Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

We are one month into the new year and it’s time to take a look at our portfolio performance.

I have a feeling that 2019 is going to be huge. I’m not just thinking about my portfolio performance here, but also the lending sector in general. P2P / Crowdlending is getting attention as more and more people learn about this “new” way of investing. It’s not really new, it has been around since 2005 but if you compare it to the stock market it’s quite fresh.

If you listen to the most popular investing media channels though, P2P lending is very rarely mentioned. I think this will change in the coming years. I really enjoy the stability and predictability of peer to peer lending. In my opinion, this way of investing is soooo satisfying compared to watching the value of your stocks go up and down.

Generating a monthly cash flow (that keeps going up!) is not only about stacking coins. Every coin set aside and invested is another step in the direction of freedom. Freedom to spend your time on whatever you value the most!

When you review your portfolio once a month, you see that you’re on the right path. One day, the cash flow of your investments will surpass your monthly expenses and when that happens you can call yourself Financially Free. Knowing that you will reach your goal eventually is extremely satisfying!

Let’s see how far away from financial freedom I am:

Income Statement: January 2019

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora | -242,24€ | -3,21% | 16.100€ | 24.883€ |

| Crowdestate | 52,86€ | 7,25% | 7.000€ | 7.643€ |

| Crowdestor | 147,46€ | 18,49% | 10.000€ | 10.771€ |

| Envestio | 417,28€ | 23,59% | 20.000€ | 24.848€ |

| FastInvest | 57,35€ | 15,63% | 4.100€ | 4.611€ |

| Grupeer | 132,07€ | 14,17% | 10.000€ | 11.046€ |

| Mintos | 93,62€ | 14,88% | 8.000€ | 9.582€ |

| Robocash | 32,31€ | 11,26% | 6.000€ | 6.804€ |

| Swaper | 82,59€ | 16,41% | 9.000€ | 10.817€ |

| Twino | 31,96€ | 15,88% | 1.300€ | 2.745€ |

| 805,26€ | 91.500€ | 113.754€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 672€ | 54,52% | 18.080€ | 26.063€ |

| Total | 1.477,26€ | 109.580€ | 139.817€ |

Freedom barometer

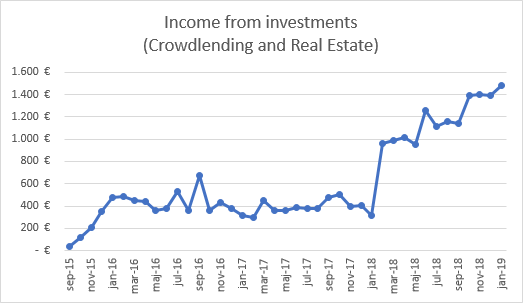

“Income from investments” in January was 1.477,26€ (82,61€ more than last month.)

That means I’m 49,24% Financially Free (up 2,75% from last month).

Historical view of my portfolio performance

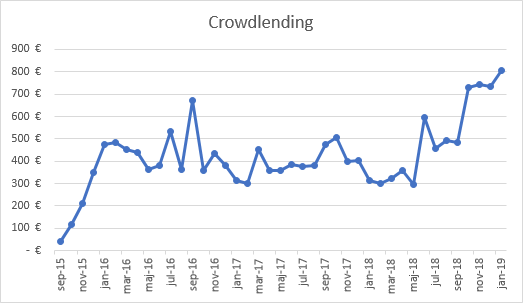

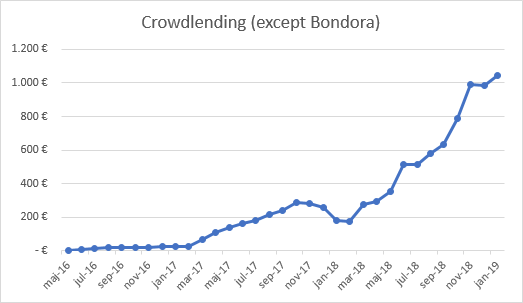

“Income from Crowdlending” in January was 805,26€ (70,61€ more than last month.)

“Crowdlending (except Bondora)” reached 1.047,50€. First time over the thousand Euro line. Yay!

