Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Monthly cash flow for September

Bondora returned 235,94€ (+66,69€ more than last month)

Twino returned 119,55€ (+1,56€ more than last month)

Swaper returned 52,10€ (-10,22€ less than last month)

Robocash returned 35,82€ (+14,61 more than last month)

Crowdestate returned 21,34€ (first repayment)

Mintos returned 12,33€ (+0,44€ more than last month)

This gives me a total of 477,08€ (+94,42€ more than last month)

which equals 15,90% of my first goal (+3,15% more than last month)

Comments to the returns

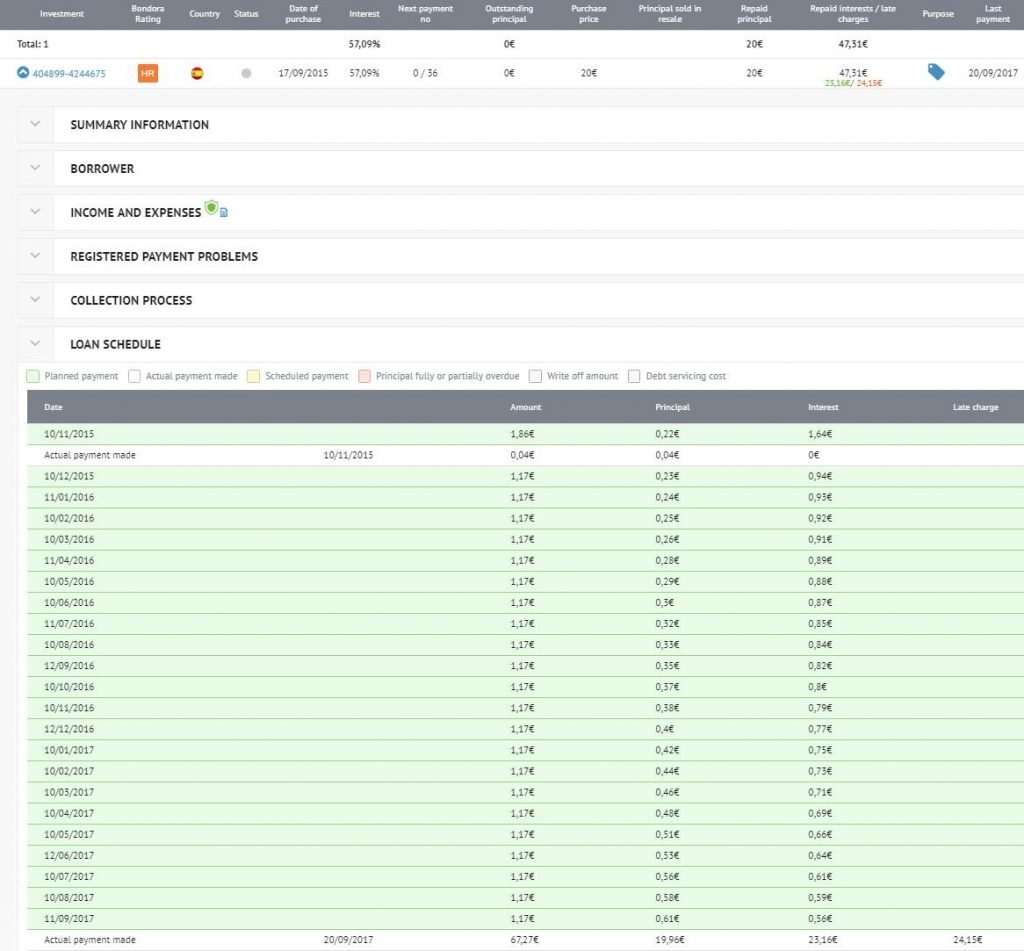

The increase in Bondora this month was primarily due to a 20€ defaulted Spanish HR loan that was fully repaid, including interest and late charges. What’s even more amazing; No DCA fees were deducted! That is a pretty rare case.

This is one of the things I don’t like about Bondora; You never know what you’re going to pay for collection. Sometimes it’s 35%, sometimes it’s 60% and sometimes they don’t take any fees at all. Would a little bit of consistency be too much to ask for?

Swaper

Swaper returned less than last month but it’s not a bad sign. With the buy back guarantee, it’s only a matter of time until it stabilizes around 60€ per month (5.200€ invested at 14% return). I’m looking forward to seeing the design and feature changes they announced a few weeks ago. I talked to the support when I started investing in Swaper and recommended making the investing process easier. It seems like they listened!

Crowdestate

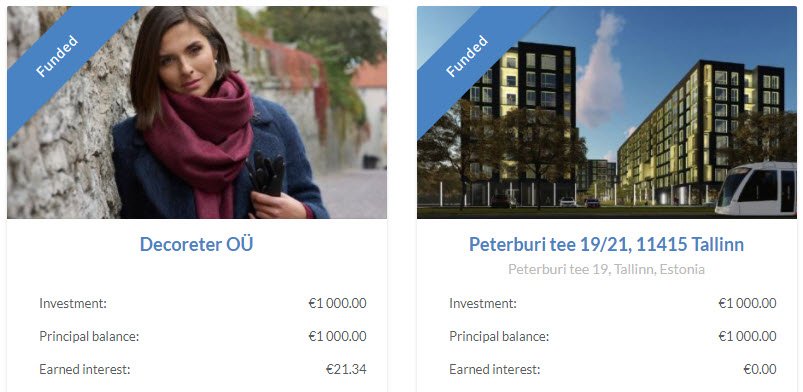

I got my first interest payment from Crowdestate. I invested 1.000€ in the company Decoreter OÜ and they paid their first repayment on time. Some confusion came up last month where I expected the first payment. However, the loan schedule posted on the website was erroneous because the agreed repayment date was 30th of September. It has been corrected and everything is fine now.

On October 13th I’m expecting to receive the first payment from the “Peterburi tee 19/21, 11415 Tallinn” investment. 41,33€ is planned and they are scheduled to pay quarterly. Decoreter OÜ pays monthly. The different payment plans will cause the cash flow from Crowdestate to go up and down from month to month but that’s just the way it is. I’m happy as long as the funds come in.

Real estate

Unfortunately, I was not able to buy the property that I wrote about last month. I didn’t even get the chance to see it in person, it was sold within a few days. I tend to believe everything happens for a reason, so I guess that wasn’t the right property for me after all 🙂

On a more attractive location I went to see another property which was equally priced. The expected return was a quite lower though due to only two apartments instead of three. After viewing the property I quickly decided that this wasn’t the right one for me. Too many things had to be fixed and the asking price didn’t reflect that.

It’s really hard to find a property in good shape yielding a decent return of investment. I’ll keep looking and keep you posted.

Where will my spare money go in October?

I’m trying to getting all my different investments to at least 5.000€. Since I didn’t get to buy any real estate this month, I’ll raise my exposure to brick and mortar through other channels; Crowdestate. Another 2.000€ will be added to my Crowdestate portfolio, bringing my total principal up to 4.000€. Lately, they released two projects with an expected interest near 20% per annum. A representative from Crowdestate told me that another 20% opportunity will be presented soon. Exciting times!

When my portfolio reaches 5.000€ on Crowdestate I will get Robocash to 5.000€ as well.

Consider subscribing, it’s free 🙂

If you like my content and have not yet subscribed, I’d really appreciate if you would do so. As a subscriber you’ll get notifications of new post by email. I promise you’ll only hear from me 1-2 times per month. Navigate to the top of this page, enter your email on the right side box and hit “Subscribe”.

Comments are closed.