Moving to another country to retire earlier

Have you considered moving to Portugal for financial freedom?

Financial freedom is a simple question of math: If you earn more from your investments than you spend, you’re financially free.

Cutting down on your 3 biggest expenses (housing, food and transport) will take you one step closer to living your life on your terms.

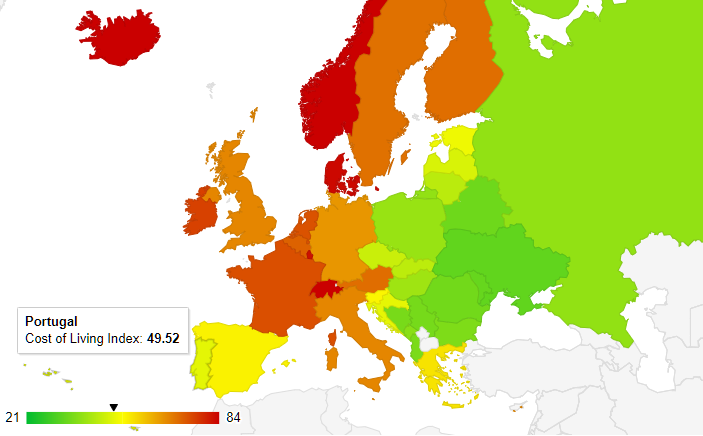

If you live in Northern Europe, moving to Portugal would reduce your costs of living.

Why Portugal?

While there’s many options worldwide, we prefer to stay in Europe.

My friend Mark moved to Portugal 3 years ago. He told me about all the benefits Portugal had to offer and after talking to him for a couple of hours, I couldn’t see any reason for staying in Denmark. Mark wrote a nice article about Portugal which totally convinced me.

As you can see on the map below, Eastern European countries are not expensive to live in. If you prefer to live in the Western part of Europe, Portugal is the cheapest with a “Cost of Living Index” value of 49.52.

Denmark, where I lived the first 40 years of my life, has a Cost of Living Index value of 83.00.

Most expensive of all is Switzerland with a value of 122.40.

Tax benefits

Another huge benefit for those who’re pursuing Financial Freedom is the NHR Regime, which can be granted to foreigners who wants to move to Portugal.

In short, the NHR Regime offers 10 years in Portugal with 0% tax on almost all foreign source income (including capital income from investments) and a 20% flat tax on everything else.

When we combine the low taxes with the low costs of living, most hours of sunshine in Europe, friendly people (of whom many speak English) Portugal is by far the best option for us.

Note: The Portuguese government is in the process of changing the NHR Regime, maybe to a 10% flat tax on everything instead of 0/20%. Either way, it’s still pretty good.

Leaving most things behind

The first 2 weeks of February 2020 were really stressful for us. We packed the things we wanted to keep and sold everything we didn’t need. More than 70 private appointments later, the sales of our belongings had brought in more than 15.000€. The rest was given away for charity.

My brother helped me sell our 2 cars after we left Denmark. This way we could use the cars to drive stuff away from our old apartment up until the very last minute. That was a huge help for us. Thank you brother!

Our “essentials” are stored away in a basement, which we have rented for 6 months. When we find a long-term place to live, we will have it shipped in a small container to us.

Now the “de-cluttering” is done, it feels really good to be free of all the stuff we rarely used.

Moving to Portugal for Financial Freedom – The journey begins

On February 15th 2020 we took the train from Denmark to Hamburg, Germany. Then we flew from Hamburg to Lisbon with 4 x handluggage, 2 x 20 kg suitcases, a carseat and a stroller for the baby.

My to-do list

- Rent a short-term home through Airbnb* – Check

- Rent a car – Check

- Get my NIF number – Check

- Open a Portuguese bank account – Check

- Learning Portuguese – Work in progress

- Find a long term-rental close to a good school – Work in progress

- Socialize the kids

- Apply for residency

- Buy a car

Finding a temporary place to live

We found a nice little 2 bedroom house on AirBnB* for the neat price of 500€ per month, everything included.

It’s in the middle of nowhere, it takes us 15 minutes by car to get to the nearest big city. We like the countryside views and it’s fine as a temporary home for the first 6 weeks.

The lady who owns the house even washes our clothes, dries it and returns it nicely folded. It’s a great gesture but having access to our own washing machine would be preferrable.

There’s oranges, lemons and tangerines in the garden and we are free to eat as many as we want. There’s a juicer available in the kitchen, nothing beats a fresh glass of orange juice in the morning.

Car rental

We prebooked a rental car in Lisbon Airport for 25 days, which is the max period allowed by many car rental companies.

When we went to pick up our Renault Megane stationcar, the guy behind the counter said “Sorry, we don’t have any stationcars available as you booked. We can offer you an Audi A3.”

I pointed to my family and the huge pile of luggage and politely explained “There’s no way we can fit all that into an Audi A3”. Once again here replied “Sorry, I don’t have any”.

After 10 minutes of explaining and insisting on a solution he went to speak with his manager. “Good news” he said when he returned. “I can upgrade you to a Mercedes 220d stationcar”. There you go!

It’s quite cheap to rent a car here, especially off-season. Typically 4-10€ per day for a VW Polo or similar. Buying a car, however, is more expensive in Portugal than in most other European countries. Once we’ve setteled we’ll be looking to buy a cheap car so we don’t need to drive to Lisbon every 25 days to exhange rental cars.

This is our current rental car. Not the best vehicle to fit 5 people but we manage. A bigger car would cost 2-3 times as much and we’d rather save where we can.

Getting my NIF number (tax number)

Shortly after arriving here, I went to the “Serviço de Finanças” in Caldas da Rainha to get my NIF number. All I needed to bring was proof of address and my passport.

