Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

This Crowdestor review is based entirely on my experiences. Always do your own research.

What is Crowdestor?

I recently had the opportunity to visit another crowdlending platform in person. This time, meet the Crowdestor team!

Crowdestor is a peer-to-business marketplace where approved companies can attract funding to help grow their businesses.

I first learned about Crowdestor in February 2018 where I made my first investment and also wrote my “Crowdestor – First impressions” blog post.

More than 3000 people have signed up and completed full registration and verification. Raised funding for projects currently amounts to ~6.000.000 EUR.

It has been a good experience investing with them so far. Interest payments have been paid on time and the first project I invested in has been paid back already. So I was pleased that they wanted to show me more.

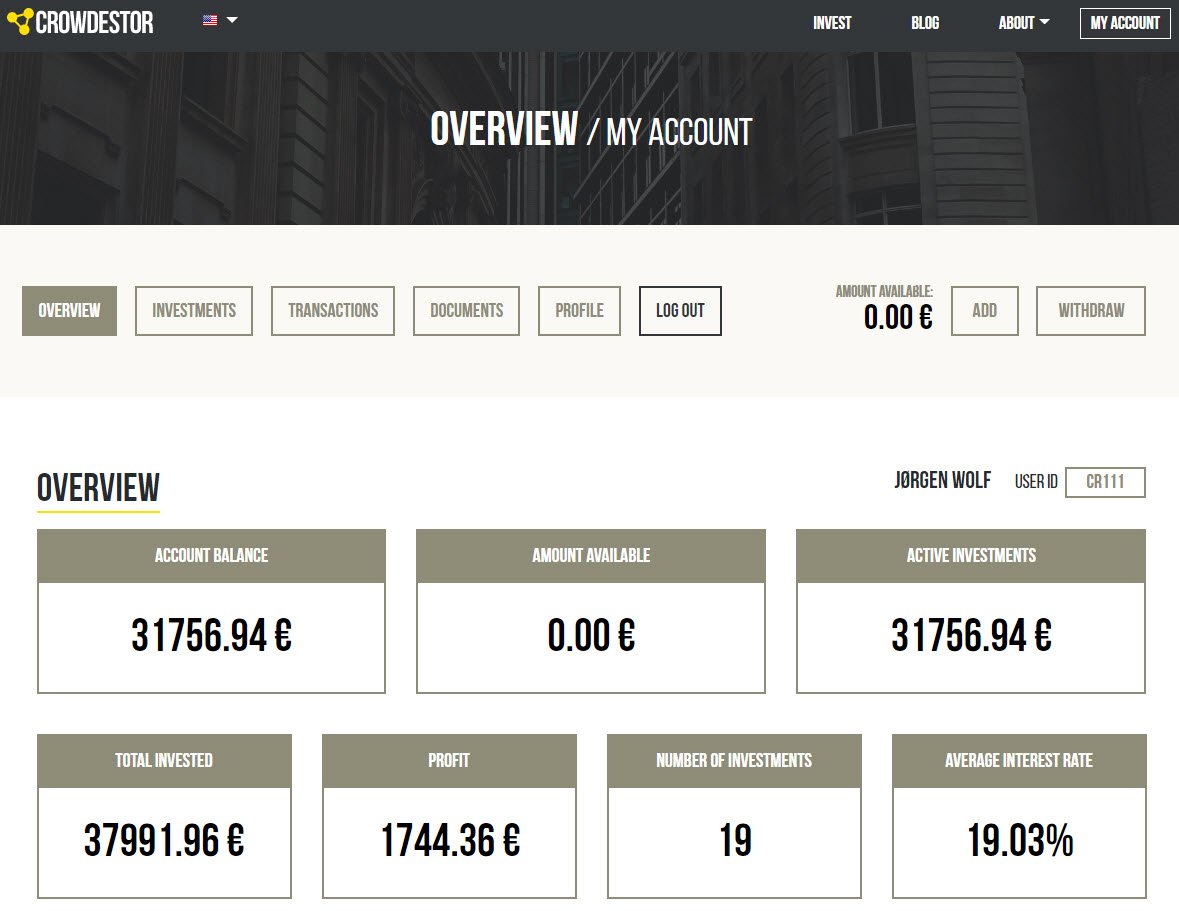

I have invested 30.000€ myself and earned 1.744,36€ interest so far. Here is my account overview from June 11th 2019:

You can track the performance of my Crowdestor portfolio on this page: https://financiallyfree.eu/crowdestor_portfolio/

It’s updated every month!

