Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

Can you believe the summer is almost over? I’m crossing my fingers for a warm and pleasant August and looking forward to visiting Portugal in the fall.

We’re currently enjoying 14 days of vacation in Norway, spending time with family and attending a wedding (yep, second wedding this summer).

Now to this month’s portfolio update.

I decided to remove the “Invested” column from the overview table to improve readability on mobile devices. You can still see how much I invested on the individual pages in the Crowdlending menu.

Monthly Income Statement: July 2019

| Crowdlending | Income | XIRR | Value |

| Bondora | -264.37€ | 6.56% | 19 749€ |

| Bulkestate | 0.00€ | 4.47% | 10 100€ |

| Crowdestate | 78.65€ | 6.87% | 7 894€ |

| Crowdestor | 248.73€ | 14.63% | 37 208€ |

| Envestio | 410.15€ | 21.58% | 27 959€ |

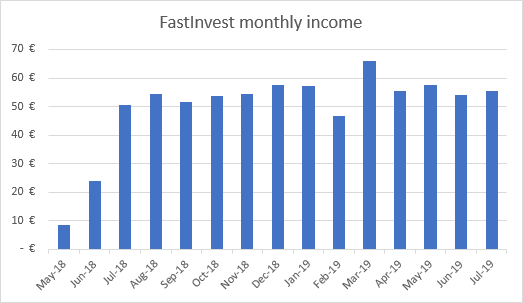

| FastInvest | 55.35€ | 17.24% | 4 946€ |

| Grupeer | 206.57€ | 15.87% | 17 112€ |

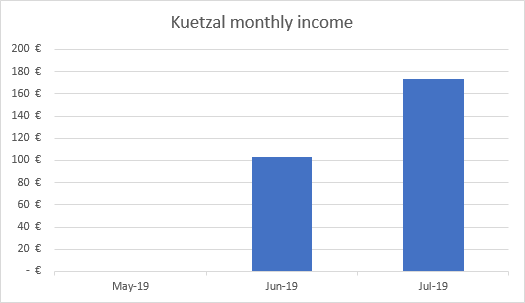

| Kuetzal | 173.15€ | 25.57% | 15 465€ |

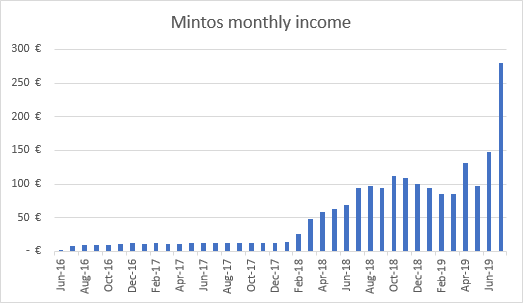

| Mintos | 280.51€ | 17.57% | 20 570€ |

| ReInvest24 | 1.27€ | -9.15% | 981€ |

| Robocash | 161.41€ | 10.71% | 11 255€ |

| Swaper | 139.26€ | 14.47% | 11 497€ |

| Twino | 37.91€ | 13.38% | 3 227€ |

| Viventor | 14.46€ | 6.68% | 2 015€ |

| 1 543.05€ | 10.94% | 189 984€ | |

| Real Estate | Income | Equity | |

| Property #1 | 691€ | 38 413€ | |

| Property #2 | 1 162€ | 56 994€ | |

| Total | 3 396.05€ | 285 391€ |

That means I’m 113.20% Financially Free (up 50.25% from last month). The addition of the second property made a huge difference 🙂

With 3 000€ per month (before taxes) I could technically quit my day job and live from my investments.

While it’s very nice to know that my expenses are covered, I wouldn’t feel comfortable living on 3 000€ long-term.

I’ll take a moment to yell “HOORAY!” and then rush on to my second goal of 7 000€ per month, which is the target where I’ll feel comfortable retiring.

