Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

We are in March and spring has officially arrived! At least according to the calendar… The rain drops on my window doesn’t remind me of spring but I do live in Denmark, so my expectations are not set too high.

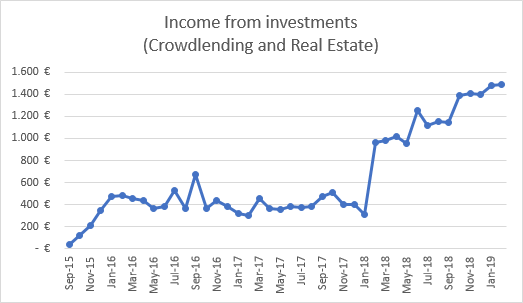

Income from investments – on the other hand – rise and shine!

Let’s dig into the numbers for last month’s earning.

Monthly Income Statement: February 2019

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora | -258,66€ | -3,56% | 16.100€ | 24.671€ |

| Crowdestate | 44,26€ | 7,32% | 7.000€ | 7.687€ |

| Crowdestor | 195,89€ | 18,71% | 15.000€ | 15.967€ |

| Envestio | 417,38€ | 22,30% | 22.897€ | 25.266€ |

| FastInvest | 46,58€ | 15,65% | 4.100€ | 4.658€ |

| Grupeer | 136,77€ | 14,94% | 10.000€ | 11.183€ |

| Mintos | 85,51€ | 14,88% | 8.000€ | 9.676€ |

| Robocash | 53,37€ | 11,31% | 6.000€ | 6.857€ |

| Swaper | 79,13€ | 16,19% | 9.000€ | 10.896€ |

| Twino | 20,29€ | 15,93% | 1.300€ | 2.767€ |

| 820,52€ | 99.397€ | 119.633€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 672€ | 60,73% | 18.080€ | 27.693€ |

| Total | 1.492,52€ | 117.477€ | 147.326€ |

Freedom barometer

“Income from investments” in February was 1.492,52€ (15,26€ more than last month.)

That means I’m 49,75% Financially Free (up 0,51% from last month). Getting close to 50%!

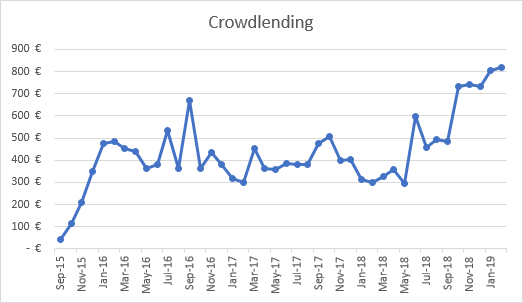

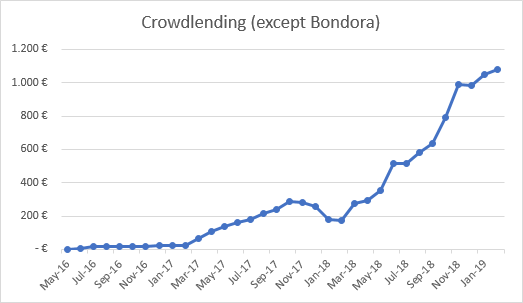

Portfolio performance: Historical view

“Income from Crowdlending” in February was 820,52€.

(15,26€ more than last month.)

“Crowdlending (except Bondora)” reached 1.079,18€.

(31,68€ more than last month.)

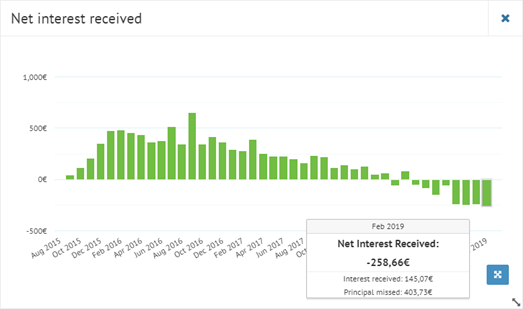

Bondora

Another negative month on Bondora.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. There’s too many defaults related to the “Portfolio Manager” or “Portfolio Pro” and the costs of recovery is too high. Chances are, that your income graph will look much like mine after a couple of years.

