Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow freedom and wealth seekers!

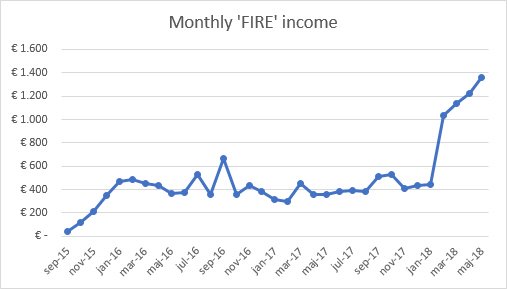

May was another great month setting a new personal record for me (again). I’m amazed that the numbers keep rising. Of course, I keep investing so, in theory, income should be following along. But theory doesn’t always match reality and the path to your goals never follow a straight line. The tide goes in and out, there’s ups and downs like in all parts in life. But one thing is sure: We have set our sails and the destination is clear. We might spend the night in a new harbor we didn’t expect to visit, but that’s also what makes the journey interesting isn’t it?

This months growth came mainly from a higher blog income. Thank you so much for being on this journey with me. I really enjoy your company and truly appreciate your support!

Here is my income statement for May 2018.

P2P Investments:

| Platform | Return | Compared to last month | Account value |

|---|---|---|---|

| Bondora | -56,58€ | -120,43€ | 30.379,20€ |

| Twino | 16,51€ | -0,88€ | 1.695,97€ |

| Mintos | 62,26€ | +4,11€ | 5.570,09€ |

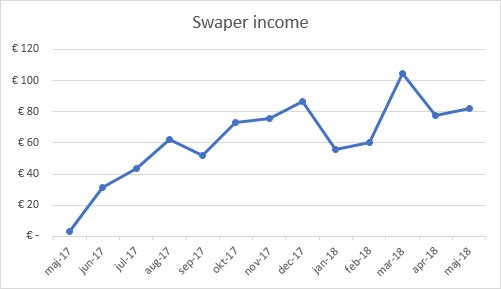

| Swaper | 81,96€ | +4,18€ | 9.809,25€ |

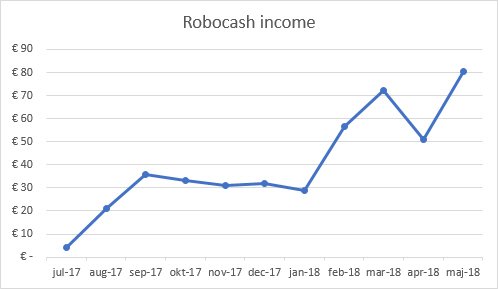

| Robocash | 80,63€ | +29,75€ | 6.449,98€ |

| Crowdestate | 11,71€ | -49,45€ | 7.330,60€ |

| Crowdestor | 89,18€ | +60,85€ | 4.117,51€ |

| Grupeer | 1,12€ | +1,12€ | 2.204,77€ |

| FastInvest | 8,45€ | +8,45€ | 2.108,45€ |

| Total | 295,24€ | -62,30€ | 69.665,82€ |

Real Estate:

First property returned 660€

Blog:

Blog returned 406,38€ (+203,46€ more than last month)

Grand total:

1.361,62€ (+141,16€ more than last month) which equals

45,39% of my first goal (+4,72% more than last month)

The law of averages

Will the income graph take a beating again some time in the future? I bet it will! Will one of the investment platforms go out of business? Probably! Will the law of averages make sure we reach our goals, if we stay focused and persist pursuing our dreams? Most likely!

If you have not heard Jim Rohn talk about the law of averages, I strongly recommend to rip out 25 minutes of your time right now and listen:

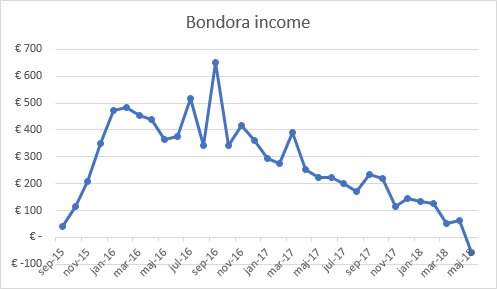

“First … The Birds Will Get Some”. Jim Rohn must be talking about Bondora?!

Bondora

May 2018 was the first month(but probably not last) where “Net interest earned” was negative. Principal was planned to 896,49€ but principal + interest received was only 839,91€.

