Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

This Crowdestate review is based entirely on my experiences. Always do your own research.

Crowdestate review

Have you considered putting Real Estate into your portfolio, but struggle to find the capital needed? Or don’t you like the thought of being a landlord where tenants can call you any time of the day? Then Crowdestate could very well be the platform for you. Minimum investment is only 100€.

This Crowdestate review is 100% unbiased and based on my own experiences after 1 year of investing.

What is Crowdestate?

Crowdestate is an Estonian real estate crowdfunding platform that primarily connects real estate developers with investors all over the world (except USA). They also offer Corporate finance and Mortgage loans.

The website launched in January 2014 and the first project was released in May 2014. In the time of writing, 19.078 investors have raised 36.210.692€ across 77 projects with an average return of 22.23%.

If you are new to the crowdfunding concept, you can read more about it on this Wikipedia page.

When did I start and how much did I invest?

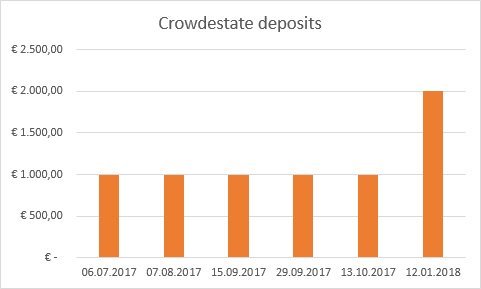

I started on Crowdestate on 06.07.2017 with a 1.000€ deposit, just to try it out. I liked it and deposited 7.000€ in total over the next 6 months.

You can see the details about my account in the menu P2P portfolio -> Crowdestate. Like the rest of the blog, it’s updated every month!

How do you start investing?

It’s very easy to sign up and invest with Crowdestate. If you have a Facebook or Google account you’re ready to start after a few clicks.

How does the website work?

I believe pictures say more than a thousand words. So I will show you some screenshots from my account. You can click on some of the pictures for full size view. Use your browsers back button to continue reading.

Investing in projects

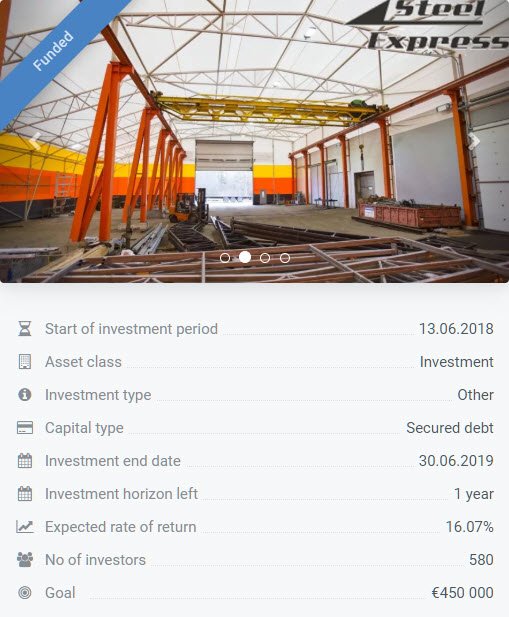

For each project you will be able to find a lot of information. Examples of information you can find:

- A short overview with picture gallery

- Executive summary

- A very detailed project description

- Location shown with google maps.

- Sponsor description (information about the developer)

- SWOT analysis

- Crowdestate rating (with explanation behind the rating)

- Repayment schedule

- Finances

- Attachments (further documents available for download)

- Q&A (where you can ask your questions directly)

