Dear fellow investors, friends, family and future self.

October 2020… Not the most eventful month of the year. But we’ve had plenty of moving around lately, so it is kinda nice to settle down for a bit. We spent most of the month looking for a place to live. Only one good rental apartment came on the market and the landlord had a list of 15 interested people who wanted to rent it. Unfortunately, someone else got it, so we’re still on the hunt.

We could go out and buy a house instead of renting one. But I’d rather spend the down payment on another rental property. A third property would increase our cash flow substantially, where owning our home wouldn’t improve our financial situation.

Not much has happened in the P2P industry since last update. A few platforms like Swaper*, Robocash* and PeerBerry* are doing exceptionally well, with no delayed payments and no withdrawal issues.

Mintos announced that they’re looking to raise funding for expanding the business. So if you’re looking to own a small part of Mintos, this is your chance. I’m not looking to participate myself.

Monthly Income Statement: October 2020

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora* | -415.19€ | -0.96% | 8 932€ | 7 982€ |

| Bulkestate* | 0€ | 6.98% | 10 000€ | 10 989€ |

| Crowdestate* | 0.18€ | 5.31% | 5 305€ | 6 393€ |

| Crowdestor* | 291.95€ | 12.89% | 82 912€ | 96 811€ |

| FastInvest* | 0.06€ | 3.24% | 864€ | 1 130€ |

| Grupeer | 0.00€ | 9.61% | 20 474€ | 24 047€ |

| Mintos* | 200.69€ | 17.19% | 20 000€ | 27 439€ |

| PeerBerry* | 84.50€ | 15.08% | 6 000€ | 7 016€ |

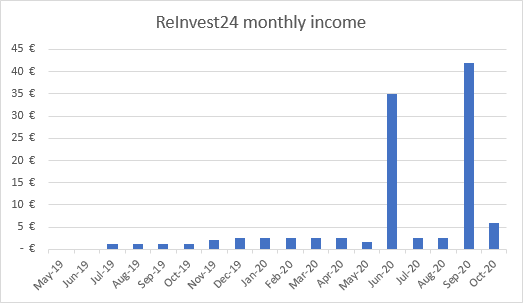

| ReInvest24* | 6.04€ | 5.62% | 1 000€ | 1 082€ |

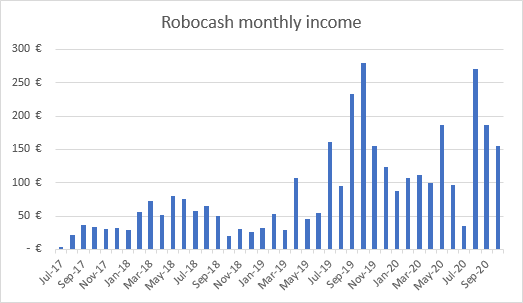

| Robocash* | 155.48€ | 13.12% | 10 000€ | 13 480€ |

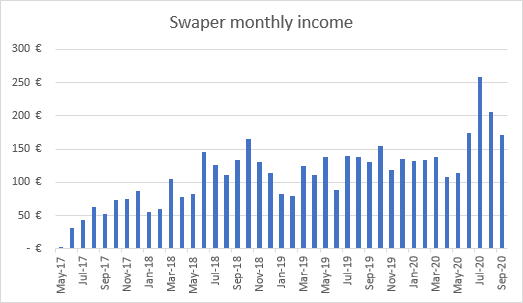

| Swaper* | 204.14€ | 14.56% | 10 000€ | 14 824€ |

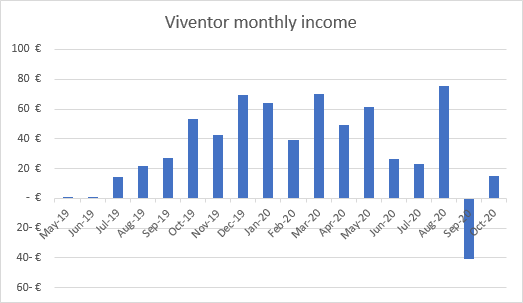

| Viventor* | 15.22€ | 14.86% | 5 000€ | 5 948€ |

| Wisefund | 0.00€ | 11.84% | 17 853€ | 20 626€ |

| Scams | XIRR | Invested | Value | |

| Envestio | -100% | 20 000€ | 0€ | |

| Kuetzal | -100% | 24 700€ | 0€ | |

| Subtotal | 542.47€ | -1.48% | 243 042€ | 237 774€ |

| Real Estate | Income | Invested | Value | |

| Property #1 | 380€ | 37.57% | 18 080€ | 43 471€ |

| Property #2 | 1 167€ | 3.64% | 61 200€ | 64 223€ |

| 1 547€ | 79 280€ | 107 694€ | ||

| Total | 2 089.47€ | 3.21% | 322 322€ | 345 469€ |

Note: I marked Grupeer as orange for now because I’m questioning future repayments.

