Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

It’s THAT time of the month and you know what it means.. It’s time for another monthly portfolio update!

Not much has happened in the world of Crowdlending since last month. But no news is often good news in the world of finance.

The stock markets on the other hand, have corrected and the latest drop has sent the American S&P 500 index back to early January 2018 levels. A lot of people are worried that the markets will drop further. Some technical analysts even point out that the charts look a lot like what happened just before the crash in 2007/2008.

However, once everyone starts talking about a crash, I think it’s unlikely to happen in the short term. History shows that market crashes usually happen when no-one expects it.

But nevermind the stock market, here at Financially Free we focus on Crowdlending and alternative investments. These portfolio updates tend to get long enough already, so let’s get right to the numbers!

October 2018

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora | -58,63€ | 1,13% | 18.100€ | 27.360€ |

| Crowdestate | 52,67€ | 7,40% | 7.000€ | 7.530€ |

| Crowdestor | 61,43€ | 18,66% | 4.000€ | 4.431€ |

| Envestio | 233,56€ | 19,07% | 20.000€ | 21.907€ |

| FastInvest | 53,78€ | 14,52% | 4.100€ | 4.342€ |

| Grupeer | 62,17€ | 10,75% | 10.000€ | 10.623€ |

| Mintos | 111,30€ | 14,52% | 8.000€ | 9.284€ |

| Robocash | 20,73€ | 12,51% | 6.000€ | 6.715€ |

| Swaper | 164,98€ | 16,60% | 9.000€ | 10.489€ |

| Twino | 29,18€ | 15,57% | 939€ | 2.306€ |

| 731,17€ | 87.139€ | 104.991€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 660€ | 68,21% | 18.080€ | 24.616€ |

| Total | 1.391,17€ | 105.219€ | 129.608€ |

My comments to the returns

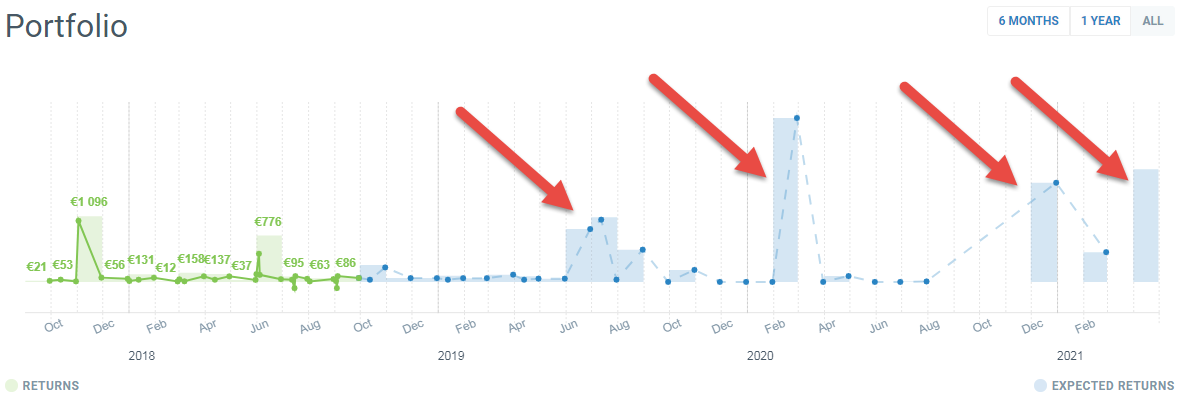

October income from investments was 1.391,17€ (+248,16€ more than last month.) I reached 46,37% of my first goal (+8,27% more than last month).

What a great month!

