Dear fellow investors, friends, family and future self.

First month of 2021 has passed! Time flies when you’re having fun, doesn’t it?

I’m thinking about revamping this blog. I’ll continue doing the monthly updates but it would be nice to bring more value in a shorter post. As a first step to cut down time spent doing these updates, I’ve deleted the savings rate and removed the monthly quote.

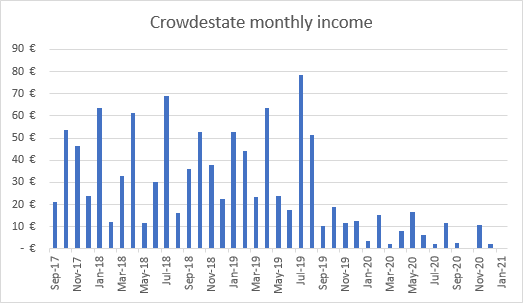

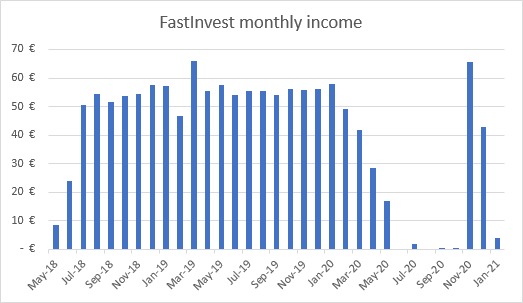

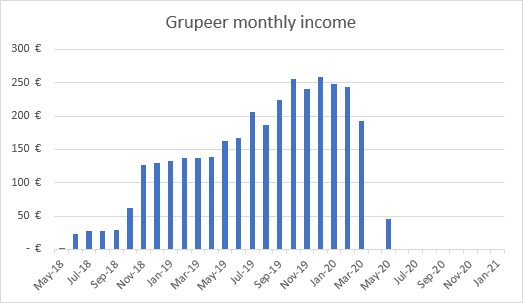

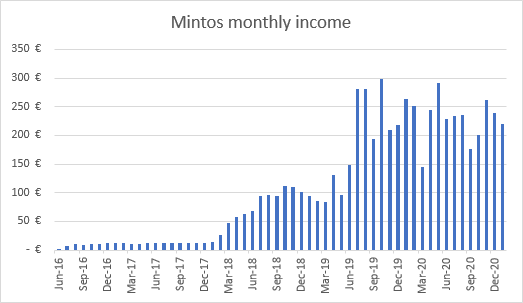

Next month I might not put the individual “monthly earnings graphs” into the update. They’ll still be available on individual pages in the Crowdlending menu. Maybe I’ll also delete the investment history and replace it with a page that shows the stocks I buy, entry point, target price for selling etc.

I spend most of my days following the stock market and searching for good investment opportunities, so I think it makes sense to bring more of this into the blog.

A friendly follower reached out and suggested that I could make a graph which shows the difference between deposited value and account value. It’s a great suggestion and I’ll probably make it. Any other ideas or suggestions? Let me know in the comments below!

Monthly Income Statement: January 2021

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -272.51€ | -0.87% | 7 918€ | 7 036€ |

| Bulkestate* | 0€ | 5.59% | 10 000€ | 10 989€ |

| Crowdestate* | 0€ | 4.89% | 5 305€ | 6 406€ |

| Crowdestor* | 109.16€ | 12.12% | 72 101€ | 87 776€ |

| FastInvest* | 3.86€ | 15.15% | -199.01€ | 1 243€ |

| Grupeer | 0.00€ | 8.36% | 20 474€ | 24 047€ |

| Mintos* | 220.61€ | 16.50% | 20 000€ | 28 172€ |

| PeerBerry* | 90.43€ | 15.17% | 6 000€ | 7 277€ |

| ReInvest24* | 6.82€ | 5.91% | 1 000€ | 1 102€ |

| Robocash* | 153.93€ | 13.07% | 10 000€ | 13 889€ |

| Swaper* | 154.41€ | 14.69% | 10 000€ | 15 397€ |

| Viventor* | 4.05€ | 15.71% | 5 000€ | 6 313€ |

| Wisefund | 0.00€ | 9.81% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 470.76€ | -0.37% | 230 153€ | 230 279€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 380€ | 37.41% | 18 080€ | 44 482€ |

