Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

Weeeeelcome to another episode of “my life is pretty darn busy” at the moment!

Here’s a few of the things I’ve been busy doing in March:

- Work full time on my 8-16 IT project manager job

- Renovate the 1st floor and kitchen of one of my apartments (I’m paying professionals to do this but is still requires my attention and decision making)

- Create water usage statements from 2018 for my tenants (in cooperation with the new property manager)

- Ended relationship with my accountant and found a new one

- Work on the 2018 Financial Statement for my Rental Company

- Find a new tenant for the empty apartment

- Wedding planning (not my own)

- Negotiate purchase conditions and price on my upcoming Second Property

- Answer emails from you guys

- Be a father for my kids and try to prevent my home from looking like a big pile of garbage

- New podcast interviews (I’ll let you know when these are published)

- Investigating new investment opportunities and new platforms

I think you get the picture. I won’t complain though, it’s good to be busy!

Busy means progress and progress is needed to reach our goals. The sails are set for success and we are cruising towards the big dream, which is slowly starting to show it’s pretty face in the horizon.

Let’s move on to the numbers to see how much my investments brought in.

Monthly Income Statement: March 2019

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora | -309,28€ | -7,33% | 14.100€ | 22.373€ |

| Crowdestate | 23,47€ | 7,13% | 7.000€ | 7.712€ |

| Crowdestor | 155,64€ | 17,26% | 20.000€ | 21.123€ |

| Envestio | 327,79€ | 21,68% | 23.093€ | 25.789€ |

| FastInvest | 65,93€ | 16,12% | 4.100€ | 4.728€ |

| Grupeer | 137,21€ | 15,28% | 10.000€ | 11.320€ |

| Mintos | 84,52€ | 14,77% | 8.000€ | 9.759€ |

| Robocash | 28,57€ | 10,99% | 6.000€ | 6.886€ |

| Swaper | 124,17€ | 16,26% | 9.000€ | 11.020€ |

| Twino | 30,35€ | 16,06% | 1.300€ | 2.792€ |

| 668,37€ | 102.593€ | 123.506€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 672€ | 71,52% | 18.080€ | 29.893€ |

| Total | 1.340,37€ | 120.673€ | 153.399€ |

Portfolio performance: Historical view

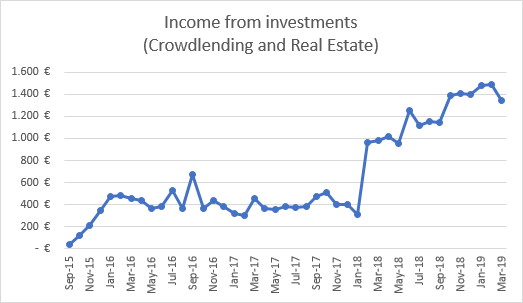

“Income from investments” in March was 1.340,37€.

That means I’m 44,68% Financially Free (down 5,07% from last month).

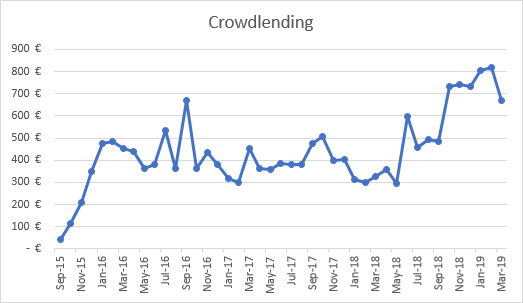

“Income from Crowdlending” in March was 668,37€.

(-152,15€ less than last month).

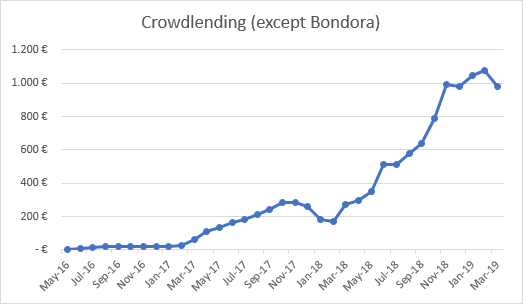

“Crowdlending (except Bondora)” reached 977,65€.

(-101,53€ less than last month.)

What caused the 5% drop?

As weird as it sounds, the bump on the road was actually caused mainly by good events:

- Project completion and loan repayment on Envestio (good)

- Project completion and loan repayment on Crowdestor (good)

- Less principal and interest received on Bondora (bad)

When a project is completed it takes a few days to reinvest the principal. This causes a small drop in the interest earned in the following month. Next month’s earnings will be higher because everything will be invested again.