Account overview

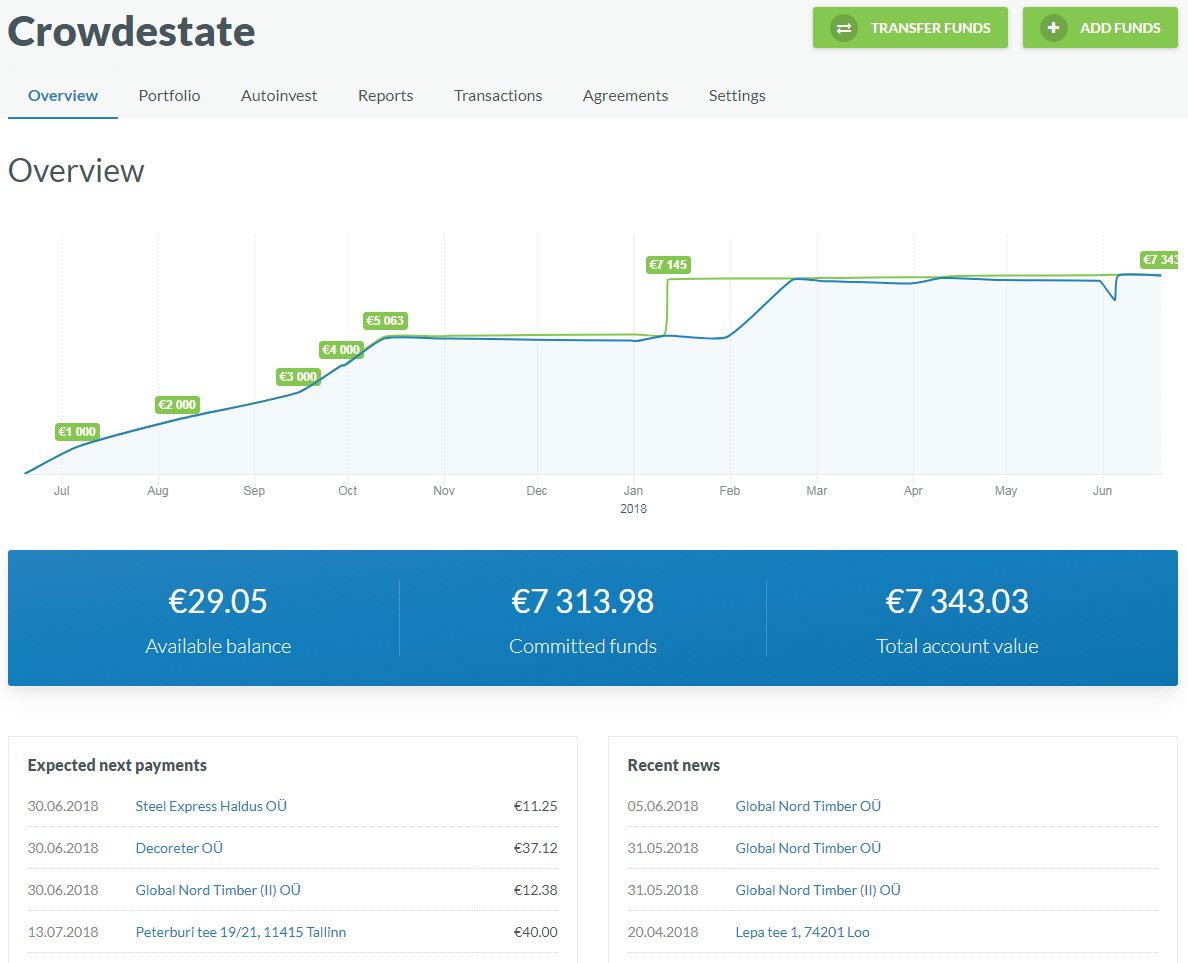

I really like the new graphs that were implemented in the last update. It’s easy to see how your portfolio evolves over time. Especially the “Expected next payments” is handy, to see when the next payments are planned.

Whenever there’s an update to a project available, you can find the information in the “Recent news” section. I appreciate the updates where you can read if your investments are still on track.

Portfolio overview

There’s also a nice graph showing expected next payments. This view comes with 3 different filtering options; 6 months, 1 year or all.

Below you will find an overview of my active investments. They have an average expected return of 18.82%. If all the projects are paid back according to the plan, Crowdestate will probably turn out to be my best investment ever!

