Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Happy new year fellow Financial Freedom and Wealth seekers!

2018 is over and we’re looking into a brand new and exciting year.

I’ll try to make this update short neat without too much chit-chat 🙂

On to the numbers!!

Income Statement: December 2018

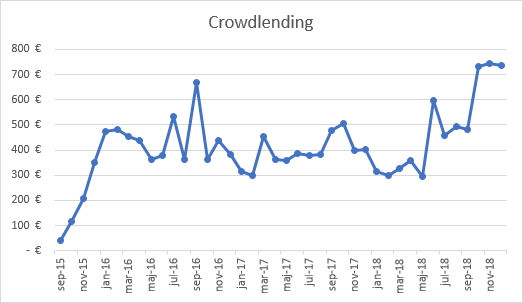

| Crowdlending | Income | XIRR | Invested | Value |

| Bondora | -248,48€ | -2,88% | 16.100€ | 25.110€ |

| Crowdestate | 22,46€ | 7,12% | 7.000€ | 7.590€ |

| Crowdestor | 121,42€ | 18,42% | 10.000€ | 10.624€ |

| Envestio | 383,98€ | 22,66% | 20.000€ | 23.984€ |

| FastInvest | 57,57€ | 15,34% | 4.100€ | 4.554€ |

| Grupeer | 130,15€ | 13,56% | 10.000€ | 10.887€ |

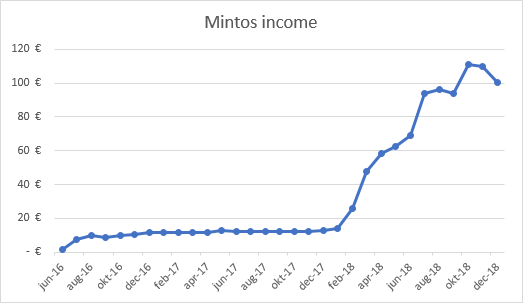

| Mintos | 100,57€ | 14,90% | 8.000€ | 9.495€ |

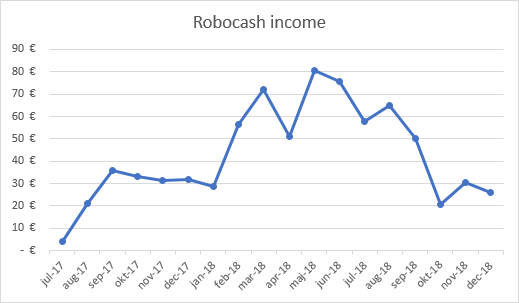

| Robocash | 26,19€ | 11,58% | 6.000€ | 6.772€ |

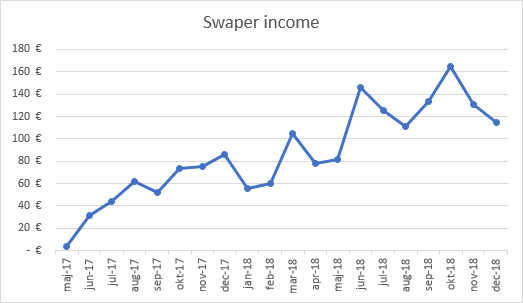

| Swaper | 114,72€ | 16,72% | 9.000€ | 10.734€ |

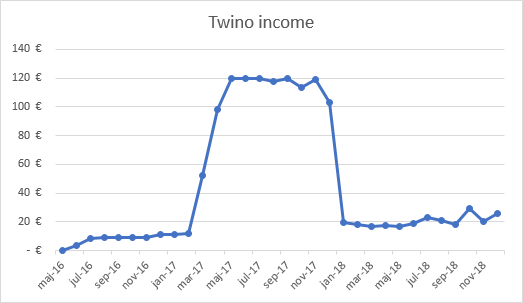

| Twino | 26,07€ | 15,73% | 1.300€ | 2.714€ |

| 734,65€ | 91.500€ | 112.468€ | ||

| Real Estate | Income | XIRR | Invested | Value |

| First property | 660€ | 64,58% | 18.080€ | 26.720€ |

| Total | 1.394,65€ | 109.580€ | 139.189€ |

My comments to the returns

Income from investments in December was 1.394,65€ (-8,71€ less than last month.) I reached 46,49% of my first goal (-0,29% less than last month).

