Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

I just returned from a wonderful 3 week holiday and I’m ready to get back into action.

Let’s see how much money I made while I was sweating in the sun, cooled by the swimming pool, drinking wine and enjoying Italian cuisine. Isn’t passive income the greatest invention of all time?

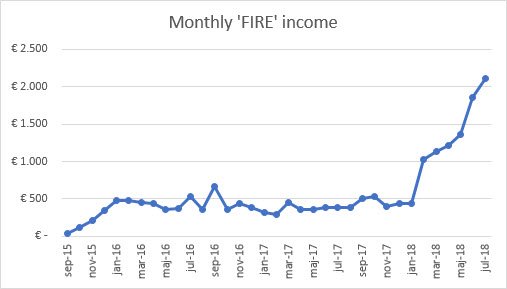

The crazy uptrend continues. 2018 has been an incredible year so far.

income statement for July 2018.

| Platform | Return | Compared to last month | Account value |

|---|---|---|---|

| Bondora | -56,81€ | -138,77€ | 30.272,58€ |

| Twino | 22,85€ | +3,72€ | 2.237,60€ |

| Mintos | 93,76€ | +24,79€ | 8.983,25€ |

| Swaper | 125,40€ | -20,51€ | 10.080,64€ |

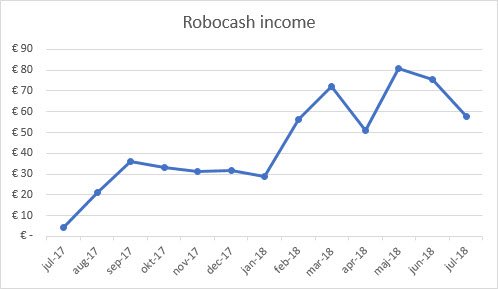

| Robocash | 57,81€ | -17,80€ | 6.579,50€ |

| Crowdestate | 68,86€ | +38,71€ | 7.425,43€ |

| Crowdestor | 28,33€ | -73,43€ | 4.247,60€ |

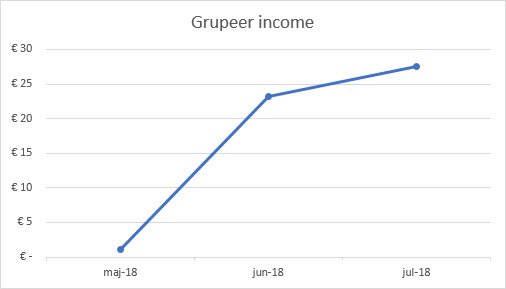

| Grupeer | 27,47€ | +4,28€ | 2.303,55€ |

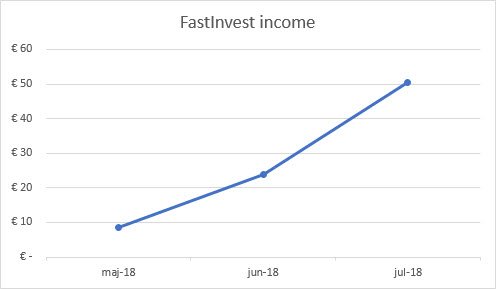

| FastInvest | 50,47€ | +26,59€ | 4.182,80€ |

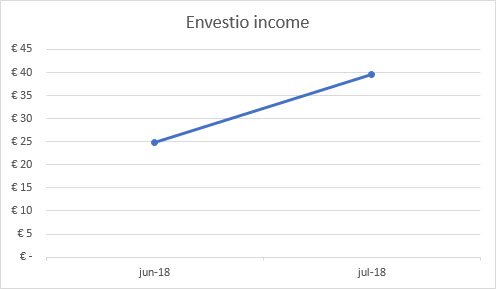

| Envestio | 39,60€ | +14,84€ | 6.254,85€ |

| Total | 457,74€ | -137,58€ | 82.567,80€ |

Real Estate:

First property returned 660€

Blog:

Blog returned 981,90€ (+397,15€ more than last month)

Grand total:

2.099,64€ (+259,57€ more than last month)

69,99% of my first goal (+8,65% more than last month)

My comments to the returns

I’m debating with myself whether I should move the Blog income to a separate graph.

Part of the reason I started this blog was to show people how it’s possible for almost anybody (with a stable day-job income) to become financially independent within 10 years.

I realize that not everyone is able to start a Blog and do the same as I do, while everyone can invest in P2P/P2B platforms and buy rental properties!

What do you think? Should I separate the two?

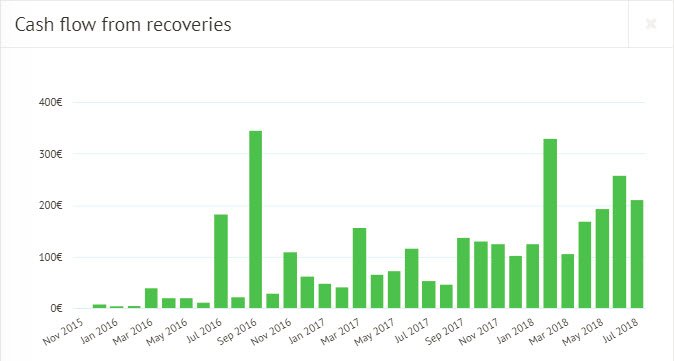

Bondora

As expected, Bondora went back into negative territory again. 210,54€ were recovered from defaulted loans but that was not enough to catch up with the missing principal and interest repayments.