| Property #2 | 1 167€ | 5.03% | 61 200€ | 65 646€ |

| 1 547€ | 79 280€ | 110 128€ | ||

| Total | 2 017.76€ | 3.87% | 309 433€ | 340 407€ |

Note:

- I marked Grupeer and Wisefund as orange because I’m questioning future repayments (no transactions since March 2020)

- FastInvest “Invested” amount is negative because I have withdrawn more than I have deposited.

Portfolio performance: Historical view

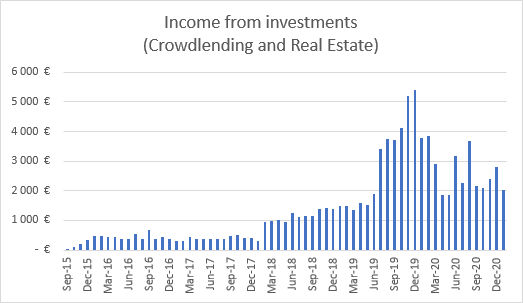

Income from Crowdlending & Real Estate combined was 2 017.76€

(-791.58€ less than last month).

That means I’m 67.26% Financially Free (-26.39 percentage points up from last month).

Stocks / trading

Here’s the changes to my stock portfolio since last update:

Sold:

- Alibaba @ 267.50$ (Bought @ 221.75$) = 20.63% gain

- AT&T @ 28.90$ (Bought @ 26.78$) = 7.92% gain

- Enphase Energy @ 185.00$ (Bought @ 177.50$) = 4.23% gain (day trade)

Bought:

- Corsair Gaming Inc (CRSR) @ 40.35$

- Frontline Ltd (FRO) @ 6.16$

Stocks on my radar. Potential buys:

- Quantumscape (QS) @ 37$

- BlackBerry (BB) @ 9.50$

- Alcoa (AA) @ 15$

- The Boeing Company (BA) @ 187$

- Church & Dwight Co., Inc. (CHD) @ 77$

This is my current equity portfolio:

[table id=1 /]I buy my stocks and trade on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction). I don’t receive any commission besides the mutual fee deduction.

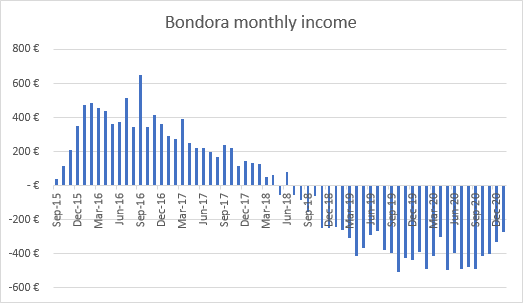

Bondora

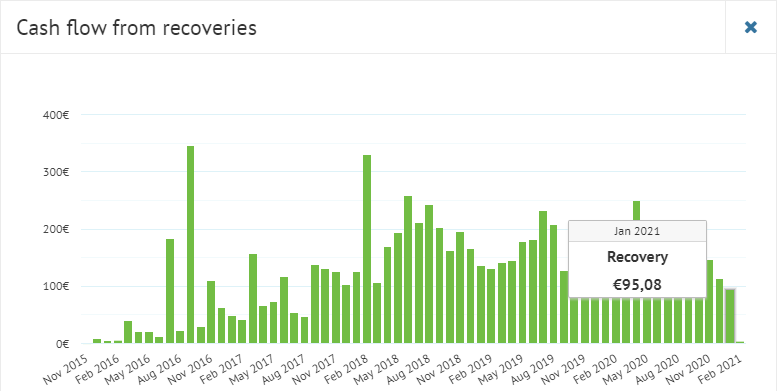

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

95.08€ was recovered in January but I still have 24.004€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

