Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Aaaalright financial freedom seekers from all over the world. Here we are back again with a new Portfolio Update for November 2019.

Airplane tickets are bought…

Our apartment contract has been terminated…

We will move from Denmark to Portugal on February 15th!

Reality is coming closer. Could you imagine leaving everything behind, except for your closest family and whatever you could fit into your suitcase?

I was just about to write some more thoughts about this subject, when I realized something… Why not make an entire post series called “Moving to another country to FIRE earlier”? It could be an interesting read.

I think I will do that and focus on MONEY in the portfolio updates.

Here’s what my investments brought in while I was busy sleeping.

Monthly Income Statement: November 2019

| Crowdlending | Income | XIRR | Value |

| Bondora | -424.81€ | 4.77% | 17 566€ |

| Bulkestate | 773.15€ | 16.07% | 10 873€ |

| Crowdestate | 11.80€ | 6.45% | 6 836€ |

| Crowdestor | 705.27€ | 14.98% | 79 324€ |

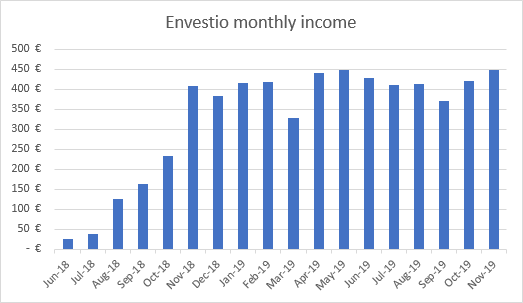

| Envestio | 447.73€ | 20.79% | 29 611€ |

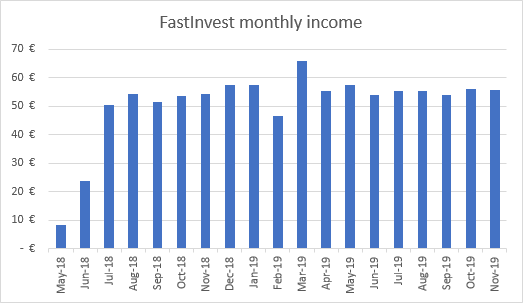

| FastInvest | 55.66€ | 16.51% | 5 168€ |

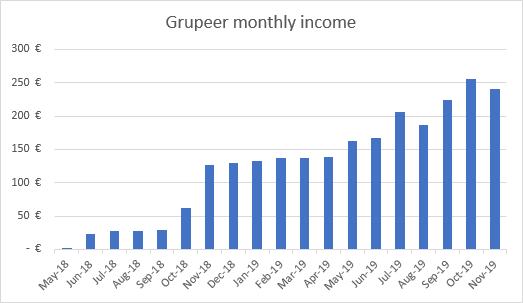

| Grupeer | 240.62€ | 15.02% | 23 021€ |

| Kuetzal | 439.85€ | 24.18% | 27 231€ |

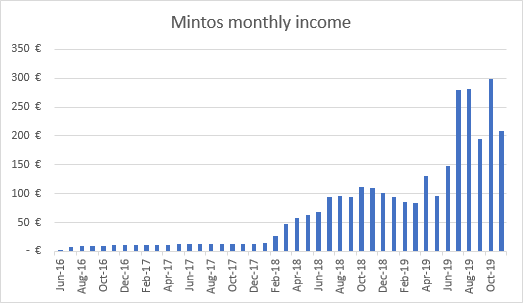

| Mintos | 209.04€ | 16.50% | 23 553€ |

| PeerBerry | 60.56€ | 11.53% | 5 640€ |

| ReInvest24 | 2.00€ | -2.13% | 988€ |

| Robocash | 155.25€ | 13.01% | 12 018€ |

| Swaper | 118.08€ | 14.37% | 13 038€ |

| Viventor | 42.40€ | 9.91% | 5 159€ |

| Wisefund | 494.64€ | 25.35% | 31 176€ |

| 3 331.24€ | 11.46% | 291 208€ | |

| Real Estate | Income | Equity | |

| Property #1 | 691€ | 40 436€ | |

| Property #2 | 1 162€ | 59 947€ | |

| 1 853€ | 100 383€ | ||

| Total | 5 184.24€ | 391 592€ |

That means I’m 172.81% Financially Free (up 35.67% from last month).

My second goal of 7 000€ per month reached 74.06% (up 15.29% from last month).