See more info and screenshot from my Bondora account

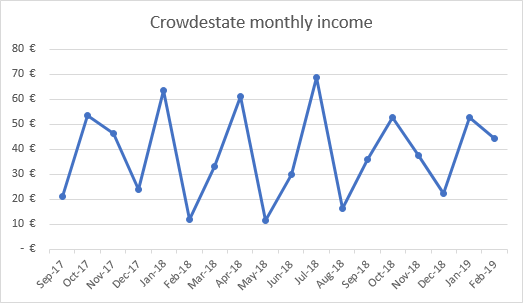

Crowdestate

Crowdestate is slowly doing it’s thing.

I’m looking forward to receive payments from the first development projects I invested in. The income I get at the moment is from short-term (6-12 months) business loans. The first development project will be finished in July 2019 and the second one in March 2020.

On Crowdestate you need patience to see results, as most projects pay the interest when the project is completely finished. That usually take 2-3 years.

See more info and screenshot from my Crowdestate account

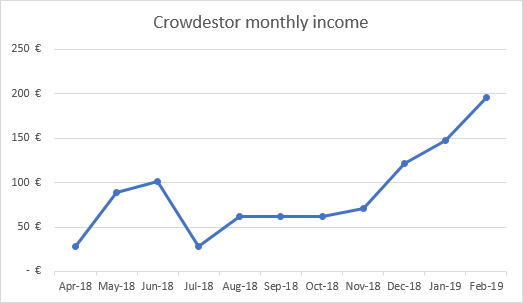

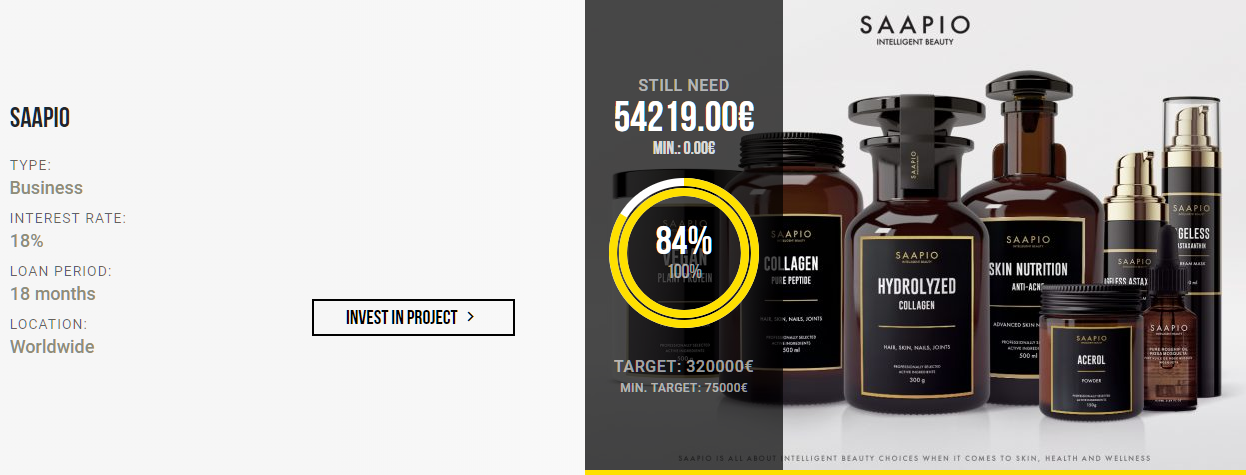

Crowdestor

2 new projects were released on Crowdestor in February and my interest earned keeps rising as well. I’m very pleased with the progress of this platform.

In February I invested 5.000€ in the Energy Production Plant project, which brings my total investment in Crowdestor to 15.000€.

I might add another 5.000€ to the platform in March to invest in one of these exciting projects:

New Crowdestor Buyback fund

Crowdestor just announced that they’re launching a Buyback Fund starting from March 1st. It’s created to protect investors in case of a borrower’s default.