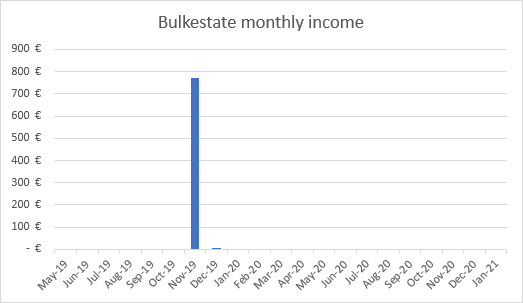

Bulkestate

On February 1st, I decided to withdraw 5 113.30€ from Bulkestate*. The money arrived in my bank account after 3 minutes!

The only reason I’m withdrawing is that all investments at Bulkestate have a 1 year duration and there’s no secondary market. As it’s unclear how 2021 will turn out for us, I prefer the liquidity and having cash available.

All new investors will receive a 5 EUR cash-back bonus upon their first investment if you use this link*.

Invest at least €4,000 and get 1% cashback! The offer is active till March 12, 2021.

See more info and screenshot from my Bulkestate account

Crowdestate

No repayments from Crowdestate* in January. That’s a first.

See more info and screenshot from my Crowdestate account

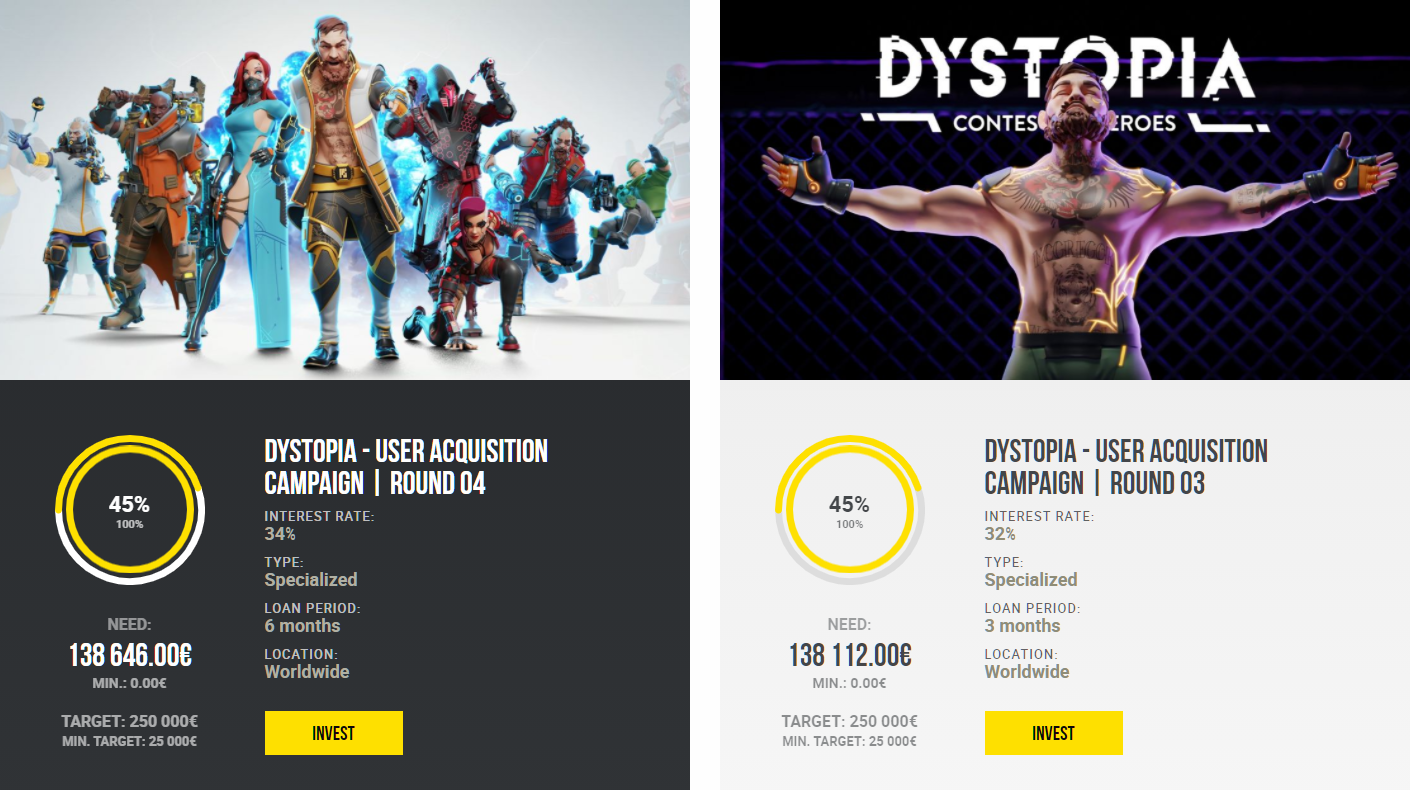

Crowdestor

It was a slow month on Crowdestor*. Not all project have monthly repayments and several projects are facing delay due to the crisis. Updates on delayed projects are posted regularly and I feel like my investments are in safe hands.

I re-invested interest and principal into Dystopia. I’ve been playing the game for several months, mostly to follow my investment and to see if they’re serious about it. The game is well made, looks great and they update it a couple of times per month.

I’ve also participated in previous financing rounds of Dystopia and the money has been paid back on time. All in all, it makes me comfortable reinvesting into it. The interest rates are amazing. 32% with 3 month duration or 34% with 6 month duration!