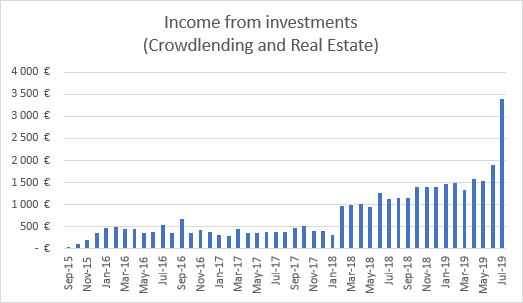

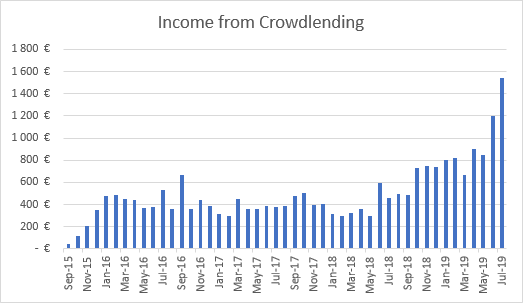

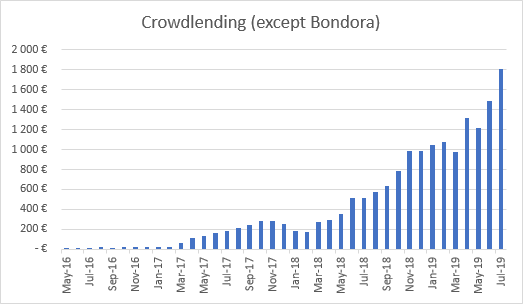

Portfolio performance: Historical view

Income from all investments (Crowdlending and Real Estate) was 3 396.05€.

(1 507.53€ more than last month).

“Income from Crowdlending” alone was 1 543.05€.

(345.53€ more than last month).

“Crowdlending (except Bondora)” reached 1 807.42€.

(321.71€ more than last month.)

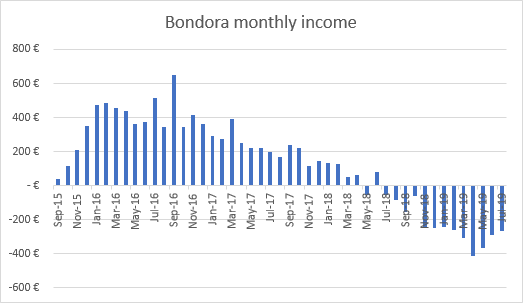

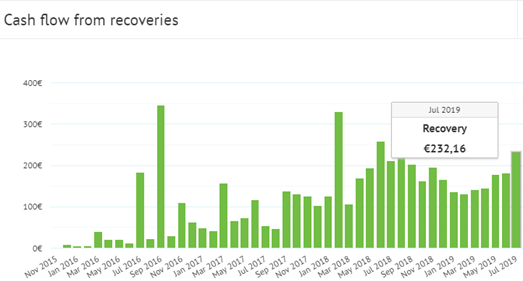

Bondora

Recoveries on Bondora increased slightly in July. There’s plenty of room for improvement though, I still have 25 993.21€ in defaulted loans.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. The Go & Grow product is alright if you’re satisfied with a 6.75% interest rate and instant liquidity.

See more info and screenshot from my Bondora account

Bulkestate

Bulkestate doesn’t pay interest on a monthly basis so there’s not much to report here.

First interest repayment is scheduled for 27.12.2019.

5 new projects were released since last update though. 4 of them are already funded.

See more info and screenshot from my Bulkestate account

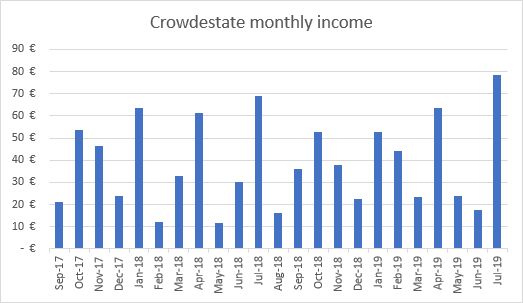

Crowdestate

I have 3 delayed payments on Crowdestate. Still, I managed to set a new monthly record due to a 9€ late fee. Delayed payments are not too bad, if they end up paying eventually.

See more info and screenshot from my Crowdestate account

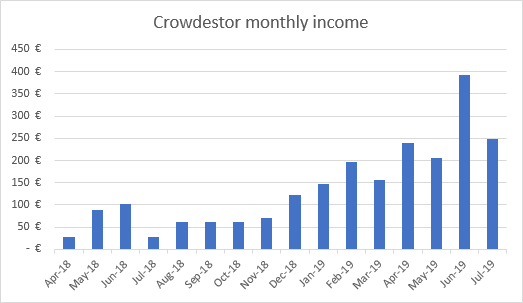

Crowdestor

Crowdestor is my favorite platform at the moment.

