Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

Another month went by and I’m ready to present my portfolio update for the month of June.

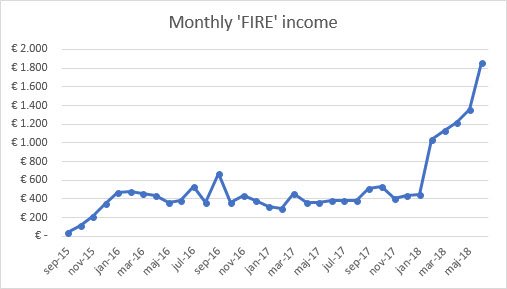

This time, I’m having difficulties finding the right words to express myself. All numbers keep going up, and not just by a small amount… I should be thrilled but it almost feels like it’s going too fast. It seems unreal. Let me show you what I mean:

income statement for June 2018.

P2P Investments:

| Platform | Return | Compared to last month | Account value |

|---|---|---|---|

| Bondora | 81,96€ | +138,54€ | 30.344,80€ |

| Twino | 19,13€ | +2,62€ | 2.214,99€ |

| Mintos | 68,97€ | +6,71€ | 8.884,59€ |

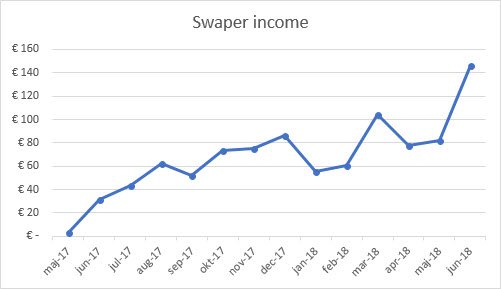

| Swaper | 145,91€ | +63,95€ | 9.954,86€ |

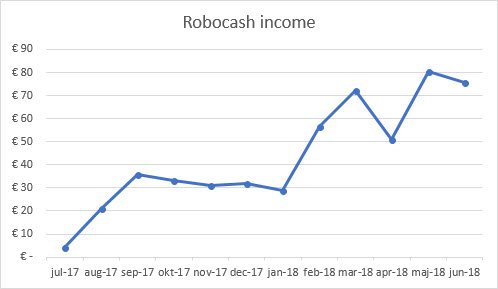

| Robocash | 75,61€ | -5,02€ | 6.521,69€ |

| Crowdestate | 30,15€ | +18,44€ | 7.356,57€ |

| Crowdestor | 101,76€ | +12,58€ | 4.219,27€ |

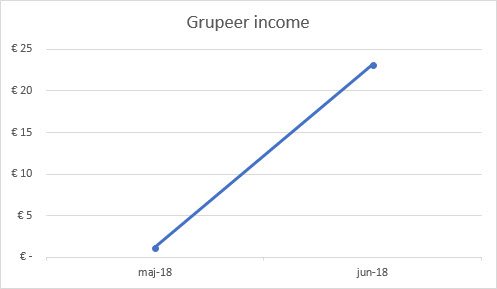

| Grupeer | 23,19€ | +22,07€ | 2.264,38€ |

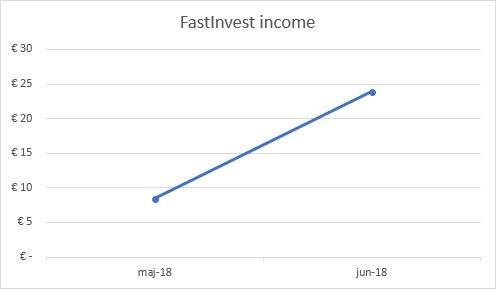

| FastInvest | 23,88€ | +15,43€ | 4.132,33€ |

| Envestio | 24,76€ | +24,76€ | 2.123,76€ |

| Total | 595,32€ | +300,08€ | 78.017,24€ |

Real Estate:

First property returned 660€

Blog:

Blog returned 584,75€ (+178,37€ more than last month)

Grand total:

1.840,07€ (+478,45€ more than last month)

61,34% of my first goal (+15,95% more than last month)

That income graph is litteraly on FIRE!

My comments to the returns

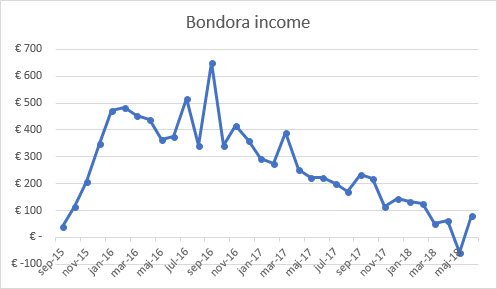

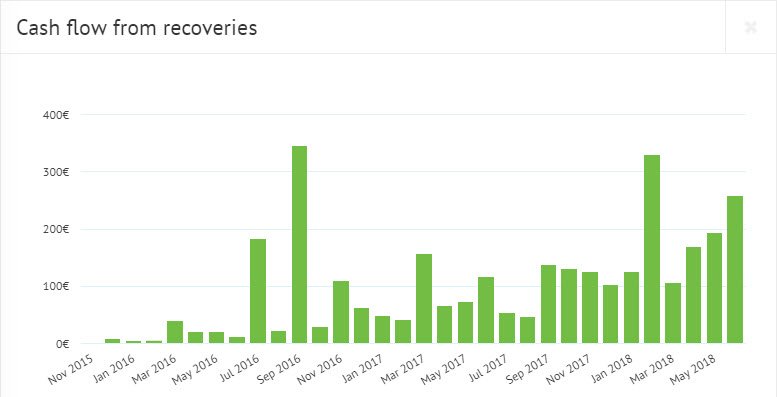

Bondora

If you remember last months update, May 2018 was the first month (but probably not last) where “Net interest earned” was negative.