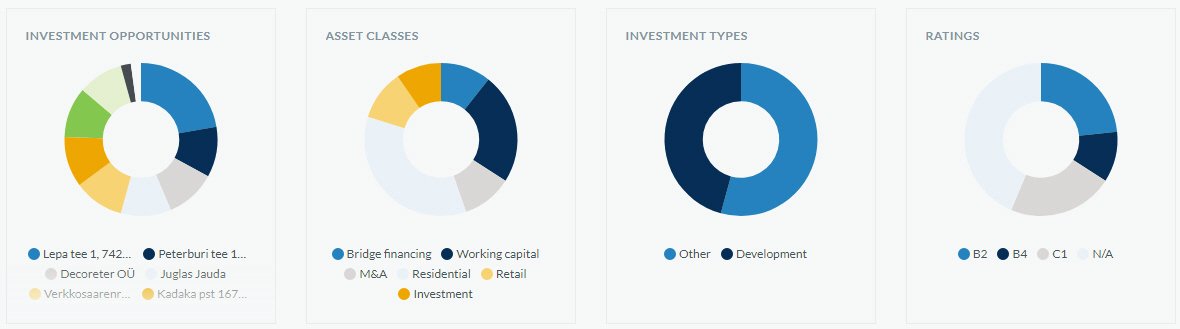

You can also see the diversification level of your portfolio, divided into asset classes, investment types and ratings.

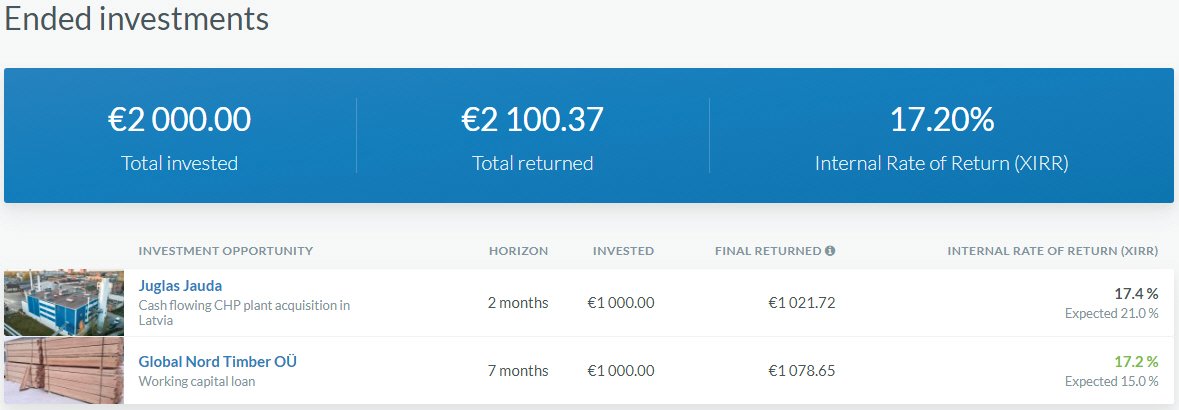

When investments are finished you’ll be able to see how much you earned.

