Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

Another month has passed which means it’s time for another monthly update.

The monthly statement has been improved with a XIRR percentage (internal rate of return). This shows the calculated return on investment.

Furthermore, I removed decimals from “Invested” and “Value” to make the table easier to read.

Grupeer Raffle Winner

In this blog post I announced that any new investor who signed up with Grupeer between 21/9 and 30/9-2018 and verified his account, would enter the Grupeer Raffle and have a chance to win 100€.

The winner has been randomly chosen using random.org

And the lucky winner is…

Adrian Bolonio from Austria!

Congratulations to Adrian! Your Grupeer account will be credited with 100€ tomorrow. I wish you the best with your investments!

Monthly portfolio update

I know you’re here for the numbers, so let’s get right to it!

September 2018

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora | -152,90€ | 1,25% | 18.100€ | 27.397€ |

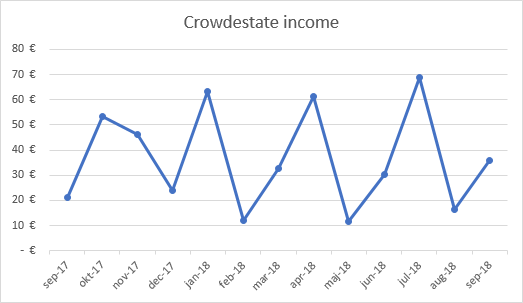

| Crowdestate | 35,88€ | 6,70% | 7.000€ | 7.477€ |

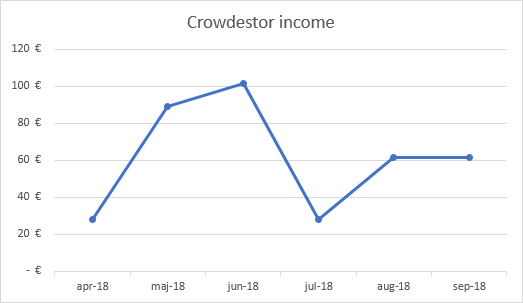

| Crowdestor | 61,43€ | 18,54% | 4.000€ | 4.370€ |

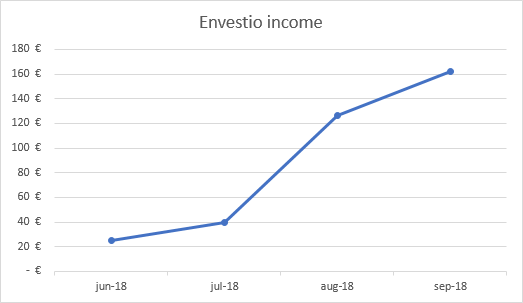

| Envestio | 162,46€ | 17,87% | 13.000€ | 14.263€ |

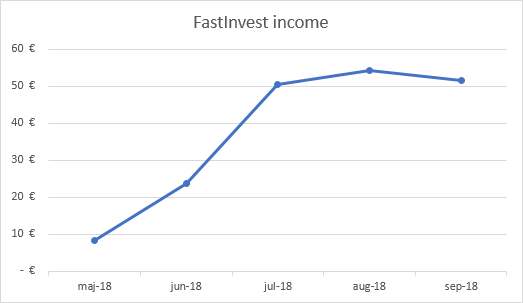

