Disclosure: All links to products and services mentioned on FinanciallyFree.eu are affiliate links. If you go through them to sign up for a service I will earn a commission. Sometimes you will receive a bonus too.

Hello fellow Financial Freedom and Wealth seekers!

Another month has passed which means it’s time for another monthly update.

I’m trying to get these updates out on the 1st or 2nd of every month. It takes a lot of time to plug all the numbers into the tables and graphs, take new screenshots of all my accounts etc.

I would have posted yesterday but the new WordPress Gutenberg update caused me a lot of headaches! They suddenly removed all table text formatting. WTF?

If you haven’t been here since last month’s update, please check out the other pages on the blog. A lot of changes has been made!

No more talking, let’s get to the numbers.

August 2018

| Crowdlending | Income | Invested | Value |

| Bondora | -85,08€ | 20.900,00€ | 30.267,34€ |

| Crowdestate | 16,20€ | 7.000,00€ | 7.441,63€ |

| Crowdestor | 61,43€ | 4.000,00€ | 4.309,03€ |

| Envestio | 126,73€ | 9.000,00€ | 9.663,02€ |

| FastInvest | 54,44€ | 4.100,00€ | 4.237,24€ |

| Grupeer | 27,87€ | 2.000,00€ | 2.375,88€ |

| Mintos | 96,39€ | 8.000,00€ | 9.076,37€ |

| Robocash | 64,91€ | 6.000,00€ | 6.644,41€ |

| Swaper | 110,71€ | 9.000,00€ | 10.190,45€ |

| Twino | 20,99€ | 939,39€ | 2.258,84€ |

| 494,59€ | 70.939,39€ | 86.464,21€ | |

| Real Estate | Income | Invested | Value |

| First property | 660€ | 18.080,00€ | 22.309,84€ |

| Total | 1.154,59€ | 89.019,39€ | 108.774,05€ |

My comments to the returns

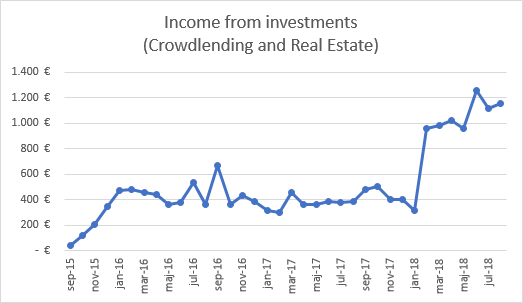

August income was +36,85€ higher than last month.

I reached 38,49% of my first goal (+1,43% more than last month).

Bondora

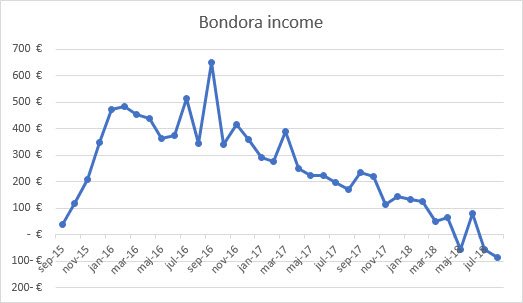

If you are new to the blog, please don’t see my big investment in Bondora as endorsement of the platform. I made a beginners mistake by allocating too much into one platform. They don’t have buyback guarantee and Bondora’s default rate is very high.

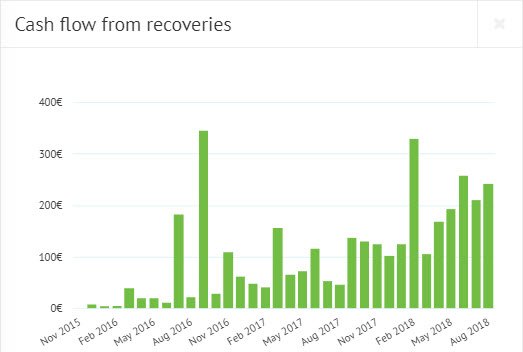

As expected, Bondora stayed in negative territory. 242,58€ were recovered from defaulted loans but that was not enough to catch up with the missing principal and interest repayments.

Last time I asked, Bondora they said my portfolio was still performing within the expected range. Mmmm okay… Who would have thought?!

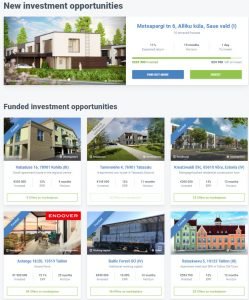

Crowdestate

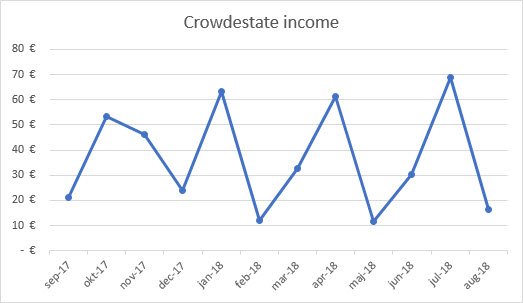

Crowdestate released 7 new projects in August. That’s pretty good!

