Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

First off, I’d like to apoligize. I know my responses to questions on email, Facebook and blog comments have been slower than usual.

November was crazy busy for me. It started with 2½ weeks in another work location, then traveling around in the Baltics to visit FastInvest, Crowdestor and Grupeer. While it has been a great month with a lot of new impressions I must admit I look forward to December. Hopefully it will be less stressful.

Sometimes it can be hard to live up to expectations from kids and family, my IT job and you guys here on the Blog. Just know, that I do my best.

On the bright side, my investments are doing really good and income keeps rising. Even blog income keeps climbing.

I’m still amazed that some of you write to me directly to make sure you use my affiliate link and support the blog. You guys are the most supportive and loyal readers I could imagine, I can’t thank you enough! <3

On to the numbers!!

Income Statement: November 2018

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora | -246,92€ | -2,52% | 16.100€ | 25.317€ |

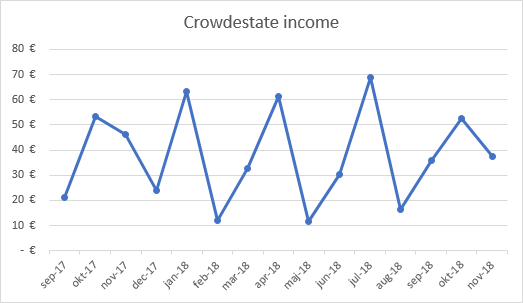

| Crowdestate | 37,61€ | 7,35% | 7.000€ | 7.567€ |

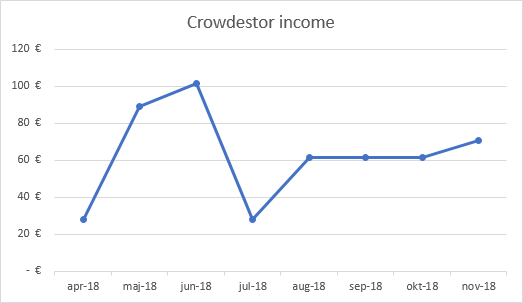

| Crowdestor | 70,85€ | 18,70% | 8.000€ | 8.502€ |

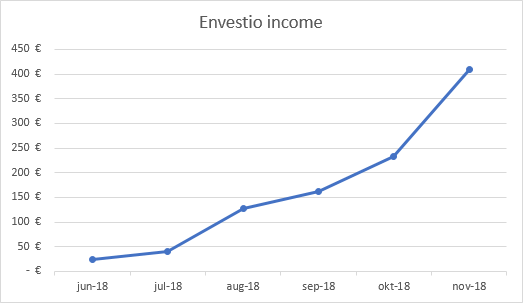

| Envestio | 409,73€ | 21,88% | 20.000€ | 22.946€ |

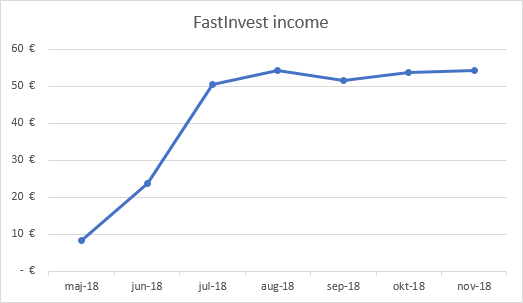

| FastInvest | 54,39€ | 14,96% | 4.100€ | 4.496€ |

| Grupeer | 126,79€ | 12,62% | 10.000€ | 10.755€ |

| Mintos | 109,69€ | 14,82% | 8.000€ | 9.394€ |

| Robocash | 30,33€ | 12,06% | 6.000€ | 6.745€ |

| Swaper | 130,43€ | 16,76% | 9.000€ | 10.619€ |

| Twino | 20,46€ | 15,63% | 1.300€ | 2.687€ |

| 743,36€ | 89.500€ | 109.035€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 660€ | 75,46% | 18.080€ | 27.160€ |

| Total | 1.403,36€ | 107.580€ | 136.195€ |

My comments to the returns

November income from investments was 1.403,36€ (+12,19€ more than last month.) I reached 46,78% of my first goal (+0,41% more than last month).

