This Mintos review is based entirely on my experiences after 3 years of investing. Always do your own research.

What is Mintos?

Mintos is a Latvian P2P investment marketplace that connects alternative lending companies with investors all over the world. The platform launched in January 2015 and currently serve 59 loan originators and more than 100 000 investors from 73 countries. Loans worth more than 1.5 billion euro’s have been funded since it’s inception.

Mintos has three offices employing 51 people in Riga, Warsaw and Mexico City, with offices shortly opening in Brazil, Russia and South East Asia. By the end of the year, they plan to double the number of employees.

Mintos is the peer-to-peer lending market leader for continental Europe with a 38% market share according to AltFi Data. Less than 3 years after launching, Mintos reached profitability in 2017 with a revenue of 2.1 million EUR and net profit of 196 000 EUR.

Mintos won AltFi’s “People’s choice award” in 2016, 2017, 2018, 2019 and “Alternative finance platform of the year” in 2019.

What kind of returns can I expect?

Click here to see how my Mintos portfolio has evolved over time. The page is updated every month!

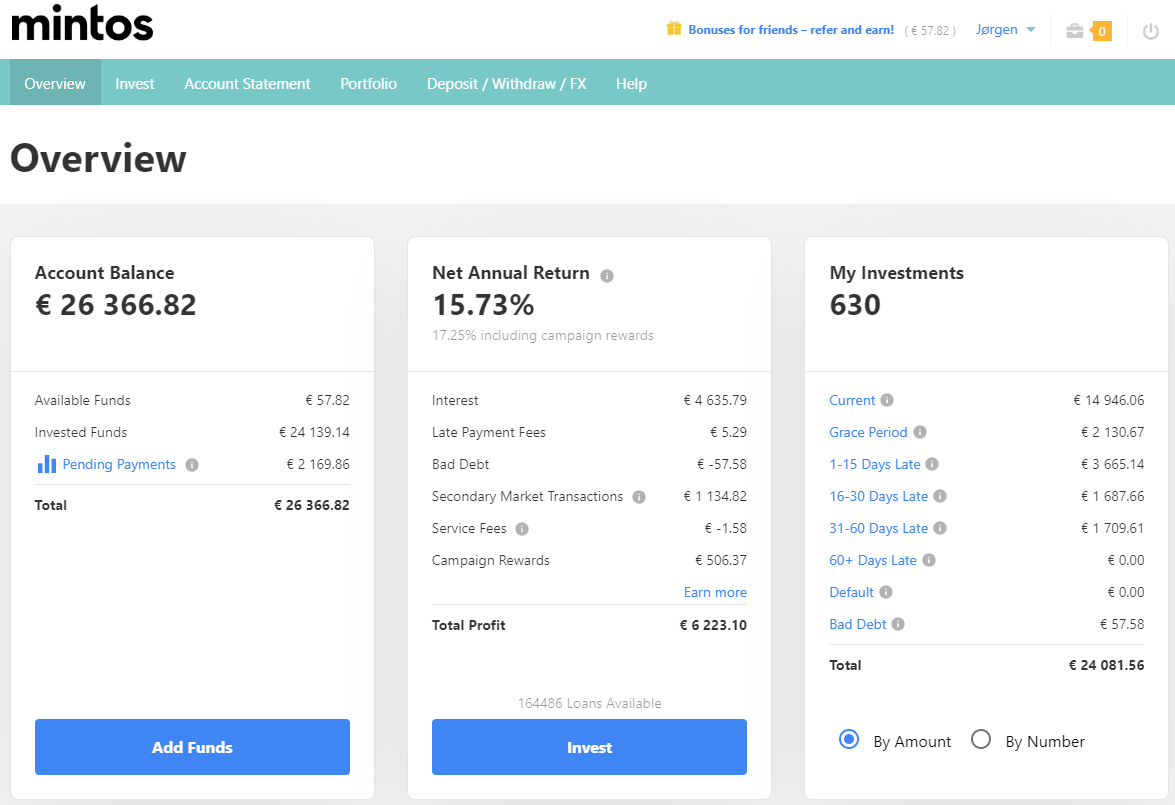

I have invested with Mintos since 07.02.2016 and my returns have been stable and predictable month after month.

My personal net return is 15.73% which is well within range of what you can expect to get. Most loans have interest rates from 10% to 20%. The net average return across the platform is 12.72%.