I know it would probably be smart to diversify further, Crowdestor is already the platform where I’ve invested most of my money.

But when I saw the “Sweet Dreams Samloem Resort” with an 8.5/10 review score from 1 525 reviews on Booking.com and an interest rate of 19.5% I had to throw another 5k at them.

Most of the recent projects with high interest rate start paying after 6 months. This means that my monthly repayments on Crowdestor will be significantly higher from December and onwards.

While we’re waiting for Envestio to publish new opportunities, Crowdestor is cranking out projects like there’s no tomorrow. Not less than 6 new projects will be available for investment in the coming days and 1 project is open right now.

- Hostel Renovation (Round 2): 15% interest rate and 12 month loan period.

- Construction company working capital: 15% interest rate and 12 month loan period.

- Warehouse Daugavpils: 12.8% interest rate and 18 month loan period.

- Renewable energy: 14% interest rate and 9 month loan period.

- Indoor beach volleyball center: 14% interest rate and 9 month loan period.

- Drum School: 14% interest rate and 6 month loan period.

- Construction company working capital (office buildings): 14% interest rate and 24 month loan period.

See more info and screenshot from my Crowdestor account

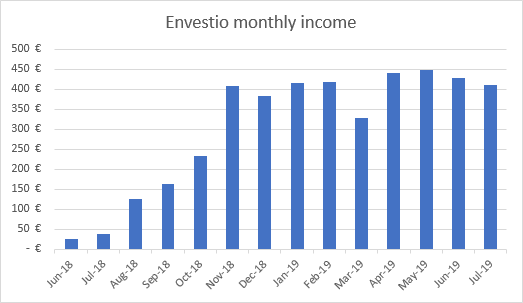

Envestio

Envestio released one project (2 tiers) in July. They are finalizing the contract with a big partner – more projects should come soon.

One of my readers, Silver, asked Envestio support about release of future projects. It’s good to know what to expect, right? He was so kind to share their answer with me:

New project tomorrow guys 🙂

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0.5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

FastInvest

I’m still happy with the performance on FastInvest. That said, I’m starting to get a little impatient about information about their loan originators though.

For those of you who are investing with FastInvest, here’s something you might not know:

Do you wonder why cash is building up even though you have enabled auto-invest? Your auto-invest is only reinvesting principal. All interest earned is not being reinvested unless you do it manually.

I asked support and this is intentional. FastInvest is the only platform which does it this way though.

Unfortunately you cannot enable “reinvest interest” in your settings. I’ve asked FastInvest to put it on their to-do list – hopefully they will introduce this feature later.

See more info and screenshot from my FastInvest account

Grupeer

More than 200€ earned in July on Grupeer. First time I’m hitting the 200€ mark – feels good.

See more info and screenshot from my Grupeer account

Kuetzal

No new projects on Kuetzal in June but there’s still several open projects which needs funding.

The good thing is, you don’t need to wait for the funding to be completed, you earn interest from the day you invest.

I added another 5k to my account last month, bringing my investment to 15k EUR.

I might add another 5k to take further advantage of the Summer Cash Back Campaign which pays up to 3% CashBack. It’s active until the end of August.

OBS! You need to invest the displayed amount into 1 project to get the cashback. If you put 200€ into 5 different projects, you will not get any CashBack.

If you want to give Kuetzal a go you can use the promo code FINANCIALLYFREE to get a 15€ gift, instantly credited to your account.

Mintos

The addition to my Mintos account last month provided a nice bump to my earnings. 280€ earned in one month!

I’d like to bring my Mintos portfolio to 30 000€, hopefully this year.

If you sign up with Mintos through my link you’ll get an exclusive 1% cash back bonus on all investments you make within the first 90 days from your registration.