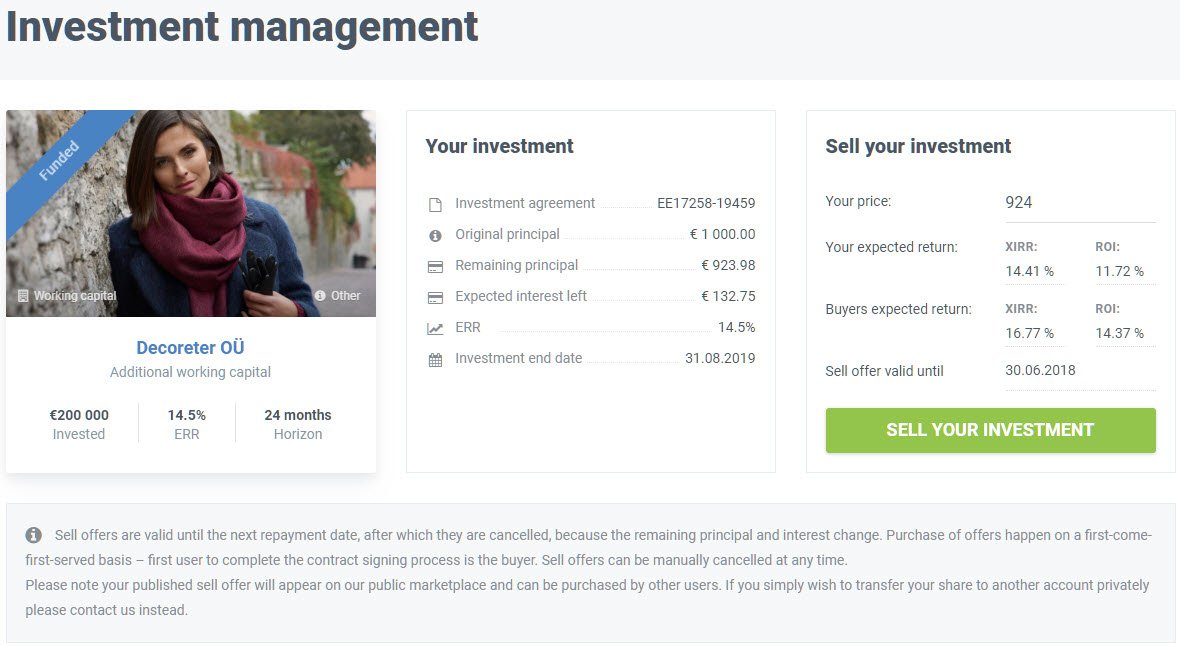

Secondary Market

A secondary market was recently added to the platform, which is great. Now you can exit your investments faster if you wish to do so. From your active investments page you can click “Manage share”. From this page you can choose your selling price and see your expected return as well as the buyers expected return.

Personally, I don’t like the possibility to add mark-up’s to the investments. Like concert tickets, some people will buy more than they need, just to make a profit on the secondary market.

Setting up Auto-Invest

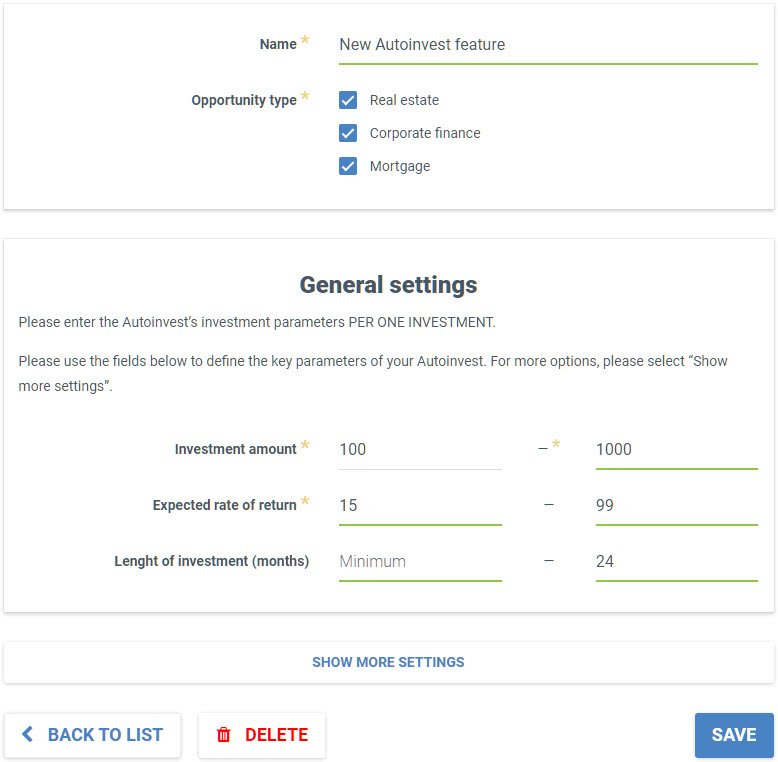

Like most platforms, Crowdestate have an “Auto-Invest” feature so you don’t have to select loans manually every time your account has cash available. A recent update to the auto-invest tool ensures that everyone gets an equal share.