Portfolio performance: Historical view

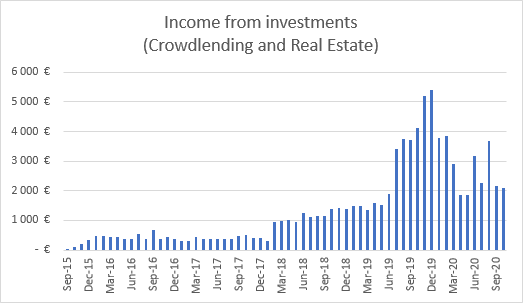

Income from Crowdlending & Real Estate combined was 2 089.47€

(-61.08€ less than last month).

That means I’m 69.65% Financially Free (-2.04 percentage points down from last month).

Stocks / trading

I made a few changes to my stock portfolio since last update:

Sold:

- General Electric @ 7.70$ (Bought @ 5.51$) = 39.75% gain

- U.S. Steel Corp. @ 9.70$ (Bought @ 7.84$) = 23.72% gain

Bought:

- Macy’s (M) @ 6.13$

- AT&T (T) @ 26.78$

- Added to Aurora Cannabis (ACB) @ 3.80$

This is my current equity portfolio:

[table id=1 /]I buy my stocks and trade on DeGiro, which I consider the best and cheapest no-bullshit broker in Europe. If you use this link to sign up we will both receive a 20€ in transaction reimbursement (fee deduction). I don’t receive any commission besides the mutual fee deduction.

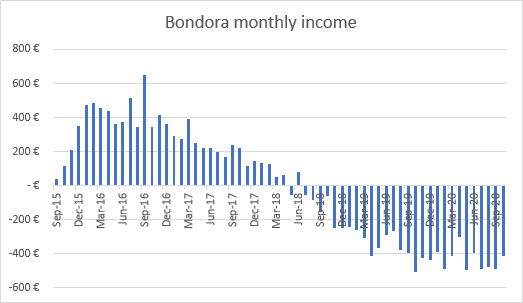

Bondora

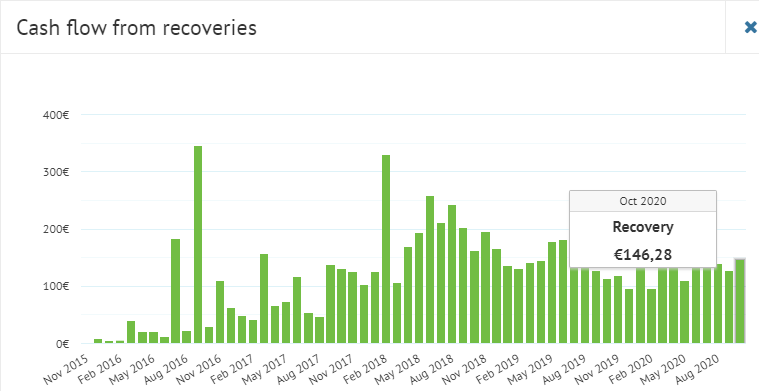

I stopped reinvesting in Bondora* a long time ago and I’ve started the slow withdrawal process.

146.28€ was recovered in October but I still have 24 355€ in defaulted loans.

I invested in loans through Bondora’s “Portfolio Manager”. I advise you not to make the same mistake.

If you want to use Bondora’s Go&Grow as a savings account and earn 6.75% interest rate, use this link* to get 5€ free when you sign up.