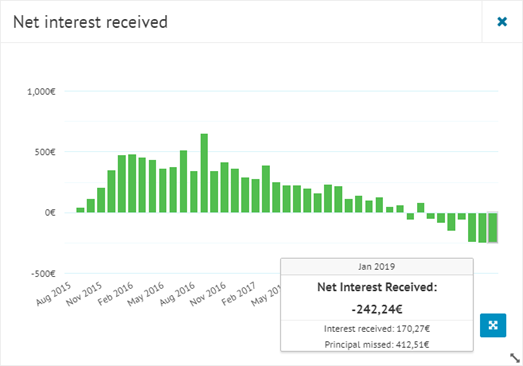

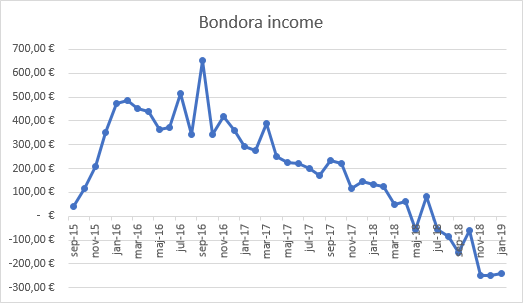

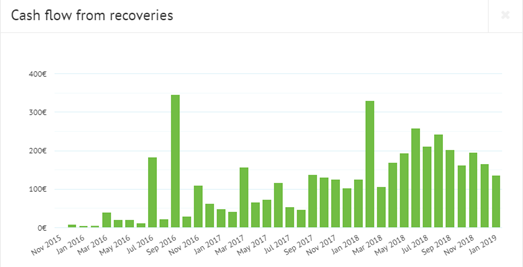

Bondora

Another negative month on Bondora.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. There’s too many defaults related to the “Portfolio Manager” or “Portfolio Pro” and the costs of recovery is too high. Chances are, that your income graph will look much like mine after a couple of years.

See more info and screenshot from my Bondora account

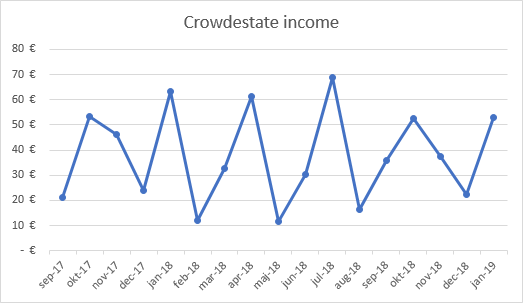

Crowdestate

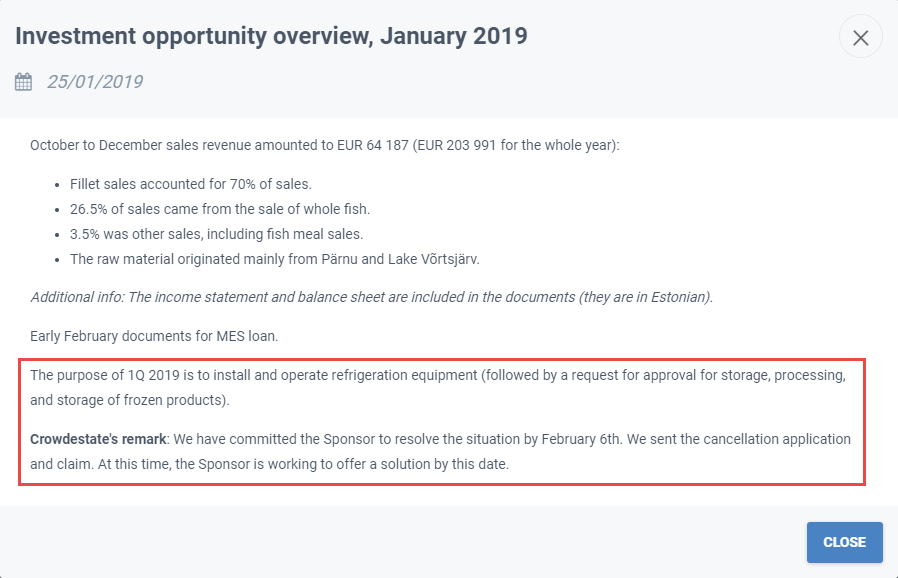

One of the projects I invested in on Crowdestate, MMMSprattus OÜ, is not going according to schedule.

If I understand correctly, MMMSprattus was supposed to use the money to expand their production facility, but it seems like they’re behind schedule building the facility.

Crowdestate has sent a cancellation application and claim to MMMSprattus, so if they don’t fix the matter before February 6th, they will go through legal processes to get the money back.

The rest of the projects in my Crowdestate portfolio are performing as expected.