See more info and screenshot from my Crowdestor account

FastInvest

My loans on FastInvest* expire on February 17th. By then I’ll request a withdrawal of my last funds.

I’m leaving FastInvest until they disclose the names of their loan originators. When that happens, I’ll consider to come back. FastInvest has been a good performer (with the exception of a 6 month delay on my last withdrawal requests).

See more info and screenshot from my FastInvest account

Grupeer

No signs of life in Grupeer since last update. Not even a blog update.

Latest blog post from November 5th can be found here.

See more info and screenshot from my Grupeer account

Mintos

I keep reinvesting in Mintos* but only in loan originators with a rating of 7 or above.

See more info and screenshot from my Mintos account

PeerBerry

I use PeerBerry* as my children’s savings account. It has been one of the most stable investments in my portfolio in 2020.

See more info and screenshot from my PeerBerry account

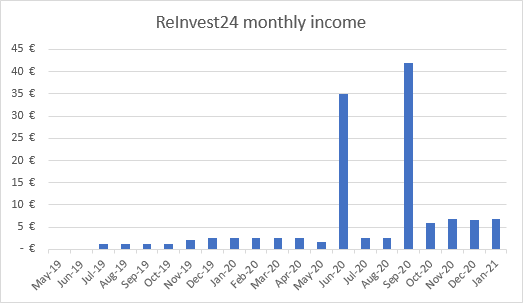

Reinvest24

Once again, I reinvested my ReInvest24* earnings into the secondary market, where I was able to find some shares without price markup.

From 08.02.2021 until 22.02.

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

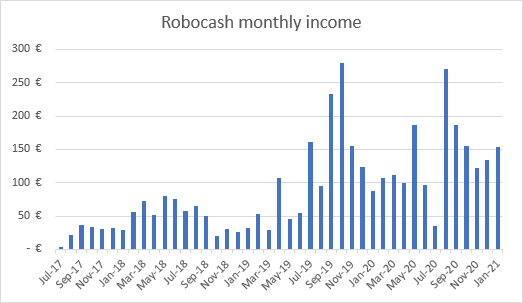

Robocash

What can I say… Robocash* keeps delivering.