See more info and screenshot from my Bondora account

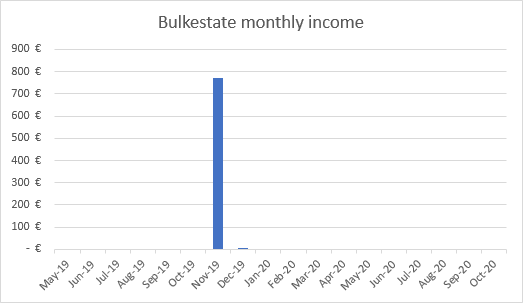

Bulkestate

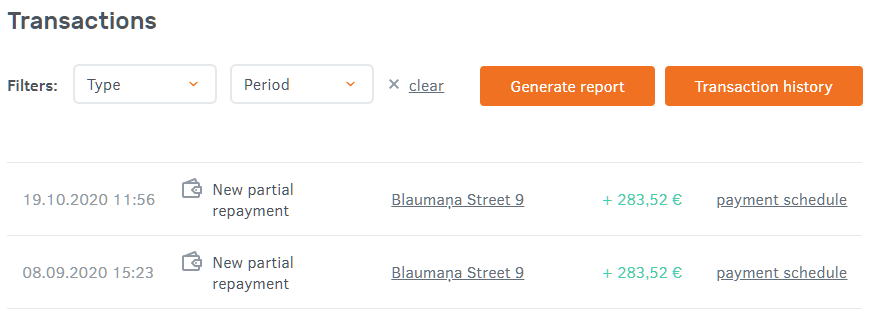

I have received two partial early repayments on project “Blaumaņa Street 9” on Bulkestate*. To me, receiving principal when the borrower is able to repay earlier, is always a good thing.

The investment is scheduled to repay the total amount on 21.12.2020.

All new investors will receive a 5 EUR cash-back bonus upon their first investment if you use this link*.

See more info and screenshot from my Bulkestate account

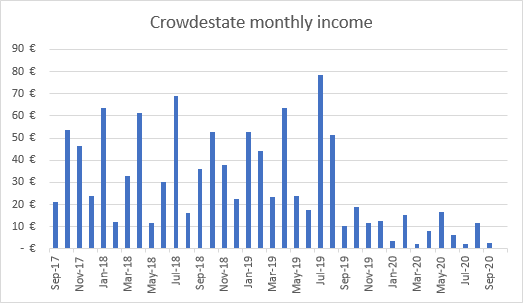

Crowdestate

I’m still withdrawing from Crowdestate*. While there’s no doubt in my mind that the platform is legit, I have not been convinced about their ability to pick the right borrowers. In my opinion, too many projects have experienced payback issues.

0.18€ received in October is not enough to make a blue bar visible on the graph:

See more info and screenshot from my Crowdestate account

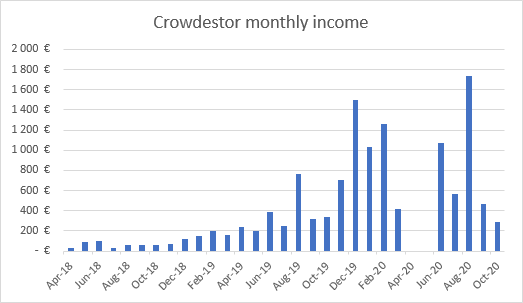

Crowdestor

I had ~6k available on Crowdestor* which was repayments from successfully exited projects. For a few weeks, I have been debating with myself whether to withdraw or to reinvest the money.

I decided to reinvest in projects with a decent discount on the secondary market, which I believe will be able to pay back.

See more info and screenshot from my Crowdestor account

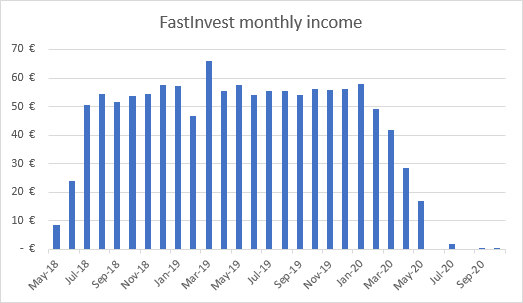

FastInvest

My latest successful withdrawal from FastInvest* was requested in late April and processed on 12.05.2020. I still have 2 pending withdrawals from May and June.

Every week, they send me the same email – that I shouldn’t worry, all withdrawals will be processed. Well, we will see, I guess.

See more info and screenshot from my FastInvest account

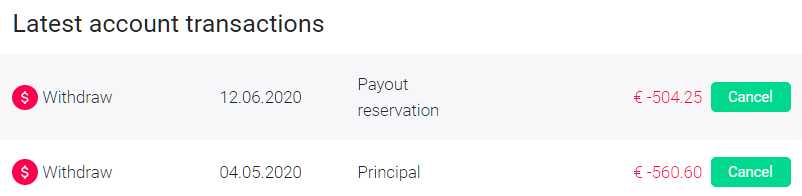

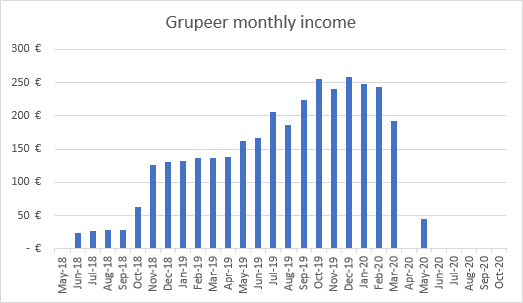

Grupeer

Grupeer continues to communicate to investors through their blog. Latest blog post here.