In the following example, I have chosen to invest in all projects with an expected rate of return from 15% per year, maximum 1.000€ and an investment horizon up to 24 month. If you have more specific investment criteria, you can set those under “show more settings”.

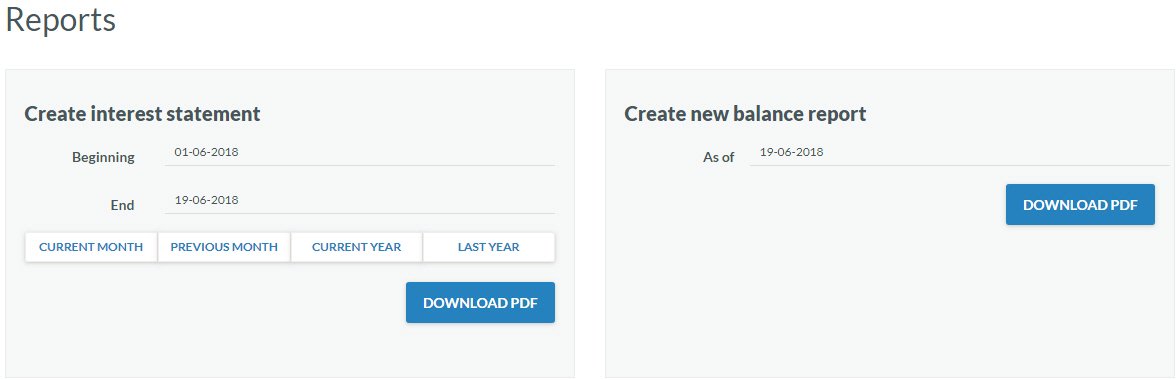

Reports

You can create an interest statement by month, previous month, current year or last year. Additionally you can create a balance report. Unfortunately, the reports are in Estonian language only. It would be nice if reports matched your choice of website display language.