Visiting some of the projects

Not only did we have the chance to talk with Gunars Udris and Janis Timma for 2 days, they also showed us some of their projects that are currently available on the platform.

The INCH2 project

One of the projects available to invest in, is the fast growing and widely popular fashion brand INCH2. They’re signing contracts with wholesale partners and need to up the production capacity. This requires money of course and interest will be paid on a monthly basis to investors.

The INCH2 investment offers a fixed 17% interest rate + up to 5% extra depending on the turn over for the company in 2019.

They are looking for 100.000€ and 90% is already funded at the time of writing.

-

The designers “Creative room” -

The designers “Creative room” -

The designers “Creative room” -

If you fancy colored shoes therea a lot to choose from! -

The black boots are the most popular -

Even my mom wanted a pair! -

-

Internal stock and returns area -

-

From left: Gunars Udris, Jørgen Wolf (me),

Edward Peterson and Janis Timma

Restaurant “The Catch”

On our second day in Riga we had an opportunity to eat at The Catch which is a Japanese Izakaya-style restaurant, focused on terrific raw food and robata-cooked seafood, meat and veggies.

The restaurant in Riga was made as a “proof of concept”. They have done nothing special about the interior or exterior design of the restaurant, they basically just wanted to see if this type of food would be popular.

We had a table booked for 15:00 o’clock but came half an hour early. The place was stuffed! So we had to walk around the city for 30 minutes and come back.

It was our first visit so the waiter recommended a “tasting menu” where he’d serve a small amount of all their most popular dishes. This way we could try a lot of different things and get more inspiration on what to order on our next visit, he explained.

I didn’t take pictures of all the dishes but here is a small preview for you. Next time I come to Riga (or Berlin soon!) I will definitely come back for more.

My girlfriend loves Chinese and Japanese food, where I’m normally more like “Okay, I’ll go with it if this is what you want tonight darling”. I’m not saying this to promote the platform or the restaurant project in particular, but holy smokes, that food was delicious!! It is hands down the best Asian food I have ever tried.

The Catch investment offers 18% interest per year and has an 18 month loan period. The project is looking for 100.000€ and 43% is funded at the time of writing.

You can read more about The Catch restaurant on Crowdestor’s investments page.

Real estate projects

The first real estate project we saw was “Development of apartment building Tomsona 6” which is currently available for investment in Crowdestor.

It’s located in a nice area and as you can see, the project drawing is already in place on the fence 🙂

Current state:

Future state:

The project is looking for 60.000€ and is 58% funded at the time of writing. Interest rate offered is 12% per year and the loan period is 9 months.