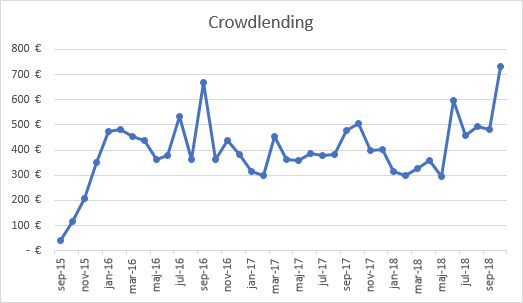

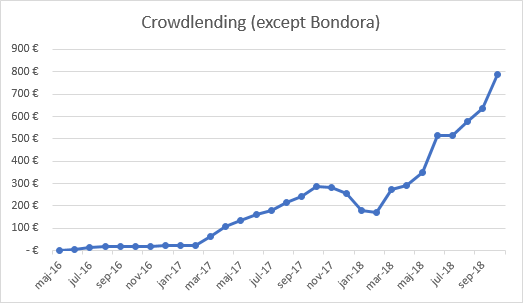

If it wasn’t for Bondora, my Crowdlending income graph would be a lot prettier though…

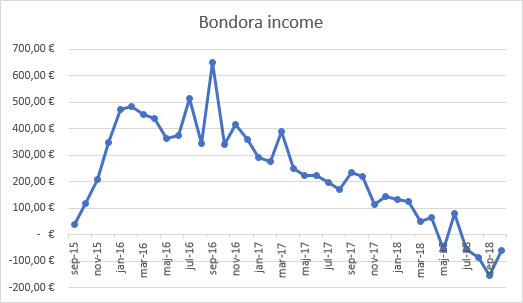

Bondora

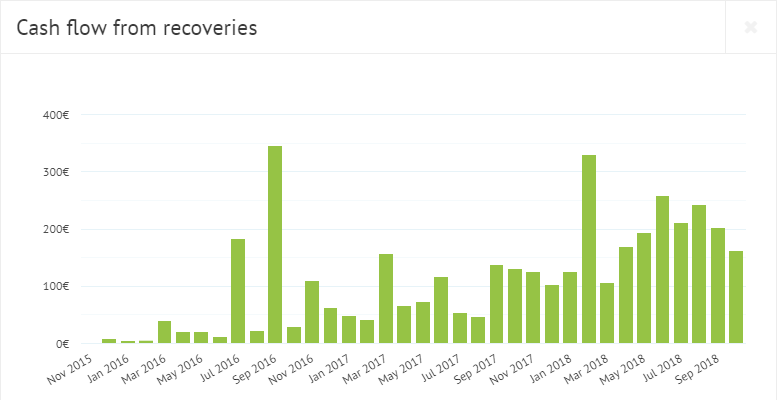

Another negative month on Bondora. I don’t expect to experience a positive month ever again, unless a miracle happens in the recovery department.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. There’s too many defaults related to the “Portfolio Manager” or “Portfolio Pro” and the costs of recovery is too high. Chances are, that your income graph will look much like mine after a couple of years.

Crowdestate

Crowdestate had a few borrowers that didn’t pay on time in October. The project “Steel Express” was supposed to pay on 31-10-2018 and the payment arrived today instead. It’s no big deal but the interest is carried over to next month in my reports.

I’m still missing payments from “MMMSprattus OÜ” and “Global Nord Timber (III)”. Global Nord Timber did payoff the full amount of their second project “Global Nord Timber (II)” on the 31st and thereby made a successful exit of that project. So that’s good.

It does happen from time to time that a payment is late but it’s usually only a few days. Sometimes I receive a late fee as well so I’m okay with it. As long as I get paid eventually 🙂

The XIRR calculation for Crowdestate is low because half of the projects I invest in, only pay interest as a bullet payment in the end of the total investment period. I expect the XIRR to rise above 17% eventually.

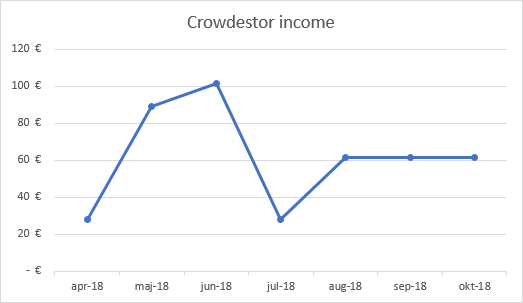

Crowdestor

Things are starting to speed up for Crowdestor. Since they decided to take part in the Invest 2019 event in Stuttgart, Germany they now have 7 exciting projects in the pipeline.