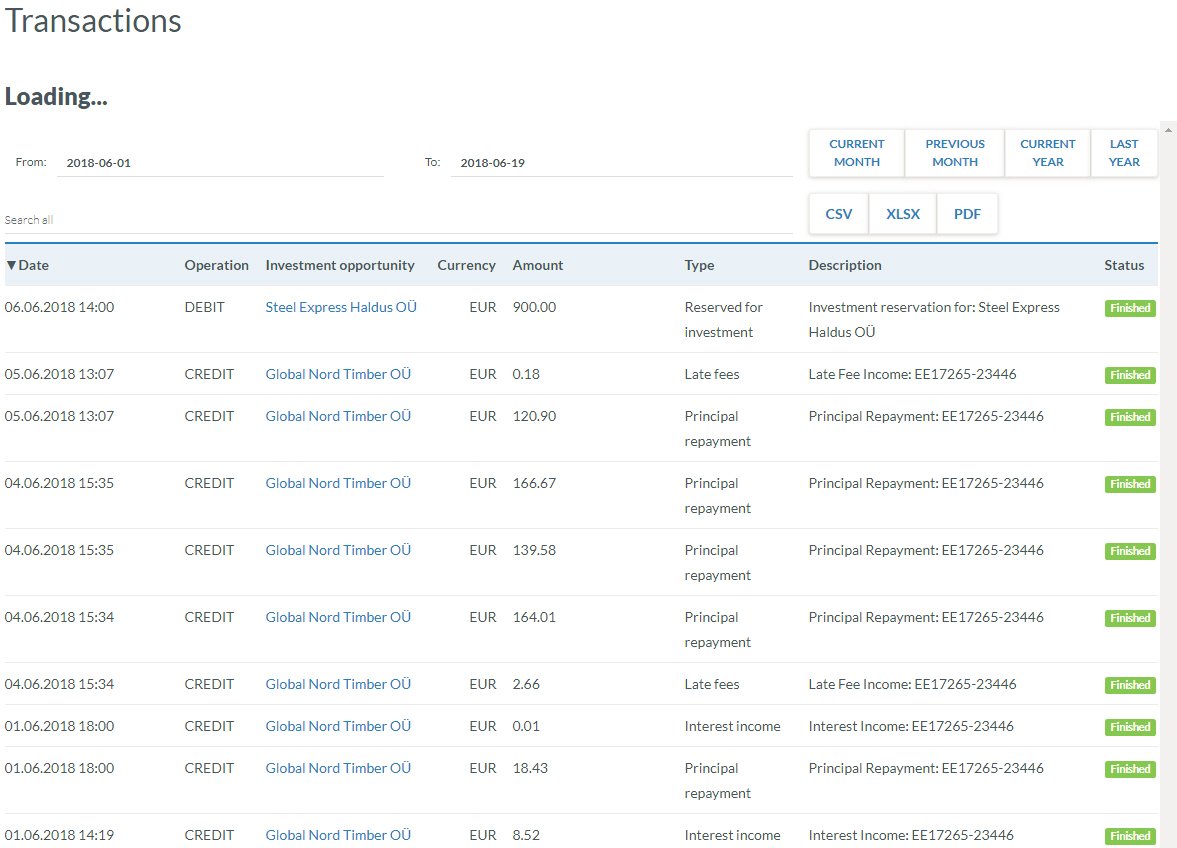

Transactions

This is where you can check all account activity. The transactions page provides a good overview of all monetary transactions. The list can be sorted in various ways. There’s even a free text search box which is handy if you want to search for a specific project. If you would like to have an offline copy, you can download the list as a CSV, XLSX or PDF document.

Zero defaults

There is no buyback guarantee on Crowdestate. However, they do have an excellent track record with zero defaults due to their rigorous due diligence process. Only about 5% of the best investment opportunities are opened for investing. 25 projects have been successfully exited. Note: past performance does not guarantee future results.

What could be better

I have invested with Crowdestate since 06.07.2017 and I’m very satisfied with the platform and the returns. There’s only 2 main things I’d like to see different.

- More available projects.

77 projects in 4 years corresponds to 1,6 projects per month. As more investors joins the platform, it gets harder and harder to get a share in the new projects. Projects with interest rate above 15% are funded almost instantly.

- Monthly interest cash flow from real estate projects.

I know, this wish is very specific to my investment strategy. I like to build a predictable monthly cash flow. Unfortunately, only Corporate finance and Mortage loans provides monthly interest payments. Real estate projects usually pays the interest as a bullet payment in the end. I understand that bullet payments might be the best solution for real estate developers. However, if interest payments were paid monthly, I would double or triple my investment on Crowdestate!

Crowdestate review: Conclusion

If you’re looking for well established real estate investing platform with a long working history, Crowdestate would be an excellent choice. The platform is very easy to use and the support is great as well. Like previously mentioned, they have a 100% success rate after 4 years of operation and 22% average. Where else do you find a track history and high returns like that?

That being said, interest rates have typically been in the range of 13-17% lately. It’s still pretty good, but I’d love to see more high yielding projects. With the stable investor growth they have experienced over the years, I wonder if those > 20% projects are a thing of the past.

In the end, there’s only one way to see if you like it. Why don’t you try it for yourself?

Please share your thoughts

Are you considering Crowdestate but still have unanswered questions? Go ahead and post your questions or concerns below!

Or if you’re already a seasoned Crowdestate investor, what are your thoughts about the platform? Are you satisfied with the investing experience?

Comments are closed.