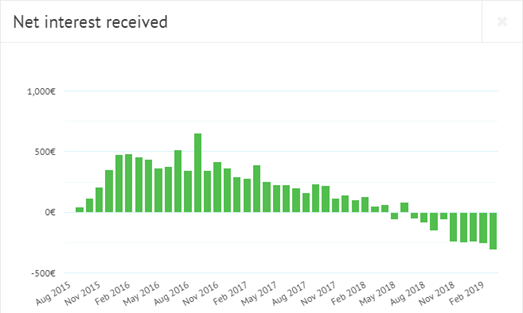

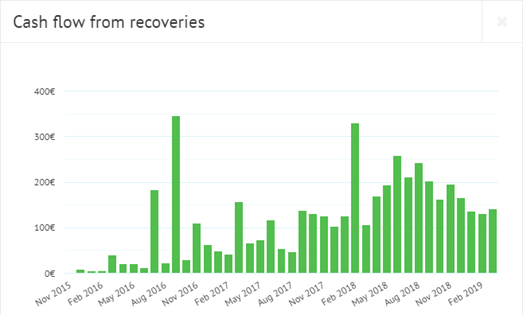

Bondora

A negative month on Bondora as usual.

I withdrew another 2.000€ so total withdrawn amount is now 12.000€ out of 26.100€ invested. I still have a long way to go to get my invested principal back.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. The Go & Grow product is actually alright if you’re satisfied with a 6,75% interest rate and instant liquidity.

Unfortunately, Go & Grow was not available when I started investing with Bondora back in 2015. I’ve got everything locked up in the traditional lending products called “Portfolio Manager” and “Portfolio Pro” where the investor takes all the risk.

There’s too many defaults related to the “Portfolio Manager” and “Portfolio Pro” and the costs of recovery is too high. If you go down that route, chances are that your income graph will look much like mine after a couple of years.

See more info and screenshot from my Bondora account

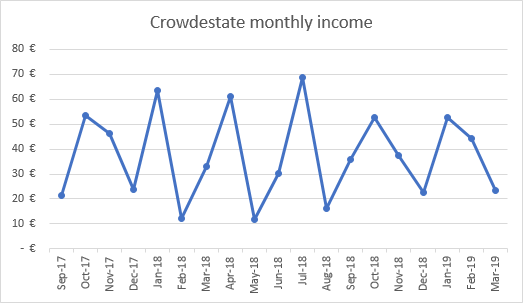

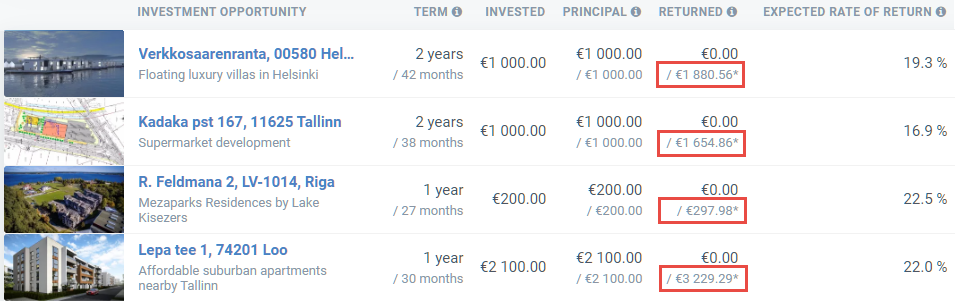

Crowdestate

The income I get from Crowdestate at the moment is from short-term (6-12 months) business loans.

I’m looking forward to receive payments from the first real estate development projects I invested in. Once these bad boys are finished I hope to see a nice return. There’s still 1-2 years left though, so patience is key.

See more info and screenshot from my Crowdestate account

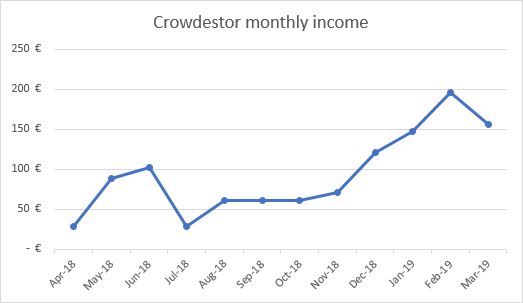

Crowdestor

Crowdestor is a small gem that offers attractive interest rates (12-20%), for short-term projects (3-24 months). In my opinion it’s the only real competitor to Envestio.

The first Crowdestor project I invested in 13 months ago called “TESLA TAXI Park Riga” was successfully completed and my 2.000€ investment was repaid in March.

I also added 5.000€ to my Crowdestor account pushing my account value above 20.000€.