“In case of a default of Borrower, the Platform will compensate all Investors, in a proportionate amount, according to Distribution Rules of Buyback Guarantee Fund, their contributions to the particular project.”

While it doesn’t guarantee full recovery of the invested principal, I think it’s a great improvement that brings extra peace to mind.

Read the details of the Crowdestor Buyback Fund by clicking the picture below.

See more info and screenshot from my Crowdestor account

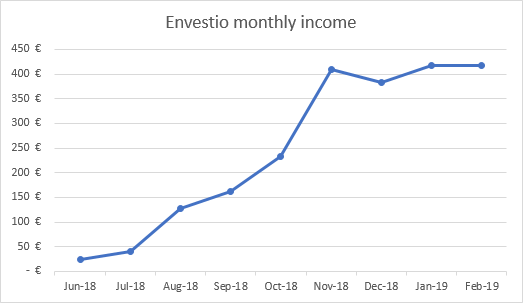

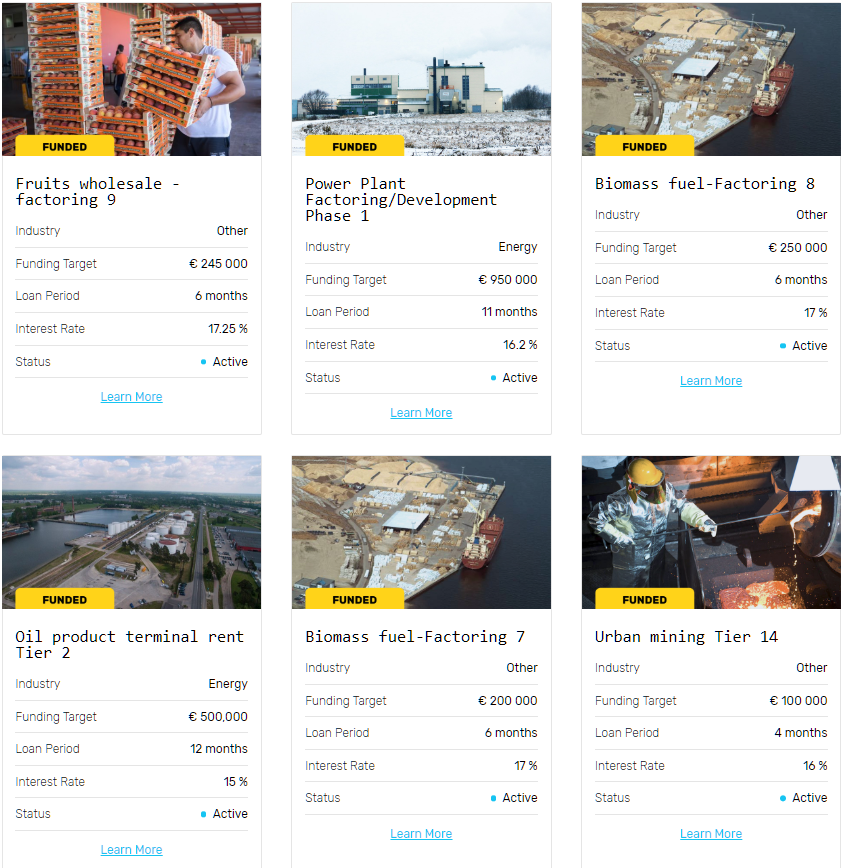

Envestio

Envestio launched 4 new projects from 3 different borrowers in February. Interest rates from 16-17%. All projects are funded now but more will be added in March.

OBS! With the rising popularity of Envestio, you’ll have to transfer money to your account before the project is released, if you want a slice of the pie. They usually get funded within a few hours, so keep an eye on your inbox.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days.

See more info and screenshot from my Envestio account

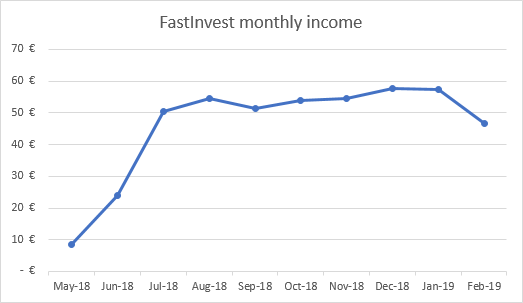

FastInvest

My FastInvest portfolio returned a little less than usual. I didn’t have any cash drag so I expect it’s because February was only 28 days. On March 1st I received 8,5€ interest so let’s see if March will be equally higher.