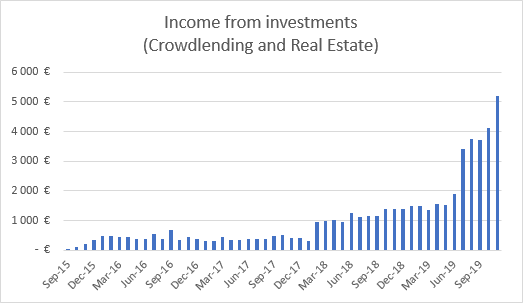

Portfolio performance: Historical view

Income from Crowdlending & Real Estate combined was 5 184.24€.

(1 070.24€ more than last month).

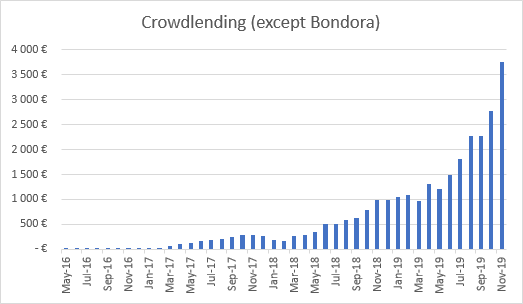

“Crowdlending (except Bondora)” reached 3 756.05€.

(984.79€ more than last month).

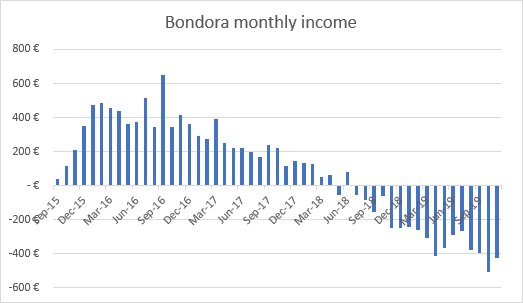

Bondora

I stopped reinvesting in Bondora a long time ago and I’ve started the slow withdrawal process.

I read somewhere that Bondora’s own employees only invest in Go&Grow. None of them uses Portfolio Manager or Portfolio Pro. They have probably seen my income graph as well 🙂

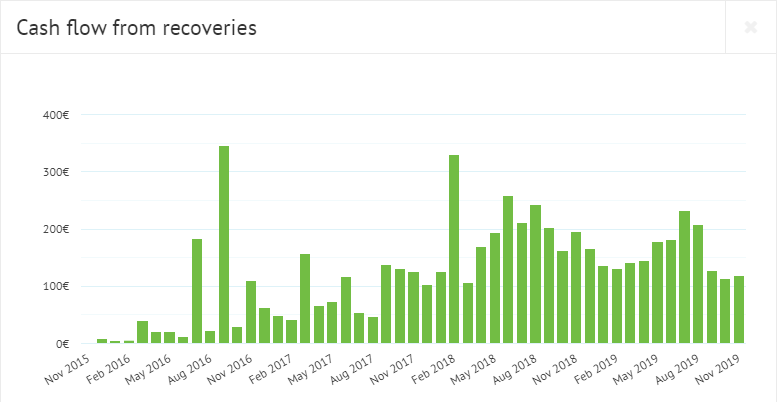

119.13€ was recovered in November but I still have 25 663€ in defaulted loans.

I do not recommend investing with Bondora unless you use the “Go & Grow” product only.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate with instant liquidity, use this link to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

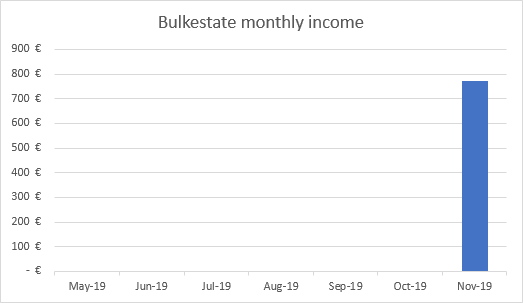

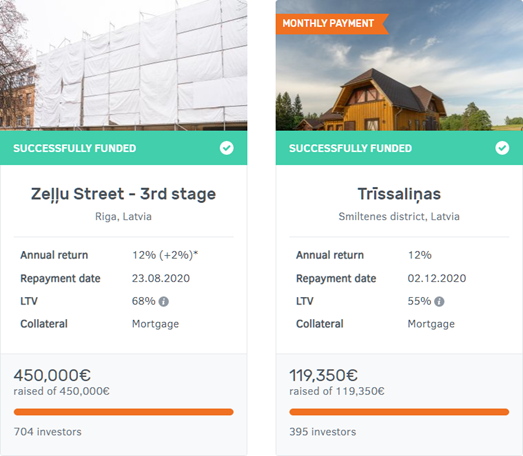

Bulkestate

I saw my first repayment from Bulkestate in November.