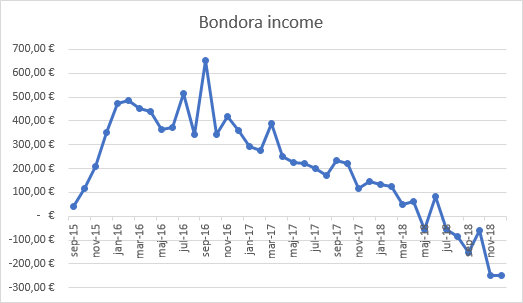

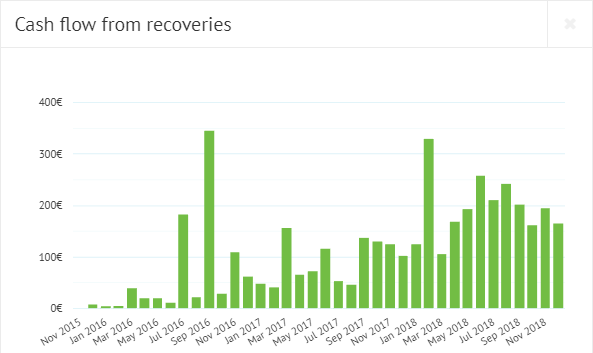

Bondora

Another negative month on Bondora. 179,87€ interest received but 428,35€ principal missed.

To any new readers, I do not recommend investing with Bondora unless you plan to use the “Go & Grow” product only. There’s too many defaults related to the “Portfolio Manager” or “Portfolio Pro” and the costs of recovery is too high. Chances are, that your income graph will look much like mine after a couple of years.

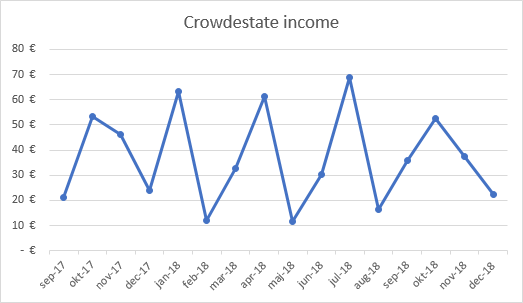

Crowdestate

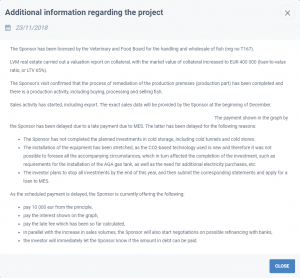

One of the projects I invested in on Crowdestate, MMMSprattus OÜ, is not repaying according to schedule. They were supposed to start paying the principal back after the 3rd month, but it has been delayed. Interest has been paid though. No official information has been given since 23.11.2018.

The rest of the projects in my Crowdestate portfolio are performing as expected.

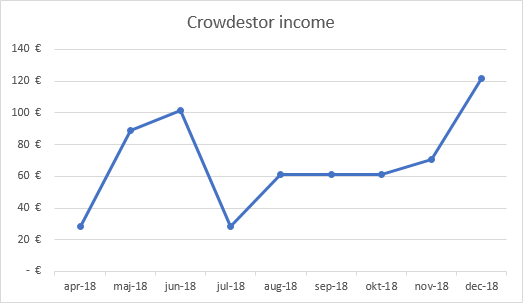

Crowdestor

With 10.000€ invested at Crowdestor, my monthly income is now well above 100€ and I expect it will continue to grow from here.