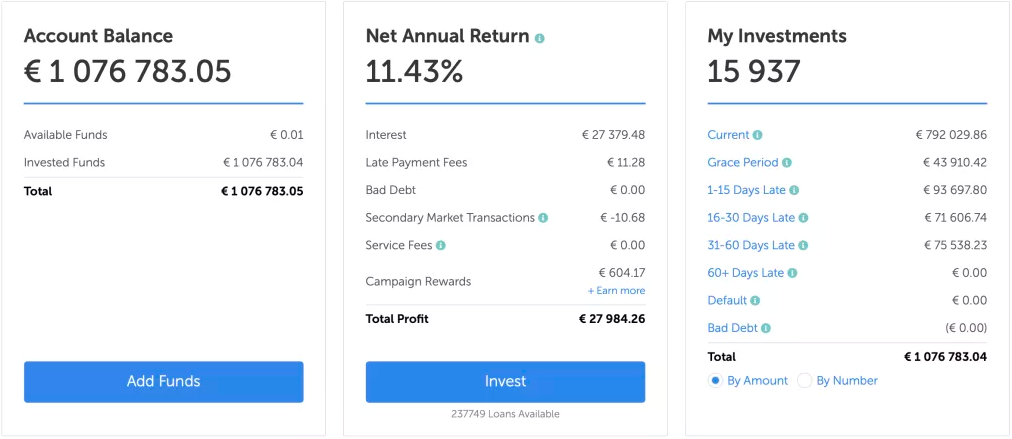

Mintos is a highly trusted platform and some people invest very large amounts there. Here’s an example of a million dollar portfolio:

Buyback guarantee

At the time of writing a massive 201 423 loans are available on the primary market. Only 191 of these have no buyback guarantee.

But what is the definition of a buyback guarantee on Mintos? It’s essentially a promise from the loan originator, that if a borrower fails to make repayments for 60 days, the loan originator will step in and give you back the invested principal + interest earned for the period you held the loan, including the 60 overdue days.

It doesn’t make it risk free. It simply transfers the risk from the borrower to the loan originator, so you don’t have to worry about each and every borrower in your portfolio. Instead you only have to worry about the loan originator defaulting. If the loan originator has a healthy and profitable business then you will be able to profit.

Personally I think the buyback guarantee makes P2P lending much more appealing to the average investor!

What if a loan originator goes bankrupt?

It’s unlikely that all loan originators will perform flawlessly for all eternity. P2P lending is a booming industry and “survival of the fittest” also applies here. After 5 years of service Mintos has seen 8 out of 70 loan originators default on their obligations.

I will not go too much into detail about defaults in this post, just be aware that bankruptcy of a loan originator can happen.

You can read more about defaulted loan originators in this Mintos blog post from July 2nd 2020.

Campaign rewards

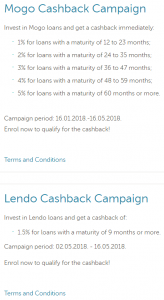

In 2018 Mintos introduced campaign rewards. It basically means that you get cash back when you invest in loans from a certain loan originator.

Below you can see some examples of these cashback campaigns.

Let’s say you invest 10 000€ in cashback loans. You get 5% back which is 500€. If you invest those 500€ and get 25€ back. Continuing to invest those 25€ you get 1,25€ back. Now your account value is 10 526.25€. Some of these loans might even be bought back if the loan agreements are changed. In that case you will receive your invested principal and interest back, which you can invest in new cashback loans.

Long story short, the cashback campaigns can give a really nice bump to your invested amount in a short period of time!

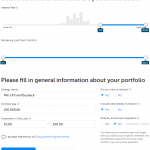

Setting up Auto-Invest

Like most platforms, Mintos have an “Auto-Invest” feature so you don’t have to select loans manually every time your account has cash available.

My Mintos portfolio is not diversified much. I’d rather maximize the potential on each platform and spread the risk between different platforms instead, but that’s just a personal preference. I cannot give you any specific advise on who and what to invest in, but I can show you how I have set up my auto-invest.

I have created 3 auto-invest strategies:

- Primary market: Min. 14% interest rate and buyback guarantee with any duration.

- Secondary market: Loans with buyback guarantee and 14% interest rate, duration up to 60 months.

- Primary market: Loans with buyback guarantee and 13% interest rate, duration up to 12 months.