I know the team is working hard to finish the new version of the website. I’m really looking forward to seeing it in action, it should be released within the first half of 2019.

See more info and screenshot from my FastInvest account

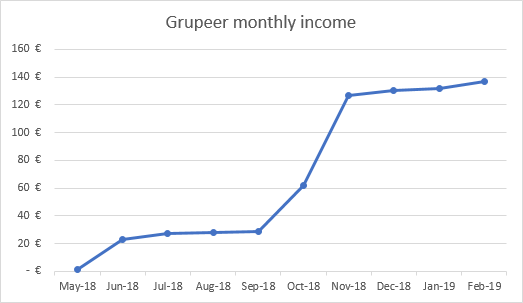

Grupeer

Grupeer is one of my favorite platforms. Some people are not happy that they only have a few loan originators though. It’s a lot harder to diversify compared to Mintos for example. But I don’t mind. I prefer to diversify by investing in several different platforms instead. And the loan originators on Grupeer has proven to be reliable and stable, that matters more to me.

The income graph speaks for itself.

See more info and screenshot from my Grupeer account

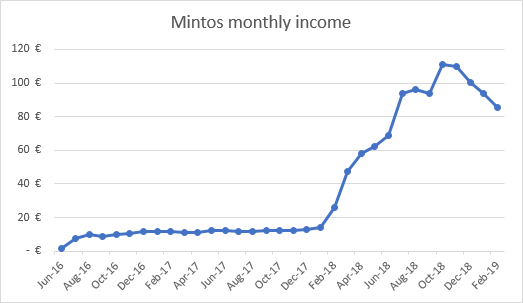

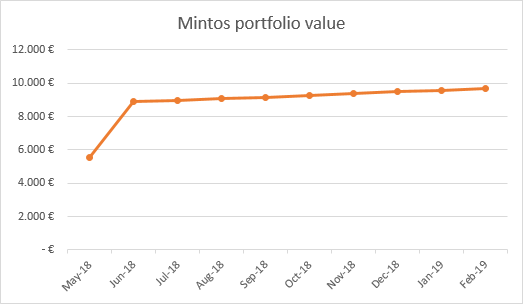

Mintos

My Mintos portfolio returned 85,51€ in February. With 9.676€ invested I should receive about 95€ per month. I expect this small drop is due to the short month and maybe some delay on buyback.

Next month should be above 95€ again.

See more info and screenshot from my Mintos account

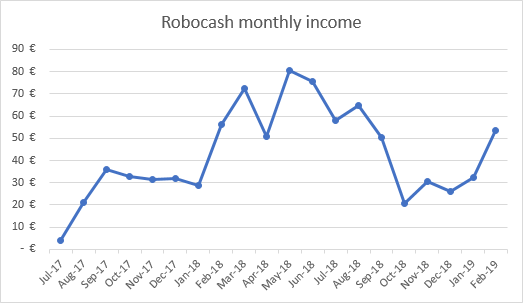

Robocash

Robocash is still giving a nice profit and effortless investing experience. All loans come with 12% and buyback guarantee. It’s the most “hands-off” investment I have. You can literally “set and forget” it.

16.682 loans with a combined value of 1.767.273€ are currently available on the marketplace. The days with cash drag on Robocash are definitely over!

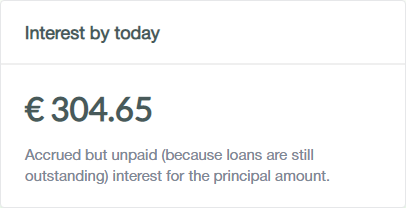

Accrued but unpaid interest (because loans are still outstanding) is slowly building up every day. This amount will be paid out when the 1-year installment loans mature. A few of these 1-year loans were paid back in february, which makes the graph start to look better.