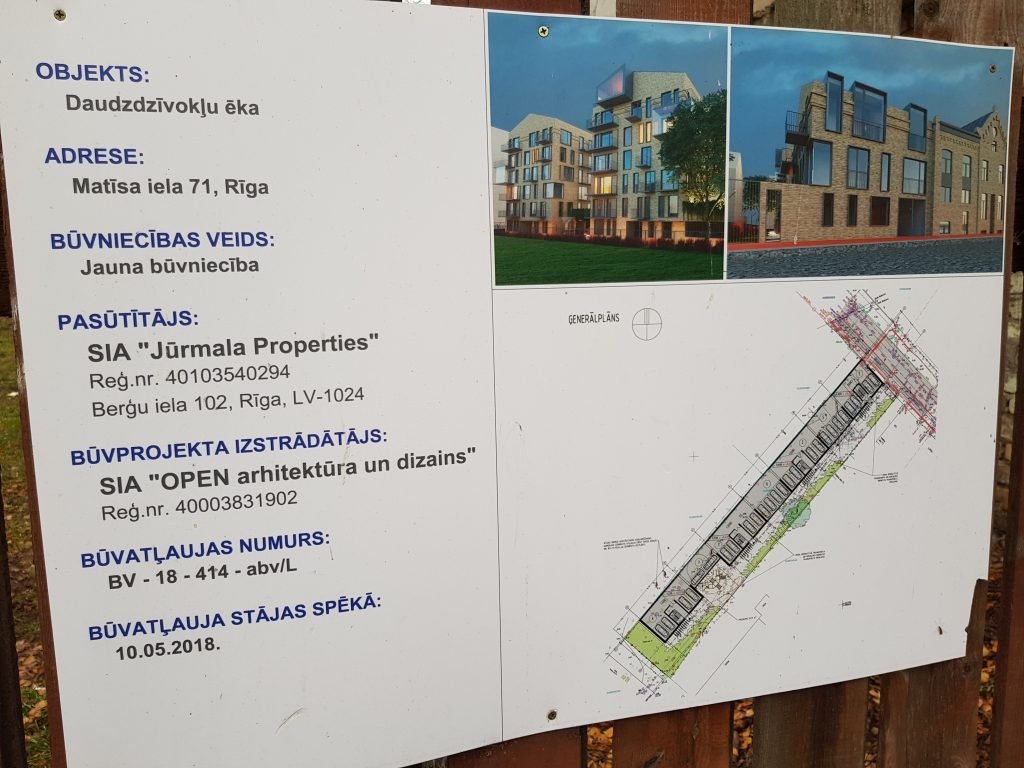

The second property we visited, is actually a small treat for you, as we saw another real estate project which is not published on the platform yet.

So you’ll be the first to learn about it! The project will probably be called “Development of apartment building Matīsa iela 71“.

Current state:

Future state:

-

-

The property will be built to the left of this building

You can read more about the development projects on Crowdestor’s investments page.

Finished real estate projects by the same developer/designer

Andris Riekstiņš, the developer of Tomsona 6 and the upcoming project on Matīsa iela 71, showed us one of the projects he has participated in – project “LEGEND” in Jurmala.

Design and architecture of project “LEGEND” was carried out by OpenAD, the same company that does the design and architecture for Tomsona 6 and Matīsa iela 71.

To see more of OpenAD’s work check out http://www.openad.lv

Project “LEGEND”

Project funding

When you invest in a project at Crowdestor, you will earn interest from the day you click invest. Even if the project is not successfully funded, you will still receive interest for the days between your investment and the deadline for the fundraising campaign.

On other platforms (Crowdestate for example) you will only earn interest from the day the final agreement is signed.

Skin in the game

Crowdestor will always be involved in all projects either as co-financiers (from 2-10%) or as co-developers. I like that! This shows investors that they believe in the investment opportunities presented on the platform.

Buyback fund

Unlike most platforms, Crowdestor doesn’t provide buyback guarantee in the traditional sense. Instead, they have created a Buyback Fund with full visibility of the funds in it. Innovative and very transparent!

Read the details of the Buyback Fund below.

My impressions of Crowdestor

It’s been a busy start for Crowdestor. The first projects have been successfully finished and there’s lots of high interest rate projects in the pipeline. I have personally received full repayment on 3 projects already. It’s still early to say anything about the success rate of future projects though, a platform needs at least 3-5 years to show the real success rate.

I think they have shown they’re focused and ambitious business men. They’re working hard to make a different kind of crowd investing platform with focus on interesting projects. To me, that is a lot more exciting to invest in, rather that just funding another p2p based consumer loan.

Don’t get me wrong, I will still invest in normal p2p lending, it’s still good money. It’s just more appealing to know, that my investment is actually going to make a difference for a company. More people will be employed and I will contribute to a growing economy because of my investment.

So far, I have been very satisfied with my investing experience at Crowdestor.

Comments are closed.