773.15€ of interest earned from the project I invested in on 17.05.2019. The project repaid early, it was scheduled for repayment on 17.03.2020.

I was quite surprised to see so much money idle on my account when I logged in. They had not sent any emails about the early repayment – there’s still room for service improvement.

The first project with monthly interest repayments was published and funded in November. I was hoping it would be the new norm but the next project was a traditional bullet type loan.

Now I’m debating whether to reinvest into new Bulkestate projects or to transfer the money to Wisefund instead. I’ll decide after seeing the next project released.

See more info and screenshot from my Bulkestate account

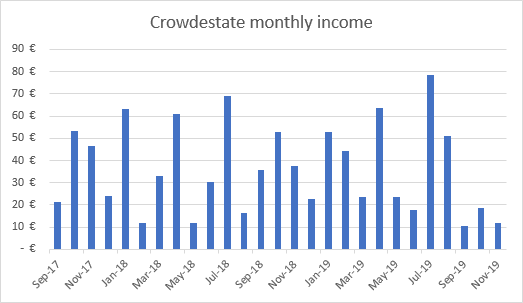

Crowdestate

The problems on Crowdestate starts to show in my income graph.

A project I had invested 2 100€ in, Lepa tee 1, 74201 Loo defaulted (potential fraud).

Investors received an email from Crowdestate which, among other things, contained this text:

“According to the land register, the owner and manager of Loo Kodud OÜ has transferred the main assets of the company (the development property) to his business partner, and as a result of this transaction, Loo Kodud OÜ has has become an assetless shell.

This situation does not leave us any other alternatives than to start the bankruptcy proceedings of Loo Kodud OÜ.”

Lepa tee 1 was my biggest single investment in Crowdestate. In hindsight, it might not have been my best decision to invest in it – it had the highest risk of all projects when it was published.

See more info and screenshot from my Crowdestate account

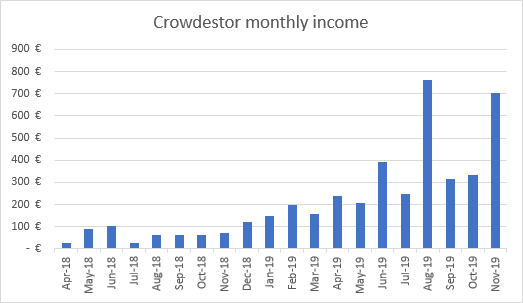

Crowdestor

Crowdestor is my favorite platform at the moment. They offer high interest rates, amazing performance (all loans have been paid on time) and a great variety of projects.

One of the best things about Crowdestor is that they actually listen. I have made several suggestions to improve the site eg. the “Upcoming payments” graph and list. Most of the things I have suggested have been implemented!

I recently invested 20 000€ in the “Consumer loan portfolio acquisition” which came with 24% interest rate, monthly principal and interest repayments and a low LTV (loan to value) of 35%.

It’s my biggest investment in a single project to date.

See more info and screenshot from my Crowdestor account

Envestio

On December 2nd, Envestio was acquired by a strategic investor from Germany, Mr. Arkadi Ganzin ![]() .

.

Mr. Eduard Ritsmann ![]() , an experienced sales person, who has more than 20 years long outstanding track record in international sales and project leadership, is joining Envestio team as the new COO and Development Director.

, an experienced sales person, who has more than 20 years long outstanding track record in international sales and project leadership, is joining Envestio team as the new COO and Development Director.

I’ll try to see if I can meet them when I visit Riga from December 16th to 18th.

I’ve been talking with the former COO, Eugene Kukin ![]() today. I wanted to hear more about the acquisition, his role going forward and if any of the existing conditions would be changed. This is his reply:

today. I wanted to hear more about the acquisition, his role going forward and if any of the existing conditions would be changed. This is his reply:

The new position will allow me to concentrate more on strategic matters, while new guys will deal with maintaining and developing everyday operations and sourcing new projects. The strategy of Envestio must remain stable within the next few years, it was one of the key points of the deal.