“Interest by today” grew from 287,48€ last month to 304,65€ this month. This means that interest earned on Robocash was actually 53,37 + 17,17 = 70,54€

See more info and screenshot from my Robocash account

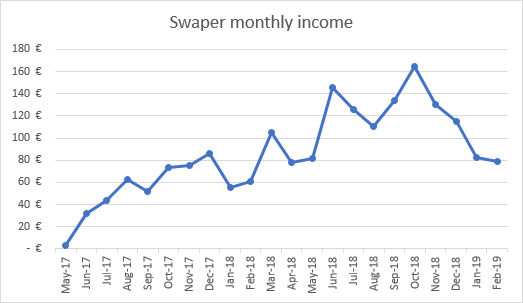

Swaper

Swaper added a good amount of loans to the marketplace in February. For the first time in a while my account is fully invested. No idle funds! I hope this is the new norm but I’m not too optimistic. 4 months of cash drag has left its marks on me.

See more info and screenshot from my Swaper account

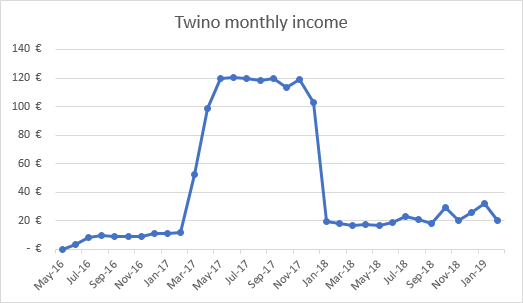

Twino

I lowered my Twino auto-invest to accept loans with min. 10% interest. It was set to min. 11% before. Unfortunately it didn’t change the cash drag situation much. I still have to check the market from time to time to invest idle cash.

See more info and screenshot from my Twino account

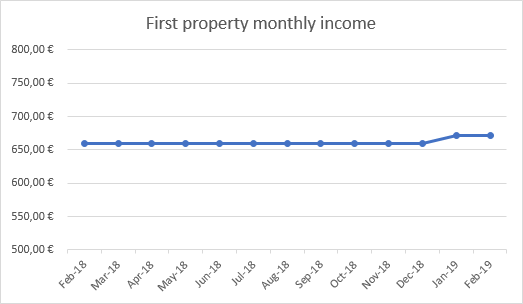

Real Estate

One of my tenants moved out in February. They’re still obliged to pay rent until May 1st though. I hope I’ll be able to find a new tenant and rent it out again as soon as possible.

But first, I’d like to upgrade the kitchen and fix a few things before a new tenant moves in. It’s a lot easier to do this while the apartment is empty.

Here’s a few pictures of the current kitchen. It’s quite dated as you can see.

I discussed different options with a carpenter last Friday. I’m looking forward to receiving an offer. If I get it updated I will keep you posted with pictures of the result.

Property management

A real estate management company started handling rent from the tenants for me. I pay 6,6€ per month per apartment for this service. It’s not really necessary when I only have 2 apartments, but I’d like to get the setup in place so I’m ready to handle more properties.

I also just got an offer from this management company to handle the water consumption accounting, which needs to be done yearly + when a tenant moves out. The fee would be 2,7€ per month for each apartment which I find pretty cheap. So I said yes to that service as well.

That means, that from next month, the rental income will drop 18,6€ in total. Totally worth it I think. Less administration for me is important, especially as I get more properties.

See more info about my First property

Searching for a second property

Speaking about more properties.. In February I put an offer on a new property. The first offer was a low ball and it was rejected (as expected). I made a new and higher offer (still 13% lower than the asking price though) and I’m waiting patiently for a reply from the seller. It would be nice to come to an agreement.

Here’s a picture of the property I hope to buy.

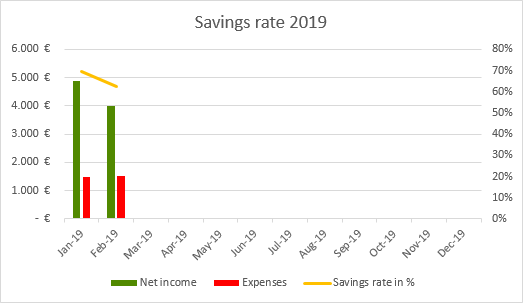

Savings rate

My savings rate for February was 62,37% (-7,03% compared to last month).