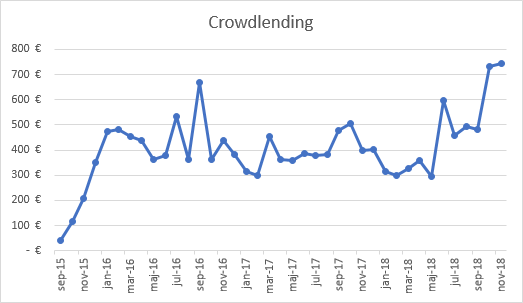

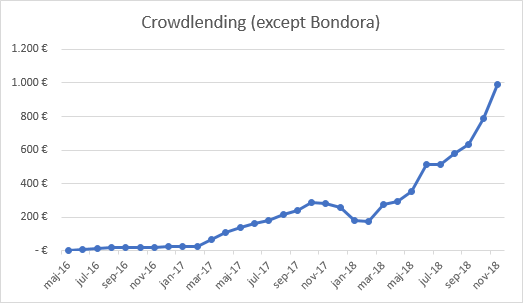

Again, if it wasn’t for Bondora, my Crowdlending income graph would be a lot prettier…

Bondora

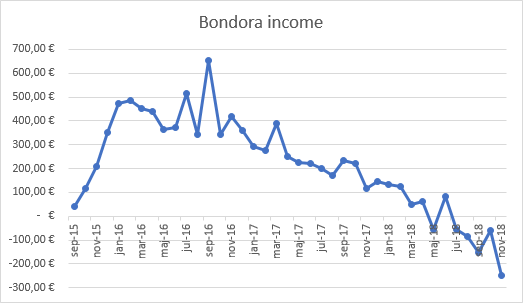

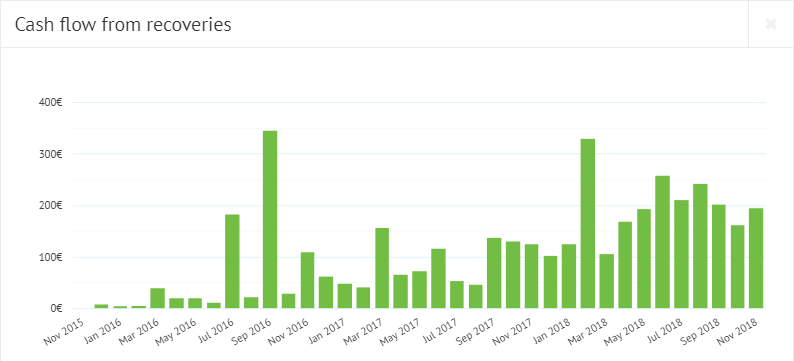

Another negative month on Bondora. 180,03€ interest received but 426,95€ principal missed.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. There’s too many defaults related to the “Portfolio Manager” or “Portfolio Pro” and the costs of recovery is too high. Chances are, that your income graph will look much like mine after a couple of years.

I was able to withdraw 2.000€ again, which makes withdrawals amount to 10.000€. From 26.100€ invested I still have 16.100€ to go to get my money back. It might not ever happen.

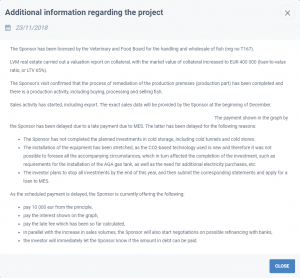

Crowdestate

Crowdestate is still publishing a lot of real estate projects every month. Most of these have interest rates around 11-12%, a bit too low for my liking.

It’s still good for diversification so I will definitely keep reinvesting. It’s just, when you remember the days at Crowdestate where most projects had interest rates abot 18% then it’s a little disappointing to see all those 11% loans now.

Last month I was missing payments from “MMMSprattus OÜ” and “Global Nord Timber (III)”. Global Nord Timber (III) did pay throughout November but the MMMSprattus payment is still delayed. I was supposed to get more than 30€ but they only paid 3,87€.

Additional information about MMMSprattus was released and I’m not worried about the investment. The company still appears to be in good shape.

Crowdestor

As you probably noticed from my last blog post, I recently visited Crowdestor. Read my review and see pictures from my visit here.

Since they decided to take part in the Invest 2019 event in Stuttgart, Germany they now have several exciting projects in the pipeline. A few have been published and a lot more will follow, as current investment opportunities are getting funded.

In November I invested 2.150€ in “INCH2 – Increase of operating capital” and 2.136,63€ in “Restaurant The Catch”. The INCH2 is fully funded, Restaurant “The Catch” is 48% funded and still needs about 50.000€ at the moment.

Envestio

Envestio keeps the momentum. More than 500 new investors joined the platform in November and they funded more than 1.500.000€ worth of investments.

3 new projects were introduced, but mostly further “Tiers” of existing projects were available. All projects with interest rates above 20%.

Some of you ask what I think about the many “Tiers” for each project. I think it’s totally fine. They do it shorten the funding processes and give the borrowers some capital to work with right away.

I would prefer if Envestio announced the full amount the borrower needed when placing the first project on the platform. This way investors wouldn’t get surprised by seeing 5 x 100.000€ funding campaigns, if the borrower is actually looking for 500.000€. So a little improvement in communication would be good 🙂

My 20.000€ investment gave a healthy 409,73€ return in November. Not bad!