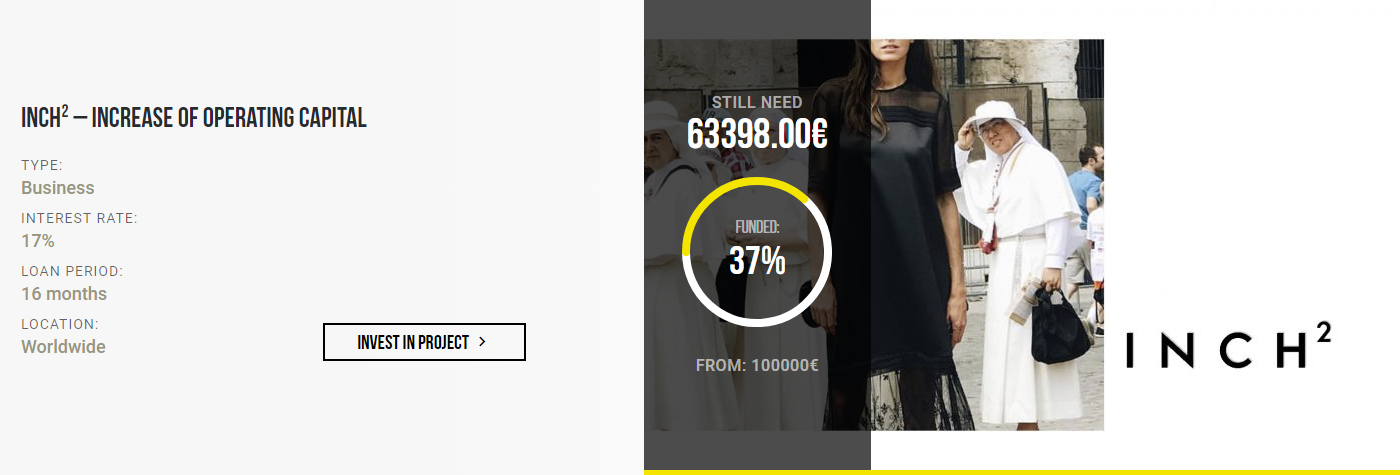

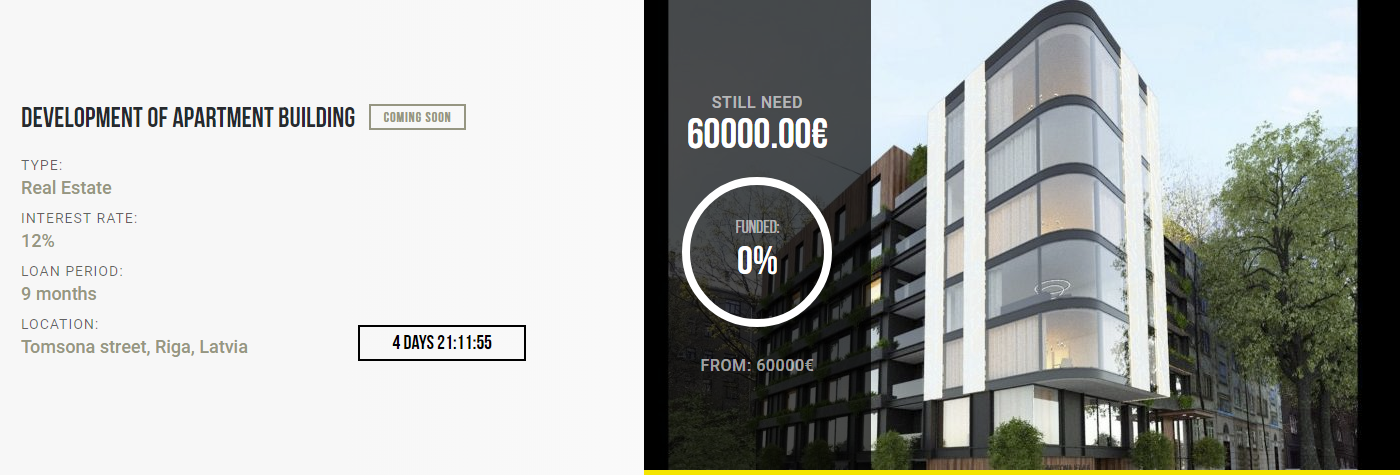

3 new projects were published on the platform in October. Interest rates offered are 12% for “Development of Apartment building”, 17% for “INCH2 – Increase of operating capital” and 18% for “Restaurant The Catch”. I’m probably going to invest in INCH2 and Restaurant The Catch. I really like to invest in (and support) small businesses rather than financing personal loans. And 17-18% interest in return is decent don’t you think?

Many of you who like Envestio have asked if there’s any similar alternative available, to spread the risk. Crowdestor is probably your best option! Give it a shot and see if you like it. I know I do 🙂

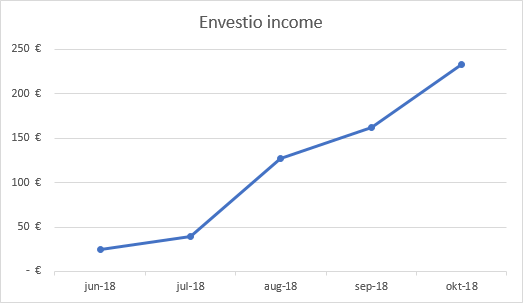

Envestio

When I wrote my Envestio review in July, 736 active investors had raised 1.246.273€ on the platform. Today, only 3,5 months later, 1.991 investors have raised 5.436.919€. Impressive!

I’m starting to wonder if they will be able to keep up with investor demand as they continue growing. So far they have not disappointed.

All projects released in October had interest rates above 20%! One of them even offered 23.5% if you invested in it within 2 days after being published. I was quick to act, transferred 7.000€ immediately and invested it all in that project. If everything goes as planned, that investment alone will add ~137€ to my monthly income. Not bad!