Twino

Yesterday Twino announced that they will be launching investments with Currency Exposure. Those loans will carry a 14% interest rate and have buyback guarantee. But the 14% is not guarantee because it will follow the Russian ruble.

They wrote a blog-post about how it works here.

While it’s great that they are introducing higher interest rate loans again, I’m not keen on having exposure to RUB. I like the normal loans where I can predict the return.

The ruble has been quite week over the past few years. However, if you think the RUB will be stronger in the future, you could get some very nice returns.

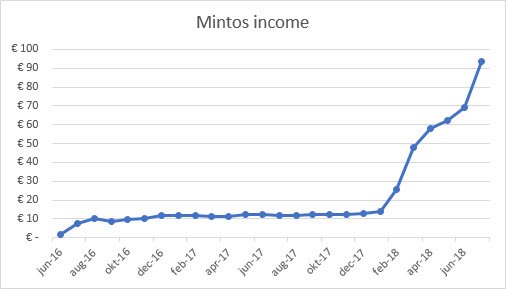

Mintos

The 3.000€ I transferred to Mintos on June 7th made the income jump to 93,76€.

Unfortunately, the interest rates have gotten a significant hair cut since last month. 13% loans are currently only available through the African “GetBucks” loan originator.

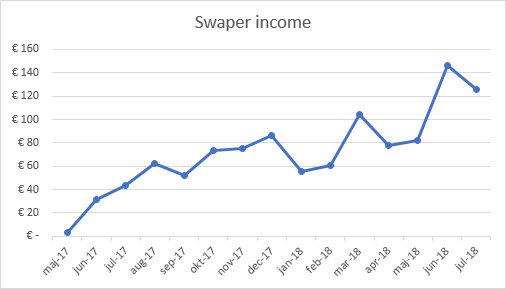

Swaper

2 personal milestones were hit on Swaper this month.

- Total interest earned > 1.000€

- Account value > 10.000€

Robocash

Some cash drag still exist on Robo.cash. I think this is the main reason for the lower income this month.

They recently introduced a new type of loan called “installment” loans.

Repayment period is up to 12 months and expected interest rate is 14.5% per year. This should help reducing cash drag as the loan volume increases. Unfortunately however, this loan type only pays interest after the full loan period.

While the overall return will still be good, it will reduce my monthly cash flow and make my monthly income graph look worse until it will get a big spike a year from now. As much as I dislike this, I’m not a fan of cash drag either so I will have to include them for now.

Contrary to the short-term loans, the installment loans can be sold to other investors and you will receive interest based on the amount of days you held the loans.

If you’re interested in Installment loans remember to update your auto-invest settings to include them.

Crowdestate

As interest is accumulated on the platforms, I like to reinvest it as soon as possible to get the snowball rolling.

I reinvested 100€ in the MMMSprattus OÜ project in July. It has a 15% interest rate and monthly interest payments, which I prefer.

I recently published a review of Crowdestate . If you have not read it yet, you can find it here.

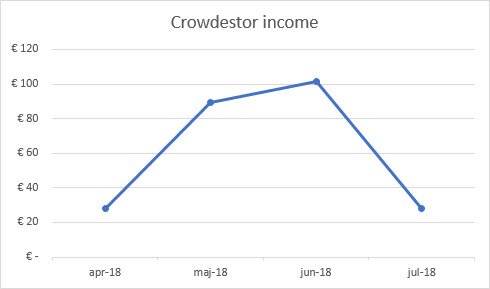

Crowdestor

Income from Crowdestor was lower in July due to the fact that I only had one active investment, namely the “TESLA TAXI Park Riga” project.

The high yield short-term Cryptocurrency mining project finished last month. It was nice to get 36% interest rate even though it was only for 2 months.

Next month I should get payments from the “Increase of operating capital” project as well, so I’m expecting 28,33 + 33,10 = 61,43€ from Crowdestor in August.

Grupeer

It was my second full month of repayments from the projects I invested in at Grupeer. Flawless experience and they all paid on time.

Some of you have wondered why personal verification this was not a part of the sign-up process. Grupeer just announced that they will start verification of all existing users within a month or two. It’s a short process identical to being verified on any other platform.

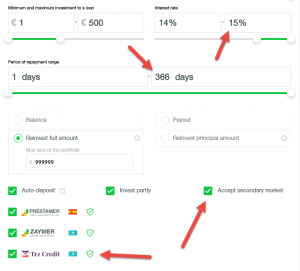

FastInvest

FastInvest has picked up speed and the returns are now very close to the expected target of 52€ per month.

I see that quite a few of you have joined me on FastInvest and it’s easy to understand why: 15% interest rate, buyback guarantee and no lack of loans which means instant re-investments.