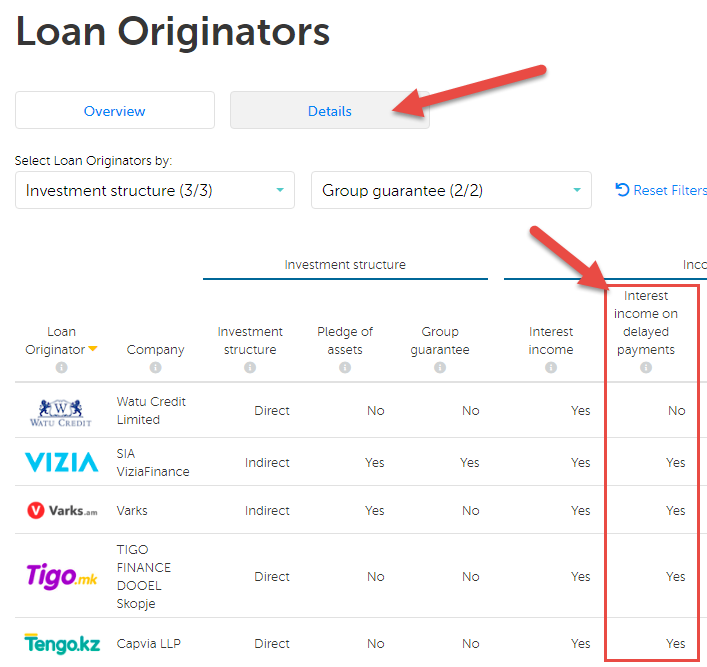

I select only the loans originators with Mintos rating from A-B, where the originator pays interest for delayed and defaulted loans.

Unfortunately, the auto-invest tool does not favor higher interest loans. If you set min. interest rate to 12% and 15% loans are available you could get 12, 13, 14 or 15% interest loans.

My auto-invest settings

Below you can see my current Auto-Invest settings. In my opinion there’s no right or wrong, it’s just a personal preference.

I adjust the settings once a month to include new originators and to make sure I get the highest interest rate possible.

OBS! To make sure you earn interest on delayed/defaulted loans, only add the loan originators who fits this criteria.

Look for this information under “Loan originators -> Details -> Interest income on delayed payments”.

Secondary Market

The secondary market on Mintos is huge (about the same size as the primary market). A lot of people try to make extra profits by selling loans with a mark-up, or to sell with a discount that is smaller than the cashback they just received.

If you wish to sell your investments and cash in before your loans reaches maturity you can do so on the secondary market. Due to the sheer number of loans available you might have to give a small discount to get any attention from other investors. Unless you have been able to get some high interest loans, those might be able to score you a nice premium.

Market expansion and growth

The rapid expansion and addition of new loan originators over the years is quite impressive. However, I’m a little concerned about the quality of the loan originators they add. Some are very small and some have not been in business long enough to prove their eligibility for existence. Investors have to do a lot of research before adding any new originators to auto-invest. Or take a leap of faith and trust 100% in Mintos’ ability to only add healthy originators to the platform.

Mintos review: Conclusion

The biggest plus about Mintos is probably all the options you have for diversifying your investments. On the other hand it may also the biggest con; there’s so many loan originators and options which makes it hard for new investors to know what to invest in. You have to select and adjust your strategy as new originators join, when new campaigns arrive or when interest rates change due to market competition. If you don’t adjust, you may experience cash drag when no loans fit your criteria. Or you might miss out on higher interest loans if you set the bar too low. That said, I only spend about 30 minutes on a monthly basis, which is not much compared to what I get in return.

If you’re looking for a trusted P2P platform with a long working history and prime diversification options there’s no way around Mintos. They have a really well working platform and good support as well. Combined with the generous buyback campaigns, Mintos is a must have platform in your P2P portfolio.

Bonus: Get 0.5% extra on your first investment

Mintos gives you an exclusive 0.5% bonus on all investments you make within the first 90 days, if you sign up through my Mintos referral link.

Enter your email address into this form on the Mintos web page to get started:

Please share your opinion

Are you already an investor at Mintos? If so, please share your thoughts on the platform in the comments section below. Does it meet you expectations? Are you satisfied with the returns? Do you try to diversify as much as possible, or do you prefer to invest in a few loan originators? How much of your portfolio would you be willing to invest into a P2P platform like this?

Other options

While you’re here, be sure to check out my other investments. Click the “Crowdlending” menu and select an investment from the list to see account screenshots, earnings graphs, deposits/withdrawals etc.

Comments are closed.