| FastInvest | 51,49€ | 14,03% | 4.100€ | 4.288€ |

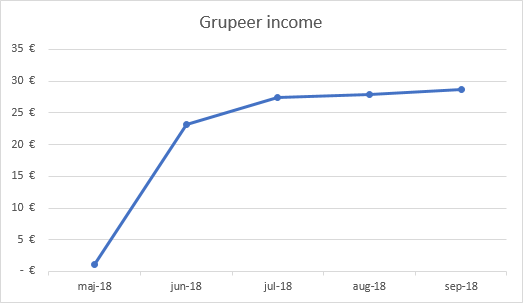

| Grupeer | 28,64€ | 15,36% | 5.000€ | 5.536€ |

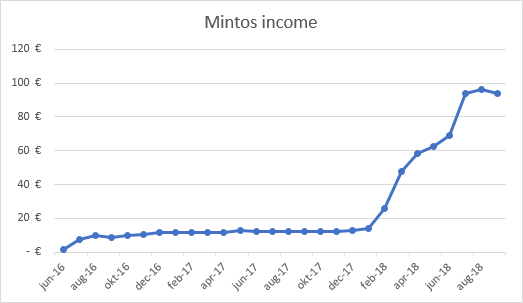

| Mintos | 93,87€ | 14,19% | 8.000€ | 9.174€ |

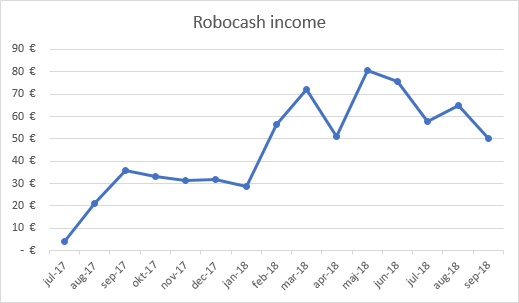

| Robocash | 50,25€ | 13,26% | 6.000€ | 6.694€ |

| Swaper | 133,50€ | 16,05% | 9.000€ | 10.324€ |

| Twino | 18,39€ | 15,44% | 939€ | 2.274€ |

| 483,01€ | 75.139€ | 91.802€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 660€ | 51,43% | 18.080€ | 23.078€ |

| Total from investments | 1.143,01€ | 93.219€ | 114.880€ |

My comments to the returns

September income was -11,58€ lower than last month.

I reached 38,10% of my first goal (-0,39% less than last month).

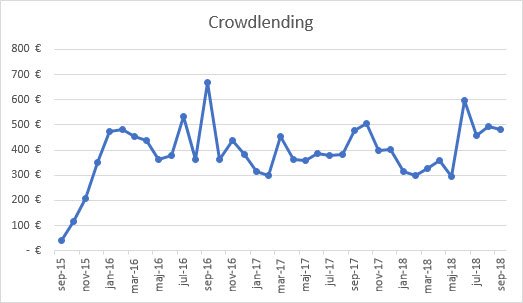

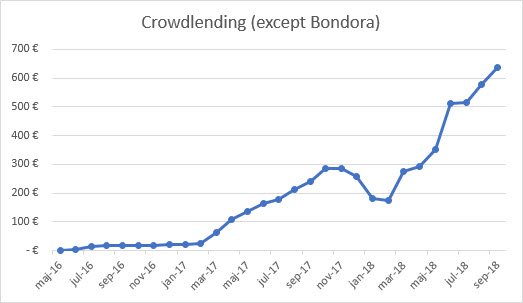

If it wasn’t for Bondora, my Crowdlending income graph would be a lot prettier!

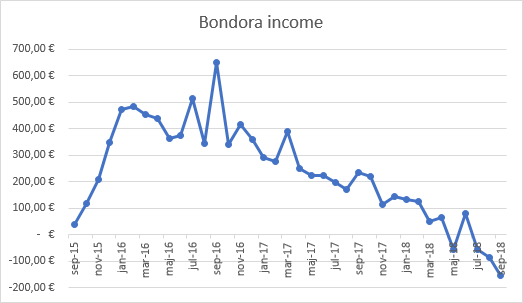

Bondora

To my surprise, people are still signing up with Bondora. I hope they are planning to only invest through the “Go & Grow” concept.

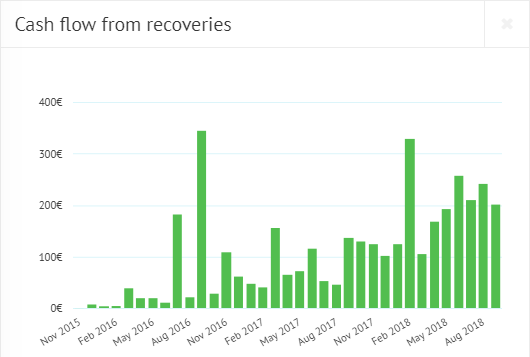

The state of my portfolio should be enough evidence to convince anyone that Bondora is a bad investment. There’s too many defaults and the price of recovery is way too high.