I (re)invested the 7.000€ between these 3 projects:

- Warehouse Riekstu

- Kabuki Restaurant at Salaris

- Saapio

See more info and screenshot from my Crowdestor account

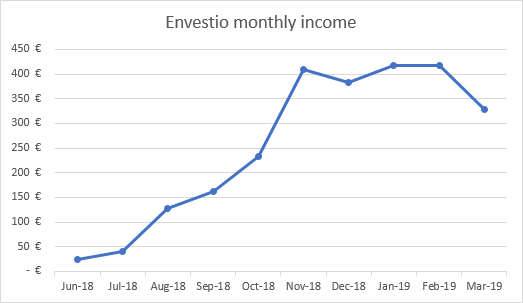

Envestio

Envestio is one of the most popular platforms at the moment and it’s easy to understand why.

- High interest rates

- Short duration projects (usually less than 12 months)

- Partial buyback guarantee (at least 90% of principal returned even in case of default)

- Payments received on time

- Clear answers to any question from the staff

The project “Construction of Modern “Slowfood” Street Market” was successfully repaid in February so I didn’t receive any interest for this in March.

I reinvested the principal in new projects so I expect to set new earning records for Envestio in April.

Envestio launched lots new projects in March. Interest rates from 16-19,85%. All projects were funded very quickly!

OBS! With the rising popularity of Envestio, you’ll have to transfer money to your account before new project are released, if you want a slice of the pie. They usually get funded within a few hours, so keep an eye on your inbox.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

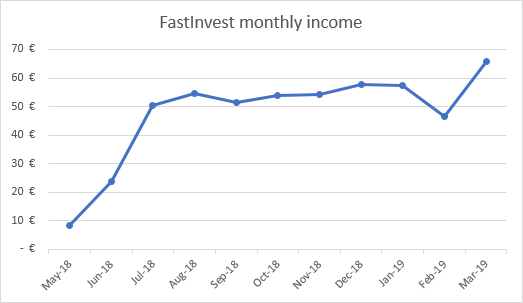

FastInvest

I was right about my FastInvest prediction from last month. The drop in February was all paid back in March instead.

The new website design was finally released and the visuals are a lot better than the old design! With the new design, I get a good estimation of upcoming returns as well.

On the Statistics page I can see that 55,36€ interest is planned for April. Isn’t it great to have this visual overview of expected payments? I love it 🙂

When I visited FastInvest they told me the new website design would be released in Q1 2019. Check!

They also told me, information about their Loan Originators is the next big thing they’re working on and should be released in Q2 2019. If they make that deadline as well, I’ll be a happy investor.

See more info and screenshot from my FastInvest account

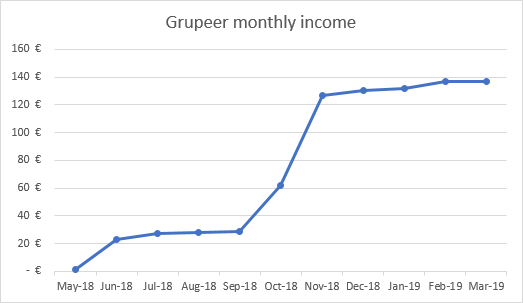

Grupeer

As you could see from my last blog post, Grupeer had problems with one of they banking connections last month. I think everything is sorted out and (if I’m not mistaking) all investors should have their deposits in their accounts now.

New loan originators: When I started investing with Grupeer in May 2018 it was a relatively small platform. I think they had 3 loan originators at that time. That is not the case anymore. Almost 8.000 investors have joined and they work with 20 loan originators now (7 new loan originators joined in 2019).

I’m preparing an overview of the new loan originators for you, so you’ll have a chance to know them better. I will probably combine it with a new Grupeer Raffle, where you’ll be able to win 50€ if you transfer at least 500€ to your new or existing account. More on this in an upcoming blog post!

1% CASH BACK: In April you will get 1% instant CashBack for all investments you make in any Finsputnik Platforma project!

Please note: Finsputnik 1% CashBack offer only applies to standard Finsputnik projects, yielding 13% (where the borrower is neither NordCard, nor Kviku, nor Ibancar or other specific borrowers). CashBack offers listed above won’t be paid for investments made in projects, which are already subject to our regular CashBack offers (i.e., these special deals doesn’t sum with other CashBack offers). Regular CashBack offers can be found on Grupeer website and are marked with a special blue badge.

See more info and screenshot from my Grupeer account

Mintos

My Mintos portfolio keeps returning lower numbers than expected. Not much but enough to make me wonder. I did have a bit of cash drag in March but only a couple of hundred euros. With 9.500€ invested I should receive at least 95€ per month. Next month must definitely be higher, right?