I withdrew 3.000€ this month. A total of 5.200€ of 26.100€ invested has now been withdrawn. Bondora recently intensified their recovery efforts. It’ll be exciting to see how much they will recover. I should probably be happy if I get my original invested principal back over the next 5 years.

Even though it looks pretty bad, I have received a relatively stable cash flow of at least 800€ every month. Let’s hope it continues like that.

Crowdestate

Global Nord Timber OÜ finished their first loan and the principal payment was scheduled for 31.05.2018. But “due to the payment limits of the Sponsor’s internet bank 31.05.18 scheduled payments will be made on this occasion in three sections: 31.05, 01.06 and 04.06.”

This means the principal and interest will be paid back with a small delay of a few days – I’m completely fine with that. All other investments on Crowdestate paid on time.

The amount of new projects published has declined, only 1 new project was published in May. It’s very hard to get a share in a new project, too many investors have idle cash waiting to be invested in their accounts! Your best chance is to enable Auto-Invest and pray. (Auto-Invest has priority over manual investments)

New investors keep flowing to the platform, and I’m not surprised; It’s a great platform with great returns! Hopefully they will publish a lot more projects in the near future.

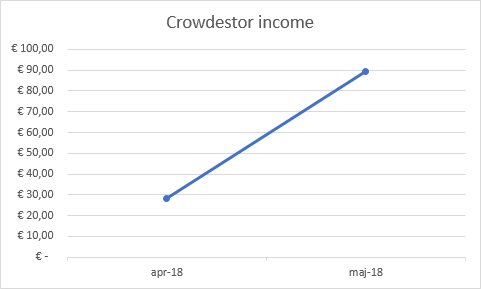

Crowdestor

The first project TESLA TAXI Park Riga made their second repayment on time on May 5th. I also received the first repayment from the Cryptocurrency Mining Farm on May 25th as scheduled. Everything is looking good so far on Crowdestor.

I have e-mailed and talked with head of Product & Services, Gunars Udris, on the phone a few times. They have a lot of plans for expansion in the near future. Hopefully, new projects will be added soon, so I can reinvest my earnings.

I also wish for a a few updates to the webpage; a better account statement for example.

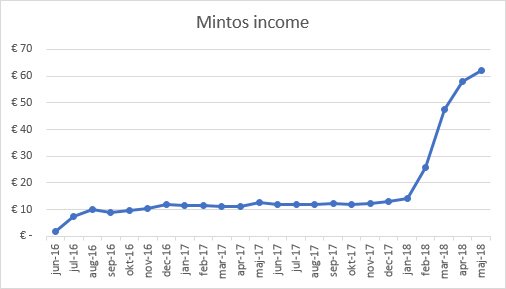

Mintos

The Mogo Cashback campaign was extended once again, this time to 16.06.2018. That means you still can get up to 5% cash back if you invest in 60 month loans from Mogo. It’s a great opportunity to invest in Mintos if you plan to get involved in the platform.

In May, reinvestments in Mogo loans gave me a cash back of 53,86€! That’s almost equal to the amount of interest earned for the same period. Additionally, some of the long-term loans that generates cash back, now come with 13 and 14% interest rate. Last month it was ‘only’ 12%. I’ll take it!

I wrote a complete review on the Mintos platform a few weeks ago. If you haven’t read it yet, you can find it here.

Swaper

Swaper returned a bit more than last month. On 16.05.2018 I invested another 2.462€ in Swaper so my total deposit is now 9.000€. This should bring the monthly returns well over 100€ every month from now on. Yay!

Robocash

As expected, May was a good month for Robocash. Some cash drag has started to build up over the past week though. I expect this is due to the high number of new investors joining the platform. 17,70% of my cash is idle at the moment. I really wanted to max out my account to 10.000€, but seeing this cash drag makes me hesitate. Give us more loans Robocash 🙂

FastInvest

I invested 2.100€ on FastInvest in May. This is a relatively new platform and thus the risk is a lot higher! It’s a relatively new platform but I decided to give it a go. I already received quite a few repayments and the auto-invest tool has reinvested the principal and earnings very quickly.

To give you a brief overview, I have invested in loans with these properties:

- 15% interest rate

- 6 month duration

- Default guarantee

- Buyback guarantee

The default guarantee is actually what other platforms call buyback guarantee. If a borrower doesn’t pay back, FastInvest will give you your principal and interest earned back.

