Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

This Viainvest review is based entirely on my experiences. Always do your own research.

Getting started

In July I decided to try Viainvest. I’ve talked with other investors who have enjoyed their platform so I decided to give it a try. This Viainvest review is not going in depth with the investing process, as I backed out pretty quickly. Continue reading to find out why.

The signup process

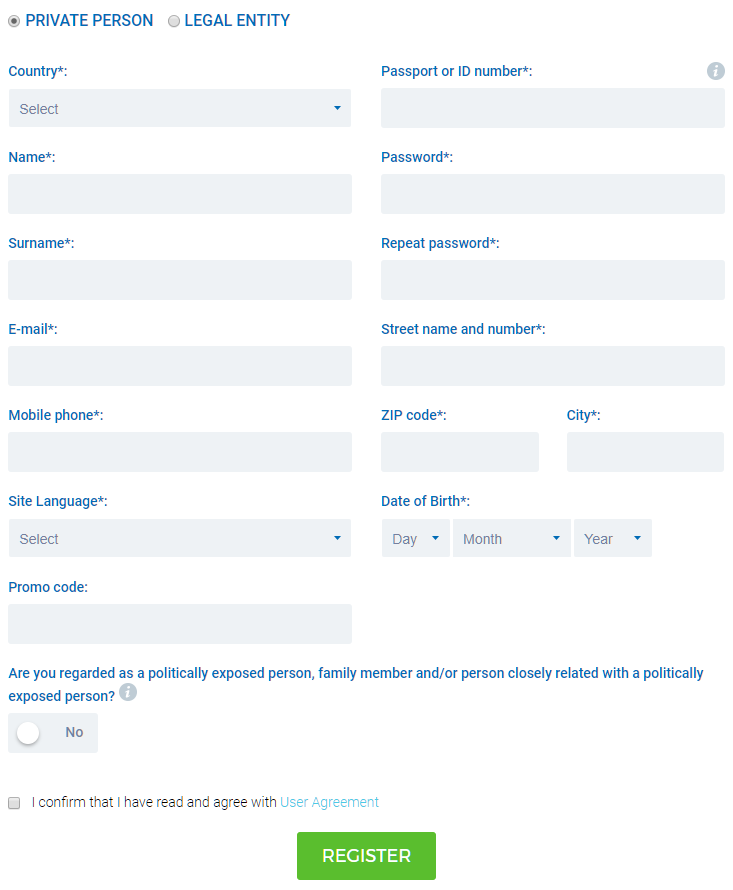

Signing up is straight forward. You just enter the standard information such as name, address and passport number and you’re good to go.

Deposit and withdrawal

Adding and withdrawing funds only took 1 day for each transaction. Thumbs up for fast processing time!

Internal taxation

Viainvest say they are obliged to make internal taxation on earned interest according to the law. I don’t know any other P2P platform I know of does this! The internal taxation percentage varies depending on which country the loan originates from.

I asked if they could provide further information or show me where I could read more about this law. The answer was: “We are asked this question a lot and we are preparing the documents to be published.” As far as I know, the legislation is in process of creation and there are no clear guidelines regarding to it yet.

Providing a tax certificate

If you provide a tax certificate / certificate of origin, you are able to avoid some of the internal taxation (but not all). Here is an exempt from the conversation I had with support on the topic:

“A Tax Certificate confirms the existence of Double Taxation Convention between the country of investor tax residence and loan origination country/-ies (in this case – Czech Republic, Spain, Poland, Latvia).

It is not mandatory, but without a Tax Certificate all earnings will be taxed within the platform in accordance with the legislation of the loan origin country – if the loan origin country is Czech Republic – Withholding Tax is 15%, if Spain – 19%, if Latvia – 23%, if Poland – 19% (for individuals).

Poland is a special case, since, according to the Polish legislation, we have to tax the income generated on VIAINVEST which means investors are unfortunately not able to avoid Withholding Tax on the platform, even if a tax or residence certificate has been provided or uploaded. If you have provided a Tax Certificate, as in your case, your income generated on the platform will be taxed as follows – with 5% if you are resident in Denmark.

For Withholding Tax not to be applied to the income within the platform, the investor must take full responsibility of handling these commitments by himself and provide (upload to the investor profile) the copy of personal Tax Certificate issued by the tax authority of the country of investor’s residence.

Kristīne from VIAINVEST“

So even if I provide a tax certificate I would still need to avoid Polish loans, or accept the extra double taxation of 5%.

Verdict

All in all, I found the internal taxation too complicated to be worth the effort. It’s a shame because I was looking forward to investing with Viainvest. I had (and still have) a really good feeling about the company.

Even though Viainvest is not for me, I’m sure they are legit and have a promising future. Furthermore, I had good conversations with their customer support who responded professionally to all my questions. If the internal taxation procedure is of no concern to you, I would definitely give Viainvest a try.

Who knows, maybe all platforms will be forced to withhold tax in the future? What do you think?

Comments are closed.