Mintos also reached another mile stone: 2 billion EUR loans funded since 2015!

See more info and screenshot from my Mintos account

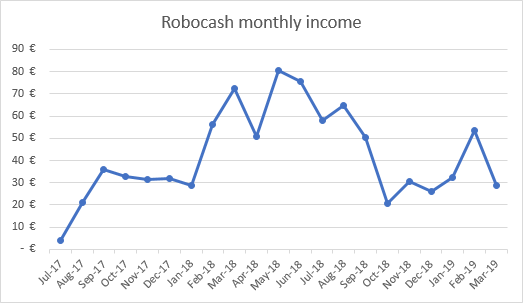

Robocash

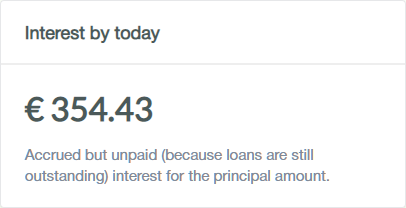

Robocash is still giving a nice profit and effortless investing experience. All loans come with 12% and buyback guarantee. It’s the most “hands-off” investment I have. You can literally “set and forget” it.

The interest returns bounce around due to “installment loans” that pay the full interest amount when the loans are returned after 1 year. Unpaid interest keeps building up day after day. In 6 months time the graph will start making some nice upward spikes.

“Interest by today” grew from 304,65€ last month to 354,43€ this month. This means that interest earned on Robocash was actually 28,57 + 49,78 = 78,35€

See more info and screenshot from my Robocash account

Swaper

Not much going on at Swaper. They added more loans so cash drag has been reduced a bit, but I’m still concerned. I can’t even remember when I received an update from them last time.

See more info and screenshot from my Swaper account

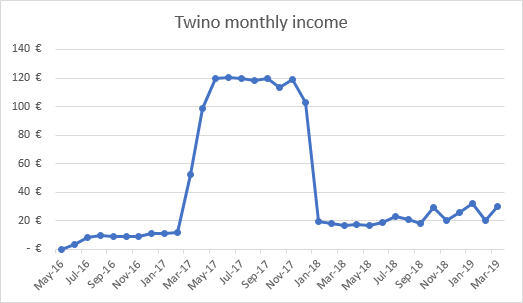

Twino

Twino updated their manual investment tool without telling anyone about it. It made manual investing a bit easier, but just like Swaper, there’s not enough loans available.

See more info and screenshot from my Twino account

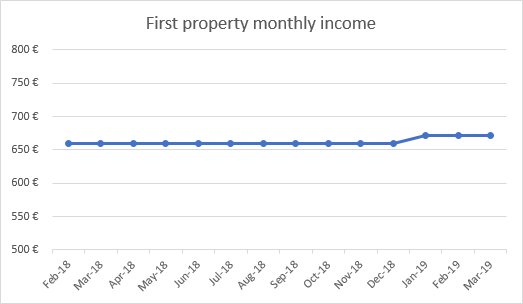

Real Estate

Lots of things are happening in the Real Estate business.

- I received all rent from the previous tenant like I should, even though they moved out early

- The apartment on the 1st floor is being renovated with a new kitchen and other improvements. Next month, I’ll post before and after pictures of the renovation for you to see

- A new tenant was found, they will move in on April 15th

See more info about my First property

New property

It’s almost certain that I’ll buy this property in May or June.

I agreed with the seller on the price ~218.000€ and we’re now in the process of finding out how large a mortgage I’ll be able to get. I’m hoping for 80% mortgage and 20% down payment.

Next platform visit

![]()

Last month I left a small teaser about the next platform I’ll visit…

In the very beginning of May I will visit the platform KUETZAL.

NOTE: I’m not sure if I will invest in Kuetzal, the visit and my review in May will determine that. My bias towards this platform is neutral/skeptic at the moment!

If you have any questions for Kuetzal be sure to post them in the comments below or send me an email and I’ll be happy to ask them for you.

New platform in my portfolio

![]()

I have decided to add Bulkestate to my portfolio. I’ve followed the platform for more than year and I like the progress they’ve been able to show.

Further more, I’ve had a good talk with one of the team members and got some insight into future projects, that will be released over the next 3 months.

I can’t show specific data, because they are still subject to change, but I can show some general information:

- 8 projects with a total amount of 4 million EUR is in the pipeline

- Interest rates for these 8 projects are from 15-17% + up to 2% extra!

What is this 2% extra interest about?