No changes of existing conditions must take place, there will be an official announcement regarding this. Everything is fixed for at least 1 year.

Also the new COO will be a more public guy. A number of conferences and special blogger events are being planned for the next year already.”

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

FastInvest

FastInvest added a new loan originator again. This time it’s “eCommerce 2020” from Denmark.

Now I just need the names of the rest and I’m ready to put more money into FastInvest.

See more info and screenshot from my FastInvest account

Grupeer

Grupeer remains one of the most stable investments in my portfolio.

They have a “Cyber-Monday” cashback campaign running from December 2nd – 8th.

There’s still plenty of cashback loans available, here’s a small preview:

See more info and screenshot from my Grupeer account

Kuetzal

Compounding starts to show on Kuetzal already. I earned 13.93€ more than last month.

Kuetzal switched CEO on November 26th from Alberts Čevers ![]() to Maksims Reutovs

to Maksims Reutovs ![]()

It came as a surprise to me so I reached out to Alberts immediately to hear what happened.

It turned out, Alberts received a very attractive offer from a big holding company that he couldn’t resist. He had been negotiating for a pretty long time and they finally reached an agreement. He will still be in touch with Kuetzal and is always available if anything comes up.

Kuetzal also updated their terms and conditions recently. This has caused a lot of confusion in forums and Facebook groups. Many of the points could easily be misunderstood because of the way it’s written. And if you don’t agree to the new conditions there’s no way to decline.

I hope to be able to meet and discuss this with Maksims when I’m in Riga from December 16th to 18th. According to Alberts, Maksims a trusted and a very ambitious person. I’d love to hear his explanation of the new terms and conditions.

If you want to give Kuetzal a go you can use the promo code FINANCIALLYFREE to get a 15€ gift, instantly credited to your account.

Mintos

The biggest Baltic P2P platform Mintos keeps growing and reached a new milestone of 4 billion EUR funded.

Because of the huge inflow of investors, Mintos decided to lower the cash back bonus for new investors from 1.0% to 0.5% from November 18th.

So, if you sign up with Mintos through my (or any other) referral link, you’ll now get 0.5% cash back on all investments you make within the first 90 days of registration.

See more info and screenshot from my Mintos account

PeerBerry

I use PeerBerry for my children’s savings account. They received their third interest payment in November.

Overall, I’m happy with the platform even though the highest yielding interest rates have dropped from 13.1% to 12.7% since I opened the account.

There’s plenty of short-term loans available at 11.5%.

See more info and screenshot from my PeerBerry account

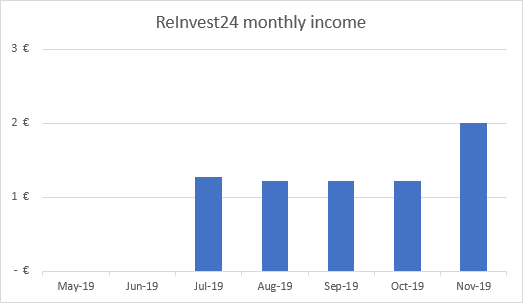

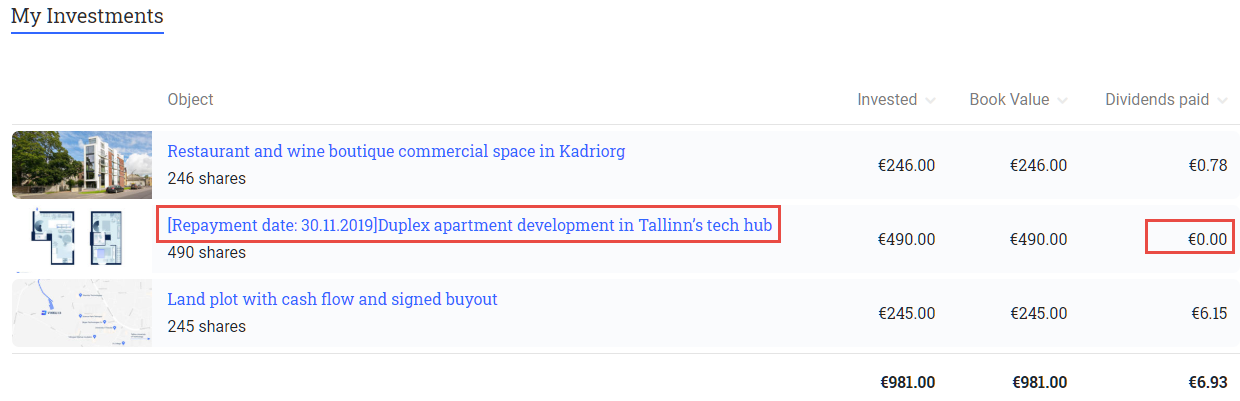

Reinvest24

2 out of 3 projects I invested in on ReInvest24 are now paying dividends.