Of course, I forgot my passport the first time, so I had to get it and come back. I’m so used to using my drivers license as ID because it’s accepted as legal ID in Denmark.

The lady in the office didn’t speak a word of English so I’m happy I brought a friend + my phone with the Microsoft Translator app.

15 minutes later I had a piece of paper with my newly acquired NIF number.

Opening a bank account

It’s nice/necessary to have a Portuguese bank account if you live in Portugal. Public institutions and some toll roads only accepts Portuguese cards. Even a McDonald’s rejected our international Visa/Mastercards.

To open a Portuguese bank account, I had to provide my NIF number, proof of address, a salary slip, my passport and a 250€ deposit.

I was recommended the bank “Millennium bcp” because they offer English interface for their internet banking services and mobile app. It’s not the cheapest option but it should be more hassle free for foreigners.

Note: While the interface is in English the push messages and emails from the bank are in Portuguese.

2 hours and 16 signatures later (!!) my bank account was opened with access to internet banking and a MasterCard (debit).

Where to search for rental properties?

I’ve never seen as many real estate offices as here in Portugal. There’s ~30 realtor offices just in the city of Caldas da Rainha (which has approx. 60.000 citizens?)

There’s a few good online real estate sites like Idealista and Imovirtual but prices for rentals on those sites are higher than if you rent from a private person.

The extra cost might be worth it though. If anything comes up with the rental, the real estate agency will assist us. If we hire from a private person we’ll be on our own.

What to rent – House, apartment or condo?

We need a 1 year rental contract to apply for residency and NHR.

Unfortunately, there’s not many houses for rent on the market. The owners will rather sell it than rent it out.

We’ve seen a few examples of houses which rents for 350-450€ per month. Of course, they’re old and no way near the standard we’re used to. Most of the older houses offer no heating at all (unless you plug in transportable electric heaters). Needless to say, it’s very expensive to use electric heating in a house without insulation. But we would be interested if it’s close to a good school, in good shape and offers a nice garden for the kids to play in.

If we want to spend 1200-1500€ per month (which we don’t) there’s a few options mainly in Golf Resorts. But who wants to live in a Golf Resort all year around? It’s not the best way to integrate.

We’re also not interested in an apartment in a big city. We prefer the country side where we can enjoy the nature and the kids can run freely around outside.

A condominium could be a good solution for us, at least for the first year or two. Condos typically offer access to a lawn and often a shared swimming pool, which the kids would love.

We’re still searching for a long-term home so if you know someone near Caldas da Rainha who’d be willing to rent to us, please let me know.

What about the kids and school?

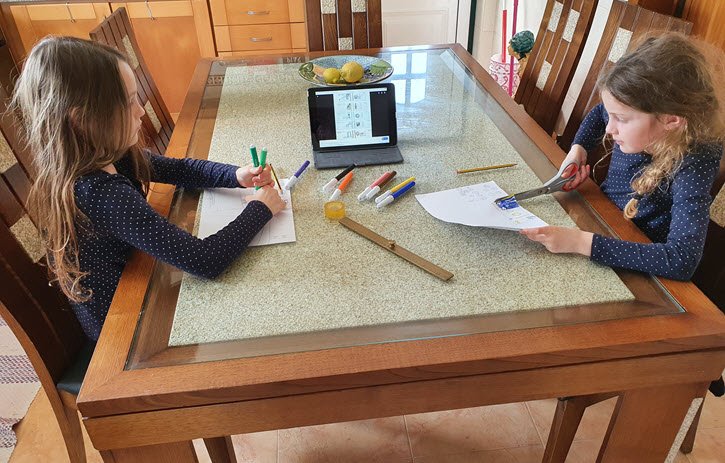

We are homeschooling our daughters at the moment. They will start in public school after the summer holidays.

The school they’ll attend depends on our address. Once we’ve found a long-term home, we’ll see if the kids can join after-school activities. This way they will be able to meet some new friends and start learning the language.

Anyone who has a sister or a brother knows how easy it is to start arguing with each other. Especially if you have no one else to play with for a month! In Denmark, they were used to playing with friends all the time and now they only have each other.

Finding other kids is among our highest priorities.

If you’re near Caldas da Rainha and you have kids, shoot us a message.

We’d love to meet up!

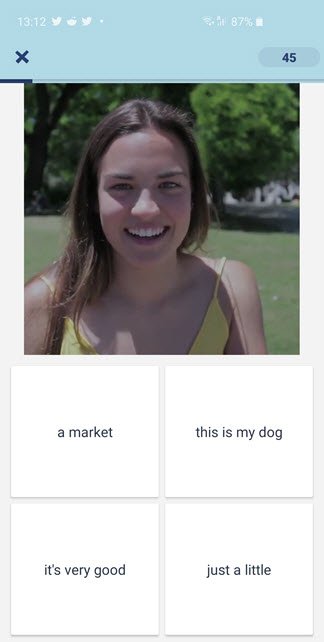

Learning Portuguese

Now we’re in Portugal I spend about 10-30 minutes each day trying to learn Portuguese with the Memrise app. Duolingo only offers Brasilian Portuguese so Memrise is a good language learning app that I enjoy using for European Portuguese.

I particularly like the video clips with Portuguese people, which makes the learning experience more joyous.

Portuguese is very different from Danish, Swedish, Norwegian, German or English, which are the languages I speak or understand. I guess the hardest part of learning Portuguese for me will be the pronounciation. Portuguese has a lot of “sch/tsj” sounds.

We’ll try our best to learn it!

Stay tuned

That’s it for the first part. I expect part 2 to be released in the middle of next month, hopefully with an update on the long-term rental situation.

Comments are closed.