Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

This Kuetzal review is based entirely on my experiences. Always do your own research.

Update 16.01.2020:

I consider Kuetzal a scam. They announced wind-down a couple of days ago, no payouts have been made since medio December (due to frozen bank accounts?) and more fraudulent projects were found.

Update 19.12.2019:

Something is not right with Kuetzal. Please read this article before you consider investing with them!

I have made a buyback and withdrawal request and I will exit if possible, even with a loss. I cannot recommend Kuetzal until I have seen proof that the owner, Viktoria actually exists.

Proceed with caution!

This Kuetzal review is 100% unbiased and based on my experiences.

From May 2-3, 2019 I had the pleasure to meet Kuetzal in their new office in Riga.

The main purpose of the visit is to ensure the investment platform is real and the listed projects exist. I ask all sorts of questions to get the best impression of the team behind.

What is Kuetzal?

Kuetzal is a Peer-to-Business platform that connects the most promising regional projects in the Baltics with investors to create mutual high value added cooperation.

Quick facts about the platform:

- Kuetzal was founded in July 2018 by Alberts Čevers

- The first investor was registered in November 2018

- 950 investors have verified their accounts and made first deposits by May 2019

- Kuetzal recently moved to a new office: Dzirnavu street 16, 2nd office, Riga. (Entrance from Strēlnieku iela 16)

Who is the founder and CEO?

Alberts Čevers was born in Riga in 1994. When he turned 18 he moved to Barcelona to study. He graduated European University in Barcelona in 2016 and holds Bachelor diploma in Business Administration.

When Alberts lived in Barcelona he also worked for 2 companies related to the P2P industry:

- Financial operator at Twinero, which is a short-term loan originator.

- Intern at Viventor, which is a well known P2P-platform.

Where does the name Kuetzal come from?

One of the first questions I had to ask was about the name of the platform.

- How did you come up with the name “Kuetzal”? Does it mean anything?

Alberts: “We wanted a unique name for our company. We were inspired by the beautiful bird – The Quetzal. We thought the letter Q was too exotic for the European market so we changed it to a K. That’s how Kuetzal was born.”

Notice how the top part of the Kuetzal logo looks like a bird (I added the black eye)

Projects

At the time of writing 14 projects are published on the platform and 11 of them have Buyback Guarantee.

5 of these projects are fully funded. The platform is still young, none of the projects have been completed or repaid yet.

Project duration has historically been between 12 and 48 months. Interest is paid out every month for all current projects. Interest rates from 6% to 21%.

As with any other Crowdlending platform, investors earn money with fixed interest rates from the projects presented on the platform.

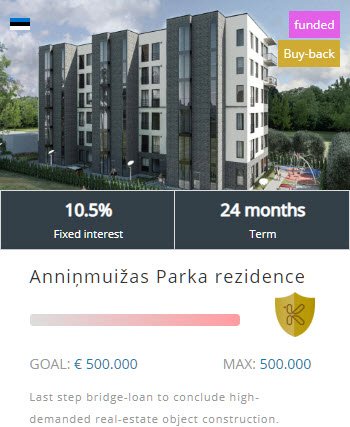

Here is an example of the last 6 projects presented on the website:

Projects we visited

While visiting Kuetzal we had the opportunity to visit several projects, talk to the project owners/borrowers and hear more about their companies and reasons for listing their project on Kuetzal.

- Anniņmuižas Parka rezidence (already funded)

Construction workers were active on the plot while we were there. A large yellow tower crane and a tractor were working on the foundation of building.

- Impaya – Online payments solution (83% funded)

Sergejs Roslikovs, CEO of Impaya, gave a company presentation and talked about future plans of the company. With Kuetzal, they are planning to acquire EMI (Electronic Money Institution) license in UK and increase their volume in Asian countries.

- VV Line (30% funded)

Lauris Valainis from VV Line gave us a good introduction to the company. They are official representatives of Kaessbohrer in the Baltic region. With Kuetzal they are planning to distribute the latest Kässbohrer truck models to their customers in the Baltics.

- European Crypto-Mining Association

European Crypto-Mining Association has built a profitable business around specialized hardware/software that automatically determines which coins are most profitable to mine – in real time. They mine for themselves and for clients who pay for the hosted service.

I was surprised to learn how fast the equipment was paid back, even without increasing price of the coins. They have access to very attractive prices on hardware, near 50-60% of retail prices.

New mining container ready to be equipped and assembled.

What is Kuetzal Care?

Kuetzal care currently has two purposes:

- To give investors interest payments from the day they invest. They don’t have to wait for the project to be fully funded.

- Projects marked with Kuetzal Care will be fully funded – in not by investors, then by Kuetzal’s own funds.

We don’t know much about the people behind Kuetzal Care. According to Alberts, it’s 4 private investors and an investment fund.