There’s no secondary market on FastInvest, but you can sell your loans back to FastInvest and receive your invested principal back within 24 hours. The drawback is that you don’t earn any interest for the time you held the loans.

Most loans are 4-8 months so the best option is stop reinvesting and wait until the loans expire. But it’s a great option to have, in case of emergency!

If you register and invest with FastInvest in August you will receive an extra 1% cash back on your investments after 12 months!

Envestio

Envestio is slowly but surely becoming my favorite choice for investing. My hopes are really high for this platform.

I transferred 4.000€ to my account in July bringing my total deposits to 6.000€.

The plan is to have 10.000€ invested as soon as possible so I will add more funds my account in August.

I recently published a review of Envestio , where I traveled to Riga to meet the team behind the platform. If you have not read it yet, you can find it here.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days. That’s 9 full months!

Real Estate

The tenants are still happy and pay their rent.

Owning a rental property is not a passive investment though. It takes some of your time but it’s definitely worth it!

My first property has a garden that I need to take care of. Weeds were growing everywhere so I had to do something about it. I bought a rake, a spade and a pair of gardening gloves for 45€ and got to work.

Maybe I’m not like most others, I actually enjoy the work.

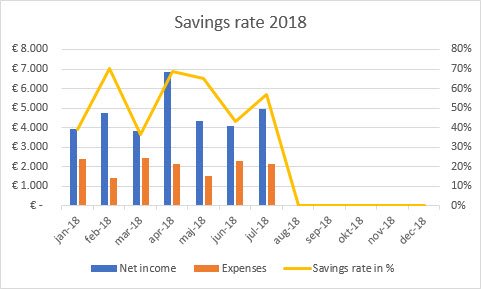

Savings rate

My savings rate for July ended up at 56,95%, which is really satisfying here in the holiday season. We have visited 4 gourmet restaurants in Italy and eaten out a lot more than usual.

Average savings rate for 2018 so far is 56,27%. If I should have any chance of reaching my goal of a 60% savings rate for 2018 I need to tighten up for the rest of the year.

Expenses

Below you can see my expenses for July.

– Costs of living –

Rent: 703

Electricity: 102€

Groceries: 249€

– Transport –

Fuel: 436€. Driving 2.000 km to Italy is expensive but still cheaper than flying.

Road taxes: 65€

Parking: 67€

Taxify rides: 17€

– Vacation –

Restaurant visits: 347€

Wine tasting and wine buying: 76€

– Misc –

Banking fees: 4€

My daughter’s phone bill for 5 months usage: 27€

Toilet visits on highways: 2€

– Blog –

Google Ads: 45€

Total expenses for June: 2.140€

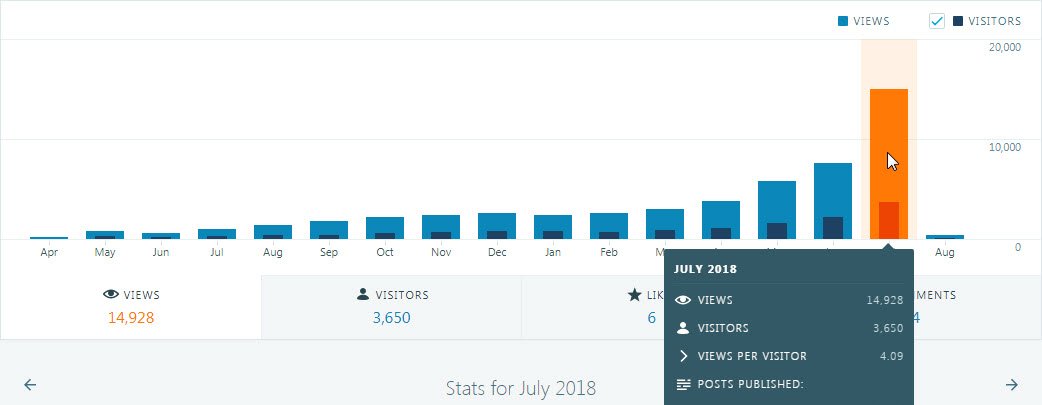

Blog statistics July 2018

This blog now returns almost as much as all my investments combined. Almost 1.000€ in one month. I think it’s fascinating, ridiculous and amazing at the same time.

In a way it makes sense though. Someone once told me “Income can only come from other people. There is no other source unless you start minting money and I wouldn’t recommend that. The more people you can help or service, the more money you will earn.”

Visitors: 3.650 (+67,43% since last month)

Page views: 14.928 (+100% since last month)

242 subscribers (133 WordPress, 109 Sumo) (+76 since last month)

I’d love to get to 10.000 visitors per month, that would be pretty amazing.I’m not really sure why the traffic is increasing so much, but I’m really grateful for it. Writing is much more fun, when you know that a lot of people are going to read it.

Most of the traffic is coming from organic Google searches. I saw that most other bloggers in the same space are experiencing growth as well. Maybe there is an increased interest for alternative investments in general?

See you next time

That’s it for this month’s portfolio update. Enjoy the last month of the summer!

If you enjoyed this post, please press the like button below and/or share it with your friends.

Comments are closed.