See more info and screenshot from my Grupeer account

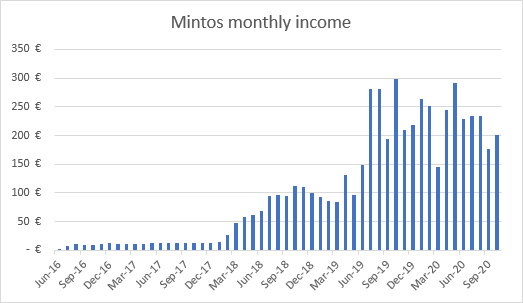

Mintos

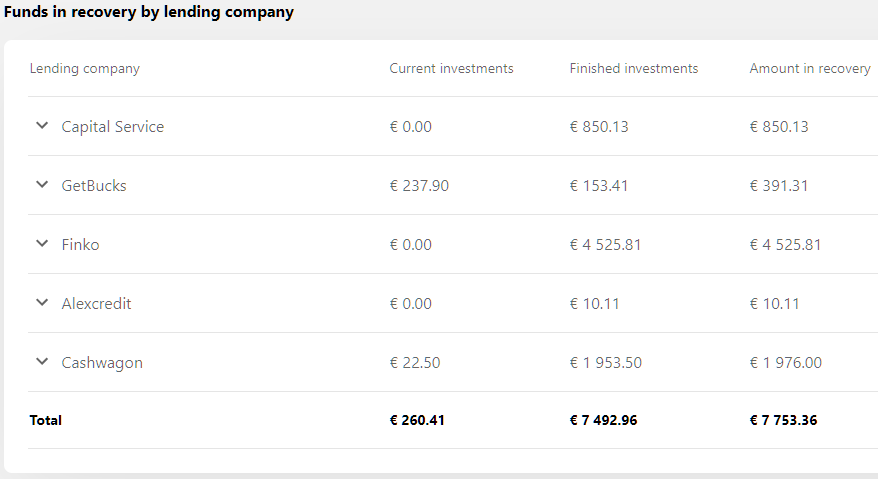

While my monthly Mintos* earnings looks quite stable, the amount of funds in recovery now adds up to more than I’ve earned. Hopefully they’ll recover some of the funds. If not, then I haven’t earned anything in the 3 years I’ve invested through Mintos.

Mintos does a good job giving updates on their blog.

See more info and screenshot from my Mintos account

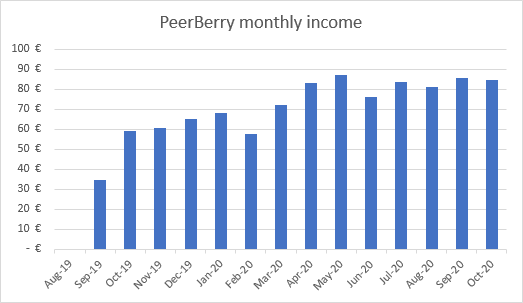

PeerBerry

I use PeerBerry* as my children’s savings account. Everything is running smooth here..

See more info and screenshot from my PeerBerry account

Reinvest24

I only have a small position at ReInvest24* but I’m starting to like it more and more. The income has been small but reliable.

All my projects on ReInvest24 now pays monthly dividend. Yay!!

A lot of projects have been successfully funded lately. A total of 498 125 EUR were invested into their properties in October. It looks like ReInvest24 is finally picking up momentum!

If you want to try ReInvest24 you will get 10€ instantly credited to your account if you sign up with my ReInvest24 referral link*.

See more info and screenshot from my ReInvest24 account

Robocash

Another solid month on Robocash*.

Robocash published their audited financial statements for FY2017-2019. You can find the audited report here. The management report is available here.

With such strong financial reports, it’s no wonder that more and more people start investing with Robocash*. I’m very happy with them.

See more info and screenshot from my Robocash account

Swaper

Swaper* is one of my favorite P2P lenders.

To me, Swaper has been a stable a predictable platform without any issues (other than the occasional lack of loans available for investment, but that’s currently not an issue).

See more info and screenshot from my Swaper account

Viventor

After Viventor‘s* late fee calculation bug last month, we’re back in positive territory. Not much though..

