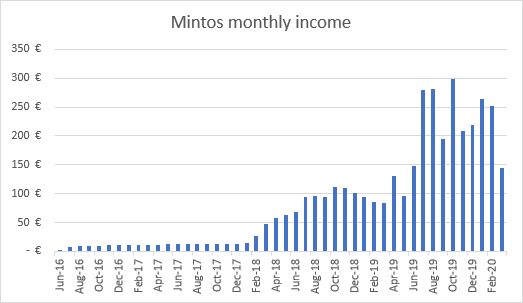

Mintos

Mintos* now have 5 loan originators who lists loans at +25% interest rate and buyback guarantee. Remember that the buyback guarantee only works if the loan originator is alive. Many of them are expected to default during a crisis.

Selecting the best loan originators are more important now than ever. I go for A-B rated loan originators with an ExploreP2P score of 65 or more.

I bought some discounted loans from A-B+ rated loan originators in March, hoping the loan originators will survive and be able to buy the loans back. A risky strategy for sure, let’s see how it works out.

Mintos tells me I earned 616.52€ in March (because of the discounts) but I don’t see it as profit until the loans are paid back. That’s why I only report pure interest earnings of 144.88€. It’s the lowest number in a very long time and it clearly shows that borrowers are troubled to pay back in time.

See more info and screenshot from my Mintos account

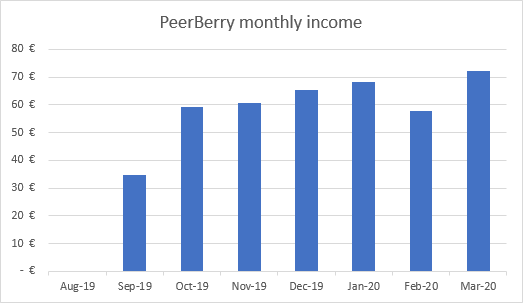

PeerBerry

I use PeerBerry* for my children’s savings account.

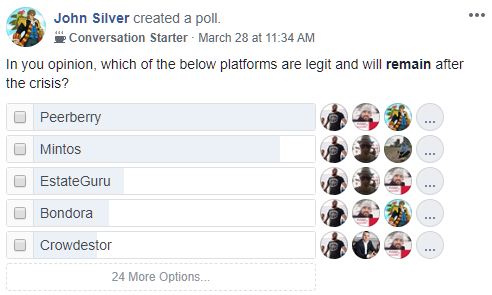

According to a recent poll on Facebook, PeerBerry is the most trusted platform with 511 votes, even beating Mintos who collected 447 votes.

The 15.5% short-term loans from last month have dried out. Now the best rates are 13.5% for ~330+ days loan duration.

See more info and screenshot from my PeerBerry account

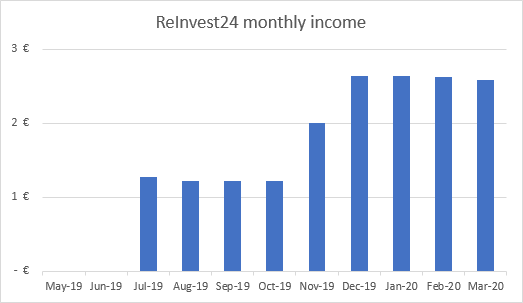

Reinvest24

My ReInvest24* account is approaching break even after nearly 1 year of investing. Not impressive. This is mainly because funding of the projects takes months and no interest is paid out for most projects in the funding period.

At least the investments are secured by real estate. Investors own the bricks so I don’t expect ReInvest24 to run away like we’ve seen other platforms do.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

Robocash

Robocash* raised interest rates of all their loans from 12% to 14% on March 20th.

On April 7th at 13:00 CET, Robocash will do a Live Web Cast.

If you have any questions to Sergey Sedov, Founder and CEO Robocash Group, make sure to ask them through this form.

A link to the webcast will be sent to Robocash investors shortly before the event starts, so if you want to join, you’ll need to create an account* first.

See more info and screenshot from my Robocash account

Swaper

For the first time ever Swaper* has a ton of short-term loans available on their primary market.

On March 18th interest rates were raised from 12% to 14%. For investors with more than 5k EUR interest rates were raised from 14-16%.

I really hope Swaper (and Wandoo Finance which is the mother company) will make it through the crisis, it’s such an easy and pleasant way to invest.

See more info and screenshot from my Swaper account

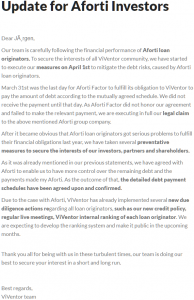

Viventor

Viventor* is a marketplace for loans like eg. Mintos and PeerBerry. I’m still testing it out to see whether it’s a platform I like to keep in the long run. The platform is working smoothly – so far so good.