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days.

FastInvest

I visited FastInvest on November 15th. I know you’re waiting for the article about my visit, I’m sorry it has not been published yet.

The reason for the delay is, that I wanted to include answers to all your questions. I did in fact receive the answers from Simona today, however a couple of questions were not answered clearly. For example, I asked how many investors were invested in P2P and how many investors were invested in the ICO and she gave me the total number of 28.000. I’m not satisfied with that answer so I’ve asked for further details.

Feel free to call me nick-picky but I want to be sure that all questions are answered in an understandable way, so there will be no more mystery around the FastInvest brand.

Please have a bit of patience, I want to publish it as much as you want to read it!

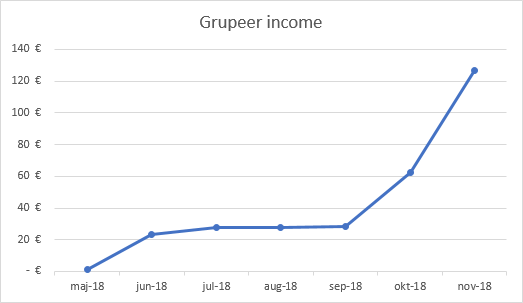

Grupeer

I met Grupeer in November as well! They were really kind to spend ½ the day with us even though it was a Sunday AND Latvia’s 100 year national day celebration. I will release a short article about this short visit as well.

They are still victim to their own success. They gained a lot of popularity and investment projects are sold out as soon as they hit the platform.

When I talked with them, they promised me more projects would come, even with 15% interest rate as we have been used to.

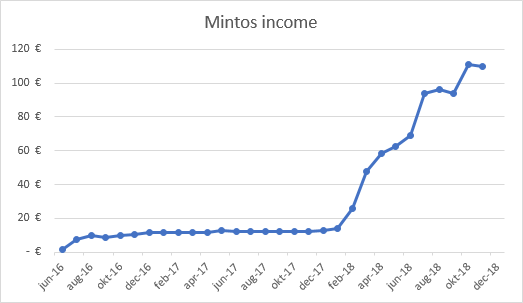

Mintos

Mintos keep adding new loan originators and new markets.

On November 29th they announced that 2 loan originators, DinDin and BIG, had left the platform. It was done in an orderly manner where all loans were bought back, paying investors all principal and interest accrued.

To me it’s great to see that things work out without losses for investors, even when things don’t go as planned.

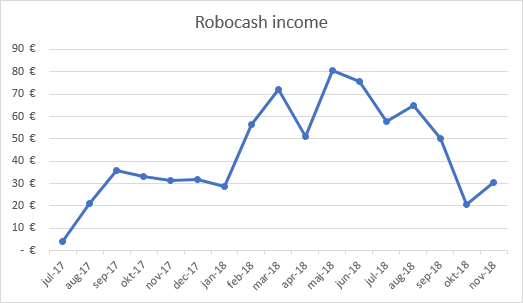

Robocash

In November Robocash announced that all loans on the platform will come with a 12% interest rate. Booooo! 🙂 I mean, they have been open about this since they started the platform. They said that the 14% was to grow faster and attract more investors and that the interest rate was likely to be lowered eventually. It still sucks when that day arrives though.

12% is still competitive compared to Mintos and Twino but I had hoped that 14% would be the standard a little longer.

Note that the drop in the income graph below mainly is due to installment loans which only pays principal and interest back after 1 year.

They also stopped paying advertisers for referrals, so it’s pretty clear they reached a stage where they are satisfied with the number of investors.

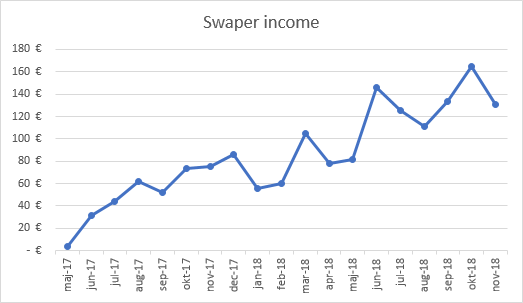

Swaper

Swaper is still out of loans most of the time. Money does get invested several times a month but 10-20% of my portfolio value remains un-invested at all times, which is a bit annoying.

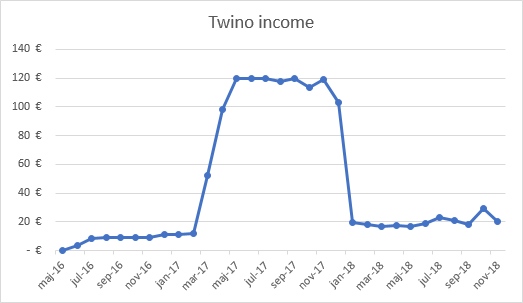

Twino

My children’s savings account came back into the ~20€ territory. We added 360,61€ to their account on November 13th so it should add ~3€ to the monthly returns in the coming months.

