Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Monthly cash flow for December

Bondora returned 144,69€ (+13,87€ more than last month)

Twino returned 102,85€ (-16,25€ less than last month)

Swaper returned 86,43€ (+11,00€ more than last month)

Robocash returned 31,71€ (+0,47€ more than last month)

Crowdestate returned 23,96€ (-22,35€ less than last month)

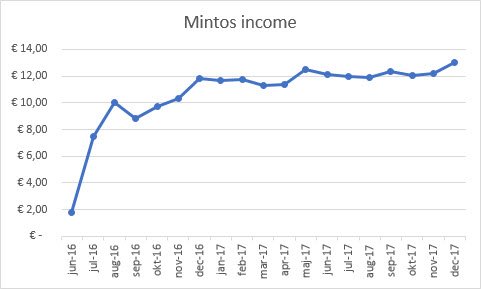

Mintos returned 13,03€ (+0,86€ more than last month)

This gives me a total of 402,67€ (-12,40€ less than last month)

which equals 13,42% of my first goal (-0,42% less than last month)

Comments on the returns

December did not differ significantly from last month. Twino returned less because I withdrew most of the funds, leaving only ~1.600€ of mostly defaulted PG loans. I needed the money for the down payment of the rental property I’m buying.

On Crowdestate I was expecting repayments from Global Nord Timber OÜ and Decoreter OÜ and they both paid. So even though interest earned is less than last month it’s all good!

Remember, companies have many different payment options on Crowdestate. Some pay monthly, some every quarter, and some with a bullet payment in the end. Hence, interest earned will vary a lot from month to month.

Swaper continues to impress me with high returns. I mean 86,43€ on a 5.465€ investment in one month is about almost 19%. The first months were lower of course and I know that the high returns are due to the buyback guarantee kicking in. The dashboard says 14.05 % XIRR but it feels higher. It must go down next month, there’s no way this can continue.

Robocash didn’t set a new record in December as I predicted, it was quite equal to last month. But I’m sure it will go higher, just like Swaper, once more buybacks are effectuated. New loans are still being bought daily, there is no cash drag anymore.

Psst.. Bondora.. This is how a reinvesting graph should look like:

Traveling to Estonia

I’m visiting Bondora’s office in Tallinn on January 12th. I’d like to meet the people behind the platform and have some of my questions answered face to face. I’ll probably make a blog post about the visit, showcasing the office space and maybe feature a little bit of sight seeing in Tallinn. Wouldn’t that be interesting to read?

If you have any questions you’d like me to ask Bondora, please let me know in the comments below!

Real estate

All the paperwork for buying the rental property is done and have been signed. The acquisition date have been changed to February 1st, it was not possible to close the sale between Christmas and New Year. I created a new company, Wolf Ejendomme ApS, that is going to own this and future properties. Now I’m just waiting for the first rent to be paid 🙂

If you are new to this blog and haven’t heard about the rental property before, you can read more about it in this previous post. I will update the Real Estate page as soon as the purchase is finalized completely.

Crypto Currencies

Everyone is talking about Blockchain, Bitcoin and other Crypto currencies at the moment. I’m trying to wrap my head around all the new possibilities Blockchain technology will bring us in the future. It will probably impact the world equally or more than the Internet did in the 90’s.

Just to let you know, I have made a very small investment in Bitcoin and five different altcoins. It’s less than 1.000€ combined and I’m not planning to write much about it on this blog, since it will not generate any monthly cash flow. I’m holding for the long term. It might not be the best time to buy, but having a little skin in the game will definitely raise my curiosity.

Are you interested in being updated on my Crypto-portfolio once in a while? Do you have interest in the topic? Let me know in the comments below and make sure to cast your vote in the Poll!

Happy New Year!

Comments are closed.