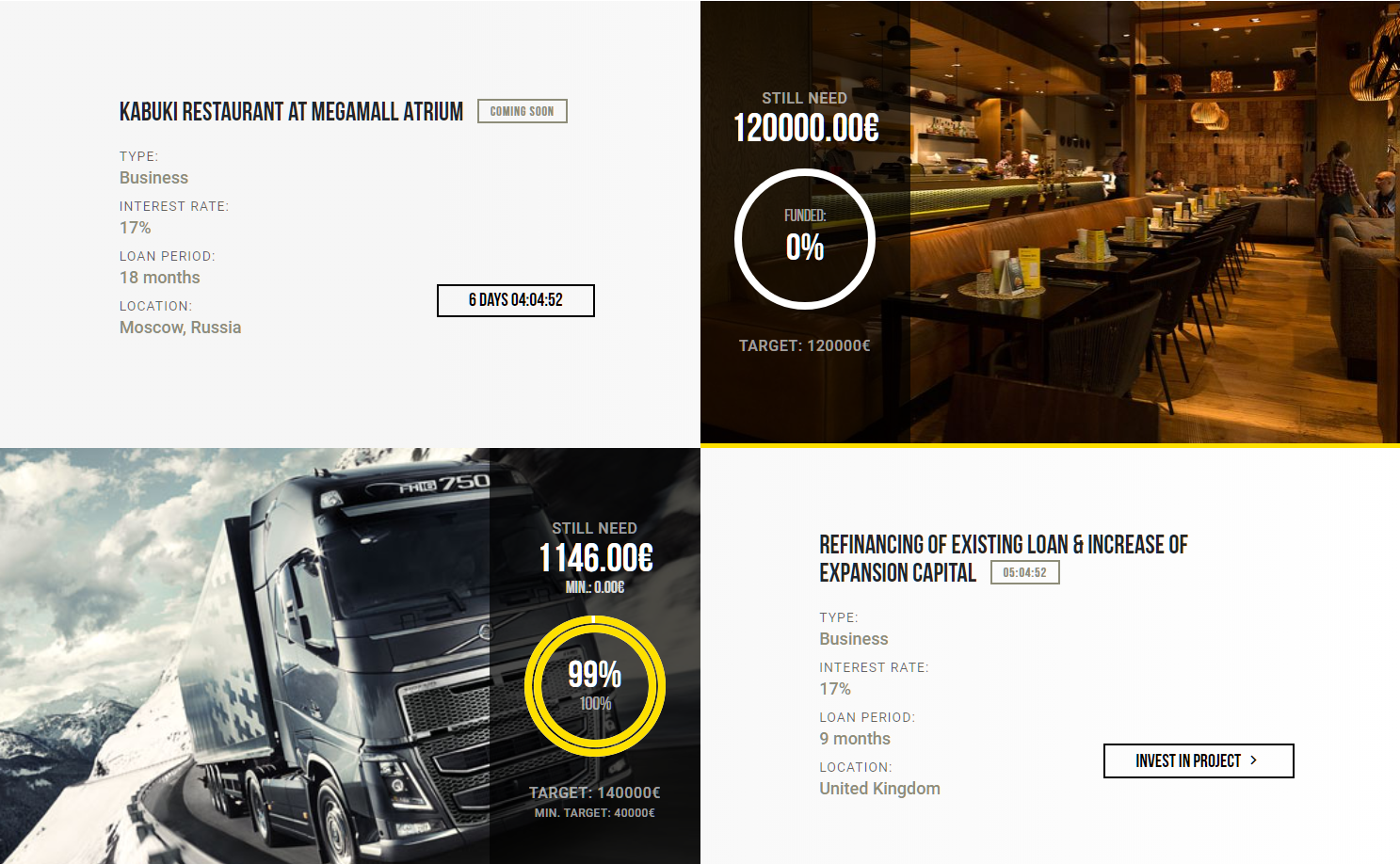

Crowdestor added 2 new projects in December and one of them is already 100% funded. The next one, “Kabuki Restaurant at megamall Atrium” will be released in 6 days, so if you’re interested you still have time to transfer money and invest in the project.

It’s great to see that Crowdestor adds new projects now that opportunities at Envestio are scarce.