See more info and screenshot from my Mintos account

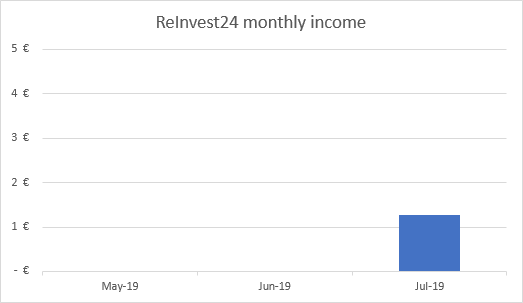

Reinvest24

I received my first interest payment on ReInvest24!

A stunning 1.27€…..

Unlike platforms like Crowdestor, Envestio and Kuetzal, ReInvest24 doesn’t pay anything until the project is funded, which is a major bummer when it takes months to fund a project!

While the idea behind ReInvest24 is brilliant, I think they need to do something to pay investors earlier.

Robocash

Several “1-year Installment loans” were paid back on Robocash which led to a record of interest payments in July.

When the rest of the installment loans are paid back in a few months I expect the monthly earnings to stabilize around 115€ per month.

See more info and screenshot from my Robocash account

Swaper

The cash drag on Swaper is definitely getting better. My funds are being reinvested almost every day now. If this continues I might deposit more money to my account.

You still need to enable auto-invest though, the loan list is still empty most of the time.

See more info and screenshot from my Swaper account

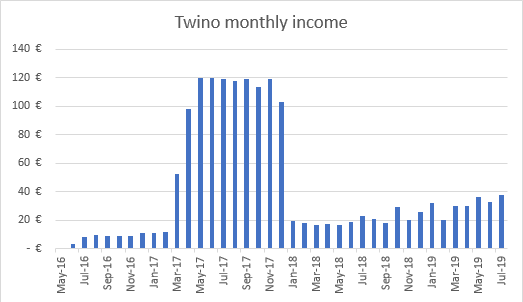

Twino

On Twino I’ve been lucky to earn some money on currency fluctiations on the Russian Ruble but I’m really not a fan of currency exposure.

Without currency exposure, I’m stuck with lower yielding loans which I don’t find attractive.

See more info and screenshot from my Twino account

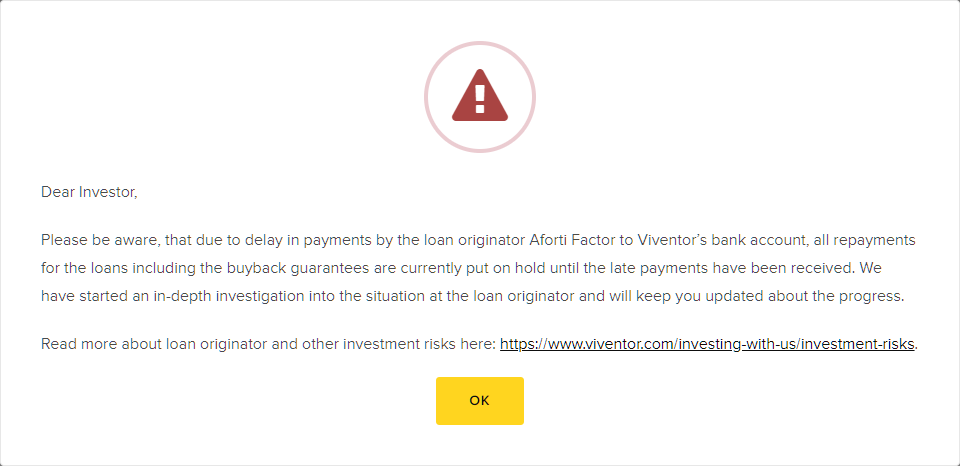

Viventor

A couple of months ago I included Viventor in my portfolio – I started out with a small 2 000€ deposit just to see how it works.

I was hoping to catch 16% interest loans regularly – but it’s not really happening.

The loan originators “Aforti Factor” and “Aforti Finance” who were primarily offering the 16% loans might be in trouble:

It’s another Polish loan originator in trouble – I hope it will not be the next Eurocent. Aforti is on Mintos as well but there’s no loans available on the primary market – coincidence or is Mintos aware and keep quiet?

Furthermore, Toms Niparts left Viventor to run his own start-up. Toms was the primary reason why I wanted to get involved in Viventor.

The problems with a loan originator and a new CEO is enough for me to go into “wait-and-see” mode. I’ll not deposit any more until I see better communication from Viventor and the issue with the loan originator is solved.