It’s hard to have everything invested as Twino still has problems with cash drag.

Real Estate

One of the tenants was late paying the rent and when it finally came in I was paid 10€ less than planned. I was told that he/she had no more money and would pay the difference with next months rent. Let’s see how that goes.

Going into 2019, I sent both tenants a formal letter that the rent would be raised according to changes in the “net price index”. It’s a small change but it’s always interesting to see if they remember to adjust the payments.

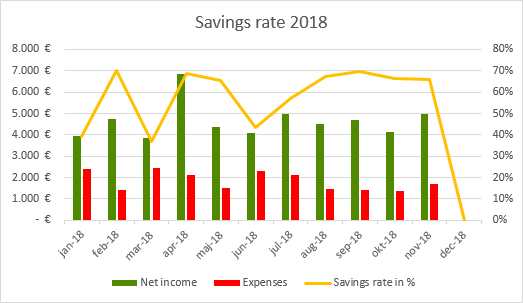

Savings rate

My savings rate for November ended up at 65,91% (-0,36% compared to last month). I hit my goal of a 60% savings rate for 2018, now I just need to keep spending tight in December and the goal will be completed! It might be easier said than done in December, but I’ll do my best!

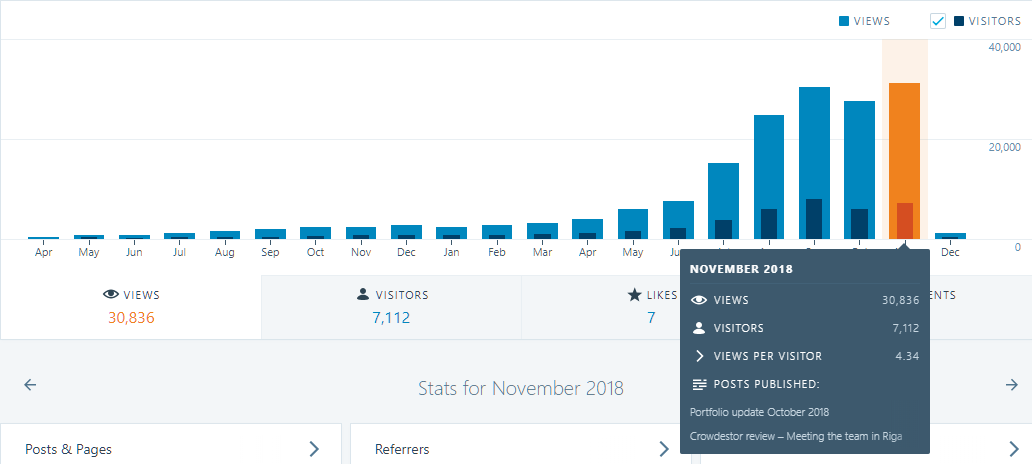

Blog statistics

The blog traffic is slowly increasing again, trying to break the “all time high” from September.

September was higher due to paid traffic from Facebook where at least 2.000 visitors came from Facebook Ads. In October, I stopped paying for Facebook Ads all together.

November actually set a new record for “page views”, where we still need another 1.000 visitors to break the record of 8.043 visitors in a single month.

Visitors: 7.112 (+18,67% compared to last month)

Page views: 30.836 (+12,86% compared to last month)

686 subscribers (384 WordPress, 302 Sumo) (+109 compared to last month)

404 Facebook likes (+40 compared to last month)

Advertising

As you might have noticed I have added 1 AD to the blog. I hope you don’t mind, I really don’t like ads myself. The reason is, I get some emails from people who want to start their own blog and ask for hosting options.

If you think about starting your own blog I can fully recommend SiteGround, especially if the main part of your readers will come from Europe. I tried other American hosting services for a similar low price but the difference in performance is HUGE.

FinanciallyFree is hosted on SiteGround for the incredible low price of 3,95€ per month. Even with 30.000 page views it’s still pretty fast don’t you think?

Until next time!

I’m still debating with myself whether I should invest more into Crowdlending in December or if I should save everything up for the next real estate purchase. While real estate has higher earnings potential it’s also more work. I will buy more real estate for sure, the question is only when.

Remember, you can always check the portfolio page to see when I invest or withdraw from a platform.

And by the way, check out the quote of the month from Mr. Money Mustache. I love it!

If you enjoyed this post, please smash that like button below and/or share it with your friends.

Comments are closed.