Unfortunately however, the interest rates were rather low compared to previous projects. Interest rates ranged from 11-15% and the historic average is 20,98%.

The Steel Express Haldus OÜ project was late on the payment again this month. I received the payment this morning though. I know it’s just a few days but it does make me think twice about the quality of this borrower.

The overall income from Crowdestate is very predictable, it’s easy to spot the pattern in the income graph below. September and October should be higher if the projects repay as planned.

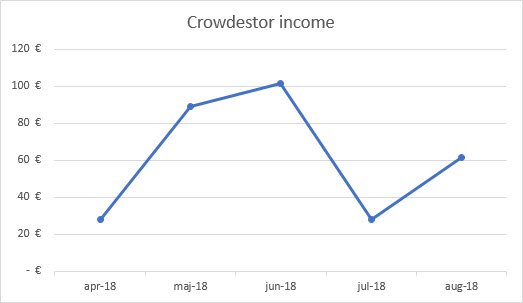

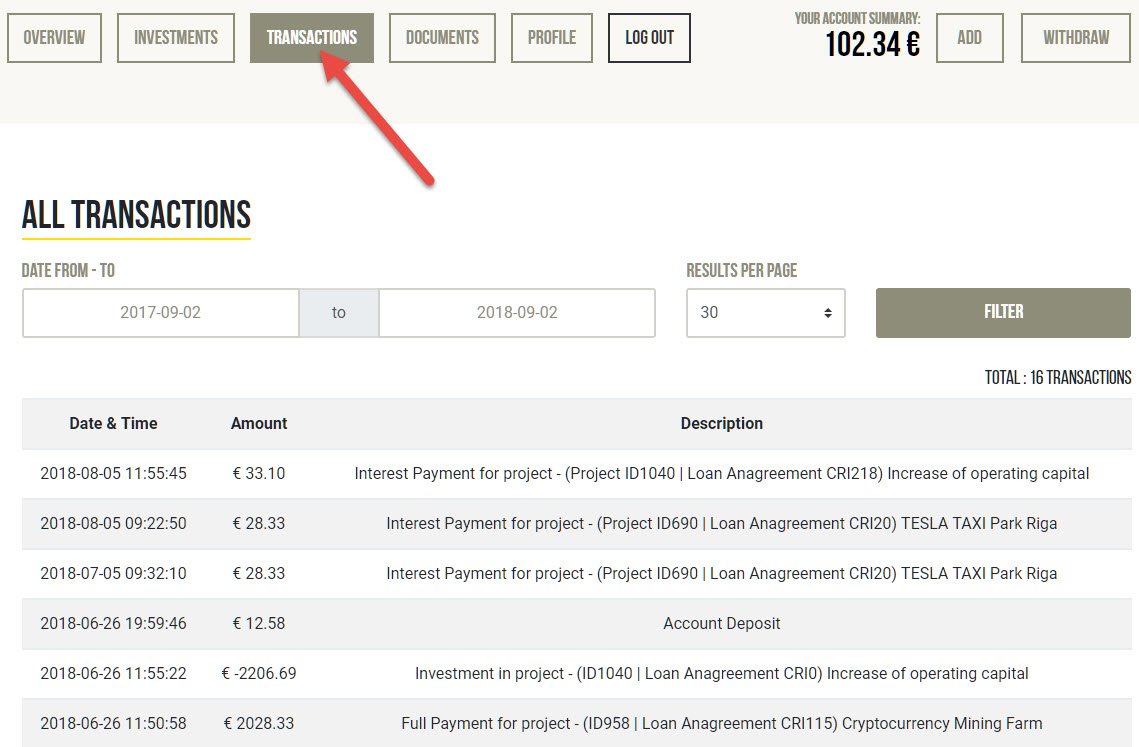

Crowdestor

This weekend Crowdestor released a long-awaited website update with a new Transactions page. Well, I think it’s released to the public? Gunars from Crowdestor asked if I would help them test it, so he activated the feature on my account. If you don’t see it yet, it will be out very soon.

I have missed a transactions page from day one and it’s great to see they’re improving the platform. An update to the Overview page is up next, I’m looking forward to that as well.

As you can see on the screenshot above, I received interest payments for the 2 projects I’m invested in according to schedule.

A new project was released in August and the funding expires on September 9th. The interest rate offered is 13% and the loan duration is 12 months. The interest rate is too low for my taste, so I will skip this one.