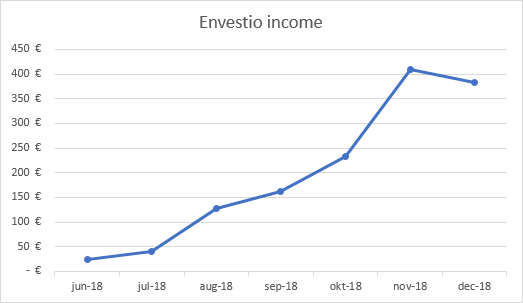

Envestio

Envestio only had a few new projects available for investment in December.

Today they released the 5th (and final) tier of the “Wind turbine farm”. Due to the increased demand the interest rates appears to start dropping already. The first 4 tiers had a 20.55% interest rate. The 5th tier is “only” 16.55% but the 225.000€ loan is already 90% funded after 5 hours.

I’m looking forward to 2019 to see if they can keep up with the demand. It will also be interesting to see if we will see any 20% interest rate projects again.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days.

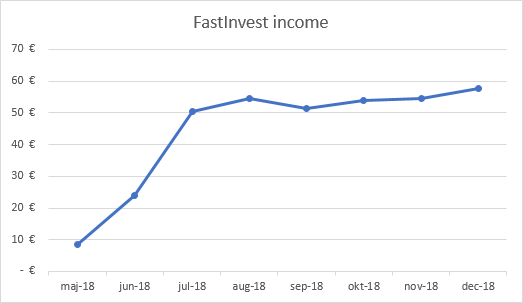

FastInvest

My FastInvest review was published recently. Many of you are still skeptic and that’s perfectly fine. Some of you are pointing out:

- “Simona was a member of the board of a company that went bankrupt.”

Yes, that is true, but she was only one out of many board members and she didn’t own that company. The company was declared bankrupt because their license was withdrawn by the regulators. They didn’t commit any crime (as far as I can see). I would like to think she learned from the process and now knows how to avoid similar situations.

- “The reason why they wont disclose loan originators might be because they own some of the loan originators.”

If that is the case, there’s nothing wrong with that. Other P2P platforms like Robocash, Swaper, PeerBerry and Twino also use this business model.

After spending 2 days with FastInvest and more than an hour on the phone with Simona afterwards, I feel comfortable enough to keep my money there and keep reinvesting. I look forward to adding to my investment once the loan originators are disclosed.

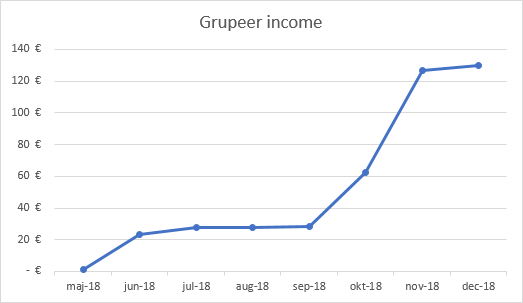

Grupeer

After a few weeks with no investment opportunities at Grupeer, they added a big amount of 14% loans on December 6th. Another project was added on December 21st and 27th so there’s still plenty of loans available.

My monthly income from Grupeer is now steadily over 100€ as well. That’s really nice to see.

Mintos

Many loans on Mintos are now back on 14% interest rate. I tried to sell out some of my 11-12% loans on the secondary market without discount and, surprisingly enough, half of them were sold within a few hours. I guess some people prefer 12% loans from Mogo rather than 14% loans from Varks. I’ll try my luck with the higher percentages.

Robocash

Robocash is still giving a nice profit and effortless investing experience. All loans now come with a fixed 12% interest rate but I’m okay with that for now. The days with cash drag are over 🙂

They resumed the referral program so they’re hungry for new investors again.

Accrued but unpaid interest (because loans are still outstanding) is slowly building up every day. This amount will be paid out when the 1-year installment loans mature.

Swaper

The cash drag on Swaper is becoming a real concern now. 40% of my funds are currently idle and doesn’t earn any money for me 🙁 Swaper needs to up the game and find more loans to invest in if they want to keep me there.

Twino

My children’s savings account returned 26€ in December. With an account value of 2.700€ it should stay above 25€ per month from this point. It’s hard to keep everything invested though, as Twino still has problems with cash drag.