- Investors making EUR 10,000 or larger investment will receive 1% incentive payment from the invested amount.

- Investors making EUR 25,000 or larger investment will receive 2% incentive payment from the invested amount.

I will transfer 10.000€ (to get 1% extra) and invest in a project with 17% interest rate, scheduled for release ultimo April 2019.

I’m also planning to visit Bulkestate later this year.

Best deal available

I’ve been able to negotiate the best deal you can get on Bulkestate.

Usually there’s no sign up bonuses available to new investors. I’d like to give something back to my readers, so I agreed to pass my affiliate earnings on to you guys!

If you sign up through my site you’ll get 5€ signup bonus and 1% Cash Back on all your investments made from 4th of April (today) – 31st of May 2019.

That means, if you’re willing to invest 25.000€ in a project through my link, you’ll earn up to 20% on your investment!

- 15-17% from the project

- +2% from investing 25.000€ or more

- +1% cash back! <- Exclusive to my readers!

- 5€ signup bonus <- Exclusive to my readers!

If you sign up anywhere else, you will not get the last 2 bonuses. Use any link to Bulkestate on my site to receive your bonus.

The exclusive bonus to investors who are going to invest during the campaign period (from 4 April 2019 to 31 May 2019) will be paid in a form of cash back at the beginning of each month. I.e. Bonus for April will be paid at the beginning of May.

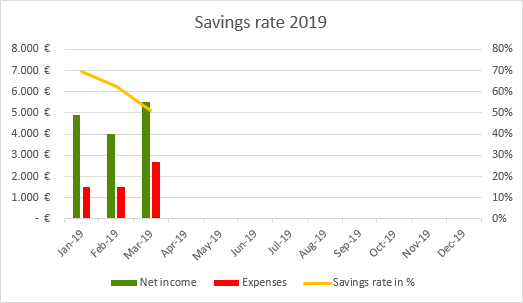

Savings rate

My savings rate for March was 51,36% (-11,01% compared to last month).

I had 2 big expenses in March:

- We bought a new blender. It was 900€ but my girlfriend paid 50%

- I bought a new tailor-made suit (925€)

We’ve been looking for a high-end top quality blender for 4-5 years. I finally decided to buy a VitaMix Ascent A3500i. We are using it a lot, not only for blending but also for chopping up vegetables. Making baby food for our upcoming child will also be a lot easier, healthier and cheaper than buying it.

I’m attending 2 weddings this summer, one in Switzerland and one in Norway. I’ve never had a suit and decided to finally get one. My arms are abnormally long so tailor-made is the way to go. It doesn’t cost much more than a regular suit so it’s definitely the right choice for me.

See more info about my Savings rate

Blog statistics

Visitor numbers keep rising, not by a lot but I like the steady improvement.

Visitors: 11.124 (+10,97% compared to last month)

Page views: 46.702 (+12,86% compared to last month)

1.371 Subscribers (720 WordPress, 651 Sumo) (+186 compared to last month)

590 Facebook likes (+39 compared to last month)

FinanciallyFree is hosted on SiteGround for the incredible low price of 3,95€ per month. Even with 11.000 visitors and 46.000 page views per month it’s still pretty fast don’t you think?

Blog income removed

This was a tough decision for me. In short, I decided to remove the blog income because it stole the show. I got to a point where 9/10 emails and comments was about the blog income. It shifted everyone’s focus away from the investments – a direction I didn’t like for the blog. I hope you understand.

P2P conference in Riga

Are you attending the biggest P2P conference in LATVIA, RIGA ON JUNE 7-8, 2019?

P2P Conference is a unique two-day concept combining conference, exhibition, networking and fun. Europe’s P2P elite meets for the second time in Riga to listen to and discuss with internationally renowned speakers, extend their network and enjoy some incredibly good food and drinks in three handpicked locations.

18 speakers will give in-depth insights into the latest product, technical and regulatory developments in the P2P and crowdfunding industry. There will be plenty of learning, inspiration, and networking for everyone – from investors to platforms and media.

Unfortunately, it’s too close to delivery date of our third child, so I won’t be able to attend this year. Hopefully next year!

That’s it folks!

This is what I had prepared for this month’s update.

I’ve always wanted to give my readers exclusive access to special bonuses. I’m so happy I made my first deal!

Hopefully I’ll be able to offer more exclusive bonuses with other platforms in the future. Maybe not only for new registrations but also for everyone who has used one of my links to sign up to a platform?! Wouldn’t that be nice?

Sharing is caring

If you enjoyed this post, maybe your friends will like it too? Please consider hitting the like button below and/or share it with your friends.

Comments are closed.