My total investment on Envestio is now 20.000€. If you’re not investing on Envestio yet you’re missing out on a great opportunity. Where else do you get 17-22% interest rate and buyback guarantee?

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days.

FastInvest

Now to one of the best news in this month’s update: I’m going to meet FastInvest on November 15th! The visit is scheduled and everything is planned. Flight tickets are paid for and the hotel room is booked. I’m so exited and really look forward to the trip.

A lot of people including myself have a lot of question we’d like to have answered. Be sure to head over to this post and put your question in the comments section. I’ll happily ask for you and post the answers in a blog post later this month!

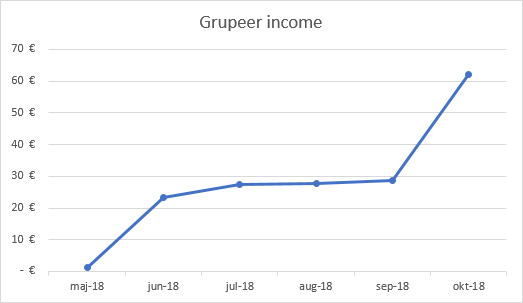

Grupeer

Grupeer is still going strong. For the first time, the recent popularity put them in a situation where all loans were sold out! They are working hard and new projects are released every week.

If you have an account already, make sure to enable auto-invest to grab the 15% loans as soon as they are published.

I bumped up my investments from 5.000€ to 10.000€ on this great platform during October.