The investment fund is mainly attracting funds of investors from Asia and using them for investments in Europe. Overall participation of that fund in Kuetzal Care is ~30% of overall cap.

Alberts knows investors prefer 100% transparency – so does he. He hopes to be able to introduce all the parties within Kuetzal Care one day.

Buyback Guarantee

Most projects have Buyback Guarantee as well, which again has two purposes:

- To give investors an option to exit a project early by selling the investment back to Kuetzal for a 10% fee. (Contact Kuetzal by mail if you want to use this option)

- To secure any principal invested and return it to the investors in case a project defaults.

Note that Kuetzal promises to cover 100% of your investment in case of default.

I have suggested Alberts to include buyback guarantee as a corner stone in Kuetzal care. That would make the concept a lot stronger (and much easier for new investors to understand). I hope they will consider this.

Answers to your questions

In the portfolio update from March, I encouraged you to write some some questions, which I would ask Kuetzal:

Q: The account-holder’s part of the site (after you have logged in) looks very similar to Envestio’s site. They are both based in Estonia, so I wonder if there is a connection between them.

A: There’s no connection between Envestio and Kuetzal.

Q: There is no date given for the investment deadline for each project. When you invest, interest is paid monthly on the same date as your investment, so the time frame to invest seems to be open-ended. This begs the question, when does the borrower receive the funds? How can the borrower be paying you interest if the project is not yet funded? They say that Kuetzal Care will complete the funding if the investors do not – but when?

A: The borrower receives the funds in small batches, as the project is being funded. The borrower pays interest for all money received. Kuetzal Care completes the funding if a project is taking too long to be funded. Each case is considered individually.

Q: They do not produce Loan Agreements for each investment yet, but, like Envestio, say they will in the future. I would have thought that this should be a priority for both platforms to get right at the beginning of operations as it sets out the legal agreement between investor, borrower and platform.

A: You’re right, the legal agreements are not automatically being produced yet, they’re working on it.

Q: Their Terms and Conditions contain phrases which appear to have nothing to do with the business e.g., “We … in no event shall be liable to You … for Your failure to understand the nature of crypto currencies, its derivatives or the market for such currencies and its derivatives.”

A: This is a mistake. The person who created the terms and conditions for Kuetzal have also created terms and condition documents for companies involved in crypto currencies. She used a template and forgot to remove this part. Updating the terms and conditions has very high priority.

Q: On the FAQ, in the question about “What are the risk of investing at Kuetzal?”, the say that “Also, Kuetzal Care and Investment Return tools are applied for majority of the projects. These tools can make particular project risk-free.” But I do not see why Kuetzal Care is mentioned here since it is just saying that they start counting interest from the moment one invests (e.g. such as Crowdestor). Also, they mention “Investment Return tools” which is not clear, what are those tools exactly?

A: By “Investment return tools” they mean Buyback Guarantee in case of project default + you have the option to sell you investment back to Kuetzal for a 10% fee.

More questions for Kuetzal ?

If you have any uncertainty about investing with Kuetzal feel free to reach them at info@kuetzal.com

OR

Meet Kuetzal on the P2P Conference in Riga!

On June 7-8, 2019 you have the chance to meet the Kuetzal team on the P2P Conference and ask them all the questions you want. Alberts and Romans are both participating!

50 platforms are attending the conference. Don’t miss out on this opportunity to find new investment opportunities and meet and greet your favorite platforms.

USE PROMO CODE FINANCIALLYFREE FOR A 20% DISCOUNT!

Conclusion

Kuetzal is young company run by a young CEO. It still has a lot to prove!

They did have a few bugs on the website and some project information wasn’t correct. They did explain all these things to me in a trustworthy way, so I’m sure it was a beginners mistake. I hope they learn from it and will make sure that all information is correct when they publish new projects in the future.

That said, I have a good feeling about Alberts Cevers, he provided good and insightful answers to all of my questions (and believe me, I asked a lot!) He did not show any signs of nervousness, in fact, he seems rather confident. I was happy to see that.

He’s also professional and polite. I’m sure Kuetzal is a serious company that will go a long way to prove it belongs in the Crowdlending industry.

My biggest concerns are:

- Do they have enough business insights to make sure the projects they select will be able to return the loans?

- Buyback guarantee is very popular these days, it’s something most investors want. But will Kuetzal be able to cover a defaulted project?

Only time will tell. Before my trip I was skeptic and hesitant. Now I’m planning to invest a couple of thousand euros to see how it works out.

If I’m happy with the platform after a few months, I will probably use the next campaign to add more funds to my account.

Campaigns and Promo code

Kuetzal is planning a summer campaign, which could be a cash back campaign. They haven’t decided on the exact details yet.

If you want to give Kuetzal a go you can use the promo code FINANCIALLYFREE to get a 15€ gift, instantly credited to your account.

Minimum deposit and investment is 100€.

Comments are closed.