See more info and screenshot from my Crowdestate account

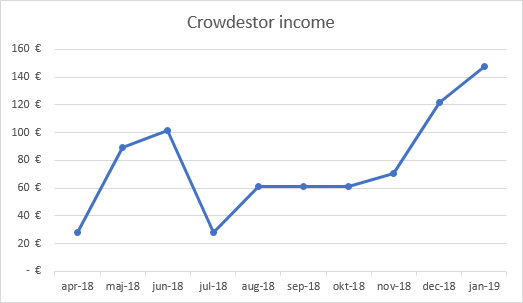

Crowdestor

4 new projects were released on Crowdestor in January and my interest earned keeps rising as well. I’m very pleased with the progress of this platform.

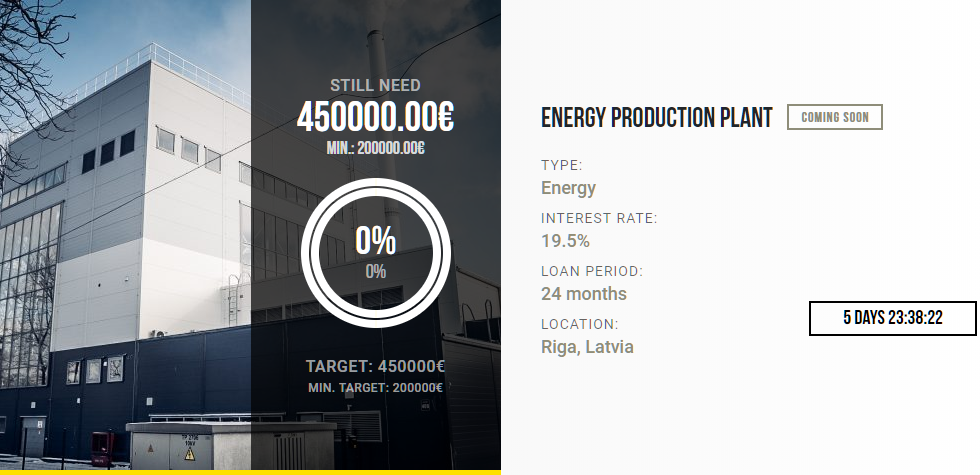

Crowdestor just added another project offering a 19.5% interest rate per year with a 24 month duration. I will definitely invest in that!

There’s still 4 days until the project is released to investors, which gives me time to transfer my money in time.

See more info and screenshot from my Crowdestor account

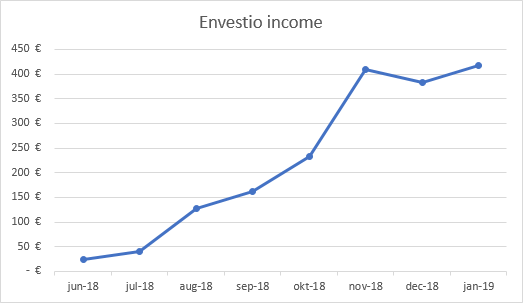

Envestio

Envestio is back in the game with 10 investment opportunities in January. It was a mix of new projects and new tiers of existing projects.

The interest rates offered last month were between 15-17.5%. Somewhat lower than the 20% they offered on the first projects, but still pretty good I think.

I’m still curious to see if we will see any 20% interest rate projects again.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

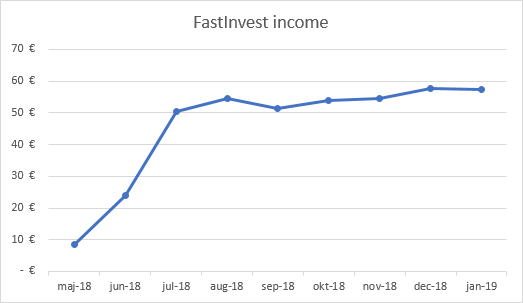

FastInvest

My FastInvest portfolio is stable and reliable. I’ve invested in 15% loans only and haven’t made any deposits since 06.06.2018.

You can already begin to see the effect of compound interest.

I know the team is working hard to finish the new version of the website. I’m really looking forward to seeing it in action, it should be released within the first half of 2019.

See more info and screenshot from my FastInvest account

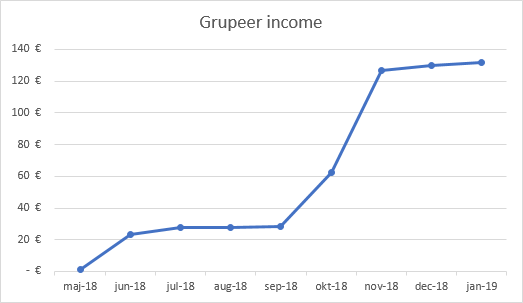

Grupeer

There’s no cash drag on Grupeer anymore. Several investment opportunities from 10-14% are available now.