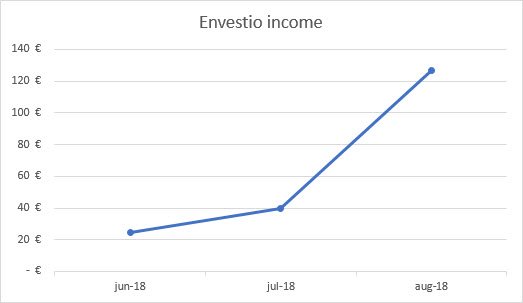

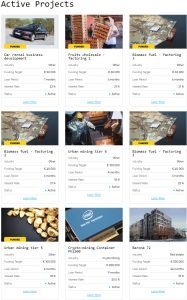

Envestio

Envestio really impressed me with 8 new project releases in August. If that isn’t impressive enough then pay attention to this: Interest rates ranged from 18-22% !!!

I see that as a clear message to the competition; Envestio is here to stay and it will become one of the major players in the near future. Buyback guarantee and 20% returns is serious business! Other crowdfunding platforms will have to follow troop or see investors walk away to greener pastures.

I’ll transfer another 4.000€ to my account Envestio account today, bringing my total deposits to 13.000€.

I recently published a review of Envestio , where I traveled to Riga to meet the team behind the platform. If you have not read it yet, you can find it here.

If you sign up and invest through my referral link, you will get a 5€ bonus when you deposit at least 100€. In addition, you will also get a 0,5% cash back on all your investments the first 270 days. That’s 9 full months!

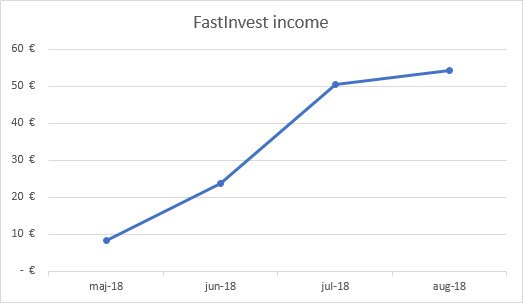

FastInvest

FastInvest continues to deliver and the returns are now slightly above the expected target of 53€ per month.

Some of you have contacted me because you’re concerned with FastInvest. In most cases you have experienced slow response from their support. I’m not sure why their support is below average but it concerns me as well. I hope it’s because they have so many new users that they are understaffed.

Earlier this year, they promised to release a list of their loan originators. This information has not been available since they started. I still haven’t seen this list. Every crowdfunding platform should be as transparent as possible. This is the only way to gain trust from investors!

Personally, I’m not investing more money with FastInvest until these questions are answered. I asked if I could meet them in their office and make a blog post about it, just like I did with Envestio. Dovile replied to me and said it was a great idea and I was very welcome to come and visit. She would also make sure I could meet their CEO Simona for the interview.

September is a very busy month for me, but I hope I’ll be able to meet FastInvest in the fall.

This morning I checked Dovile’s Facebook account and apparently she left FastInvest a few days ago. Not exactly a good sign either.

UPDATE: I just heard from FastInvest and other sources as well: Dovile has left to maternity leave. She is expecting a baby girl in a few months!

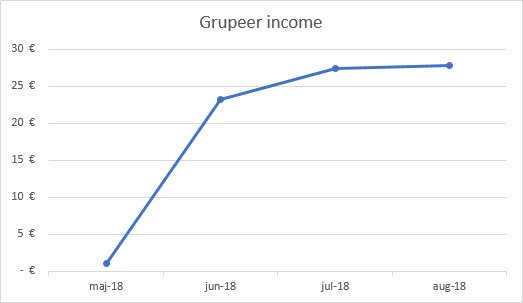

Grupeer

This platform continues to give good returns. Investing at Grupeer is a very stable experience and all the projects pay on time. I really only have positive things to say about Grupeer.

They recently prepared an update post of Promenada project to show how investments of the investors helped to bring this project to life.

They also installed an online camera where you can see the building being constructed in real-time. That’s a great way for investors to follow the project they invested in. Very cool and creative thinking Grupeer, well done!

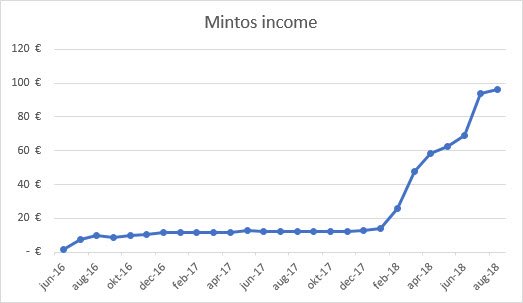

Mintos

Despite the recent interest rate drop on Mintos, I still managed to set a new record with 96,39€ in on month. Interest rates are slowly climbing up again, I wouldn’t be surprised to see 13-14% loans again in early 2019.