FastInvest has no secondary market BUT you can choose to sell the loans back to FastInvest at any time. This is what they call Buyback guarantee. If you choose to do so, you will lose all interest earned for the loans you choose to sell, but you will get your principal back within 1 business day, guaranteed. This is an interesting approach.

I’ll write a complete review about FastInvest when I have gathered enough information to do so.

Grupeer

I joined Grupeer in May as well. Other investors in the P2P community have stated that Grupeer is their favorite platform, so I had to try it. The platform is very easy to use and the returns are great. Loans with 14% and 15% interest rate are very common. All loans at Grupeer comes with a buyback guarantee.

Grupeer recently added an Auto-Invest option. This tool makes investing effortless!

I wrote a complete review of my first experiences with Grupeer. If you haven’t seen it, you can find it here.

Envestio

I invested 2.000€ in Envestio today. This is a relatively new platform and thus the risk is a lot higher! I have emailed a lot with Eugene Kukin, COO of Envestio, and the answers he provided gave me enough confidence to give it a try.

If you decide to test the platform with me, consider using my link. You will get:

- A bonus amount of 7€ just after you make the first deposit to your investment account for a minimum amount of EUR 100€

- 0,5% cash back on all investments made in the first 270 days (That’s 9 full months!)

Be sure to sign up from directly from this link to get your bonuses: https://financiallyfree.eu/envestio

If you sign up from https://envestio.com/en/signup/ you don’t get any of the bonuses!

Real Estate

I had a meeting with the bank earlier this month. Unfortunately, they demanded to see at least 20% of the value of the property in cash, if I wanted to buy a second property. I had hoped that 10% would be enough, when the seller offered the last 10% as a loan. Oh well, I will need to save up more!

The second property I had in mind was for sale at 335.570€, but it would take me some time to find 67.114€. Now I’m looking at another property priced at 234.900€. To buy this I will have to save up ~47.000€. I should be able to do so within a year, if I also sell some of my P2P investments when needed.

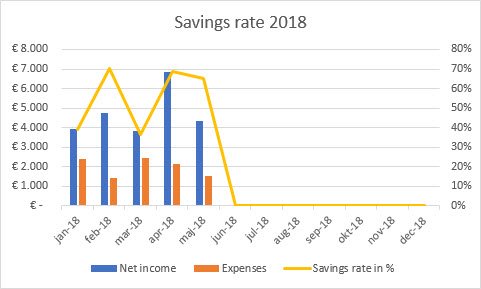

Savings rate

In May I managed to get a savings rate of 65%. I’m very satisfied with this. It will be lower next month due to our summer holiday payment. In July, we are going to my favorite spot in Italy and I’m really looking forward to it!

New pages and better overview

During the past 14 days I have updated the blog with new pages, more graphs and more information. I hope you like it! Now you will be able to see:

- Investment history: Every time I make a new investment or withdrawal I will post it on this list. I will not send you any emails about new investments, you will have to check this list yourself if you’re interested.

- Savings rate: I have tracked my earnings and expenses for a long time and decided to make a page with all this information, going all the way back to 2016. Starting now, I will show you exactly what I earn, how much I spend and how much I save every month. I try my best to provide full transparency about my economy. I hope you can relate my numbers to your own economy, at least in percentages.

- Deposit/Withdrawal graphs: If you check my list of P2P investments, you will now be able to see a graph with deposits/withdrawals for each platform. This should give you a better indication of why the income graph looks like they do.

The blog is gaining momentum

More than 1.500 unique users visited financiallyfree.eu in May 2018. That’s a 39% increase compared to April! It’s still a small number compared to other personal finance blogs, but I feel incredibly blessed to have so many readers. Writing new posts is much more fun, when a lot of people want to read them.

Last words

With this blog I gave myself the obligation to test out new platforms with MY money, so YOU don’t have to take the risk, until you feel certain that the platform can be trusted and provides the returns you would expect.

If you choose to invest in any of the platforms I invest in, please proceed with caution and do your own research first. Remember, I’m just showing what I do, in attempt to reach financial freedom.

Enjoy the summer!

P.S. Do you believe in the law of averages? Leave a Reply below to let me know if you liked the videos!

Comments are closed.