Crowdestate

Crowdestate continue to crank out projects. A total of 6 new projects were released in September. Even at 11% these projects are now devoured in a matter of minutes by hungry investors.

The XIRR calculation for Crowdestate is low because half of the projects I invest in, only pay interest as a bullet payment in the end of the total investment period. I expect the XIRR to rise above 17% eventually.

Crowdestor

Not much to report here, Crowdestor is still going strong. I’d like to see more projects to invest in though. It feels like they’re a bit slow compared to other platforms.

Both projects paid according to schedule.

Envestio

When I wrote my Envestio review in July, 736 active investors had raised 1.246.273€ on the platform. Today, only 2,5 months later, 1.504 investors have raised 4.056.454€.

11 new projects were released in September and most of them are funded already. All projects released last month had interest rates above 20%!

If you’re not investing on Envestio yet you’re missing out on a great opportunity. Where else do you get 17-22% interest rate and buyback guarantee?

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days. That’s 9 full months!

FastInvest

I’m planning to meet FastInvest in November. They already agreed to meet me for an interview and we’re in the process of finding a date that suits all of us.

A lot of people including myself have a lot of question we’d like to have answered. If you’d like me to ask them a question for you, please head over to this post and put your question in the comments section.

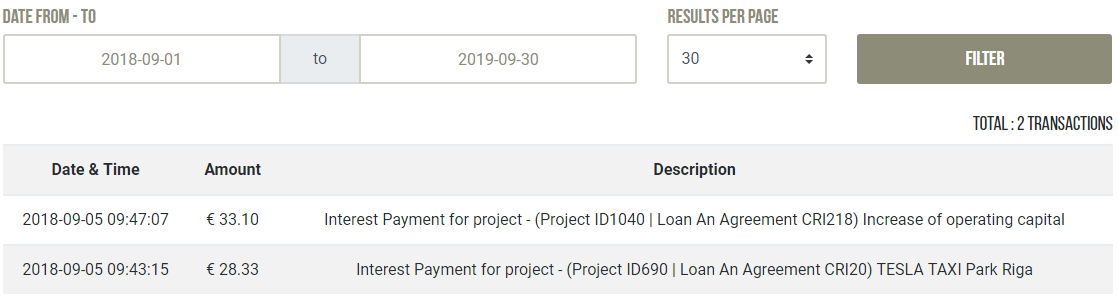

Grupeer

Things are going well at Grupeer. I just transferred another 3.000€ today bringing my total investment to 8.000€. I expect it to arrive in my account on Wednesday.

Mintos

Interest rates at Mintos are currently sitting around 12%, which is better than last month’s 10% but still inferior of the 13-14% we got 3 months ago.

I’m investing into 12% short-terms loans from Varks at the moment. Short-term loans makes it easier for me to get back into 13-14% loans again, if they should appear on the platform.

Robocash

The earned income and XIRR on Robocash is not completely accurate. The reason is the “Installment loans”. They only pay interest when the loan is returned or sold. If I sold those Installment loans now, XIRR would be above 14%.

There’s still more investors than loans available on Robocash. It’s popularity has risen to the point where they have stopped affiliate deals with guys like me, in attempt to reduce the influx of new investors.

Oskars Skreija from Robo.cash writes: ” In the near time there will be added the loan originator from Russia that will considerably improve the situation with loans.”

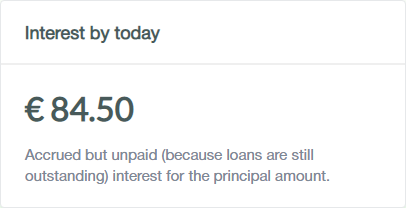

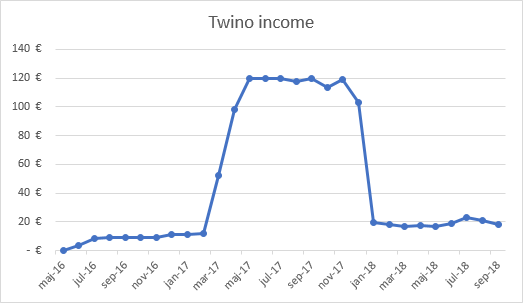

Swaper

Like Robocash, Swaper‘s popularity is rising to the point where cash drag is a real issue. It’s hard for investors get all their money invested.