They also added two new loan originators recently, Kviku and NordCard.

A few days ago, all investors received an email, offering all investors (new and existing) 1% CashBack on investments made in these 2 loan originators within the period from 31st of January to 5th of February.

See more info and screenshot from my Grupeer account

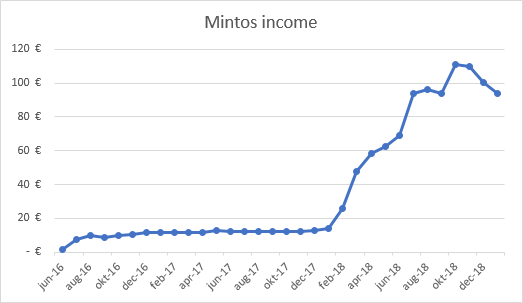

Mintos

I sold most of my 11-12% long-term loans on the secondary market because I wanted to exchange them for the 13-14% loans which are now available.

For that reason I missed some interest in January, but I’d rather have higher paying loans and benefit from the higher returning loans in the long run.

See more info and screenshot from my Mintos account

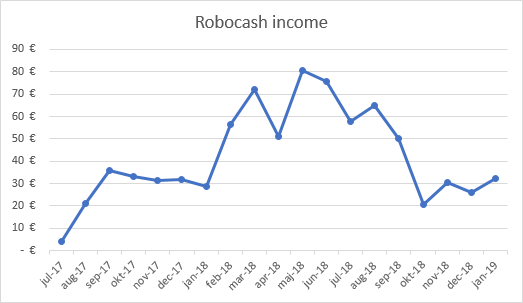

Robocash

Robocash is still giving a nice profit and effortless investing experience. All loans now come with a fixed 12% interest rate and most of them are short-term (30 days or less).

6445 loans with a combined value of 910.402€ are currently available on the marketplace. The days with cash drag on Robocash are over 🙂

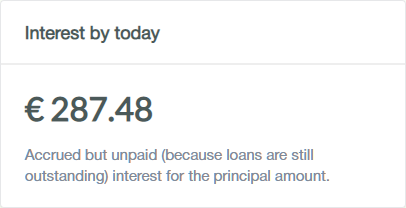

Accrued but unpaid interest (because loans are still outstanding) is slowly building up every day. This amount will be paid out when the 1-year installment loans mature.

“Interest by today” grew from 243,28€ last month to 287,48€ this month. This means that interest earned on Robocash was actually 32,31 + 44,20 = 76,51€

See more info and screenshot from my Robocash account

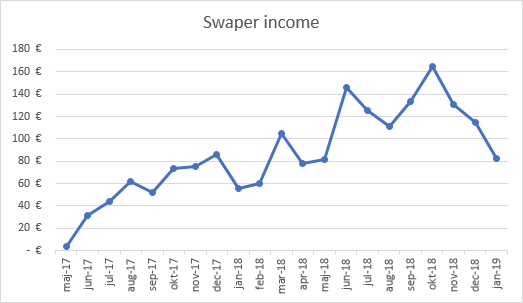

Swaper

Even though Swaper put 3,5 million Euro’s worth of loans on their marketplace during the last 30 days, 25-40% of my funds were not invested in January.

I’m considering giving up on Swaper and move my money to a better place. You know, somewhere where they actually get invested. It’s kinda sad, because I’ve been satisfied with the platform up until recently.

See more info and screenshot from my Swaper account

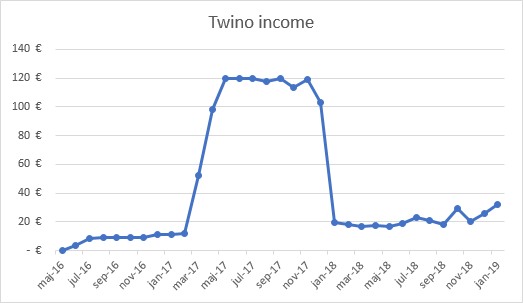

Twino

Twino is almost as annoying as Swaper in terms of Cash drag. I mean, Twino actually has loans available, but I don’t like their “Payment Guarantee” loans with 8-10% interest rate. If they default, you’re stuck with them until the maturity date, as they can’t even be sold on the secondary market.

