Why is savings rate important?

When you are steering towards Financial Freedom it’s fun and satisfying to look at your income raising from month to month. However, income is only a part of the equation. Expenses are just as important. Still, a lot of people choose to neglect this area. Why? It’s obvious… It means cutting down on all the things you’re used to buy for short term pleasure! Who want’s to cut down on fun? We all want to be rich to spend lots of money, right?

Raise your awareness

The thing is, every small purchase will postpone the day you will be able to retire as a financially free human being. Every unnecessary thing you buy means more working years. Is it really worth it? You don’t necessarily have to be a fanatic about money and sit on your wallet like a cheap Scotchman during a financial crisis. But if you start being aware and ask yourself if you really need the thing you’re about to buy, you’re doing yourself a huge favor. More often than not, you will be able to postpone the purchase. Maybe you will even forget that you wanted it in the first place.

To make it easier to save, I tell myself: I’m not denying myself this treat. I’m going to get it… LATER. I’m just postponing the purchase a few years. I’m going to buy it when I’m rich – when I’m financially free!

Be grateful for what you already have

Throughout the day I remind myself of all the things I’m grateful for. Small things like “drinking a glass of fresh cold water”, “having a nice bed with a soft pillow to rest my head at night”, “my children” or “good health”. The more you remind yourself of all the good things you already have in your in life, the easier it is to stop spending money on things you don’t really need.

When will I be able to retire?

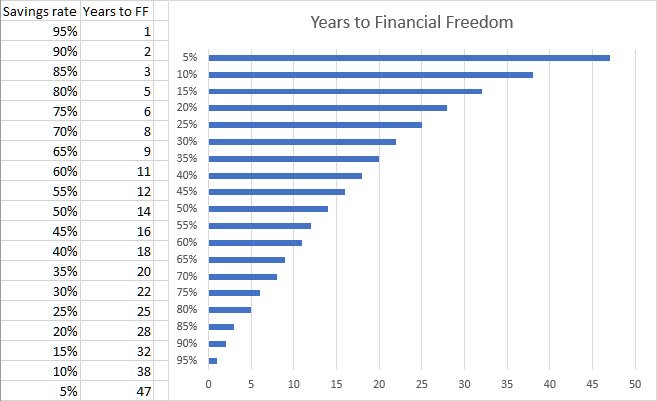

Take a look at the chart below. It shows when you will be financially free based on your savings rate. It assumes an 8% interest rate and a 4% withdrawal rate. 8 and 4 percent is what most financial independence guru’s consider reasonable numbers. If I manage to maintain a 55-60% savings rate, I will be able to retire in 11-12 years. I started 2 years ago so I have 9-10 years left. I hope my investments will have a better return than 8%. A decade seem so far away!

My personal numbers

I just published a new page called “Savings rate“. Here you can find a complete summary of my job income, expenses and savings rate from 2016 to 2018. It will be updated every month as well. I hope this will give you insight and maybe inspire you to take action to reduce your spending and grow your income.

See the new Savings rate page here.

Conclusion

If you’re looking for an answer to the post title, the short answer is “Try to do both”. Both methods will save you equally many years in the process of reaching financial independence. Higher income is preferred as it gives you better options to choose what you want to spend your money on. But sometimes it’s easier to cut down your spending than getting a raise.

Happy savings everyone!

Comments are closed.