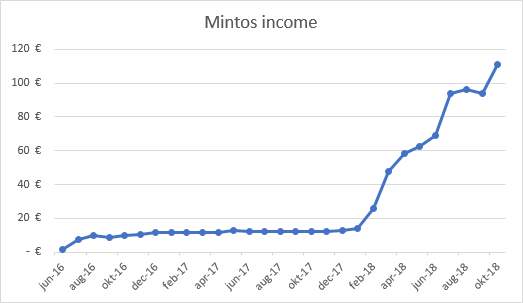

Mintos

While people are debating on the Mintos Fellows Facebook group, whether interest rates are high enough, my Mintos portfolio broke the 100€ mark for the first time! Yay!

Yes, interest rates are still 2-3% lower than they were a few months ago but I still think it’s a good investment.

Like last month, I’m still investing into 12% short-terms loans from Varks at the moment. Short-term loans makes it easier for me to get back into 13-14% loans again, if they should appear on the platform.

Also, the very popular Mogo loans appeared with 12% rates today. It’s definitely a good sign and it could force other originators to follow troop.

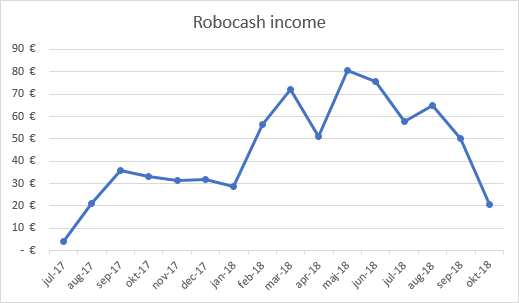

Robocash

Good news for Robocash investors! The long-awaited Russian loan originator “Z Finance” started to publish their loans on the platform. That means no more cash drag (at least temporarily).

Z Finance loans comes with 12% interest, which is alright, but to be honest I had expected 14% like the other loan originators on Robocash offer.

The earned income and XIRR on Robocash is not completely accurate. The reason is the “Installment loans”. Interest is paid when the loan is returned or if I sell it on the secondary market. If I sold those Installment loans now, XIRR would be above 14%.

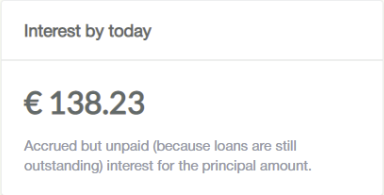

“Interest by today” which means “accrued interest that I will receive eventually” grew from 84,50€ last month to 138, 23€ this month. Add the difference of 53,73€ to the 20,73€ I received and the total for the month is 74,46€. That would be close to the expected XIRR of 14%.

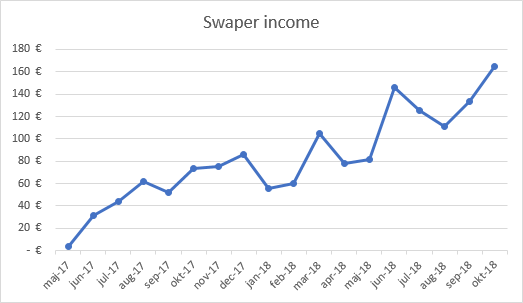

Swaper

October was a record month for my Swaper portfolio. Interest earned amounted to 164,98€ even with the cash drag that still exists on the platform.

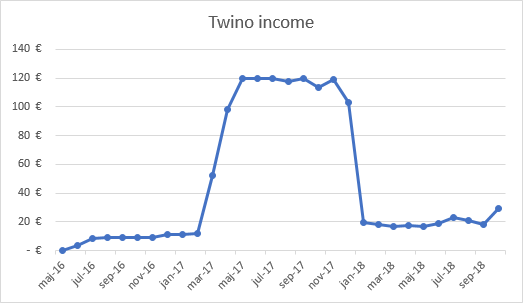

Twino

My children’s savings account returned 29,18€. A healthy bump from 18,39€ last month.

They have saved up 300€ from birthday gifts and are ready to invest some more. I’m so proud of their attitude towards spending vs. investing already at the age of 6 and 8.

Twino was a great platform when they had 14% loans and plenty of them. Now, offering 10-11% loans, not so much.

If you’re willing to take on currency risk with the Russian Ruble AND you’re lucky enough to snatch them on the marketplace, some loans do offer 14%. But it’s a rarity these days.