See more info and screenshot from my Twino account

Real Estate

January was a different/difficult month for my rental property. On of the tenants didn’t pay the rent and I was very close to terminating the contract. The money came in just in time so the tenant stays for now.

The other tenant sent a “termination of lease” notice, which means they will be moving out on 1/5 (They have 3 months notice). So I will need to find another tenant for that apartment soon.

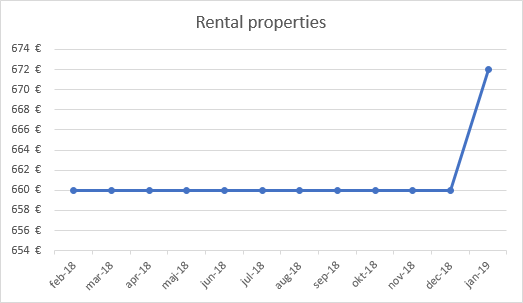

The rent was increased 0,8% for my tenants. ( I raise the rent every year to match the changes in the “Net price index”). For this reason, income on the rental property grew 12€, from 660€ to 672€.

I have talked to a real estate management company which offers to handle some of the administration for me. It’s quite cheap so I decided to give it a try to get first hand experience with them.

See more info about my First property

Savings rate

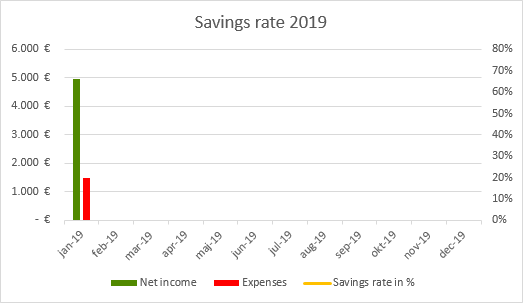

My savings rate for January was 69,40% (+47,14% compared to last month).

I receive 865€ in child benefit every 3rd month, which helped raise the savings rate for January.

See more info about my Savings rate

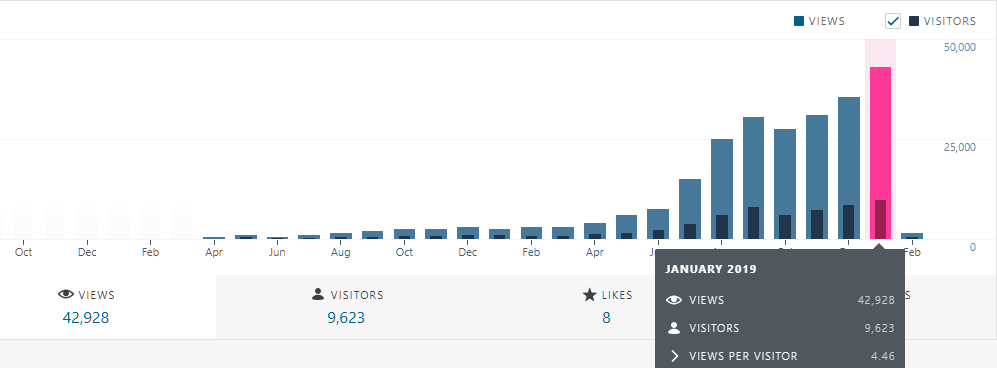

Blog statistics

The blog traffic reached new heights in January.

Visitors: 9.623 (+13,73% compared to last month)

Page views: 42.928 (+22,30% compared to last month)

1.036 subscribers (577 WordPress, 459 Sumo) (+211 compared to last month)

502 Facebook likes (+57 compared to last month)

FinanciallyFree is hosted on SiteGround for the incredible low price of 3,95€ per month. Even with almost 10k visitors and 43.000 page views per month it’s still pretty fast don’t you think?

Until next time!

In February I’ll throw some money after the Crowdestor “Energy production plant” project. I’m thinking about making a 5.000€ deposit to increase my investment on Crowdestor to 15.000€ in total.

I will post future monthly updates around the 3rd of each month. It’s just too much work to do in one day. And with all the other things I have going on in my life, it’s stressful to have a strict deadline for this task. I changed the format of this post a tiny bit, which will help reduce the time I need for the next update. Every small tweak makes a big difference 🙂

If you enjoyed this post, please hit the like button below and/or share it with your friends.

P.S. If you missed the latest Podcast episode with my friends from Financial-independence.eu you can listen to it on my About page. We talk about P2P lending, minimizing risk, surviving recessions and auto-invest strategies.

Comments are closed.