If you want to start investing with Robocash you can get 1% cash back from all your investments until January 31, 2021, where the offer expires. Make sure to use this exclusive link* to get your cash back.

See more info and screenshot from my Robocash account

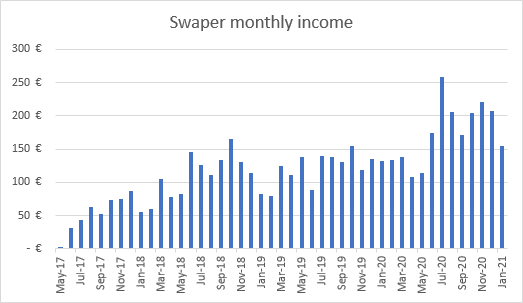

Swaper

Swaper* has been one of my best P2P investments since May 2017.

If you’d like to try them out, you can create your account here*.

See more info and screenshot from my Swaper account

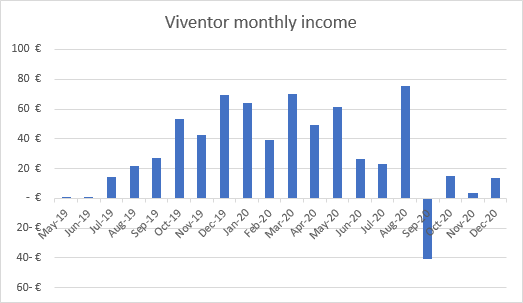

Viventor

I’m not having a good feeling about Viventor*. I’ll start to withdraw what I can from Viventor as the loans are being repaid.

Viventor’s CEO Andrius Bolšaitis has left the company and 4 loan originators were suspended in 2020.

See more info and screenshot from my Viventor account

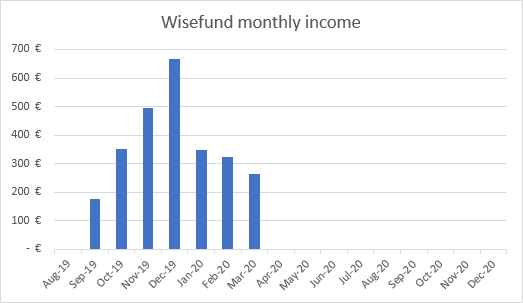

Wisefund

Still no updates on delayed/defaulted loans on Wisefund. My mom requested a small payout of available funds a few days ago. It’ll be interesting to see if it’ll be processed.

See more info and screenshot from my Wisefund account

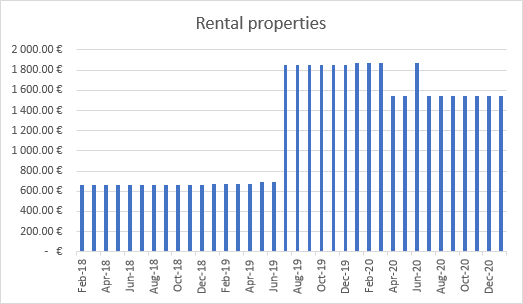

Real Estate

I received rent from 4 tenants in January. One apartment is currently vacant and I’m looking for a new tenant to move in.

It’s been harder to find a new tenant this time. Maybe the pandemic has a negative impact on people looking for a new place to live?

I’m in the process of buying a 3rd property, the purchase agreement has already been signed. Now I just need to secure financing and get a mortgage, which shouldn’t take more than a month.

Turns out getting a mortgage is not as easy when you’re retired. My bank rejected my mortgage application because out current monthly income is too low for their requirements. Pretty stupid if you ask me, especially because I could buy the house in cash if I wanted to.

I’m currently talking with another bank who seems to be more helpful. Hopefully it works out.

See more info about my First property and Second property

Free EUR bank account with no fees

Do you live in Denmark, Poland or Sweden? Having an N26 bank account will save you from currency exchange fees when dealing with euros!

I use N26* to transfer to and from my investments. It even comes with a free debit MasterCard. N26 is by far my favorite banking provider!

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough).

Comments are closed.