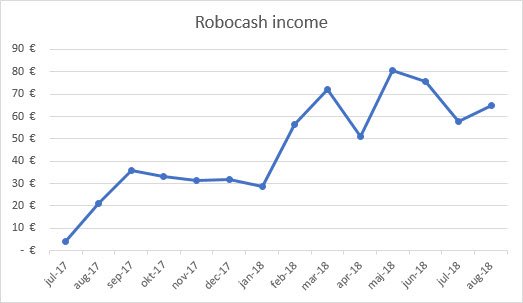

Robocash

Some cash drag still exist on Robo.cash as well. It’s not as bad as last month though. I’m still happy with my investment here. It’s very “hands off”, you don’t get any closer to passive investing than this.

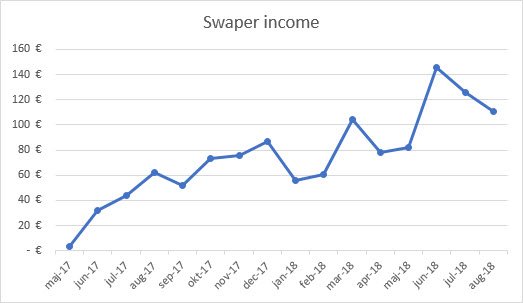

Swaper

A lot of you have asked me about cash drag on Swaper. It’s very hard to get all your money invested. There’s nothing you can do about it, other than keep your auto-invest enabled and wait for it to grab some loans. Fortunately all investors are treated equally and everyone will get some loans at some point.

If you invested in Swaper my best advice is: Have patience.

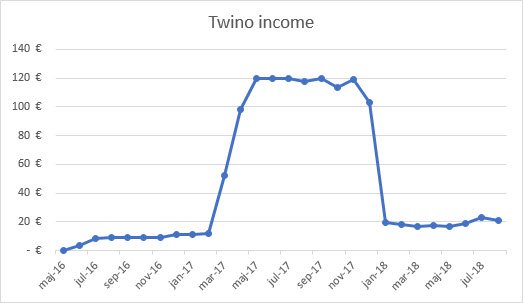

Twino

Not much to report here. I tried to invest in a few loans with currency exposure to get 14% interest (instead of 11%) but the Russian Ruble has not performed well. I’ll probably avoid the currency exposure in the future and take the 11%. I’m not much of a gambler anyways.

Real Estate

My rental property has appliances installed and it’s my responsibility that they work.

One of my tenants called and told me the dishwasher was broken. It would start washing but it never stopped. The machine was about 8 years old so I decided to switch it.

I bought the new dishwasher with transportation, installation and disposal of the old machine included. I’m so happy I went for the “everything included” package. I would have spent hours trying to do it myself and it was surprisingly cheap.

I monitor all expenses on my first property on this page.

|

|

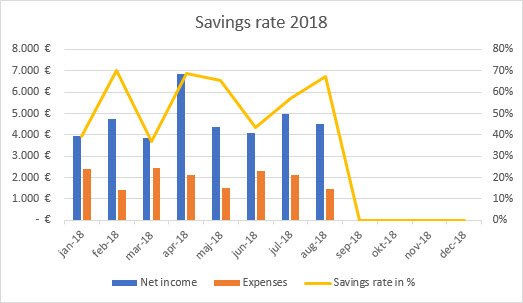

Savings rate

My savings rate for August ended up at 67,39% (+10,44% compared to last month) which is pretty good. I even spent 148€ on Facebook ads. Had I not done this, the savings rate would have been even higher.

Average savings rate for 2018 so far is 57,62%. I still have to be extra frugal for the rest of the year to reach my goal of a 60% savings rate for 2018.

Blog statistics August 2018

Another good month in the books on blog growth.

Visitors: 5.962 (+63,34% since last month)

Page views: 24.761 (+65,87% since last month)

355 subscribers (210 WordPress, 145 Sumo) (+113 since last month)

August was the first month where I started advertising on Facebook. It definitely helped bringing more traffic to the blog, but it’s not cheap.

I will keep testing different advertising strategies to see if I can get the message out to my target audience for a reasonable price.

I’d love to get to 10.000 visitors per month, that would be pretty amazing.

That’s all for August

I have received a lot of mails lately and I truly enjoy the conversations I’m having with all of you. If we haven’t talked yet, don’t be shy if you have any questions or just want to say hi. Hit me with an email on jwolfdk@gmail.com, I’ll be happy to help you 🙂

If you enjoyed this post, please hit the like button below and/or share it with your friends.

Comments are closed.