I hope ReInvest24 will turn out to be an amazing platform but somehow I feel like they keep disappointing.

One of the projects I invested in was supposed to pay back on November 30th. They even put the date into the description:

Today is December 3rd and I’ve not heard a word. No email, no repayment… nothing.

Come on Tanel ![]() I know you can do better 🙂 I don’t mind a small delay but I do expect to get notified.

I know you can do better 🙂 I don’t mind a small delay but I do expect to get notified.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with this referral link.

See more info and screenshot from my ReInvest24 account

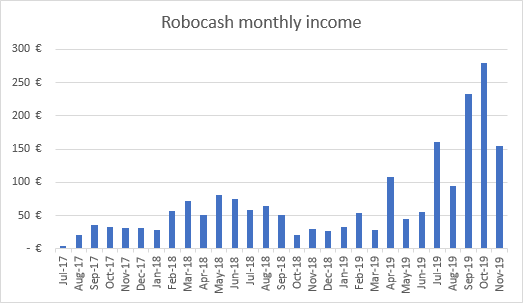

Robocash

I’ve now earned 2 000€ interest on Robocash .

My last “installment” loan was repaid last month. Now I only have short-term loans in my portfolio. This means, that from next month, returns should stabilize around 125€ per month.

See more info and screenshot from my Robocash account

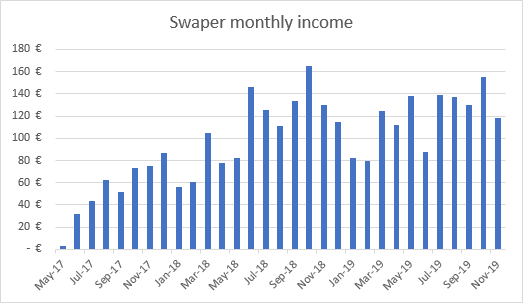

Swaper

I have earned 3 000€ since I started on Swaper in 2017.

I typically have 2 000€ idle waiting to be invested. If this cash drag stopped, I’d be happy to invest a lot more in Swaper.

See more info and screenshot from my Swaper account

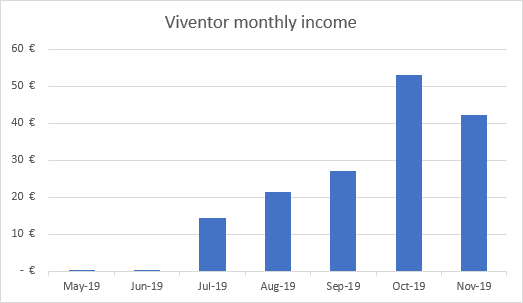

Viventor

I’m still testing out Viventor to see whether it’s a platform I like to keep in the long run.

Not a single repayment from the troubled loan originator “Aforti” in November. No news either. Not a good sign.

See more info and screenshot from my Viventor account

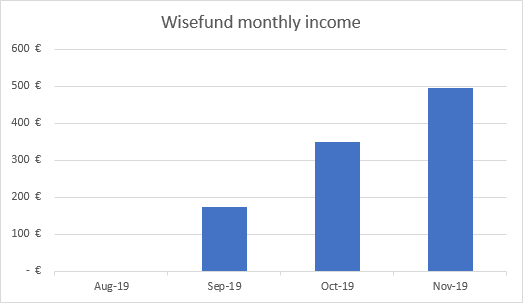

Wisefund

Almost 500€ earned on Wisefund in November.

The main purpose of my trip to Riga from December 16th to 18th is to interview Wisefund. I think it’s the most interesting new platform around and I’d love to show you why.

Lately, I have been thinking how I can give my readers more value. How I can give more insights, how you can experience what I experience when I visit these platforms.

So I will try to take this Wisefund interview to the next level. I hope it’ll be amazing. Stay tuned!