Real Estate

Everything is still going fine with my rental property. I’m hungry for more 🙂

In November, one of the tenants was late paying the rent and when it finally came in I was paid 10€ less than planned. I was told that he/she had no more money and would pay the difference with next months rent.

In December I received the 10€ from November as promised and the rent for December was paid on time.

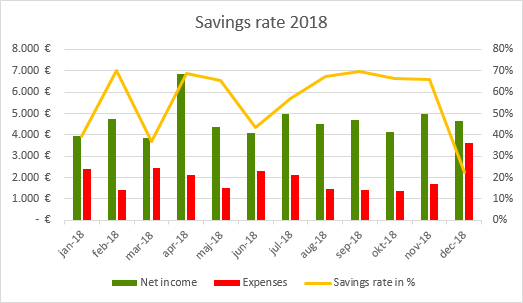

Savings rate

My savings rate for December was only 22,26% (-43,65% compared to last month). Why so low, you might ask?

Well first of all, our insurances are due in December, so there goes 925€.

I also had to pay 1.050€ for a small paint scratch incident we had in our rental car during the summer. I never pay for extra insurance, so when something happens I’ll have to pay out. That’s just the way it works.

Without this last unforeseen expense I would have hit a total savings rate of 58,97% for 2018. Instead it ended up at 57,09%, which I’m satisfied with after all.

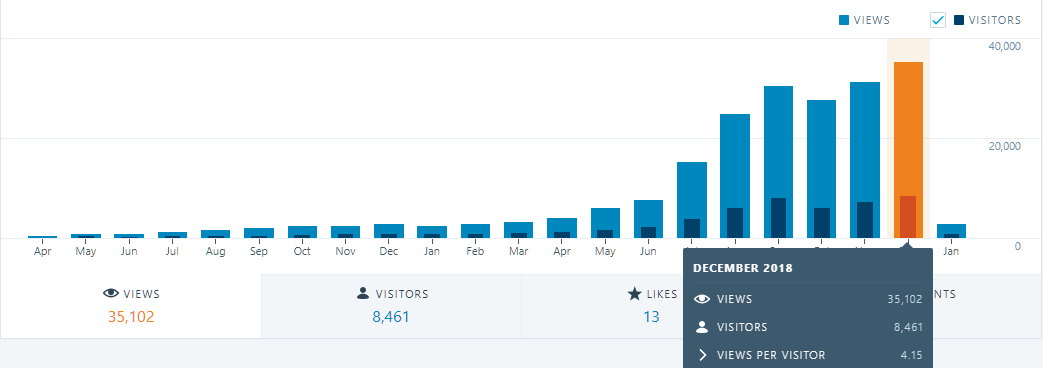

Blog statistics

The blog traffic reached new heights in December.

Visitors: 8.461 (+18,97% compared to last month)

Page views: 35.102 (+13,83% compared to last month)

825 subscribers (470 WordPress, 355 Sumo) (+139 compared to last month)

445 Facebook likes (+41 compared to last month)

FinanciallyFree is hosted on SiteGround for the incredible low price of 3,95€ per month. Even with 35.000 page views per month it’s still pretty fast don’t you think?

Until next time!

2019 will be a great year in many ways.

First of all, we expect our third child in July! We don’t know the gender, we like to keep it a surprise. While we are thrilled and happy about this, it’ll be quite a challenge to keep the savings rate near 60% as in 2018. With 3 kids we’ll probably need a bigger car that fits 3 children’s seats. Luckily we’ve saved all equipment from our 2 daughters so we don’t need to buy a lot of other stuff. Unless it’s a boy, then we need a complete new wardrobe 🙂

2019 is also looking good when it comes to investments. Crowdlending is growing rapidly, Mintos expects a 200% increase in their investor base in 2019!

Now, I could continue babbling for a while but I already failed to keep this update short, as I stated in the introduction.

So, I wish you all a successful investment year in 2019 and, as usual, if you enjoyed this post, please smash that like button below and/or share it with your friends.

P.S. I will update all the other pages and numbers on the blog tomorrow, I’ll have to get some sleep now 🙂

Comments are closed.