See more info and screenshot from my Viventor account

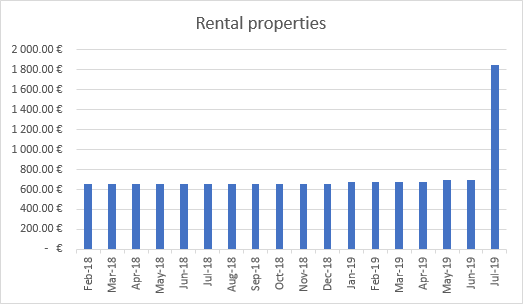

Real Estate

The second property is up and running and I received all 3 rental payments on time – very nice to see!

One of the tenants in the second property called and complained about a clogged drain in the kitchen sink. I called a plumber who fixed it the same day. I would usually do it myself but I was on the ferry to Norway so I had to pay for it this time.

The empty apartment in my first property was refreshed with new paint and cleaning. The new tenant moved in and paid rent on time as well.

See more info about my First property and Second property

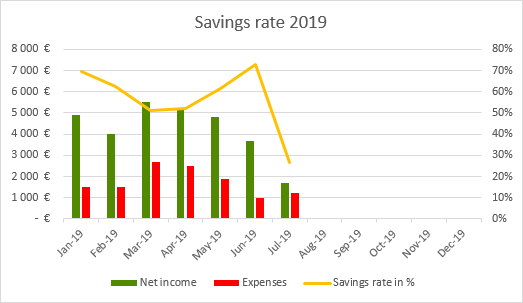

Savings rate

My savings rate for July was 26.74% (-46.26% compared to last month).

My income was the lowest in more than a decade. I only received 14 days of pay and the small compensation for being on paternity leave hasn’t arrived yet.

The next 3 months will be about the same low level around 1 600€.

While low income sucks it’s nice to get a feeling of being retired. I think I could get used to this quickly!

See more info about my Savings rate

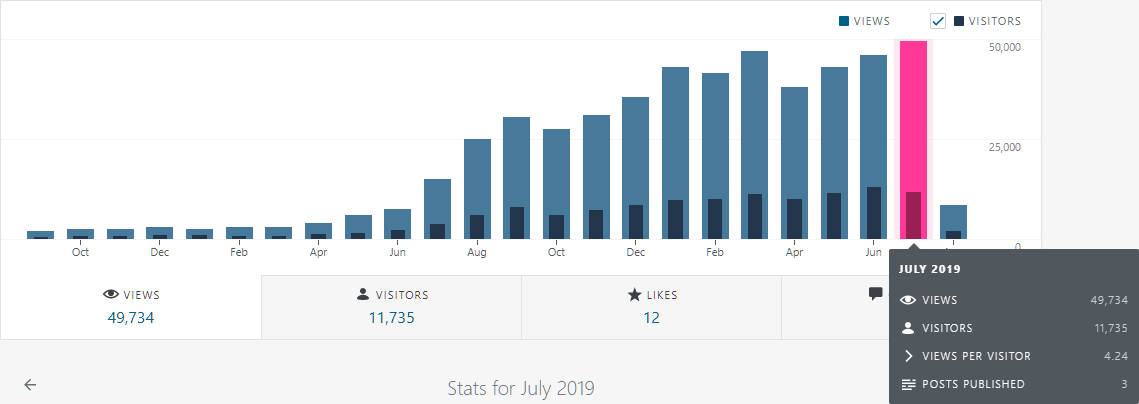

Blog statistics

Visitors: 11 735 (-9.36% compared to last month)

Page views: 49 734 (+8.53% compared to last month)

1 853 Subscribers (+153 compared to last month)

902 Facebook followers (+79 compared to last month)

FinanciallyFree is hosted on SiteGround for the incredible low price of 3.95€ per month. I honestly couldn’t imagine a better host for a WordPress site!

Free international transfers

In Facebook groups and on investor forums I see people praising Revolut for very fast transfers and zero fees. I tested it and I must admit – it’s really good.

It’s probably the cheapest and fastest method to deposit to your investments. You can even get a free VISA card.

Sharing is caring

If you enjoyed this post, maybe your friends will like it too? Please consider hitting the like button below and/or share it with your friends.

Comments are closed.