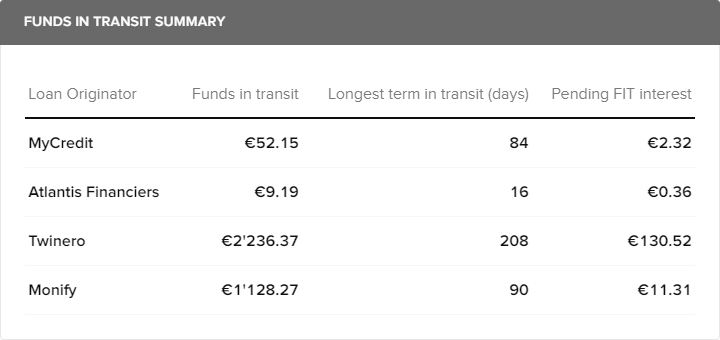

I’m waiting for funds in transit from Twinero and Monify.

See more info and screenshot from my Viventor account

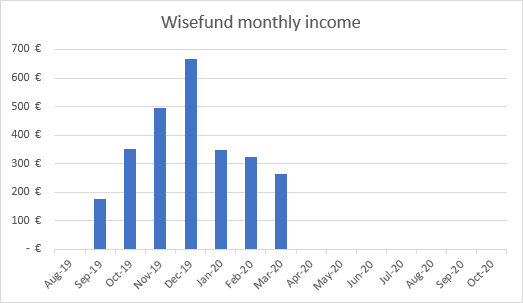

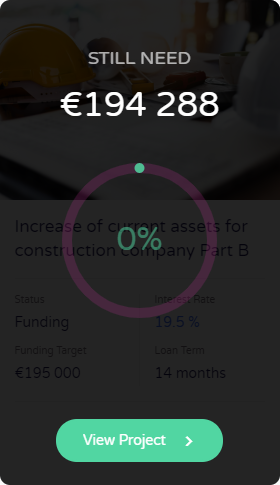

Wisefund

No news from Wisefund since last month. All the projects I have invested in have defaulted and are awaiting recovery.

The lastest project has attracted less than 1% funding. The future does not look bright for Wisefund. Investors have lost trust in the company and rightly so.

See more info and screenshot from my Wisefund account

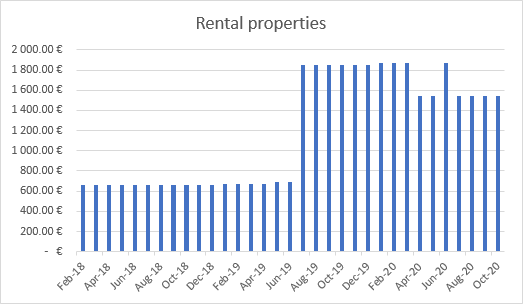

Real Estate

I received rent from 4 tenants in October. One apartment is currently vacant while it’s being renovated. The renovation is almost finished and I expect to have it rented out again soon.

I’d love to buy a third rental property. I’m looking at a few that seems attractive.

Perhaps a property like this with 7 apartments would be nice.

See more info about my First property and Second property

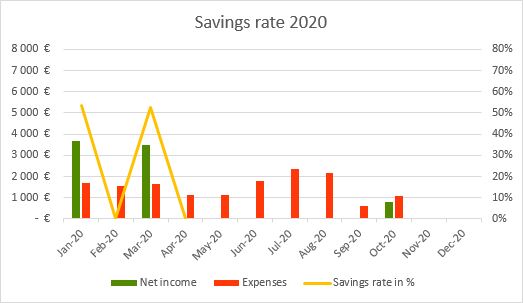

Savings rate / expenses overview

Like most other Danes, I received a small amount of income from “Vacation pay” in October.

My total expenses for the month were 1 098€, which includes seasonal tickets to Djurs Sommerland 2021 (entertainment park) and an Amazon Kindle Paperwhite e-book reader. Those two things combined were almost half of my monthly expenses.

See more info about my Savings rate

Blog statistics

Visitors: 5 514 (+0.18% compared to last month)

Page views: 14 680 (+0.24% compared to last month)

3 180 Subscribers (+6 compared to last month)

1 614 Facebook followers (+11 compared to last month)

Quote of the month

Start your own blog

Have you been thinking about starting your own WordPress blog?

FinanciallyFree.eu is hosted on SiteGround* – probably the best WordPress host in Europe!

Free EUR bank account with no fees

Do you live in Denmark, Poland or Sweden? Having an N26 bank account will save you from currency exchange fees when dealing with euros!

I use N26* to transfer to and from my investments. It even comes with a free debit MasterCard!

That’s it for this month!

If you enjoyed this post, maybe your friends will like it too? Hit the like button below and/or share it with your friends!

P.S. When you comment, please use your real name (first name is enough). Blog names are not accepted and will be renamed to Anonymous.

Comments are closed.