Viventor published another update about the troubled loan originator “Aforti” to everyone who invested in Aforti. In short, Aforti are still not paying (after almost 1 year) and Viventor proceeds with legal action to recover the money.

At the same time, Aforti posts on Facebook that they have become the winner of the diamonds ranking of the Polish economy. What a joke…

See more info and screenshot from my Viventor account

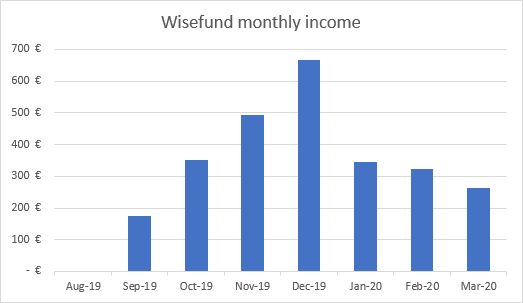

Wisefund

Of the 5 projects I invested in on Wisefund, 2 of the projects didn’t pay in March. They’re likely to have liquidity issues due to the Coronavirus but no official explanation has been given.

Wisefund decided to remove me from their affiliate program because I wrote this text in my last update:

“I decided to reduce my exposure to Wisefund until I’m 100% certain they’re legit. Since I reduced my investment from 30k to 20k EUR, interest payments are equally lower. All my withdrawal requests have been processed.”

Apparently, Wisefund doesn’t allow affiliates to express any doubts about the platform. If affiliation means pure promotion, I don’t want to be a part of it. If I feel uncertain or have doubts, I want to express my thoughts freely.

This step just proves to me that withdrawing from Wisefund was the right decision. I’ll keep withdrawing my money and exit completely if/when the projects are paid back.

See more info and screenshot from my Wisefund account

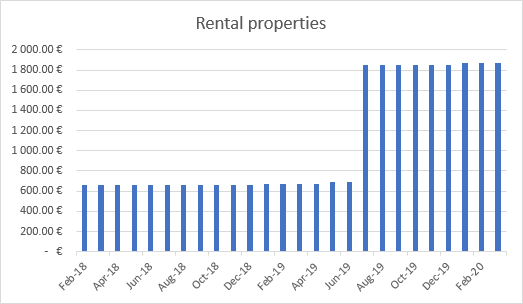

Real Estate

I received rent from all 5 tenants on time as usual.

The tenant who complained about moist in the apartment (first property), said she’ll be moving out on April 31st. According to the contract she has 3 months notice. I always collect 1 month prepaid rent and 3 months deposit so even if she moves out earlier, I’ll not be missing any payments.

I also agreed on changing 3 windows in the second property.

See more info about my First property and Second property

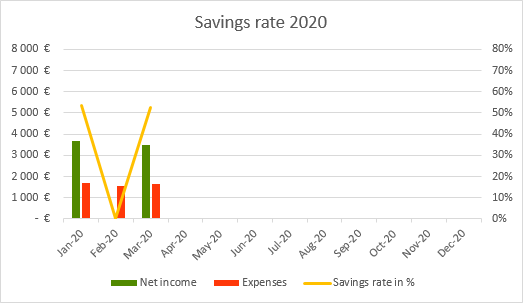

Savings rate / Expenses overview

I’ll most likely change “savings rate” to “expenses” in the near future, as I don’t have any salary income anymore.

My total expenses for the month were €1 662, including 800€ in rent (the full rental amount). My partner paid 50% of our rent in Denmark but I will pay 100% in the future. We still share other household expenses.

Compensation for “accumulated vacation days” from my previous job was paid out in March. That’s the last paycheck I’ll receive from them.

See more info about my Savings rate

Blog statistics

It’s clear to see that less people are searching for alternative investments and financial freedom during a pandemic.

Visitors: 10 043 (-28.68% compared to last month)

Page views: 31 417 (-36.21% compared to last month)

3029 Subscribers (+38 compared to last month)

1 513 Facebook followers (+32 compared to last month)

Quote of the month

“If a problem is fixable, if a situation is such that you can do something about it, then there is no need to worry. If it’s not fixable, then there is no help in worrying. There is no benefit in worrying whatsoever.”

― The Dalai Lama

Start your own blog

What better time to start blogging than during a lockdown? During the Covid-19 pandemic, SiteGround* offers 3 months StartUp hosting for 0.99€.

First renewal will be on promotional terms for 1 year (50% discount) keeping the overall cost very affordable.

Free EUR bank account with no fees

N26 is a German bank based in Berlin and your account is secured up to 100 000€ like any traditional bank.

If you live in Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, Sweden orthe United Kingdom, having a EUR bank account will save you from currency exchange fees.

I use N26* to transfer to and from my investments. Even living in Portugal, it’s my main choice of bank.

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.