Real Estate

Not much to report this month. The rent was paid on time and I didn’t hear from the tenants this month either. That’s 2 consecutive months without a call.

Fall is here, which means that the trees have shaken off most of their leaves. I was out with the rake but unfortunately I forgot to take a picture. I promise I will remember next time 🙂

Now that the Blog income has risen so much lately, I hope I’ll be able to buy my second rental property within 6 months.

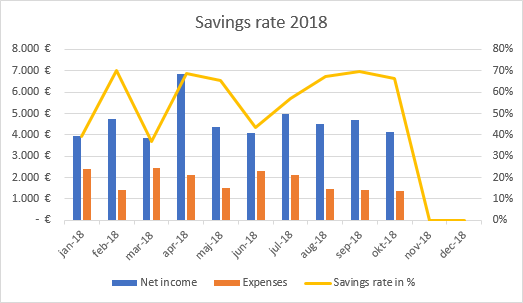

Savings rate

My savings rate for October ended up at 66,27% (-3,55% compared to last month). I’m almost at my goal of a 60% savings rate for 2018, I just need to make sure I finish the year off strong.

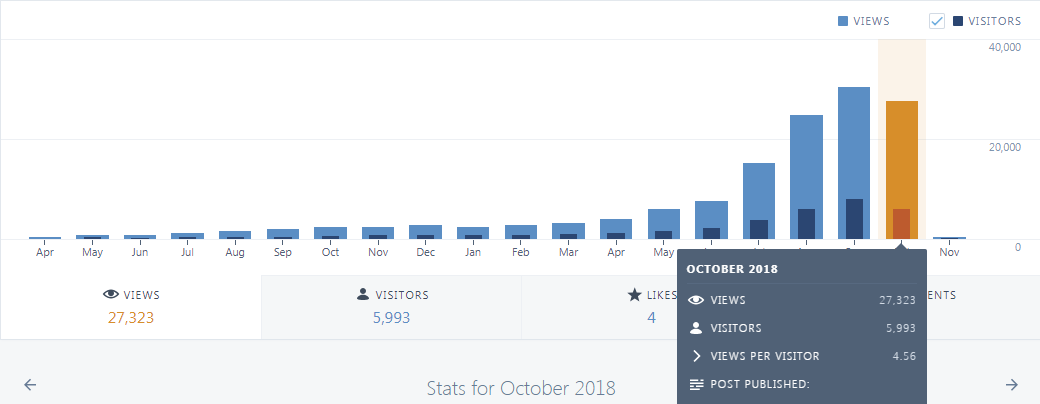

Blog statistics

So the blog traffic decreased for the first time. September was higher due to paid traffic from Facebook where at least 2.000 visitors came from Facebook Ads. In October, I stopped paying for Facebook Ads all together.

Visitors: 5.993 (-25,49% compared to last month)

Page views: 27.323 (-9,91% compared to last month)

577 subscribers (337 WordPress, 240 Sumo) (+118 compared to last month)

364 Facebook followers (+66 compared to last month)

Why did I stop advertising on Facebook, you may ask? First of all, even though I have done a lot of research and spent hours and hours on different setups, I have not been able to find a healthy cost per click ratio. Secondly, the traffic from Facebook had a 85% bounce rate, meaning that 85% of all visitors only saw the front page and clicked away after only ~20 seconds. If you’re into digital marketing, that’s not the kind of statistics you want to see. Especially not when the cost per click ratio is 3-5 times higher than my Google Ads.

That’s it folks!

Those are the words I have prepared for you this month.

I promise you won’t have to wait another month for the next post. You can look forward to the FastInvest review that will be published around November 20th, after I have visited their office in Kaunas, Lithuania.

If you pay attention to the portfolio page, you probably noticed that I invested a massive 12.000€ in October. That should be enough fuel to prepare an exciting portfolio update next month, where I hope to set another record!

If you enjoyed this post, please smash that like button below and/or share it with your friends.

Comments are closed.