This month, recoveries from defaulted loans managed to push the returns into positive territory again.

Crowdestate

I invested 900€ in the new Steel Express Haldus OÜ project in June. It has monthly interest payments, which I prefer.

I recently published a review of Crowdestate . If you have not read it yet, you can find it here.

Crowdestor

All projects paid on time on Crowdestor.

The Cryptocurrency Mining Farm exited early and paid back investors everything including a 20% early exit bonus on remaining interest.

2 new projects were published in June. I reinvested the principal and interest from the Crypto project into the Transport project.

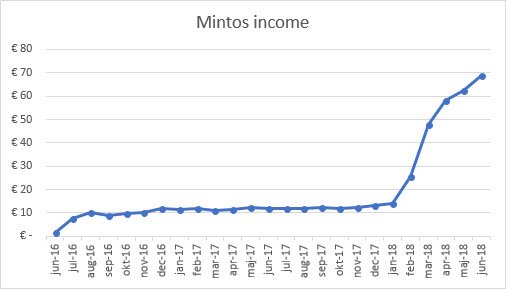

Mintos

I invested another 3.000€ in Mintos on June 7th. It will show in next months update. We should get close to 100€ per month soon.

The Mogo Cashback campaign came to an end. For 6 months investors were able to get up to 5% cash back for loans with durations over 60 month. It was a great opportunity to get some extra capital deployed.

I harvested 408,02€ from cash back campaigns so far.

Swaper

The 2.462€ I deposited on Swaper last month made a nice income spike this month.

Robocash

June was a decent month for Robo.cash. Some cash drag still exist though. From my 6.500€ invested I’ve had 800-1.600€ sitting idle most of June. Reinvestment still happen daily but the amount of principal paid back is greater than the new loans acquired. Robocash are too successful, they get more investors than their current loan volume can handle.

FastInvest

I invested another 2.000€ on FastInvest in June brining my total investment to 4.100€.

I’ll write a complete review about FastInvest when I have gathered enough information and experience to do so.

Grupeer

I received my first full month of payments from the projects I invested in at Grupeer. Flawless experience and they all paid on time.

Envestio

When I find a new platform I’d like to invest in, I like to meet the team in person to see what they’re all about. It gives me a good feeling about the company so I know if it’s somewhere I’ll feel safe to put my money.

I just returned from a trip to Riga, Latvia where I had the opportunity to meet a part of the Envestio team, see some of their projects and ask all the questions I could think of.

It was a great experience and I will make a complete blog post about the visit shortly!

Real Estate

Not much new here. One of my tenants called because their oven died. I purchased and installed a new one the very next day. As a landlord I want to act quick and offer good service to my tenants.

The property also has a garden that I need to take care of. During the summer everything is growing quicker so I spend about an hour a week to remove weeds, mow the lawn cut down trees etc. Owning a rental property is not a passive investment. It takes some of your time but it’s definitely worth it!

I’d love to buy another rental property as soon as possible. I will have to set up another meeting with the bank. I was turned down last time, because they insisted on me bringing 20% cash. But I’m not giving up! Bringing proof of a solid cash flow should be just as good as cash, right?

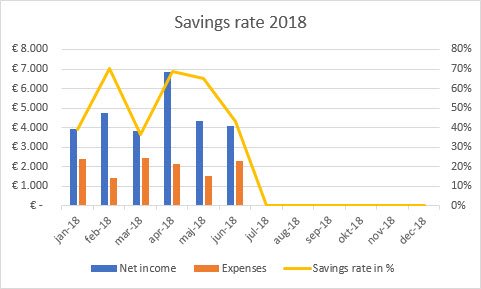

Savings rate

In June I managed to get a savings rate of 43%, which is okay. Optimally, it should be more than 50% but at the same time, I still want to spend money on experiences with my family. We got coupons for the amusement park Djurs Sommerland at an attractive price, including transport and lunch buffet for ~27€ per person. The kids deserves trips like this once in a while. Who want’s to be remembered as the stingy father who saved every penny he earned?

I also paid for the rest of our vacation in Italy, so naturally the expenses were higher this month.

Expenses

Some of you have asked if I could outline my expenses for you. I will give it a shot and post a simple list of my expenses for June. Maybe I’ll find a better way to present it next month.

Costs of living:

Rent and electricity: 805€

Last payment for vacation: 575€

“After school care” for the children: 364€

Groceries: 127€

Entertainment:

Djurs Sommerland (amusement park): 108€

Lunch for 2 on the AirBaltic plane to Riga (both ways): 56€

Beer and water at a concert: 18€

Transport:

Gasoline for the car: 136€

Car taxes for ½ a year: 45€

Train tickets: 21€

Airport parking: 14€

Misc:

Present to a work colleague: 4€

Banking fees: 10€

Google Ads: 25€

Total expenses for June: 2.308€

If you wonder why there’s no internet bill on the list, it’s because my employer pays for this. And I don’t watch TV 🙂

The blog keeps growing

2.180 people visited financiallyfree.eu in June 2018 with a total of 7.448 page views . That’s a 43,6% increase compared to May! It’s still a small number compared to other personal finance blogs, but I feel incredibly blessed to have so many readers. Writing new posts is much more fun, when a lot of people want to read them.

That’s it for this month’s portfolio update. Enjoy the summer!

If you enjoyed this post, please press the like button below and/or share it with your friends.

Comments are closed.