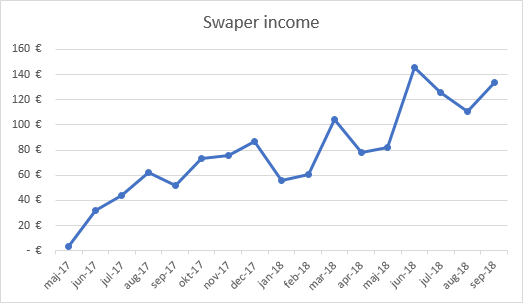

Twino

My children’s savings account continues to return about 20€ per month. Much better than what the banks offer them!

There’s still some work involved in getting 11% loans (forget 12%, those are near impossible to get?!)

Real Estate

Not much to report this month. The rent was paid on time and I didn’t hear from the tenants at all.

I bought this garden sprayer to help combat the weed in the gravel. 2 months ago I spent 5 hours digging it all up by hand. The weed is growing back really fast!

Since I don’t want to spend 5 hours of hard work every couple of months, tougher measures are needed. Hopefully some weed killer once in a while will do the trick.

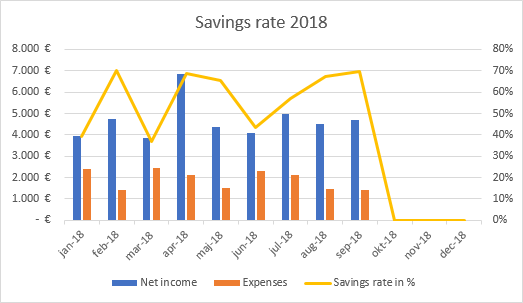

Savings rate

My savings rate for September ended up at 69,82% (+2,43% compared to last month) which is very satisfying. A few more months like this and I’ll reach my goal of a 60% savings rate for 2018.

New Facebook page!

I recently created the Financially Free Facebook page for your those of you who want more content. I will post inspirational content like this several times per week!

Be sure to like the page to stay on track to Financial Freedom with other like-minded people!

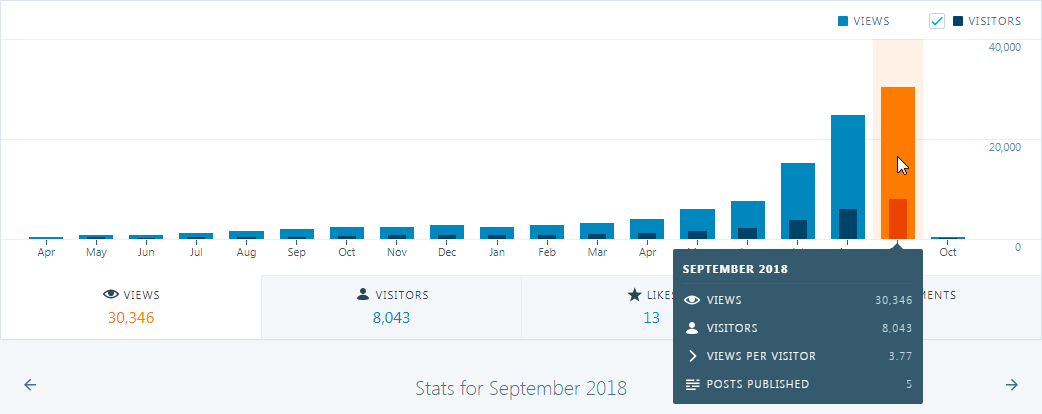

Blog statistics

Visitors: 8.043 (+34,90% since last month)

Page views: 30.346 (+22,56% since last month)

459 subscribers (261 WordPress, 198 Sumo) (+104 since last month)

298 Facebook followers

That’s all for this episode

If you enjoyed this post, please hit the like button below and/or share it with your friends.

How was your month? Are you on track to hit your goals for 2018?

Comments are closed.