Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Last week I traveled to Tallinn, Estonia to visit Bondora. I brought my mom who also invested in Bondora. Visiting a company always gives a better impression of your investment decision. Most of my questions had already been answered on email beforehand but we got a chance to meet and greet the people working there which I highly appreciate.

We traveled with airBaltic from Denmark, through Riga to Tallinn. During the visit we were staying at the TALLINK Spa & Conference Hotel, located in the old town of Tallinn. It’s a nice hotel with a very good breakfast buffet and a wonderful Spa area.

Meeting the Bondora team

Greeting Bondora’s employees in person was a pleasant experience. Everyone was very kind and we got a chance to talk to all the people with I’ve exchanged emails with over the past few years.

Questions asked

- Quality of borrowers

I wanted to get a little more insight into the screening process of new borrowers. To me it seems like more borrowers default on Bondora than on other platforms. We got a detailed explanation of how the automated process works without coming to any conclusions on whether it’s good enough.

- Recovery in Spain

Quite a few of my Spanish loans have defaulted. Recently Bondora put a lot of effort into filing Estonian loans to the court. Naturally, I wanted to hear when something similar was planned in Spain. Bondora explained they had been working on sending out “pay now or we will take the case to court” documents to defaulted borrowers lately. I got the impression that those who doesn’t pay will be taken to court starting from Q2. Bondora is expecting recoveries from the Spanish market to increase manyfold in 2018. I hope they are right 🙂

- Better liquidity

I asked for better liquidity options. Other platforms offer buy back guarantee which makes it very easy to sell your portfolio without losses. Unfortunately, Bondora doesn’t offer buy back guarantee and they don’t plan to introduce it.

However, they do have another product in the pipeline. There’s no official information out yet but they plan to inform about in the coming months. This product should offer better liquidity at the cost of a lower interest rate. I’m not sure if it will be competitive but we will see.

Bondora’s office

Getting around in Tallinn

Being one of the leading FinTech cities in Europe, Tallinn offers a Taxi service called Taxify. It’s more or less the same as Uber but it’s cheaper and there are always a lot of cars available due to the huge local support. When you request a ride you can choose between 4 different types; Taxify (budget), Comfort, Tesla or XL.

We used the service 11 times in 2½ days and the average cost was 5€. I’m a fan!

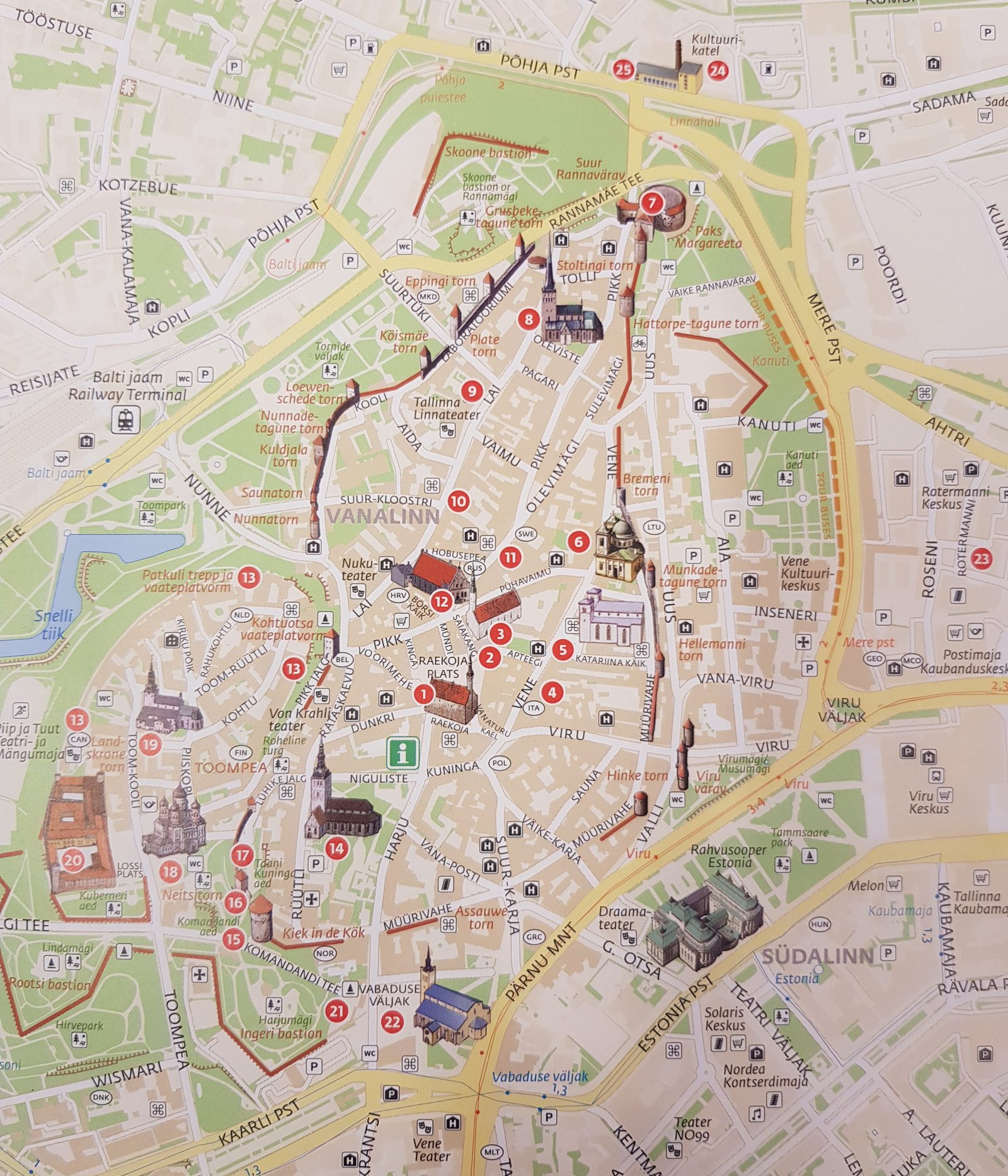

Sightseeing in the Old Town of Tallinn

That’s it for this time. I really enjoyed the trip and I’m seriously thinking about visiting some of the other companies I invested into.

I’m looking forward to giving you another portfolio update on February 1st. Stay tuned!

Comments are closed.