By the way! Many of you are wondering when you can deposit again! Wisefund is in the final test phase and the automated deposit system will be ready this week. It’ll be well worth the wait, deposits will be processed faster and several projects in pipeline are ready to be released.

If you sign up and invest through my referral link, you will get 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Wisefund account

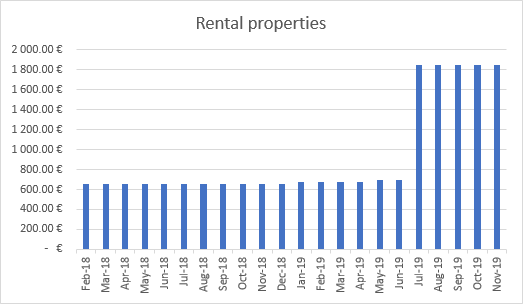

Real Estate

I received rent from all 5 tenants on time as usual.

Remember the buzzing sound from the gas furnace I mentioned last month? It turned out that the furnace was dying. A couple of days later it stopped working completely and I had to replace it with a new one.

-4 496€ later the tenants are no longer freezing and the new furnace is up and running.

While my wallet was open anyway, I decided to replace a rotten bathroom windows as well. I knew, from the home inspection made before I bought the property, that the window had to be changed eventually. So I decided to do it now.

-2 597€ later the windows were changed, 2 new air vents were built into the living- and bedroom, 4 old windows had their rubber strips changed and a front door had it’s lock and handle changed.

I didn’t do any of the work myself, I hired professional craftsmen to do it.

Those expenses brought the budget for the second property into -4 279€ for 2019 and there’s still a few things I’d like to have fixed before I move.

Hopefully 2020 will be gentle to me.

See more info about my First property and Second property

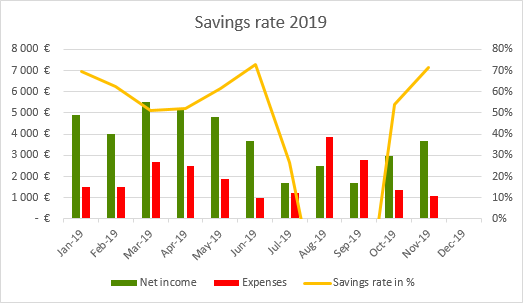

Savings rate

My savings rate for November was 71.35%.

Even though I’m still being on paternity leave, I’m now back to regular income from my old IT-job for 3 months (November, December and January).

From 31.01.2020 I’m 100% relying on myself to generate enough income for our family. The math says we should be fine but it’s still a bit scary to think about it. I’ve always been dependent on salary from a job.

See more info about my Savings rate

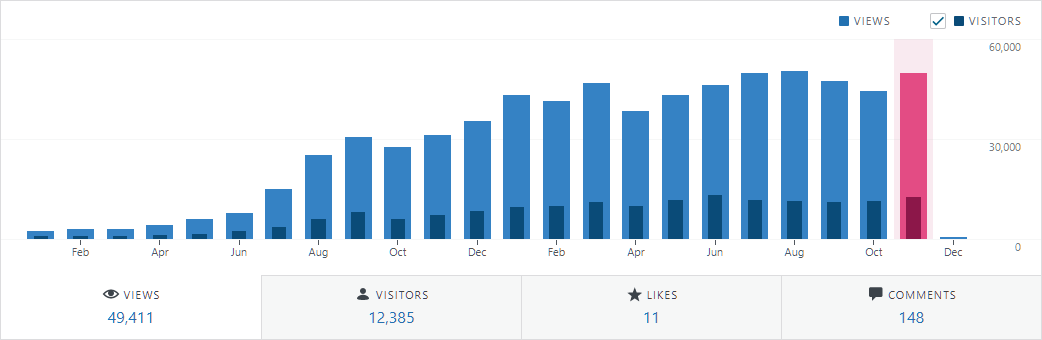

Blog statistics

Visitors: 12 385 (+10.32% compared to last month)

Page views: 49 411 (+12.53% compared to last month)

2 437 Subscribers (+169 compared to last month)

1 177 Facebook followers (+112 compared to last month)

Start your own blog

FinanciallyFree is hosted on SiteGround for the incredible low price of 3.95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

Free international transfers

Do you know you can use Revolut for very fast international transfers and zero fees? It’s probably the cheapest and fastest method to deposit to your crowdlending investments.

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.s. When you comment, please use your first name or your full name. Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.