I’m still trying to decide whether we need a bigger car that can fit all 5 family members when the 3rd child arrives in late June or start July. That would spell disaster for my savings rate in 2019.

Right now we have a Peugeot 108 and a Ford Fiesta. (2 very small cars.) While I hate the thought of spending lots of money on a new car, I need to figure out a way to bring the family around. More on that later… 🙂

See more info about my Savings rate

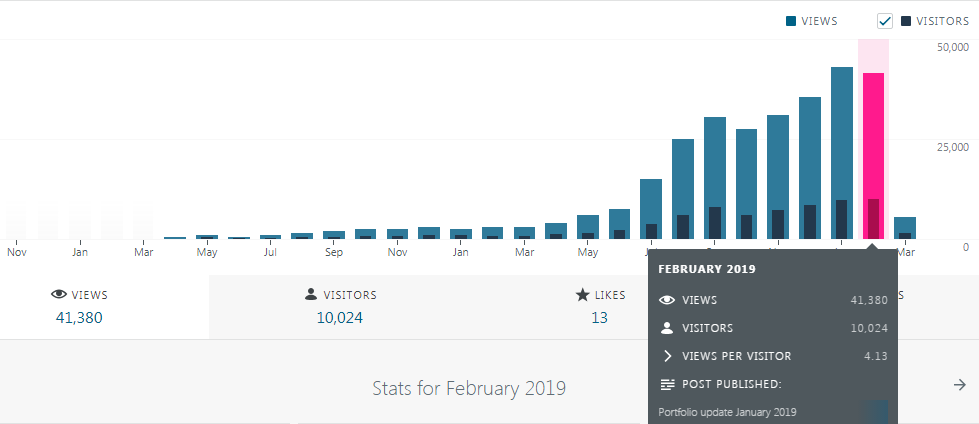

Blog statistics

The number of visitors hit 10.000 in February. Hooray! That’s a really nice milestone to reach.

Visitors: 10.024 (+4,17% compared to last month)

Page views: 41.380 (-3,74% compared to last month)

1.185 subscribers (648 WordPress, 537 Sumo) (+149 compared to last month)

551 Facebook likes (+49 compared to last month)

FinanciallyFree is hosted on SiteGround for the incredible low price of 3,95€ per month. Even with 10k visitors and 41.000 page views per month it’s still pretty fast don’t you think?

More statistics

I added a new graph to all the detailed portfolio sites called “Portfolio value”. Recently, I’ve thought of ways to improve the blog for the readers and I think this information is valuable for you in addition to the monthly earnings.

Unfortunately, the platforms doesn’t display this information so I had to save it myself. I started saving the monthly portfolio values in May 2018. Now that I have collected enough data, it’s time to show the graphs. Hope you like it!

Here’s an example from the detailed Mintos page:

These “detailed info” pages has not received many views, even though I think they bring the most value to the blog. So I’ve created a new top menu called “Investments” with direct access to more info about my accounts. Hope you’ll like it!

That’s it folks!

That’s all I had for this month’s update.

Oh wait, I almost forgot to tell you that I’m visiting another platform in early May! The flight and the hotel room is booked already. I will leave a cliff hanger and reveal the name of the platform later 🙂

It’s one of the platforms I’m really excited to learn more about. I discovered a project on their platform that wasn’t what it was supposed to be. The project was 30% funded but when I called the borrower they said they had no agreement with that particular platform! Maybe the borrower was corrupt, I’m not sure. The borrower’s attitude was rude and he told me to leave them alone.

I got a decent explanation from the CEO of the platform and the project was removed after my discussions with them. It will be good to meet them in person to make sure they are legit before I start investing there.

Sharing is caring

If you enjoyed this post, maybe your friends will like it too? Please consider hitting the like button below and/or share it with your friends.

Comments are closed.